House Republicans' Trump Tax Plan: Key Details Unveiled

Table of Contents

Proposed Tax Rate Changes

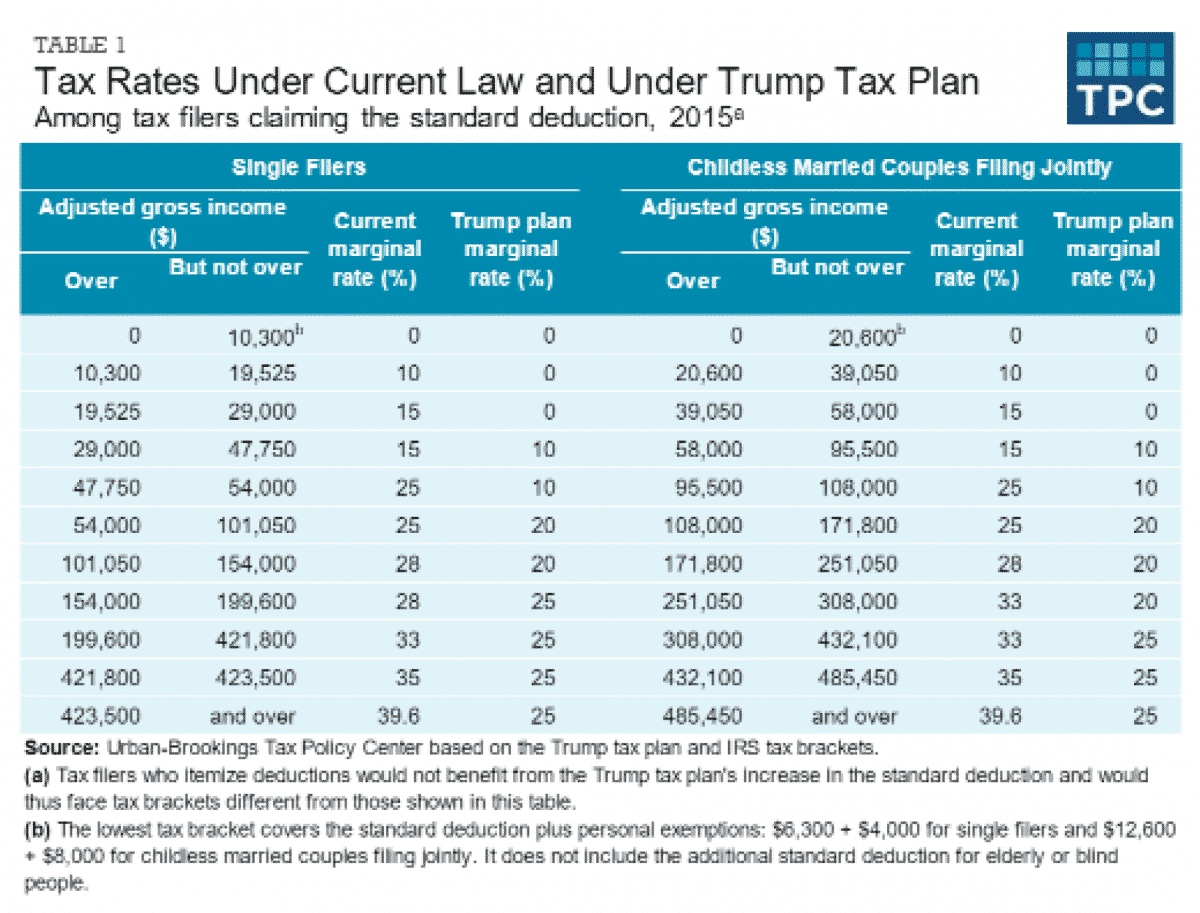

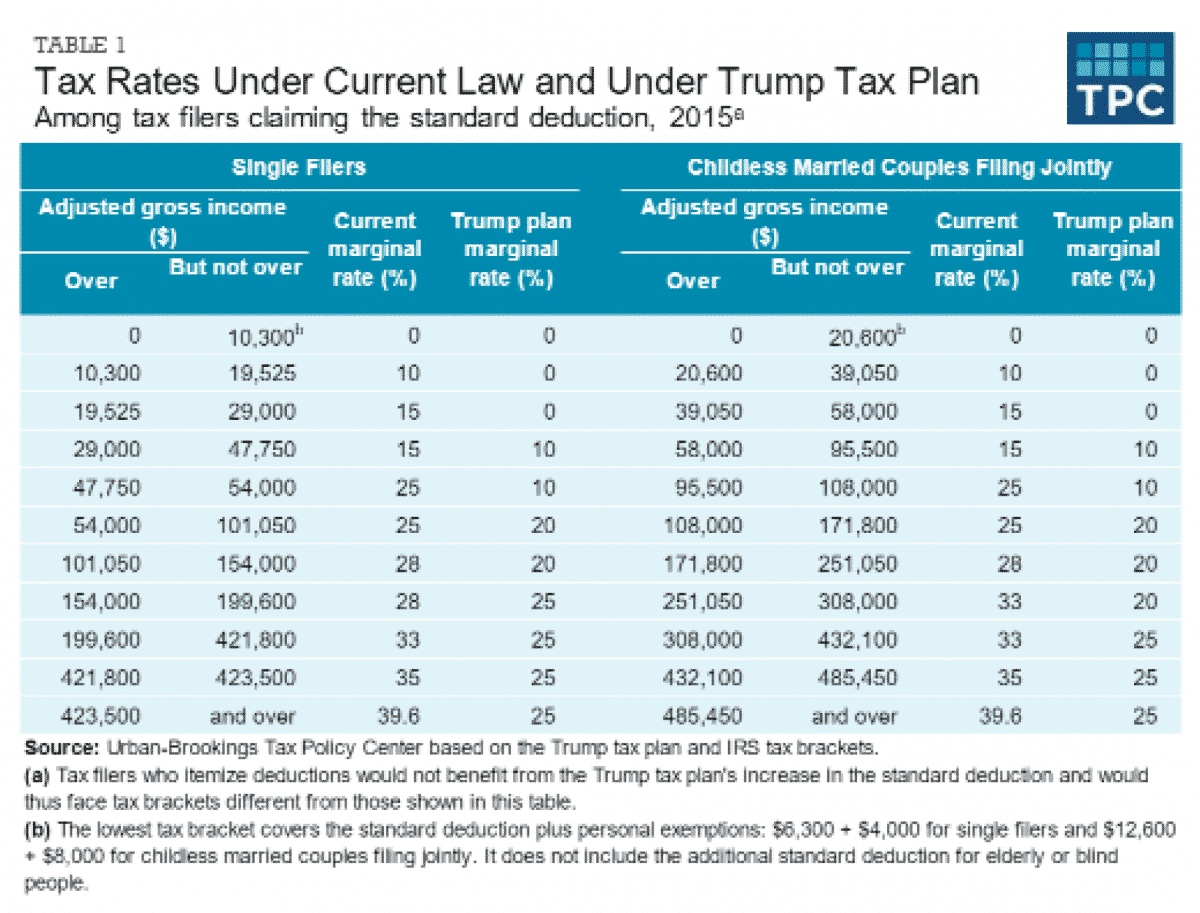

The House Republicans' Trump Tax Plan proposes substantial changes to both individual and corporate income tax rates. These alterations represent a departure from current rates and previous proposals, potentially impacting various income brackets differently. Key keywords include "tax brackets," "marginal tax rates," "corporate tax cuts," and "individual tax cuts."

-

Specific changes to each tax bracket: The plan might suggest lowering the number of tax brackets, potentially consolidating several into fewer broader ranges. Specific percentage reductions for each bracket would need to be detailed in the official proposal. This could lead to either significant tax savings or minimal changes depending on individual income levels.

-

Impact on high-income earners vs. low-income earners: The proposed changes likely favor high-income earners more than low-income earners through lower marginal tax rates. However, the impact will vary greatly depending on the specific changes made to each tax bracket and deductions. This aspect of the plan will be subject to intense scrutiny and debate.

-

Comparison with the previous tax code: The plan aims to simplify the tax code, reducing complexity and potentially lowering the overall tax burden for businesses and individuals. A thorough comparison with the existing tax code is necessary to fully understand the potential impacts and evaluate the plan's effectiveness.

The potential economic effects of these rate changes are hotly debated. Some economists argue that lower corporate tax rates will stimulate investment and economic growth, citing increased business profitability and job creation. Others express concerns about increased income inequality and a widening budget deficit. Further analysis and independent economic modeling are required for accurate predictions.

Changes to Deductions and Credits

The House Republicans' Trump Tax Plan also proposes significant alterations to various deductions and tax credits. Understanding these changes is critical, as they directly impact individual and family tax liabilities. Key terms include "standard deduction," "itemized deductions," "SALT deduction," "child tax credit," and "tax deductions."

-

Specific changes to each deduction and credit: The plan might increase the standard deduction, potentially eliminating the need for many taxpayers to itemize. Changes to itemized deductions, such as those for mortgage interest and state and local taxes (SALT), are expected, likely impacting homeowners and those in high-tax states. The child tax credit could also see modifications, impacting families with children.

-

Impact on different demographic groups: Families, homeowners, and those in high-tax states may be disproportionately affected by changes to deductions and credits. The impact on different income levels also needs careful consideration.

-

Potential increase or decrease in tax liability: The net effect of these changes on individual tax liability will depend on several factors, including income level, family size, homeownership status, and state of residence. Some taxpayers might see significant tax savings while others might experience a tax increase.

These modifications reflect specific policy goals, such as incentivizing homeownership or supporting families with children. However, the overall fairness and effectiveness of these changes are subjects of ongoing debate.

Impact on Specific Industries and Sectors

The House Republicans' Trump Tax Plan is expected to differentially impact various industries. Analyzing these sector-specific effects is crucial for understanding the plan's overall economic consequences. Relevant keywords include "tax reform," "economic impact," "sector-specific analysis," and "industry effects."

-

Potential benefits or drawbacks for specific industries: Industries heavily reliant on deductions or credits, such as real estate or those with high research and development expenses, could see significant changes in their tax burdens.

-

Job creation or loss predictions: Tax changes can influence investment decisions and hiring patterns, leading to potential job creation or job losses across various sectors.

-

Impact on investment and economic growth: Lower corporate tax rates could stimulate investment and economic growth, but the magnitude of this effect depends on various factors, including the overall economic climate and business confidence.

Data and forecasts from reputable economic sources are needed to make accurate predictions about the effects on various industries and their overall impact on the economy. This will provide a more robust understanding of potential winners and losers under the proposed plan.

Potential Economic Consequences and Projections

The House Republicans' Trump Tax Plan has potentially significant macroeconomic impacts. Analyzing these consequences is essential for evaluating the plan's overall success and potential risks. Key terms include "economic growth," "inflation," "national debt," "fiscal policy," and "budget deficit."

-

GDP growth projections under the proposed plan: Supporters argue that the plan will stimulate economic growth through increased investment and consumer spending. However, critics express concerns about the potential for increased national debt and inflation.

-

Predictions for inflation and unemployment rates: The plan's impact on inflation and unemployment rates is uncertain and depends on various factors, including the overall global economic environment and the effectiveness of the plan in stimulating investment and growth.

-

Estimated changes to the federal budget deficit: The plan is likely to increase the federal budget deficit, raising concerns about long-term fiscal sustainability. Independent economic analyses are needed to determine the extent and potential consequences of this impact.

Independent economic analyses and forecasts provide varied perspectives on these projections. Some suggest modest positive growth; others express significant concerns about the potential risks.

Political and Public Reaction to the House Republicans' Trump Tax Plan

The House Republicans' Trump Tax Plan has generated significant political and public reaction. Understanding this response is essential for gauging the plan's prospects and anticipating potential legislative hurdles. Keywords include "political analysis," "partisan divide," "public opinion," and "congressional response."

-

Statements from key political figures: Republican lawmakers generally support the plan, citing its potential benefits for businesses and taxpayers. However, Democratic lawmakers have expressed concerns about its impact on income inequality and the national debt.

-

Public opinion polls and surveys: Public opinion is divided, with varying levels of support among different demographic groups. Public perception and acceptance are critical factors in determining the plan’s success.

-

Potential legislative hurdles: The plan faces potential hurdles in Congress, including opposition from Democrats and even internal disagreements among Republicans. The likelihood of its passage into law depends on various factors, including the political climate and the willingness of both parties to compromise.

The plan's eventual fate remains uncertain, highlighting the complex interplay of political considerations and economic analysis.

Conclusion: Understanding the House Republicans' Trump Tax Plan

The proposed changes within the House Republicans' Trump Tax Plan represent a significant overhaul of the tax code, with potentially far-reaching consequences for individuals, businesses, and the national economy. This analysis has highlighted the plan's key provisions, including proposed tax rate changes, alterations to deductions and credits, and potential impacts on specific industries. The potential economic consequences, ranging from GDP growth projections to changes in the federal budget deficit, have been explored. Moreover, the political and public reaction surrounding the plan underscore its complexity and the ongoing debate surrounding its ultimate impact.

The House Republicans' Trump Tax Plan's long-term effects remain uncertain, necessitating ongoing monitoring and careful analysis. Understanding these potential consequences is crucial for informed civic engagement. Stay updated on the latest developments concerning the House Republicans' Trump Tax Plan by following reputable news sources and engaging in informed discussions about its potential effects on you and the nation.

Featured Posts

-

Massirovannaya Raketnaya Ataka Rf Po Ukraine Bolee 200 Raket I Dronov

May 16, 2025

Massirovannaya Raketnaya Ataka Rf Po Ukraine Bolee 200 Raket I Dronov

May 16, 2025 -

Jimmy Butler Injury Update How Nba Fans Are Reacting Ahead Of Game 4

May 16, 2025

Jimmy Butler Injury Update How Nba Fans Are Reacting Ahead Of Game 4

May 16, 2025 -

Maple Leafs Vs Red Wings Tonights Nhl Game Prediction And Betting Odds

May 16, 2025

Maple Leafs Vs Red Wings Tonights Nhl Game Prediction And Betting Odds

May 16, 2025 -

The Padres Fight Against The Dodgers Domination

May 16, 2025

The Padres Fight Against The Dodgers Domination

May 16, 2025 -

Foot Lockers Huge Sneaker Sale Nike Air Dunks Jordans 40 Off

May 16, 2025

Foot Lockers Huge Sneaker Sale Nike Air Dunks Jordans 40 Off

May 16, 2025