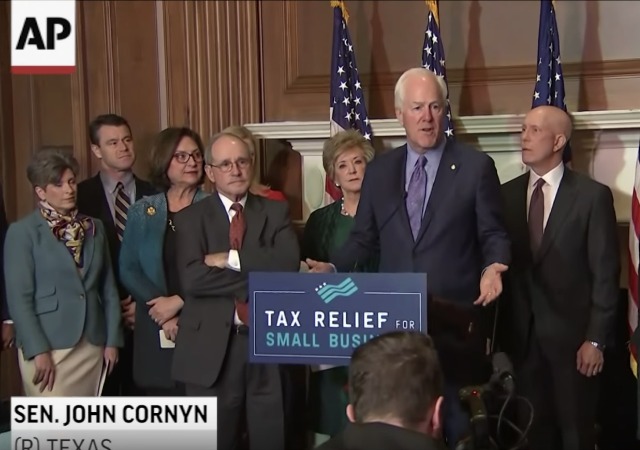

House Tax Bill Passes: Impact On Stock Market, Bonds, And Bitcoin

Table of Contents

Impact on the Stock Market

The passage of the House tax bill is likely to trigger significant shifts within the stock market, affecting different sectors in varying degrees. Changes to corporate tax rates are at the heart of this impact. A reduction in corporate taxes, for example, could boost corporate profits, leading to increased stock valuations for companies benefiting from the change. Conversely, sectors heavily reliant on government subsidies or facing increased taxation might experience a decline in stock prices.

The uncertainty surrounding the bill's implementation and its long-term effects will also fuel market volatility. Investor sentiment will play a crucial role; optimism regarding the bill's economic stimulative effects could drive market upswings, while pessimism could lead to sell-offs.

- Increased corporate profits: Sectors like technology and energy, which often benefit from lower tax burdens, might see a surge in stock prices.

- Decreased corporate profits: Industries heavily regulated or facing increased taxation might see a decline in valuations.

- Increased market volatility: The uncertainty surrounding the bill's implementation will likely translate into increased market fluctuations.

- Shifts in investor behavior: Investors might re-allocate their portfolios based on their assessment of the bill's impact on specific sectors.

Impact on the Bond Market

The bond market will also feel the effects of the "House Tax Bill Passes" event. Several interconnected factors will influence bond yields and investor behavior. Changes in interest rates, a common consequence of shifts in fiscal policy, are central to this. Increased government borrowing to fund the initiatives outlined in the bill might push bond yields upward. Inflation expectations also play a crucial role; higher inflation could reduce the attractiveness of bonds, leading to lower prices.

The type of bond also matters. Treasury bonds, generally considered safe haven assets, might see increased demand during times of uncertainty, while corporate bonds might face increased scrutiny based on the companies' individual prospects under the new tax regime.

- Rising interest rates: Higher interest rates often lead to a decrease in bond prices, as existing bonds become less attractive compared to newer, higher-yielding ones.

- Increased government borrowing: Increased government debt issuance to finance the tax bill could lead to higher bond yields.

- Inflation expectations: Rising inflation expectations can negatively impact bond prices, as the real return on bonds diminishes.

- Shift in investor allocation: Investors might shift their investments away from bonds and into other asset classes deemed more attractive under the new tax environment.

Impact on Bitcoin and Cryptocurrencies

The cryptocurrency market, particularly Bitcoin, is not immune to the effects of the "House Tax Bill Passes" event. The bill’s provisions regarding the taxation of cryptocurrency transactions and investments will significantly impact the space. Increased tax clarity on crypto could potentially attract more institutional investment, reducing uncertainty and increasing the appeal of cryptocurrencies as an asset class. However, increased regulatory scrutiny, a frequent consequence of significant legislative changes, could also lead to market volatility. Changes to capital gains taxes on crypto investments could also affect trading volume and investor sentiment.

- Increased tax clarity: Clearer tax guidelines could potentially attract institutional investors, leading to increased market stability.

- Increased regulatory uncertainty: Increased regulatory scrutiny could introduce uncertainty and lead to price fluctuations.

- Changes in tax treatment of crypto mining: Specific tax rules regarding crypto mining operations could affect the profitability and appeal of this sector.

- Impact on overall perception: The overall tone and specifics of the bill's crypto-related provisions could shape public perception of cryptocurrencies as an investment.

Conclusion: Understanding the House Tax Bill's Long-Term Effects

The "House Tax Bill Passes" event marks a significant turning point with far-reaching consequences across the financial landscape. Its impact on the stock market will depend heavily on sector-specific changes in tax burdens and investor sentiment. The bond market will be affected by interest rate changes, government borrowing, and inflation expectations. Finally, the cryptocurrency market will navigate the complexities of newly defined tax regulations and potential increased regulatory scrutiny. The long-term effects remain to be seen, but careful observation and analysis are crucial for investors across all asset classes. Stay informed about the evolving situation and conduct thorough research on the "House Tax Bill Passes" and its specific impacts on your investments. Consult with a financial advisor for personalized guidance.

Featured Posts

-

The Whos Octogenarian Journey Honesty And The Hard Rock Life

May 23, 2025

The Whos Octogenarian Journey Honesty And The Hard Rock Life

May 23, 2025 -

Vybz Kartel Self Esteem Issues And Skin Bleaching

May 23, 2025

Vybz Kartel Self Esteem Issues And Skin Bleaching

May 23, 2025 -

Kazakhstans Billie Jean King Cup Victory Over Australia

May 23, 2025

Kazakhstans Billie Jean King Cup Victory Over Australia

May 23, 2025 -

Ebd Alqadr W Khsart Fryq Qtr Amam Alkhwr Baldwry

May 23, 2025

Ebd Alqadr W Khsart Fryq Qtr Amam Alkhwr Baldwry

May 23, 2025 -

Exploring The Connections Karate Kid Legend Of Miyagi And The Franchise

May 23, 2025

Exploring The Connections Karate Kid Legend Of Miyagi And The Franchise

May 23, 2025

Latest Posts

-

Memorial Day 2025 Shopping Editors Top Sales And Deals

May 23, 2025

Memorial Day 2025 Shopping Editors Top Sales And Deals

May 23, 2025 -

The Last Rodeo Neal Mc Donoughs Standout Performance

May 23, 2025

The Last Rodeo Neal Mc Donoughs Standout Performance

May 23, 2025 -

Score Big Savings Best Memorial Day Sales And Deals 2025

May 23, 2025

Score Big Savings Best Memorial Day Sales And Deals 2025

May 23, 2025 -

Neal Mc Donough A Leading Role In The Last Rodeo

May 23, 2025

Neal Mc Donough A Leading Role In The Last Rodeo

May 23, 2025 -

Best 2025 Memorial Day Sales And Deals A Shopping Editors Picks

May 23, 2025

Best 2025 Memorial Day Sales And Deals A Shopping Editors Picks

May 23, 2025