How To Interpret The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

What is the Net Asset Value (NAV)?

The Net Asset Value (NAV) represents the current market value of an ETF's underlying assets per share. For the Amundi MSCI World II UCITS ETF Dist, this means the NAV reflects the total value of the stocks and other assets held within the ETF, mirroring the MSCI World Index it tracks, after accounting for expenses. The calculation is essentially the total value of the portfolio divided by the number of outstanding shares.

The NAV differs from the market price, which fluctuates throughout the trading day based on supply and demand. While they often move in tandem, discrepancies can occur, particularly in less liquid ETFs. Understanding this difference is key to interpreting your investment's actual performance.

Key factors influencing the Amundi MSCI World II UCITS ETF Dist's NAV include:

- Market Fluctuations of Underlying Assets: Changes in the prices of the individual stocks and securities within the ETF directly impact the overall NAV. A rising market generally leads to a higher NAV, and vice versa.

- Dividend Distributions: When the ETF distributes dividends from its underlying holdings, the NAV typically decreases by the amount of the distribution. This is because the assets within the fund have reduced in value accordingly.

- Expense Ratios: The ETF's expense ratio, which covers management and administrative fees, gradually erodes the NAV over time. These are usually deducted daily, impacting the daily NAV.

- Currency Exchange Rates: As the Amundi MSCI World II UCITS ETF Dist invests globally, fluctuations in exchange rates between different currencies can affect the NAV, particularly if significant portions of the portfolio are held in non-domestic currencies.

Finding the Amundi MSCI World II UCITS ETF Dist NAV

Finding the daily NAV of the Amundi MSCI World II UCITS ETF Dist is straightforward. Reliable sources include:

- Amundi's Official Website: The fund manager, Amundi, typically publishes the daily NAV on its official website, usually alongside other key performance indicators.

- Major Financial News Websites: Reputable financial news sources like Bloomberg, Yahoo Finance, and Google Finance often provide real-time or end-of-day NAV data for ETFs.

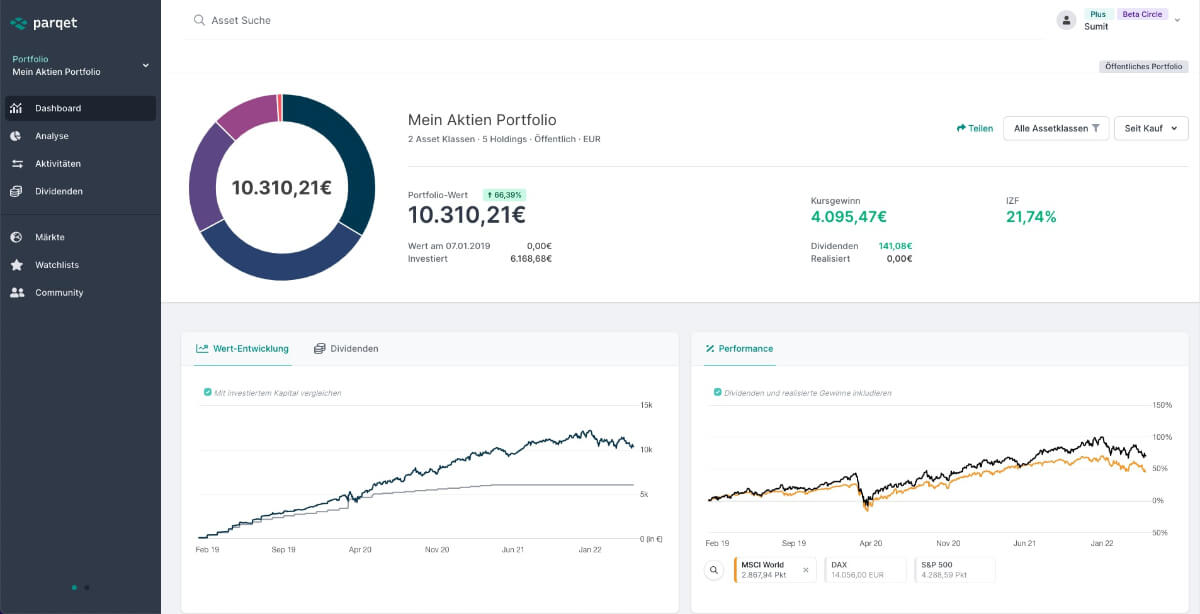

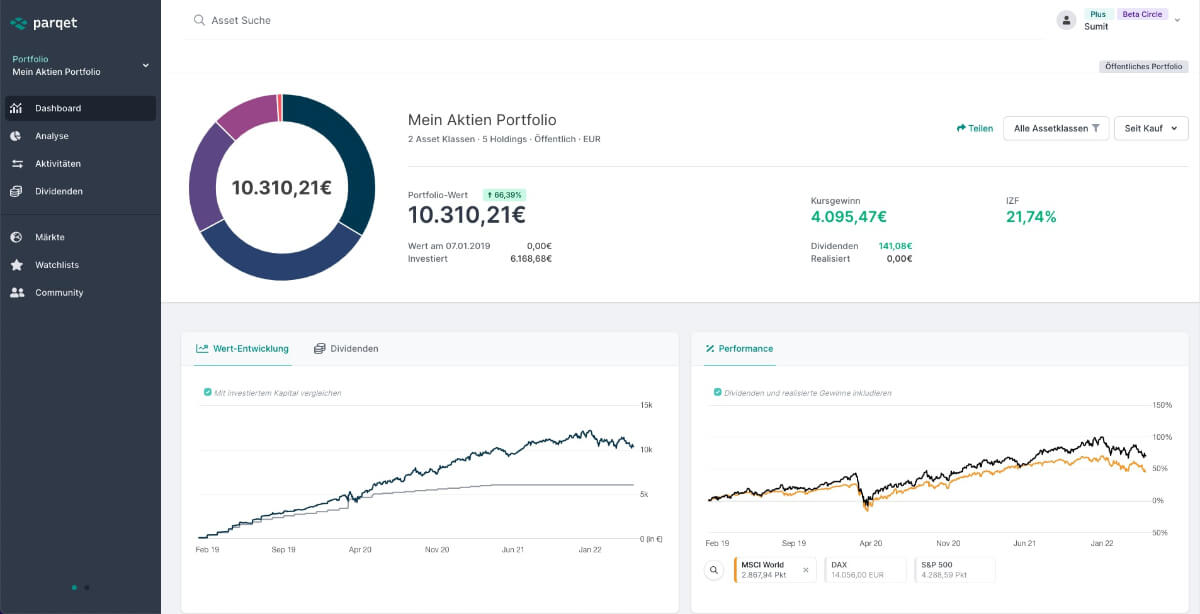

- Your Brokerage Account: Your brokerage account will display the NAV (and usually the market price) of your ETF holdings. This is often the most convenient method for monitoring your investment.

Accessing the data varies depending on the platform. You may find it displayed in charts, tables, or within detailed fund fact sheets. Crucially, always remember to check the NAV at the end of the trading day to get the most accurate daily value, as the NAV is calculated at the close of the market.

Using the NAV to Analyze Performance

Tracking the Amundi MSCI World II UCITS ETF Dist's NAV over time allows you to assess its performance. Comparing the NAV to its benchmark, the MSCI World Index, provides context and helps gauge the ETF's ability to track its target.

Calculating percentage changes in the NAV over various periods (daily, weekly, monthly, yearly) reveals performance trends. Positive changes indicate growth, while negative changes show losses.

Interpreting NAV trends requires consideration of market events.

- Identifying Upward and Downward Trends: Consistent upward trends suggest strong performance, while prolonged downward trends might indicate underperformance or broader market weakness.

- Understanding the Impact of Market Events: Major market events like economic downturns or geopolitical crises will significantly influence the NAV, often causing short-term volatility.

- Using Historical NAV Data to Predict Future Performance (with Caution): Past performance is not indicative of future results. While historical NAV data can provide insights, it's crucial to avoid relying solely on this information when making investment decisions.

NAV and Investment Decisions

The NAV is a crucial factor when making buy and sell decisions for the Amundi MSCI World II UCITS ETF Dist. However, it should not be the sole determinant. Consider your risk tolerance, investment goals, and broader market conditions. Regular monitoring of the NAV is important for informed decision making.

Using NAV for strategic investment might include:

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals, regardless of the NAV, can help mitigate the risk of investing a lump sum at a high NAV.

- Identifying Potential Entry and Exit Points: While risky, some investors attempt to time the market based on perceived NAV trends. This requires extensive market knowledge and experience.

- Understanding the Limitations of Using NAV Alone: NAV should be considered alongside other metrics, including expense ratios, dividend yields, and the overall market outlook, before making any investment decisions.

Conclusion

This guide has explained how to interpret the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist, highlighting its importance for tracking performance and making informed investment decisions. Understanding the factors that influence NAV and using reliable sources for data are crucial for successful investment. Regularly monitor the NAV of your Amundi MSCI World II UCITS ETF Dist holdings to stay informed about your investment's performance. Learn more about effectively using NAV data to optimize your Amundi MSCI World II UCITS ETF Dist investment strategy. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

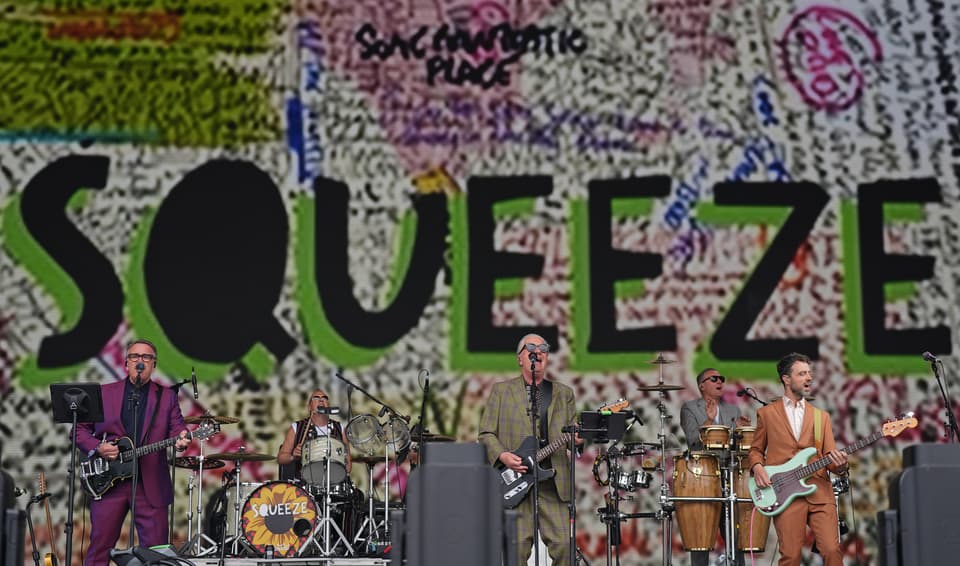

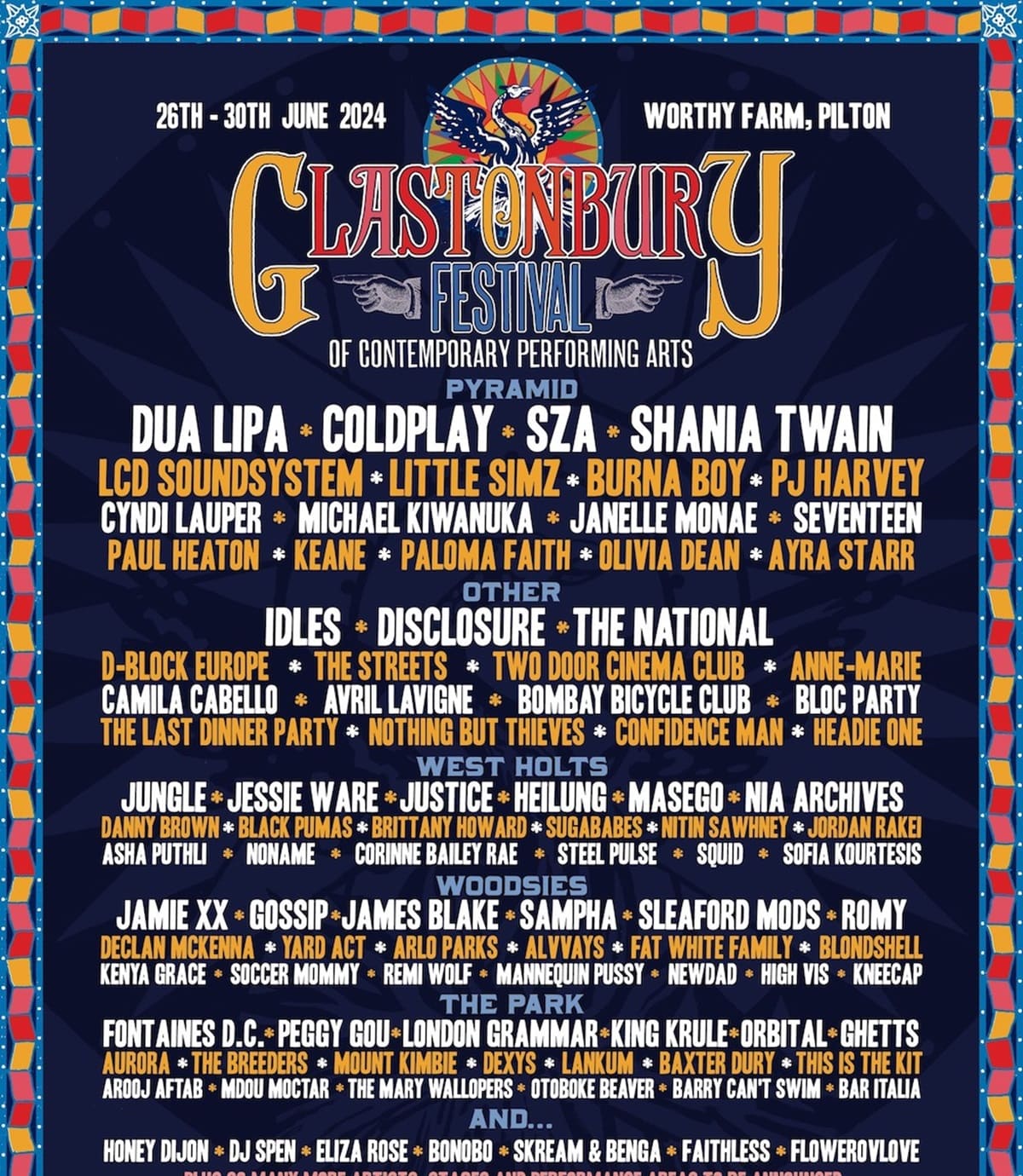

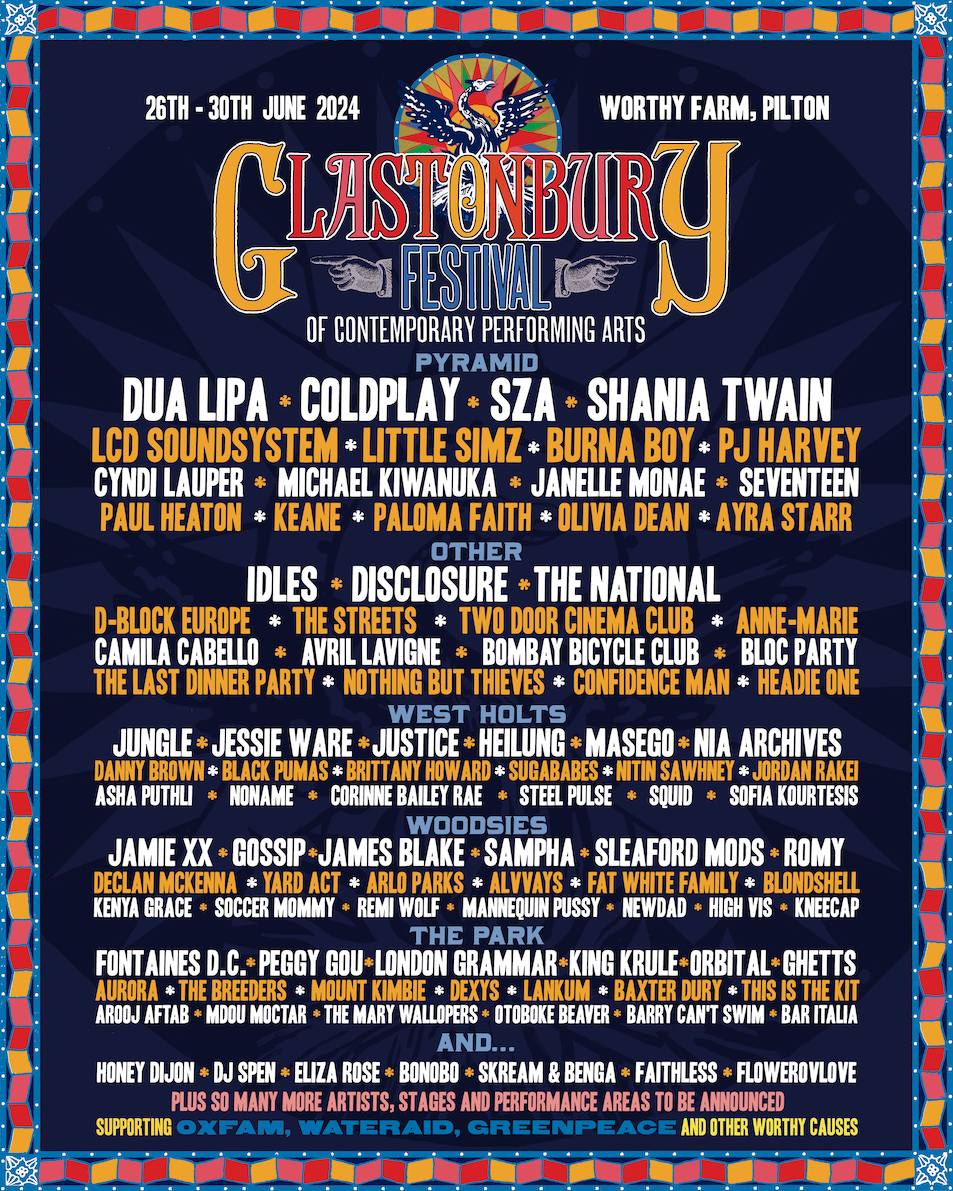

Is Glastonbury 2025s Lineup The Strongest Ever Featuring Charli Xcx Neil Young And Must See Acts

May 25, 2025

Is Glastonbury 2025s Lineup The Strongest Ever Featuring Charli Xcx Neil Young And Must See Acts

May 25, 2025 -

10 Let Posle Pobedy Na Evrovidenii Sudby Pobediteley

May 25, 2025

10 Let Posle Pobedy Na Evrovidenii Sudby Pobediteley

May 25, 2025 -

This Weeks Hottest R And B Featuring Leon Thomas And Flo

May 25, 2025

This Weeks Hottest R And B Featuring Leon Thomas And Flo

May 25, 2025 -

Konchita Vurst Peredbachennya Peremozhtsiv Yevrobachennya 2025 Unian

May 25, 2025

Konchita Vurst Peredbachennya Peremozhtsiv Yevrobachennya 2025 Unian

May 25, 2025 -

New R And B Releases Leon Thomas And Flos Chart Topping Hits

May 25, 2025

New R And B Releases Leon Thomas And Flos Chart Topping Hits

May 25, 2025

Latest Posts

-

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025 -

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025 -

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025 -

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025 -

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025