How Will QBTS Earnings Affect Its Stock Price?

Table of Contents

QBTS's upcoming earnings announcement is a pivotal moment for investors. The reported financial performance will significantly impact the QBTS stock price, influencing investor confidence and market reactions. This article delves into the key factors that determine how QBTS earnings affect its stock price, examining the interplay between financial results, market expectations, and overall investor sentiment. We'll explore potential scenarios and provide insights for informed investment decisions regarding QBTS investment.

Analyzing QBTS's Financial Performance

Analyzing QBTS's financial performance is crucial for understanding its stock price movement. Several key metrics will influence investor perception and the subsequent QBTS share price reaction.

Revenue Growth and Expectations

Past revenue trends provide valuable context for predicting future performance. Comparing QBTS's revenue growth to industry benchmarks reveals its competitive position. Exceeding or falling short of analyst expectations for QBTS earnings will significantly impact the stock price.

- Year-over-year revenue growth: A consistent upward trend suggests strong market demand and business health.

- Quarterly revenue performance: Analyzing quarterly results reveals short-term performance patterns and seasonality.

- Revenue breakdown by segment: Understanding revenue contributions from different business segments helps identify growth drivers and potential risks.

- Analyst consensus estimates: Comparing actual results to analyst forecasts is vital in predicting market reaction. A significant deviation from these estimates will likely influence the QBTS stock forecast.

Profitability and Margins

Profitability metrics are essential indicators of a company's financial health. Improving or declining margins directly impact investor confidence and the QBTS stock price.

- Gross profit margin: This metric reveals the efficiency of QBTS's production or service delivery.

- Operating profit margin: This shows profitability after deducting operating expenses.

- Net profit margin: This represents the ultimate profitability after all expenses, including taxes and interest, are considered.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): EBITDA is a useful measure of a company's operating profitability.

- Profitability trends: Analyzing the trends in these margins over time provides insights into the long-term financial health of QBTS.

Key Performance Indicators (KPIs)

Specific KPIs relevant to QBTS's business model offer deeper insights into its operational performance. These metrics significantly influence the QBTS stock price valuation.

- Customer acquisition cost (CAC): A lower CAC suggests efficient marketing and customer acquisition strategies.

- Customer lifetime value (CLTV): A high CLTV indicates strong customer retention and loyalty.

- Average revenue per user (ARPU): ARPU growth reflects the ability to increase revenue from existing customers.

- Churn rate: A lower churn rate suggests high customer satisfaction and retention.

- Market share: Growth in market share indicates successful competition and market penetration.

Market Sentiment and Investor Expectations

Market sentiment and investor expectations heavily influence the QBTS stock price reaction to earnings. Understanding these factors is crucial for accurate forecasting.

Analyst Ratings and Price Targets

Financial analysts provide valuable insights through ratings and price targets. Changes in these predictions before and after earnings can significantly influence the QBTS stock price.

- Buy, hold, sell ratings: These ratings reflect analysts' overall assessment of QBTS's prospects.

- Average price target: This indicates the consensus price expectation among analysts.

- Range of price targets: The range highlights the variation in analysts' opinions and the potential price volatility.

News and Media Coverage

News articles, press releases, and social media sentiment influence investor perception of QBTS. Positive or negative coverage can impact the QBTS stock forecast and trading activity.

- Positive and negative news coverage: Positive news generally boosts investor confidence, while negative news can trigger selling.

- Social media sentiment analysis: Tracking social media sentiment can offer a real-time pulse on investor opinions.

- Impact of news on stock price volatility: Significant news events can increase price volatility around the QBTS earnings announcement.

Overall Market Conditions

Broader economic factors impact investor behavior and market reactions to QBTS earnings.

- Interest rate environment: Rising interest rates might negatively impact valuations across the market, including QBTS.

- Inflation rates: High inflation can erode profitability and reduce investor confidence.

- Overall market performance (e.g., S&P 500): A strong overall market tends to support positive reactions to earnings, even if QBTS's performance is only slightly better than expectations.

Potential Scenarios and Their Impact on QBTS Stock Price

The QBTS stock price reaction depends heavily on how the actual earnings compare to expectations and the overall market context.

Beating Expectations

Surpassing expectations generally leads to a positive market response, boosting investor confidence and the QBTS stock price.

- Magnitude of the beat: A larger-than-expected positive surprise usually results in a more significant price increase.

- Investor confidence boost: Exceeding expectations reinforces confidence in QBTS's management and future prospects.

- Potential for increased trading volume: Positive surprises often attract increased trading activity.

Meeting Expectations

Meeting expectations usually results in a relatively neutral market reaction, with minimal impact on the QBTS share price.

- Market neutrality: Meeting expectations may result in little price change in the short term.

- Potential for short-term price fluctuations: Even if QBTS meets expectations, short-term price fluctuations are possible based on market sentiment.

Missing Expectations

Underperforming expectations typically leads to a negative market reaction, potentially causing a significant drop in the QBTS stock price.

- Magnitude of the miss: The extent of underperformance will directly impact the severity of the price decline.

- Investor sell-off: Disappointment can trigger a sell-off by investors, pushing the QBTS stock price down.

- Potential for increased volatility: Missing expectations can increase price volatility in the short term.

Conclusion

QBTS earnings are a critical factor influencing its stock price. The impact depends significantly on how the company's financial performance compares to analyst expectations and broader market conditions. Exceeding expectations typically results in positive price movements, while falling short can lead to declines. Understanding the interplay between financial results, investor sentiment, and market factors is crucial for navigating the potential volatility around the QBTS earnings announcement. Remember that past performance is not indicative of future results.

Call to Action: Stay informed about QBTS earnings and their impact on the stock price by regularly monitoring financial news, analyst reports, and market trends. Thorough research and careful consideration of your risk tolerance are crucial when making investment decisions based on QBTS earnings and their effect on its stock price. Always consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Original Sin Season 1 A Deeper Look At Dexters Debra Morgan Error

May 21, 2025

Original Sin Season 1 A Deeper Look At Dexters Debra Morgan Error

May 21, 2025 -

Liverpool Fc News Jeremie Frimpong Transfer Update Agreement But No Contact

May 21, 2025

Liverpool Fc News Jeremie Frimpong Transfer Update Agreement But No Contact

May 21, 2025 -

Huizenprijzen Nederland Analyse Van Abn Amro En De Geen Stijl Reactie

May 21, 2025

Huizenprijzen Nederland Analyse Van Abn Amro En De Geen Stijl Reactie

May 21, 2025 -

Strange Red Lights In The French Sky A Recent Investigation

May 21, 2025

Strange Red Lights In The French Sky A Recent Investigation

May 21, 2025 -

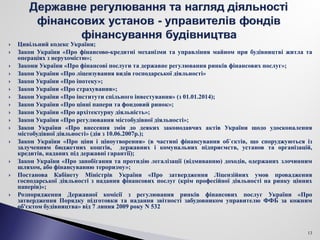

Analiz Rinku Finansovikh Poslug Ukrayini Lideri 2024 Roku

May 21, 2025

Analiz Rinku Finansovikh Poslug Ukrayini Lideri 2024 Roku

May 21, 2025

Latest Posts

-

Wife Of Tory Politician Remains Imprisoned For Anti Migrant Outburst In Southport

May 22, 2025

Wife Of Tory Politician Remains Imprisoned For Anti Migrant Outburst In Southport

May 22, 2025 -

8 6 Thriller Tigers Prove Doubters Wrong Against Rockies

May 22, 2025

8 6 Thriller Tigers Prove Doubters Wrong Against Rockies

May 22, 2025 -

Delayed Ruling Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 22, 2025

Delayed Ruling Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 22, 2025 -

Rockies Vs Tigers 8 6 Upset Shows Promise For Detroit

May 22, 2025

Rockies Vs Tigers 8 6 Upset Shows Promise For Detroit

May 22, 2025 -

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 22, 2025

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 22, 2025