How Musk's X Debt Sale Reshaped The Company's Financial Landscape

Table of Contents

The Details of Musk's X Debt Sale

Musk's acquisition of Twitter burdened the company with a substantial debt load, estimated to be in the tens of billions of dollars. This debt, largely comprised of high-yield bonds and loans, significantly impacted X's financial health from the outset. To alleviate this burden and improve financial flexibility, Musk orchestrated a debt sale. While the exact figures haven't been fully disclosed publicly, reports suggest a considerable amount of debt was successfully offloaded.

- Total amount of debt sold: The precise figure remains undisclosed, but estimates range widely depending on the source and the specific tranche of debt being discussed. Further transparency is needed from X's financial reporting.

- Key investors or investment firms: Information on specific investors remains largely confidential due to the nature of these private transactions. However, it's likely a mix of high-net-worth individuals, hedge funds, and private equity firms were involved.

- Interest rates associated with the debt: The interest rates on the debt sold were likely high, reflecting the inherent risk involved in lending to a highly leveraged company. This suggests a high cost of borrowing before the sale, which decreased following the sale.

- Timeline of the debt sale process: The sale likely involved several phases, extending over a period of months. Negotiations with potential investors, legal and financial due diligence, and finalizing the agreements are crucial steps.

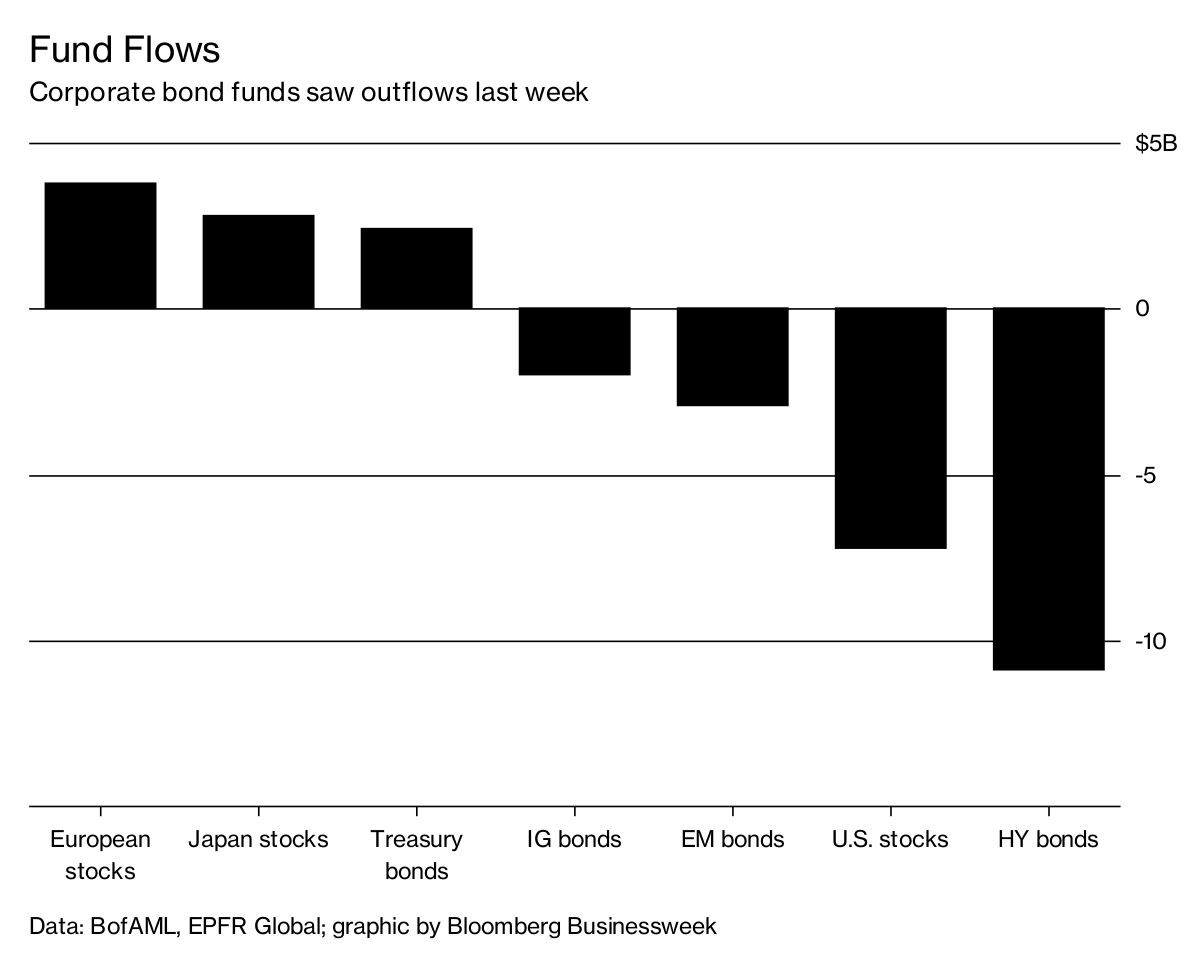

[Insert image or infographic here showing X's debt structure before and after the sale. Ideally, this would be a visually appealing chart comparing total debt, equity, and other liabilities.]

Impact on X's Financial Health

The debt sale had an immediate and measurable impact on X's balance sheet. By reducing its debt levels, X improved its debt-to-equity ratio, a key indicator of financial health. This improved ratio signals reduced financial risk and increased stability.

- Reduction in debt levels: The sale significantly reduced X's overall debt burden, freeing up cash flow and improving its financial standing.

- Improvement in debt-to-equity ratio: Lower debt improved the ratio, indicating lower financial risk for potential investors and lenders.

- Changes in credit rating: Although not publicly confirmed, the debt reduction likely had a positive impact on X's credit rating, making future borrowing potentially cheaper and easier.

- Impact on interest expense: The reduced debt load directly decreased X's interest expense, allowing for more funds to be allocated to other crucial areas like product development or marketing.

- Increased financial flexibility for future investments or acquisitions: With less debt, X has more financial freedom to pursue strategic investments, acquisitions, or innovative projects.

Strategic Implications of the Debt Sale

The debt sale has broad strategic implications for X. Reducing the financial burden allows X to focus on long-term strategic goals. This could include investment in new features, expansion into new markets, or aggressive marketing campaigns to enhance its competitiveness in the social media landscape.

- Effect on future acquisition possibilities: The improved financial health makes future acquisitions more feasible, allowing X to expand its offerings or eliminate competitors through strategic buyouts.

- Impact on R&D spending: Freeing up capital allows for increased investment in research and development, potentially leading to innovative new features and services.

- Changes in marketing and growth strategies: The reduced financial pressure allows X to implement more ambitious marketing and growth strategies.

- Competitive advantage or disadvantage post-debt sale: The decreased debt burden puts X in a stronger competitive position, enabling it to invest more aggressively in its growth and market share.

The Role of Musk's Leadership in the Debt Restructuring

Musk's leadership played a pivotal role in the debt restructuring. His decision-making, while often controversial, ultimately aimed to improve X's financial standing and strategic flexibility.

- Musk's stated goals for the debt restructuring: Musk likely aimed to reduce financial risk, increase liquidity, and position X for future growth and expansion.

- Potential alternative strategies: Alternative strategies might have included seeking government aid, delaying certain projects, or focusing on cost-cutting measures exclusively, but the chosen method seems to have been more assertive and potentially faster.

- Evaluation of the success of the debt sale strategy: The success of the strategy remains to be seen, depending on X's future financial performance and ability to execute its long-term strategic plans.

Conclusion

Musk's X debt sale represents a significant turning point in the company's financial history. The reduction in debt improved X's balance sheet, enhancing its credit rating and providing greater financial flexibility. This, in turn, will likely influence X's strategic decisions, impacting its long-term growth and competitiveness in the social media market. Understanding the complexities of this debt sale is essential for anyone interested in the future of the platform. Stay informed about the evolving financial situation at X by following our updates on future analyses of Musk's X debt sale and its ongoing consequences. Learn more about the intricacies of high-stakes business decisions and their impact on major corporations.

Featured Posts

-

Arizona Speedboat Record Attempt Ends In Dramatic Flip

Apr 29, 2025

Arizona Speedboat Record Attempt Ends In Dramatic Flip

Apr 29, 2025 -

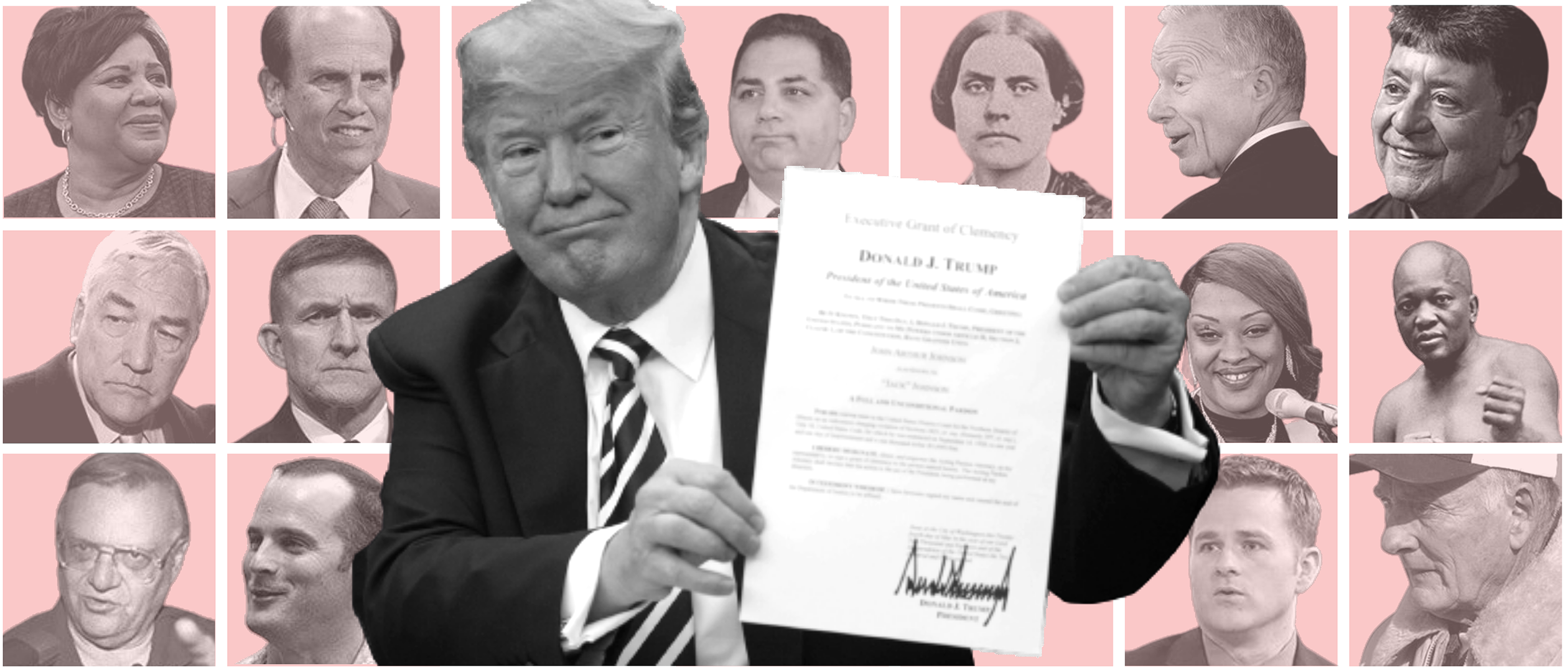

The Pete Rose Pardon Trumps Decision And Baseballs Reaction

Apr 29, 2025

The Pete Rose Pardon Trumps Decision And Baseballs Reaction

Apr 29, 2025 -

From Street Sweeper To National Icon The Story Of Macario Martinez

Apr 29, 2025

From Street Sweeper To National Icon The Story Of Macario Martinez

Apr 29, 2025 -

Khazna Data Centers Saudi Arabia Expansion Plans Following Silver Lake Investment

Apr 29, 2025

Khazna Data Centers Saudi Arabia Expansion Plans Following Silver Lake Investment

Apr 29, 2025 -

Donald Trump Mlbs Handling Of Pete Rose Is A Shame Pardon Promised

Apr 29, 2025

Donald Trump Mlbs Handling Of Pete Rose Is A Shame Pardon Promised

Apr 29, 2025

Latest Posts

-

Papal Conclave Convicted Cardinals Unexpected Request

Apr 29, 2025

Papal Conclave Convicted Cardinals Unexpected Request

Apr 29, 2025 -

Debate Surrounds Convicted Cardinals Participation In Papal Conclave

Apr 29, 2025

Debate Surrounds Convicted Cardinals Participation In Papal Conclave

Apr 29, 2025 -

Controversial Cardinal Demands Inclusion In Conclave

Apr 29, 2025

Controversial Cardinal Demands Inclusion In Conclave

Apr 29, 2025 -

Cardinal Maintains Entitlement To Vote In Next Papal Election

Apr 29, 2025

Cardinal Maintains Entitlement To Vote In Next Papal Election

Apr 29, 2025 -

Papal Conclave Disqualified Cardinal Fights For Voting Rights

Apr 29, 2025

Papal Conclave Disqualified Cardinal Fights For Voting Rights

Apr 29, 2025