How Luxury Real Estate Offers Stability Amidst Market Volatility For High-Net-Worth Individuals

Table of Contents

H2: Luxury Real Estate as a Hedge Against Inflation

H3: Tangible Asset Appreciation

Unlike stocks or cryptocurrencies, luxury properties represent a tangible asset. This inherent physicality provides a crucial buffer against inflation. Luxury real estate tends to appreciate in value over time, particularly during inflationary periods. The inherent scarcity of prime properties in desirable locations further contributes to this appreciation. As inflation erodes the purchasing power of other assets, the value of luxury real estate often holds its ground, or even increases.

- Historically low interest rates have impacted the returns of other investment options, making luxury real estate a relatively more attractive proposition.

- Increased demand for luxury properties, especially in prime locations, consistently outpaces the supply, driving up prices.

- Many luxury properties generate rental income, providing a passive income stream that can help offset inflation and increase overall return on investment.

- Historical data from past market downturns consistently shows that luxury real estate either held its value or even appreciated, outperforming many other asset classes.

H2: Geographical Diversification and Portfolio Protection

H3: Global Luxury Real Estate Markets

Diversifying your investment portfolio across different geographical markets is crucial for mitigating risk. Investing in luxury properties in various global markets – such as London, New York, Miami, or Hong Kong – allows you to hedge against regional economic downturns. If one market experiences a downturn, your other luxury real estate holdings can potentially offset these losses.

- Stable and rapidly growing luxury markets offer excellent opportunities for appreciation and secure long-term returns.

- Diversification extends beyond geographical location to encompass property types. A portfolio encompassing beachfront villas, city penthouses, and country estates provides a more balanced and resilient investment.

- Working with experienced real estate advisors specializing in global luxury markets is essential for navigating the complexities of international property investment and ensuring compliance with local regulations.

H2: Long-Term Investment and Generational Wealth

H3: Legacy Building and Family Offices

Luxury real estate is not just an investment; it's a legacy. For HNWIs, it represents a cornerstone of generational wealth building and family legacy planning. Prime properties have historically retained their value and often appreciated significantly over the long term, offering lasting financial security for future generations.

- The enduring value of prime real estate passed down through families represents a tangible and secure inheritance.

- Luxury properties can serve as family compounds or vacation homes, creating lasting memories and strengthening family bonds.

- Strategic ownership structures and careful tax planning can maximize the tax advantages and estate planning benefits associated with luxury real estate ownership.

H2: Unique Amenities and Lifestyle Benefits

H3: Beyond Investment: The Lifestyle Factor

The appeal of luxury real estate extends beyond pure investment returns. Owning a luxury property offers an enhanced lifestyle, providing exclusivity and access to amenities unavailable to most. This intangible value adds significantly to the overall investment proposition.

- High-end properties often incorporate superior privacy and security features, offering peace of mind and a refuge from the outside world.

- Access to exclusive clubs, concierge services, and other premium amenities enhances the overall lifestyle and provides significant convenience.

- The prestige and social status associated with owning luxury real estate are valuable intangible assets, contributing to the overall investment appeal.

3. Conclusion

Luxury real estate offers a compelling combination of financial stability and lifestyle benefits for HNWIs. Its ability to act as a hedge against inflation, its potential for geographical diversification, and its role in building generational wealth make it a uniquely attractive investment during periods of market volatility. The intangible benefits of enhanced lifestyle, exclusivity, and access to premium amenities further solidify its appeal. Secure your financial future with luxury real estate; discover the stability of luxury real estate investments. Explore the world of luxury real estate stability today by contacting a qualified luxury real estate advisor. [Link to contact form/broker]

Featured Posts

-

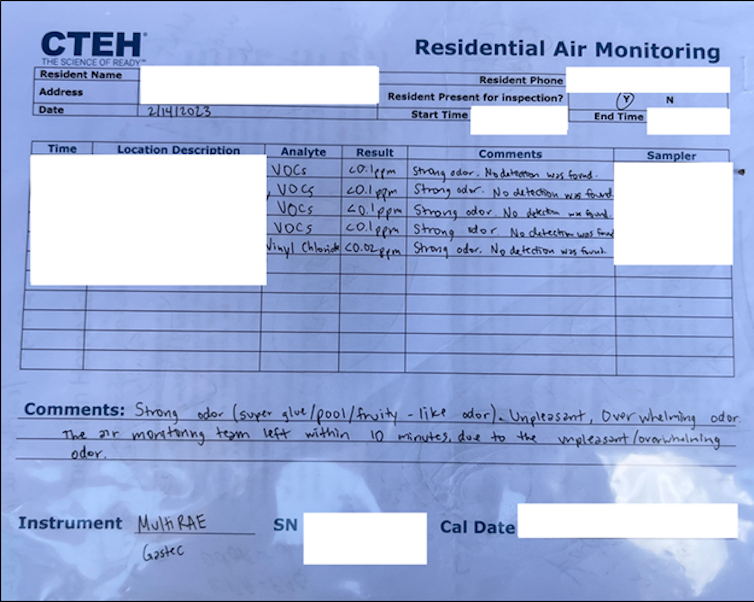

Toxic Chemicals From Ohio Derailment Months Long Lingering In Buildings

May 17, 2025

Toxic Chemicals From Ohio Derailment Months Long Lingering In Buildings

May 17, 2025 -

Singapore Airlines Generous 7 Month Bonus For Staff

May 17, 2025

Singapore Airlines Generous 7 Month Bonus For Staff

May 17, 2025 -

Price Gouging Allegations Surface After La Fires A Selling Sunset Perspective

May 17, 2025

Price Gouging Allegations Surface After La Fires A Selling Sunset Perspective

May 17, 2025 -

Mlb Betting Mariners Vs Reds Game Predictions And Best Odds

May 17, 2025

Mlb Betting Mariners Vs Reds Game Predictions And Best Odds

May 17, 2025 -

How Josh Cavallo Is Changing The Game His Impact After Coming Out

May 17, 2025

How Josh Cavallo Is Changing The Game His Impact After Coming Out

May 17, 2025

Latest Posts

-

The Challenges Of Severance An Interview With Gwendoline Christie Game Of Thrones

May 17, 2025

The Challenges Of Severance An Interview With Gwendoline Christie Game Of Thrones

May 17, 2025 -

Severance Season 3 Renewal Status And Predictions

May 17, 2025

Severance Season 3 Renewal Status And Predictions

May 17, 2025 -

Will Severance Return For A Third Season Lehigh Valley Live Com Update

May 17, 2025

Will Severance Return For A Third Season Lehigh Valley Live Com Update

May 17, 2025 -

Severance Ben Stiller Compares Lumon Industries To Apple

May 17, 2025

Severance Ben Stiller Compares Lumon Industries To Apple

May 17, 2025 -

Is Severance Renewed For Season 3 A Look At The Possibilities

May 17, 2025

Is Severance Renewed For Season 3 A Look At The Possibilities

May 17, 2025