How To Interpret The Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

What is Net Asset Value (NAV)?

The Net Asset Value (NAV) represents the true underlying value of an ETF's holdings. For the Amundi MSCI All Country World UCITS ETF USD Acc, the NAV is calculated by taking the total market value of all the securities held within the ETF (its assets), subtracting any liabilities (expenses and other obligations), and then dividing the result by the total number of outstanding ETF shares. Understanding this figure is key to assessing your investment's performance.

- Definition of NAV in the context of ETFs: NAV is the per-share value of an ETF's assets, net of liabilities. It reflects the intrinsic worth of the investments held within the fund.

- Breakdown of the calculation: (Total Asset Value - Total Liabilities) / Number of Outstanding Shares = NAV per Share

- Why NAV is important for investors: NAV provides a clear picture of the ETF's underlying value, independent of market fluctuations in the ETF's share price.

How to Find the NAV of Amundi MSCI All Country World UCITS ETF USD Acc

Finding the daily NAV for the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. Several reliable sources provide this critical information:

- Official Amundi website: The most authoritative source is Amundi's official website. They usually publish the daily NAV prominently within the ETF's fact sheet or dedicated page.

- Major financial news sources (e.g., Bloomberg, Yahoo Finance): Reputable financial news websites and data providers typically list the NAV for major ETFs like the Amundi MSCI All Country World UCITS ETF USD Acc. Simply search for the ETF's ticker symbol.

- Your brokerage account: If you hold the ETF through a brokerage account, the current NAV will be readily available on your account statement or portfolio overview.

- ETF data providers: Specialized ETF data providers offer comprehensive information, including historical NAV data, allowing for detailed performance analysis.

Interpreting the NAV and its Implications

Changes in the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc directly reflect the performance of the underlying global assets. A rising NAV indicates positive performance, while a falling NAV suggests negative performance. However, it's vital to understand that several factors can influence NAV fluctuations:

- Rising NAV indicates positive performance: An increase signifies that the value of the ETF's holdings has increased.

- Falling NAV indicates negative performance: A decrease shows a decline in the overall value of the underlying assets.

- Factors affecting NAV (market volatility, currency exchange rates, dividend distributions): Market downturns, changes in currency exchange rates (as the ETF is USD-denominated), and dividend distributions from the underlying companies all impact the NAV.

- Understanding the difference between NAV and market price: While the NAV represents the intrinsic value, the market price can fluctuate throughout the trading day. This difference can create opportunities for buying low and selling high, though this requires a sophisticated understanding of market dynamics.

Using NAV in Investment Decisions

While the NAV provides valuable information, it shouldn't be the sole factor in your investment decisions. It's a crucial tool, but it needs to be integrated into a broader investment strategy:

- NAV as a tool for evaluating long-term performance: Tracking the NAV over time allows you to assess the long-term performance of your investment.

- NAV in comparison with other similar ETFs: Comparing the NAV performance of the Amundi MSCI All Country World UCITS ETF USD Acc with similar globally diversified ETFs helps you evaluate its relative performance.

- The importance of considering other factors (risk tolerance, investment goals): Your individual risk tolerance and overall investment goals must inform your decisions, in conjunction with the NAV data.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is fundamental for any investor. While NAV is a critical indicator of the ETF’s underlying performance, remember to consider other factors and your investment strategy before making buy or sell decisions. Regularly monitor your Amundi MSCI All Country World UCITS ETF USD Acc NAV to stay informed about your investment's performance. Start monitoring your Amundi MSCI All Country World UCITS ETF USD Acc NAV today! Learn more about using Net Asset Value (NAV) to improve your ETF investment strategy.

Featured Posts

-

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025 -

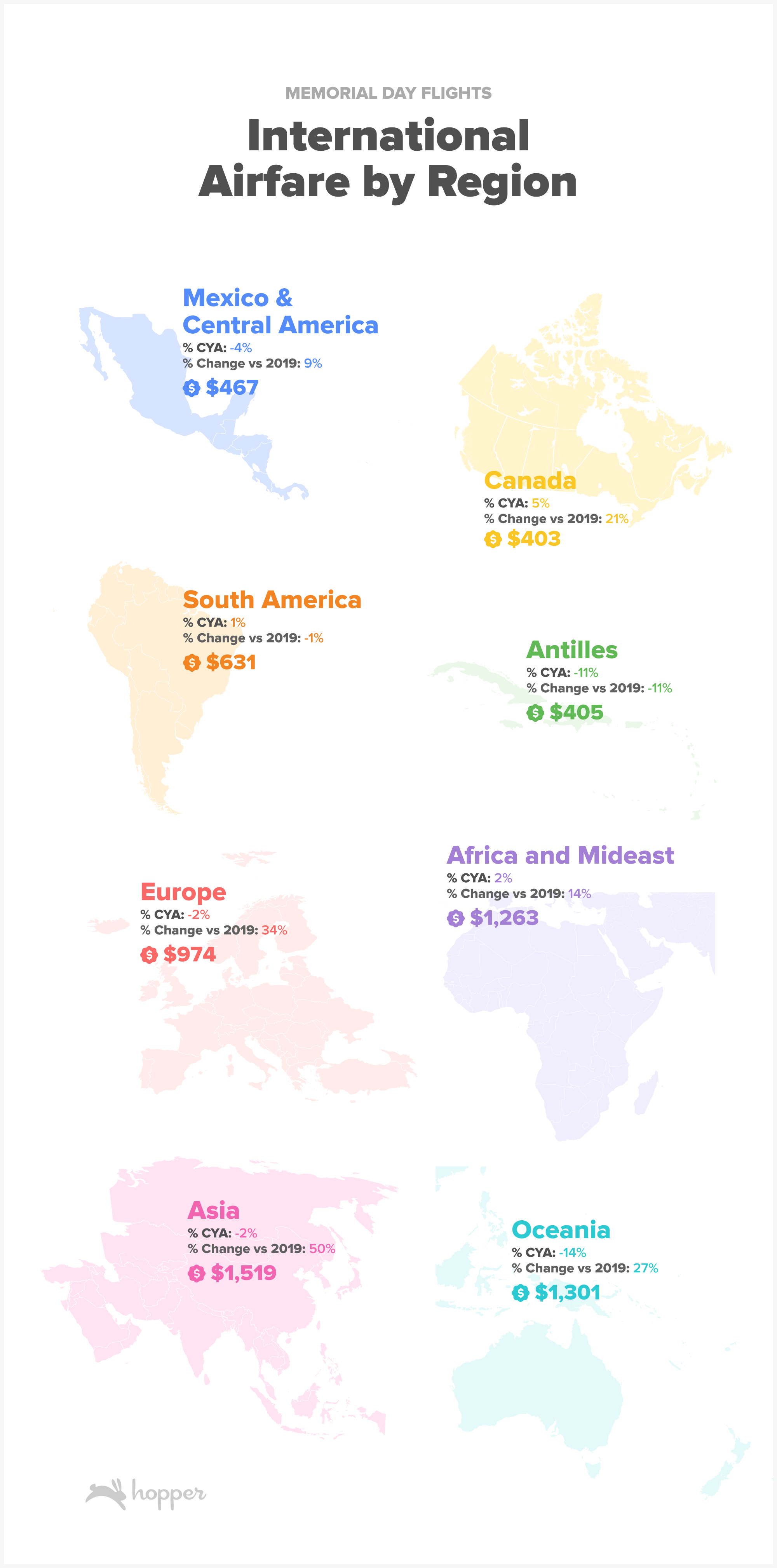

Memorial Day 2025 Airfare When To Book For The Best Prices

May 24, 2025

Memorial Day 2025 Airfare When To Book For The Best Prices

May 24, 2025 -

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025 -

Atfaq Washntn Wbkyn Altjary Ydfe Mwshr Daks Laela Artfae Ila 24 Alf Nqtt

May 24, 2025

Atfaq Washntn Wbkyn Altjary Ydfe Mwshr Daks Laela Artfae Ila 24 Alf Nqtt

May 24, 2025 -

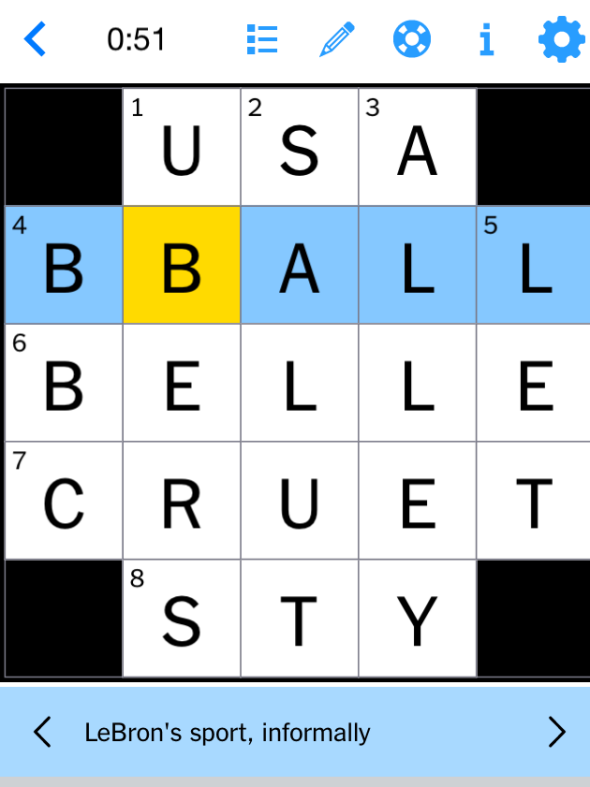

Nyt Mini Crossword Solutions March 26 2025

May 24, 2025

Nyt Mini Crossword Solutions March 26 2025

May 24, 2025

Latest Posts

-

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025 -

Annie Kilner Addresses Allegations Public Statement And Social Media

May 24, 2025

Annie Kilner Addresses Allegations Public Statement And Social Media

May 24, 2025 -

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025 -

The Kyle Walker Annie Kilner Story A Timeline Of Events

May 24, 2025

The Kyle Walker Annie Kilner Story A Timeline Of Events

May 24, 2025 -

Kyle Walker New Details Emerge Following Party Pictures And Annie Kilners Trip Home

May 24, 2025

Kyle Walker New Details Emerge Following Party Pictures And Annie Kilners Trip Home

May 24, 2025