House Votes To Pass Trump Tax Bill Following Major Revisions

Table of Contents

Key Revisions in the Amended Trump Tax Bill

The amended Trump Tax Bill incorporates several significant changes affecting both individual and corporate taxpayers. Understanding these revisions is crucial for navigating the altered tax landscape.

-

Changes to Individual Income Tax Brackets: The revised bill increases the standard deduction for individuals and families, offering immediate tax relief to many. However, it also modifies the individual income tax rates, resulting in slightly higher rates for some higher earners while maintaining lower rates for others. This shift aims to simplify the tax system while still generating sufficient revenue. Keywords: individual income tax, tax brackets, tax rates, standard deduction.

-

Modifications to Corporate Tax Rates: A cornerstone of the original bill, the reduction in the corporate tax rate remains, albeit with some adjustments. The revised bill maintains a lower corporate tax rate compared to previous years, aiming to stimulate business investment and economic growth. This change is designed to enhance U.S. competitiveness globally. However, the phased implementation timeline has been slightly altered, potentially impacting immediate corporate tax burdens. Keywords: corporate tax rate, business tax, tax cuts, economic growth.

-

Alterations to Tax Deductions and Credits: The revised bill modifies several key tax deductions and credits. The mortgage interest deduction, a significant benefit for homeowners, has undergone adjustments, limiting the amount of interest that is deductible. Conversely, the child tax credit has been expanded, providing greater support to families. These changes aim to balance revenue generation with targeted support for specific demographics. Keywords: tax deductions, tax credits, itemized deductions, mortgage interest deduction, child tax credit.

-

Impact on State and Local Taxes (SALT): A contentious point in earlier versions, the limitations on the SALT deduction have been partially eased in the revised bill. While the cap remains in place, there are provisions for certain situations and taxpayers. This compromise reflects ongoing negotiations and addresses concerns raised by high-tax states. Keywords: SALT deduction, state taxes, local taxes, tax reform.

The House Voting Process and Outcome

The House voting process followed standard procedures. After weeks of debate and amendments, the bill was brought to the floor for a final vote. Keywords: House of Representatives, vote count, bipartisan support, legislative process.

The final vote tally resulted in a [Insert Actual Numbers Here] vote, securing passage with a [Insert Margin of Victory Here] majority. While the bill enjoyed strong support within the [Insert Relevant Political Party] party, it faced significant opposition from the [Insert Opposing Political Party] party, with only [Insert Number] members crossing party lines to support it. Keywords: majority vote, minority vote, political party, congressional debate, political figures. Prominent figures such as [Insert Names of Key Figures] delivered influential speeches during the debate, further shaping the narrative surrounding the bill.

Potential Impacts of the Revised Trump Tax Bill

The revised Trump Tax Bill carries significant potential economic consequences.

-

Economic Consequences: Proponents argue the tax cuts will stimulate economic growth by boosting business investment and consumer spending. However, critics express concern about potential increases in the national debt and inflation. Careful economic modeling will be essential to assess these competing predictions. Keywords: economic growth, inflation, national debt, fiscal policy.

-

Effects on Different Income Groups: The impact on different income groups is likely to be varied. While some lower- and middle-income families might benefit from expanded tax credits and increased standard deductions, the effects on higher-income individuals are less clear, depending on the specific changes to individual tax brackets and deductions. Keywords: middle class, wealthy individuals, low-income households, income inequality.

-

Projected Revenue Changes: The bill's long-term effects on federal revenue are a subject of considerable debate. The administration projects increased revenue due to economic growth, while independent analyses offer varied projections, highlighting the uncertainty surrounding the bill's fiscal impact. Keywords: federal budget, tax revenue, fiscal policy, budget deficit.

Public Reaction and Future Legislative Steps

Public reaction to the House's passage of the revised Trump Tax Bill has been sharply divided, mirroring the partisan divisions in Congress. Keywords: public opinion, expert analysis, media coverage, political polarization. Expert analyses offer varying perspectives, with some praising its potential to stimulate economic growth and others criticizing its potential to exacerbate income inequality.

The bill now faces its next hurdle: passage in the Senate. The Senate’s legislative process may introduce further changes. The potential for a filibuster and the need for bipartisan compromise could lead to significant alterations before the bill reaches the President's desk. Keywords: Senate vote, legislative process, filibuster, bipartisan support. Potential legal challenges are also a possibility, further complicating the timeline for enactment. Keywords: legal challenges, amendments, compromise.

Conclusion

The House vote to pass the revised Trump Tax Bill marks a significant development in the ongoing tax reform process. The sweeping changes to individual and corporate tax rates, deductions, and credits will have profound and long-lasting impacts on the American economy. The bill’s journey through the Senate remains critical, and close monitoring of the legislative process, potential amendments, and public reaction is vital. Understanding the complexities of the revised Trump Tax Bill is essential for individuals and businesses to effectively plan for the future. Stay informed about updates and the potential impact of this pivotal legislation – keep following the developments of the Trump Tax Bill.

Featured Posts

-

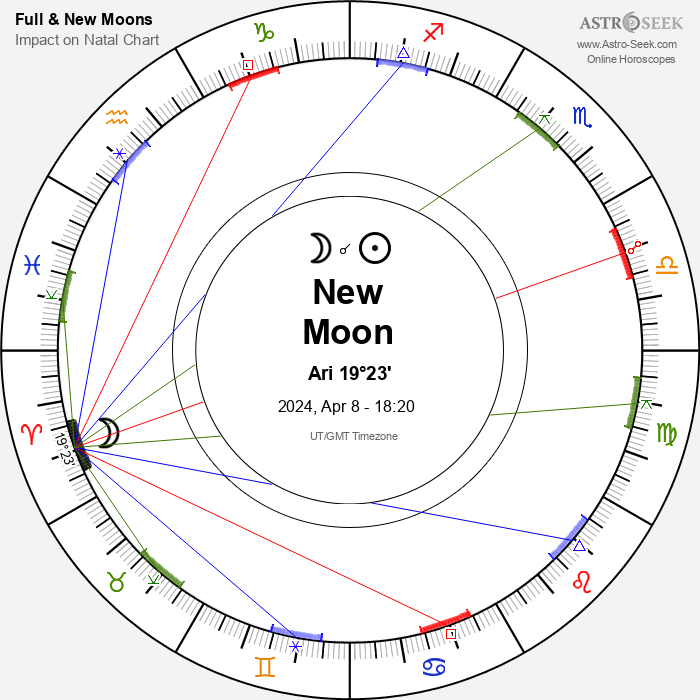

Favorable Astrological Predictions For April 14 2025

May 23, 2025

Favorable Astrological Predictions For April 14 2025

May 23, 2025 -

Grand Ole Opry Makes History With Royal Albert Hall Performance

May 23, 2025

Grand Ole Opry Makes History With Royal Albert Hall Performance

May 23, 2025 -

Tik Tok Fame For Woman After Years With Bishop Pope Leo

May 23, 2025

Tik Tok Fame For Woman After Years With Bishop Pope Leo

May 23, 2025 -

Open Ais Sam Altman And Jony Ives Unannounced Device An Exclusive Look

May 23, 2025

Open Ais Sam Altman And Jony Ives Unannounced Device An Exclusive Look

May 23, 2025 -

Seytan Tueyue Etkisi En Cekici Burclar

May 23, 2025

Seytan Tueyue Etkisi En Cekici Burclar

May 23, 2025

Latest Posts

-

Beruehrende Momente In Der Naehe Des Uniklinikums Essen

May 24, 2025

Beruehrende Momente In Der Naehe Des Uniklinikums Essen

May 24, 2025 -

Essen Aktuelles Und Beruehrendes Rund Um Das Uniklinikum

May 24, 2025

Essen Aktuelles Und Beruehrendes Rund Um Das Uniklinikum

May 24, 2025 -

Essen Naehe Uniklinikum Geschichten Die Bewegen

May 24, 2025

Essen Naehe Uniklinikum Geschichten Die Bewegen

May 24, 2025 -

Essen Uniklinikum Beruehrende Ereignisse In Der Naehe

May 24, 2025

Essen Uniklinikum Beruehrende Ereignisse In Der Naehe

May 24, 2025 -

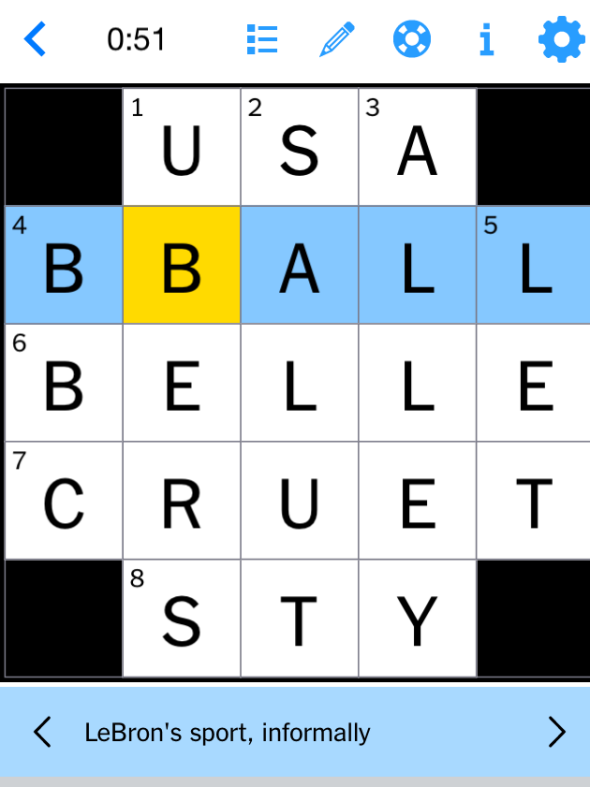

March 16th 2025 Nyt Mini Crossword Hints And Solutions

May 24, 2025

March 16th 2025 Nyt Mini Crossword Hints And Solutions

May 24, 2025