How To Interpret The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

Investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist requires a solid understanding of its Net Asset Value (NAV). The NAV serves as a crucial indicator reflecting the ETF's performance and the underlying value of its assets. This comprehensive guide will demystify the NAV of this specific ETF and explain how it impacts your investment strategy. Understanding the NAV is key to making informed decisions about your portfolio.

What is Net Asset Value (NAV)?

Keywords: NAV definition, ETF valuation, asset value, fund value

The Net Asset Value (NAV) represents the intrinsic value of each share in an exchange-traded fund (ETF). In simple terms, it's the total value of all the assets held within the ETF, divided by the total number of outstanding shares. Unlike the market price, which can fluctuate throughout the trading day, the NAV is calculated at the end of each trading day. This provides a more accurate picture of the fund's underlying asset value.

- NAV is calculated daily: The calculation takes place after the close of the market, reflecting the final prices of all assets held within the ETF.

- It reflects the total value of the ETF's holdings: This includes all stocks, bonds, or other assets within the fund's portfolio, based on their respective market values.

- Fluctuations in the NAV mirror changes in the underlying assets' value: If the stocks comprising the MSCI World Index, which this ETF tracks, increase in value, the NAV will generally rise as well.

- Understanding NAV helps investors assess the intrinsic value: By comparing the NAV to the market price, investors gain insight into the ETF's true worth and can identify potential buying or selling opportunities.

How the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is Calculated

Keywords: Amundi MSCI World II NAV calculation, USD Hedged impact, currency hedging, MSCI World Index constituents, ETF holdings

The NAV calculation for the Amundi MSCI World II UCITS ETF USD Hedged Dist involves several key steps. The fund aims to track the MSCI World Index, a broad market-capitalization-weighted index of global equities. However, a crucial aspect is the USD hedging strategy.

- Portfolio Composition: The ETF invests in a diverse portfolio of stocks that mirror the MSCI World Index’s composition, offering exposure to various sectors and geographic regions globally.

- Impact of Currency Hedging: The "USD Hedged" designation indicates that the fund employs currency hedging strategies to mitigate the impact of exchange rate fluctuations between the USD and other currencies. This hedging reduces the risk associated with international investments but can also influence the NAV calculation.

- Data Sources: The NAV calculation relies on the closing market prices of all constituent assets within the ETF's portfolio. These prices are obtained from reputable sources.

The precise calculation involves converting the value of assets denominated in non-USD currencies to USD using the prevailing exchange rates (adjusted for the hedging strategy), summing the USD value of all assets, and dividing the result by the number of outstanding shares.

Interpreting the NAV and its Significance for Investors

Keywords: NAV interpretation, investment decisions, ETF performance, Amundi MSCI World II performance, risk management

The NAV provides crucial information to investors regarding the Amundi MSCI World II UCITS ETF USD Hedged Dist's performance and risk profile.

- Tracking NAV Changes: Monitoring the NAV over time reveals the ETF's growth or decline. Consistent upward trends generally signify strong performance, while downward trends might warrant a closer look at the underlying market conditions.

- NAV vs. Market Price: The market price of the ETF might deviate slightly from the NAV. A premium (market price > NAV) or discount (market price < NAV) can emerge due to supply and demand dynamics. Recognizing these discrepancies can present potential trading opportunities.

- Risk Assessment: Analyzing historical NAV fluctuations helps investors assess the ETF’s overall risk profile. Larger swings in the NAV indicate higher volatility, suggesting a potentially riskier investment compared to an ETF with a more stable NAV.

- Long-Term Investment Strategy: The NAV provides a critical metric for evaluating the long-term performance and effectiveness of your investment strategy. Consistent monitoring allows for timely adjustments based on performance relative to your goals.

Where to Find the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Keywords: Amundi website, financial news sources, brokerage platforms, NAV data access

Accessing the daily NAV for the Amundi MSCI World II UCITS ETF USD Hedged Dist is straightforward:

- Amundi's Official Website: The fund manager, Amundi, typically publishes the daily NAV on its investor relations page.

- Financial News Websites and Data Providers: Major financial news sources (like Bloomberg, Yahoo Finance, etc.) and data providers often include NAV data for ETFs.

- Brokerage Account: Your brokerage account will display the NAV of the ETF alongside its market price, providing a convenient way to track your investment's performance.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is fundamental to successful investing. By regularly monitoring the NAV, comparing it to the market price, and analyzing its historical trends, you can gain valuable insights into the ETF’s performance, risk profile, and the overall health of your investment portfolio. Regularly monitor the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF USD Hedged Dist investment to make informed investment decisions. Proactive monitoring of the NAV is crucial for long-term success with this and similar ETFs.

Featured Posts

-

Porsche Macan Your Comprehensive Buyers Guide For 2024

May 25, 2025

Porsche Macan Your Comprehensive Buyers Guide For 2024

May 25, 2025 -

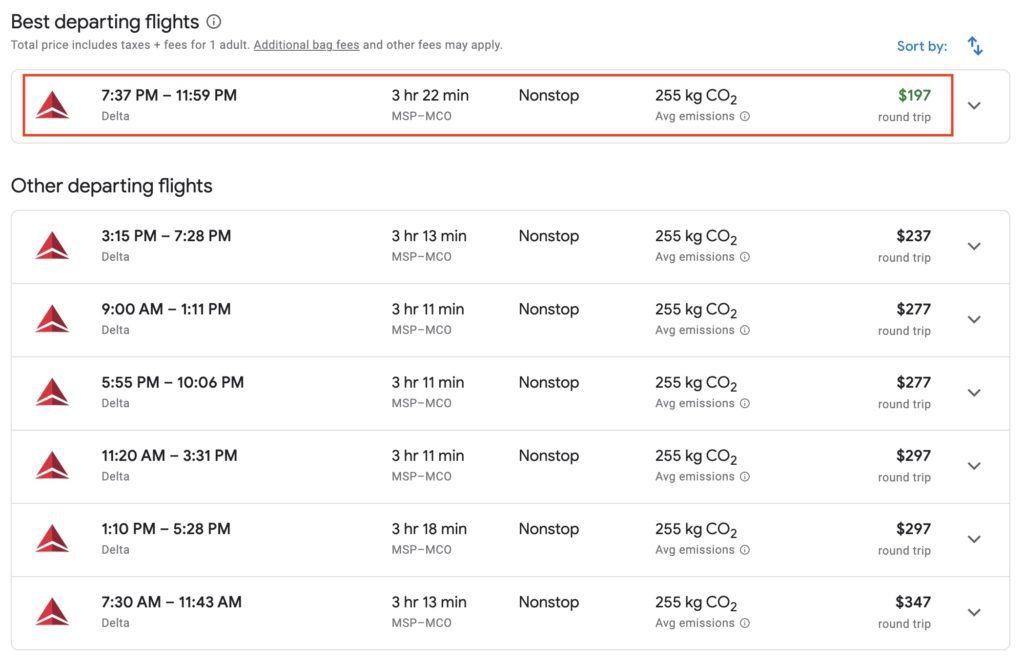

Cheapest Flights For Memorial Day 2025 When To Book And Fly

May 25, 2025

Cheapest Flights For Memorial Day 2025 When To Book And Fly

May 25, 2025 -

Picture This Soundtrack Your Guide To The Music Of The Prime Video Film

May 25, 2025

Picture This Soundtrack Your Guide To The Music Of The Prime Video Film

May 25, 2025 -

Fyrsta 100 Rafmagnsutgafan Af Porsche Macan Oell Upplysingar

May 25, 2025

Fyrsta 100 Rafmagnsutgafan Af Porsche Macan Oell Upplysingar

May 25, 2025 -

Your Dream Country Escape A Step By Step Plan

May 25, 2025

Your Dream Country Escape A Step By Step Plan

May 25, 2025

Latest Posts

-

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025 -

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025 -

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025 -

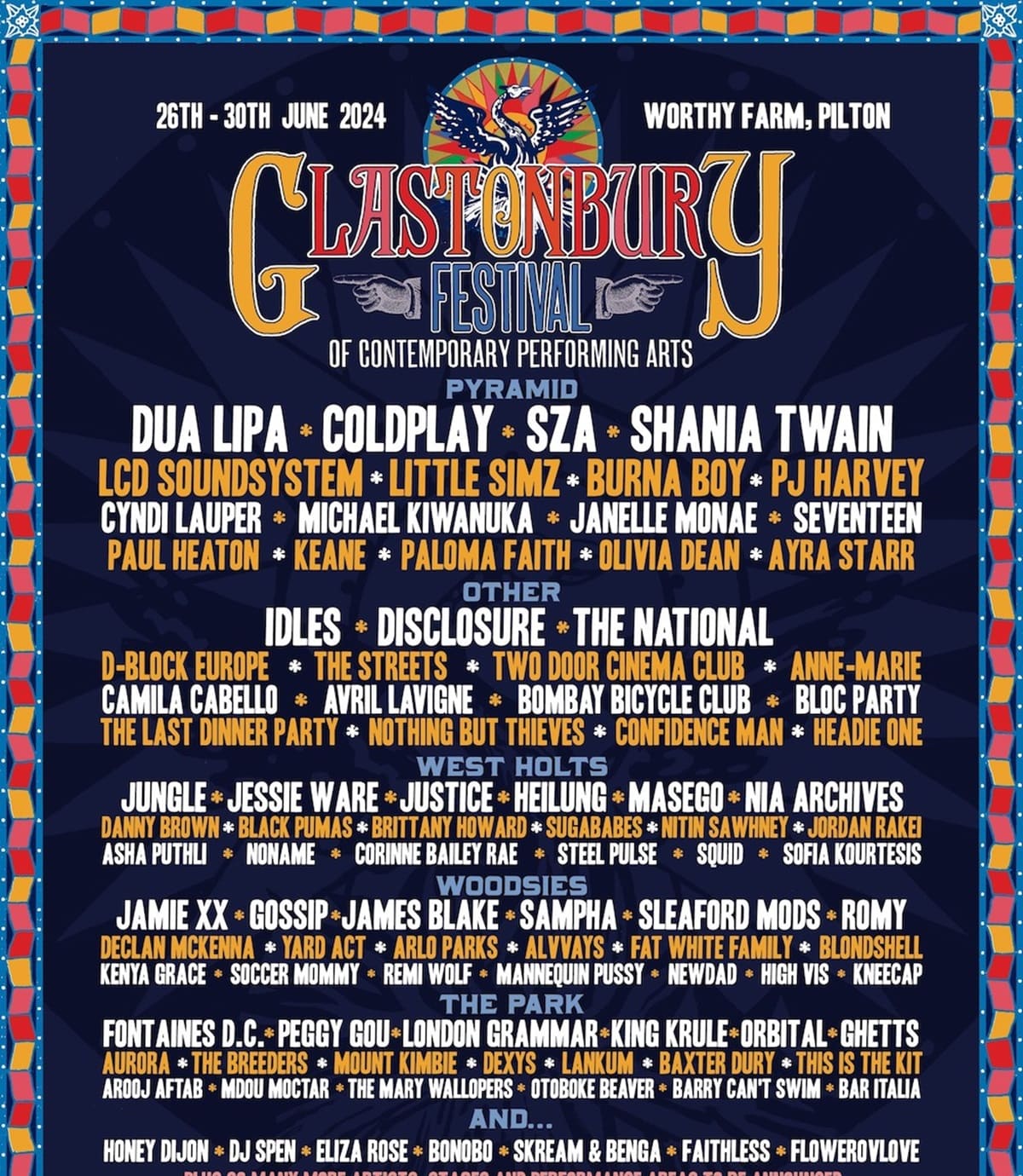

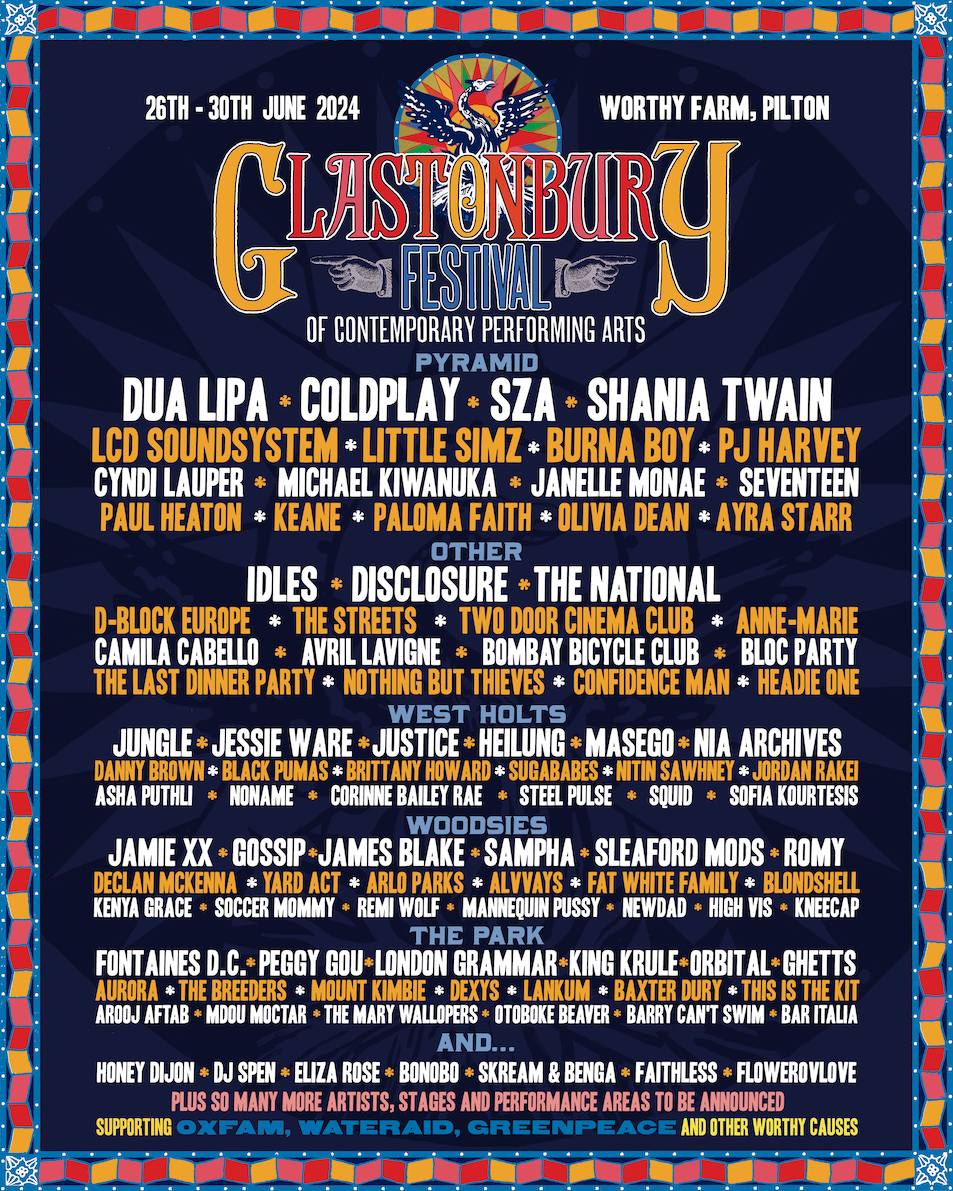

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025 -

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025