How Johnson Matthey's Honeywell Transaction Impacted BT's Bottom Line

Table of Contents

The recent transaction between Johnson Matthey and Honeywell significantly reshaped the industrial landscape, creating ripple effects across various sectors. This article delves into the specifics of this transaction and meticulously analyzes its impact on BT Group's (BT) bottom line, considering both direct and indirect consequences. We will explore the complex financial ramifications and offer insights into the future implications for all parties involved. Understanding the intricacies of this deal is crucial for assessing its broader market impact and its consequences for investors.

Understanding the Johnson Matthey-Honeywell Transaction

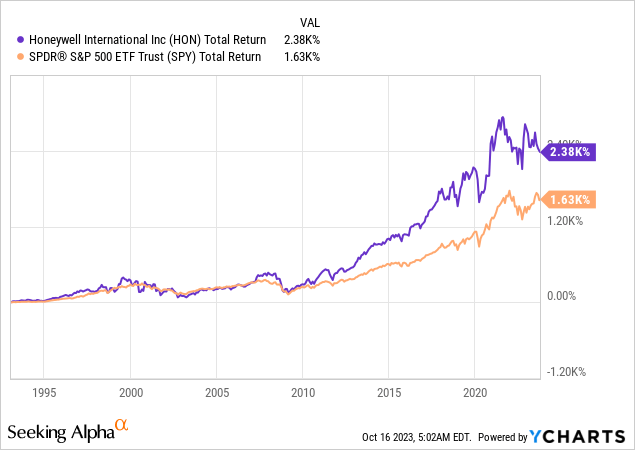

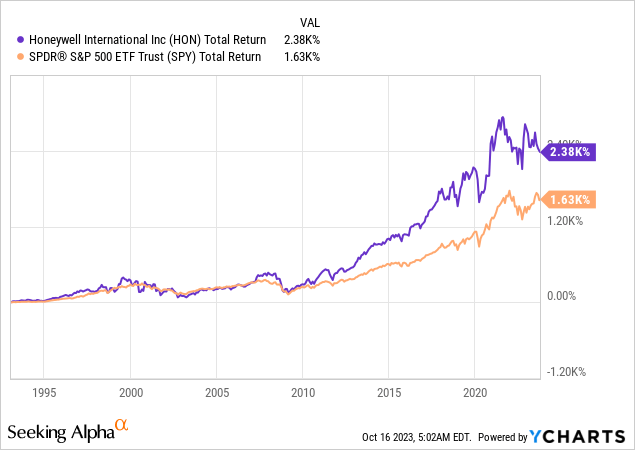

This analysis focuses on the divestiture of Johnson Matthey's emission control technologies business to Honeywell in 2021. This significant transaction involved the sale of a substantial portion of Johnson Matthey's automotive catalyst operations, representing a key asset in the global automotive emissions control market. While the exact financial details weren't publicly released in full, the sale involved a considerable sum, reflecting the substantial market value of the technology and manufacturing capabilities involved.

- Strategic Rationale: For Johnson Matthey, the sale allowed them to focus on core businesses and streamline their operations, potentially improving profitability and shareholder value in the long run. For Honeywell, the acquisition strengthened their position in the growing market for clean energy technologies, enhancing their product portfolio and customer reach.

- Regulatory Approvals: The transaction likely required significant regulatory approvals from various competition authorities worldwide, given the size and importance of the assets involved. The timeline for securing these approvals undoubtedly impacted the overall deal completion time.

- Timeline: The transaction likely spanned several months, encompassing due diligence, negotiation, regulatory approvals, and finally, the completion of the sale. The exact timeline isn't readily available for all steps but typically involves a significant lead time for deals of this magnitude.

Direct Impacts on BT's Bottom Line

The direct impact of the Johnson Matthey-Honeywell transaction on BT's bottom line is likely minimal. BT, a telecommunications company, doesn't have direct contractual or supply chain relationships with either Johnson Matthey or Honeywell within their core business operations. However, indirect effects are more likely to be observed.

- Quantifiable Impact: It's unlikely that any directly measurable financial impact can be attributed to this specific transaction for BT. Changes in BT's financial performance are more likely attributed to other factors within their industry, like market competition or regulatory changes.

- Short-term Consequences: Any immediate impact would likely be indirect, potentially through market volatility influenced by investor reactions to the transaction itself.

- Operational Strategy Changes: No significant changes in BT's operational strategies should be directly linked to this transaction. BT operates in a vastly different sector.

Indirect Impacts on BT's Bottom Line

While the direct links are weak, the Johnson Matthey-Honeywell transaction had indirect effects on BT's operational environment and, consequently, its bottom line.

-

Market Effects: The transaction could influence broader market sentiment related to the automotive and clean technology sectors. Changes in investor confidence could impact the overall market performance and indirectly affect BT's stock price, though this effect is likely to be small.

-

Competitor Dynamics: The impact on competitors of Johnson Matthey and Honeywell could be significant, but this doesn't directly translate into substantial impact for BT, whose primary competition lies within the telecommunications sphere.

-

Macroeconomic Factors: Global macroeconomic conditions and industry-specific factors significantly influence BT's financial performance. The Johnson Matthey-Honeywell deal is just one of many factors impacting the broader economic landscape.

-

Market Positioning: The transaction is not directly relevant to BT's market positioning, which primarily depends on its competitive advantage within the telecommunications market and its ability to adapt to changing customer demands.

-

Long-Term Growth: The long-term growth trajectory of BT remains primarily influenced by the success of its own strategies and the evolving telecommunications landscape, rather than this particular transaction between Johnson Matthey and Honeywell.

Long-Term Implications and Future Outlook

The long-term implications for BT from this transaction are likely to be minimal and indirect. The major impact will be felt by companies directly involved in the automotive and emissions control technologies sectors.

- Potential Risks and Opportunities: For BT, the primary risks and opportunities remain within its own sector, including competition, technological advancements, and regulatory changes within the telecommunications industry.

- Mitigation Strategies: BT's mitigation strategies should primarily focus on managing risks within its own business model and adapting to market trends in the telecommunications sector, rather than those related to this particular acquisition.

- Future Trajectory: BT's future financial performance will be shaped by factors specific to the telecommunications industry, rather than the long-term effects of this transaction in a different sector.

Conclusion

The Johnson Matthey-Honeywell transaction, while a significant event in the industrial sector, has only minimal indirect impact on BT Group's bottom line. Direct financial linkages are virtually non-existent. Any indirect effects are primarily through broader market sentiment and macroeconomic conditions. Therefore, analyzing the impact of this specific transaction on BT requires understanding its indirect influence on the broader financial markets and recognizing the minimal connection between BT's business model and the involved companies. For further insights into the dynamic interplay between corporate transactions and their effects on individual companies, continue exploring the financial implications of major acquisitions and divestitures. Stay updated on the ongoing impact of the Johnson Matthey-Honeywell transaction on the broader market and consider how wider economic shifts might influence BT Group’s financial performance. Understanding the complexities of these transactions is crucial for making informed investment decisions and navigating the ever-evolving business landscape.

Featured Posts

-

Unveiled A Major Disagreement Within The Who

May 23, 2025

Unveiled A Major Disagreement Within The Who

May 23, 2025 -

Emmy Awards 2025 Lead Actress In A Limited Series Contenders And Predictions

May 23, 2025

Emmy Awards 2025 Lead Actress In A Limited Series Contenders And Predictions

May 23, 2025 -

Shadman Islams Strong Reply Leads Bangladesh To Victory Against Zimbabwe

May 23, 2025

Shadman Islams Strong Reply Leads Bangladesh To Victory Against Zimbabwe

May 23, 2025 -

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Poslug U 2024 Rotsi Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 23, 2025

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Poslug U 2024 Rotsi Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 23, 2025 -

The One Percent And Presidential Power Case Study Of Clintons Vetoes

May 23, 2025

The One Percent And Presidential Power Case Study Of Clintons Vetoes

May 23, 2025

Latest Posts

-

Hollywood Legends Film Debut And Oscar Winning Role Now Streaming On Disney

May 23, 2025

Hollywood Legends Film Debut And Oscar Winning Role Now Streaming On Disney

May 23, 2025 -

Pivdenniy Mist Remont Pidryadniki Byudzhet Ta Termini

May 23, 2025

Pivdenniy Mist Remont Pidryadniki Byudzhet Ta Termini

May 23, 2025 -

Remont Pivdennogo Mostu Oglyad Proektu Ta Zaluchenikh Koshtiv

May 23, 2025

Remont Pivdennogo Mostu Oglyad Proektu Ta Zaluchenikh Koshtiv

May 23, 2025 -

Did Eric Andre Turn Down Kieran Culkin For A Role

May 23, 2025

Did Eric Andre Turn Down Kieran Culkin For A Role

May 23, 2025 -

Revenirea Lui Andrew Tate Din Dubai O Noua Provocare

May 23, 2025

Revenirea Lui Andrew Tate Din Dubai O Noua Provocare

May 23, 2025