Housing Affordability: Can We Achieve It Without Lowering Home Prices?

Table of Contents

Increasing Housing Supply: A Fundamental Solution

The fundamental principle of supply and demand applies directly to housing. A shortage of available homes drives prices up, making it harder for people to afford a place to live. While lowering prices is one outcome of increased supply, our goal is to improve housing affordability in a sustainable way. Increasing the housing supply is key to making homes more accessible, even if prices remain relatively stable.

Strategies to Boost Housing Construction:

- Reforming Zoning Regulations: Many areas have restrictive zoning laws that limit density and the types of housing allowed. Relaxing these regulations, allowing for more multi-family dwellings, accessory dwelling units (ADUs), and mixed-use developments can significantly increase the housing stock. This approach tackles the root of the problem by creating more housing options within existing communities. This addresses both affordability and the lack of available housing units in desirable locations.

- Government Incentives for Developers: Governments can incentivize developers to build more affordable housing units through various means. Tax breaks, expedited permitting processes, and direct subsidies can make affordable housing projects more financially viable. This financial support helps offset construction costs, making it easier for developers to build homes that are accessible to low- and moderate-income families. Furthermore, this helps create a positive cycle for community development.

- Innovative Construction Techniques: Utilizing innovative construction techniques, such as modular construction and prefabricated homes, can streamline the building process and reduce construction costs. These methods offer efficiencies that lead to faster construction times, lowering overall costs and increasing the speed at which affordable housing units become available. This also provides more resilient homes in certain cases.

- Infrastructure Development: Investing in infrastructure, including roads, utilities, and public transportation, is crucial to supporting new housing developments, particularly in areas with limited resources. Adequate infrastructure is essential for making new housing developments attractive and livable. Without it, construction projects can stall or be significantly more expensive.

Improving Access to Financing and Mortgage Options

Securing a mortgage can be a significant hurdle for first-time homebuyers. High interest rates, stringent lending requirements, and substantial down payment requirements often exclude many potential homeowners from the market. This creates a barrier to entry even for those who can afford monthly payments.

Solutions for Easier Homeownership:

- Government-Backed Loan Programs: Expanding and improving government-backed loan programs, such as FHA loans, can reduce the financial burden for first-time homebuyers. These programs often require lower down payments and more flexible lending criteria, making homeownership more attainable.

- Shared Equity Programs: Shared equity programs, where a buyer owns a portion of the home and a government entity or private investor owns the rest, can lower the initial investment required. This shared ownership model reduces the financial risk for buyers and expands homeownership opportunities.

- Alternative Mortgage Products: Innovative mortgage products, such as shared-appreciation mortgages or interest-only loans (with appropriate safeguards), can make homeownership more manageable for low-income households. Such options are carefully designed to alleviate financial stress and allow for a more manageable transition into homeownership.

- Financial Literacy Programs: Investing in financial literacy programs can empower potential homebuyers with the knowledge and skills needed to navigate the complex mortgage process. Financial education is critical in preparing individuals for the responsibilities and financial commitments associated with homeownership.

Addressing Systemic Issues Affecting Housing Affordability

Beyond supply and financing, broader systemic issues influence housing affordability. Income inequality, stagnant wage growth, and high property taxes contribute to the challenge.

Policy Solutions for Systemic Issues:

- Policies Supporting Wage Growth: Implementing policies that promote wage growth and reduce income inequality is crucial to enhancing affordable housing solutions. A stronger economy and a more equitable distribution of wealth will create more people who can comfortably afford housing.

- Affordable Childcare and Transportation: Reducing the cost of childcare and transportation, major household expenses, frees up more disposable income for housing. Policies supporting affordable childcare and efficient public transportation can significantly enhance affordability.

- Property Tax Reform: High property taxes can place a significant burden on homeowners, particularly those on fixed incomes. Reform aimed at making property taxes more equitable and affordable can be a significant step towards greater housing affordability.

Conclusion: Achieving Housing Affordability Through Holistic Approaches

Improving housing affordability requires a multi-pronged approach. Increasing housing supply, reforming financing options, and addressing systemic issues are all critical components of a sustainable solution. We must move beyond solely focusing on lowering home prices and instead embrace a broader strategy that makes homeownership accessible to a wider range of individuals and families. Let's work together to achieve sustainable housing affordability in our communities through innovative solutions and responsible policy changes. Learn more about affordable housing solutions in your area and advocate for policies that improve access to affordable housing.

Featured Posts

-

Kak Brezhnev Spas Garazh Istoriya Mesti Myagkovu I Sovetskoy Satiry

May 25, 2025

Kak Brezhnev Spas Garazh Istoriya Mesti Myagkovu I Sovetskoy Satiry

May 25, 2025 -

Atletico Madrid Espanyol Maci Hakemin Tartismali Karari

May 25, 2025

Atletico Madrid Espanyol Maci Hakemin Tartismali Karari

May 25, 2025 -

Canada Mexico Trade Navigating The Challenges Of Us Tariffs

May 25, 2025

Canada Mexico Trade Navigating The Challenges Of Us Tariffs

May 25, 2025 -

Datavorser Relx Sterke Groei Ondanks Economische Tegenwind Dankzij Ai

May 25, 2025

Datavorser Relx Sterke Groei Ondanks Economische Tegenwind Dankzij Ai

May 25, 2025 -

Global Healthcare Transformation Insights From The Philips Future Health Index 2025 On Ai

May 25, 2025

Global Healthcare Transformation Insights From The Philips Future Health Index 2025 On Ai

May 25, 2025

Latest Posts

-

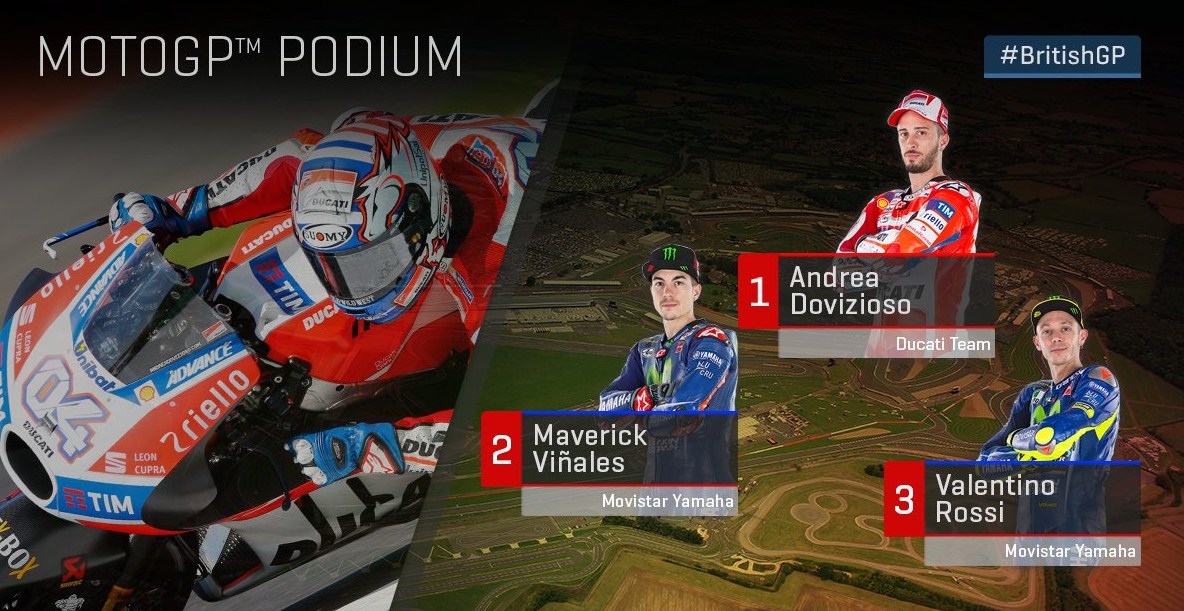

Jadwal And Hasil Moto Gp Inggris Silverstone Klasemen Dan Dominasi Marquez

May 26, 2025

Jadwal And Hasil Moto Gp Inggris Silverstone Klasemen Dan Dominasi Marquez

May 26, 2025 -

Sirkuit Silverstone Jadwal Moto Gp Inggris Posisi Marquez And Perebutan Juara

May 26, 2025

Sirkuit Silverstone Jadwal Moto Gp Inggris Posisi Marquez And Perebutan Juara

May 26, 2025 -

Sprint Race Moto Gp Inggris Di Trans7 Rekor Baru Rins Insiden Jatuhnya Marquez

May 26, 2025

Sprint Race Moto Gp Inggris Di Trans7 Rekor Baru Rins Insiden Jatuhnya Marquez

May 26, 2025 -

Klasemen Moto Gp Terbaru Jadwal Balapan Silverstone Inggris And Performa Marquez

May 26, 2025

Klasemen Moto Gp Terbaru Jadwal Balapan Silverstone Inggris And Performa Marquez

May 26, 2025 -

Moto Gp Inggris Di Silverstone Jadwal Lengkap Update Klasemen And Analisis Balapan

May 26, 2025

Moto Gp Inggris Di Silverstone Jadwal Lengkap Update Klasemen And Analisis Balapan

May 26, 2025