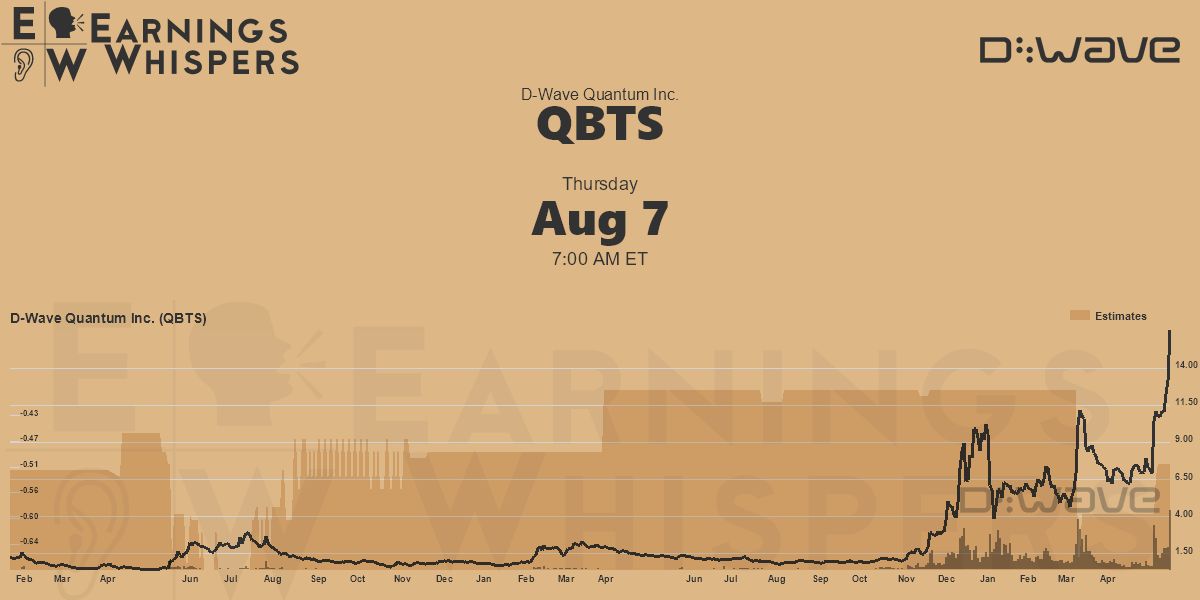

How Will The Next QBTS Earnings Report Affect The Stock Price?

Table of Contents

Brief Overview: QBTS, a leading [insert QBTS's industry and brief description, e.g., technology company specializing in cloud-based solutions], has shown [mention recent performance, e.g., mixed results in recent quarters, with fluctuating revenue growth]. The upcoming QBTS earnings report will be closely scrutinized by investors to gauge the company's future trajectory and the health of its financial performance.

Analyzing QBTS's Past Performance to Predict Future Trends

Analyzing past QBTS financial performance is key to forecasting the market's reaction to the next QBTS earnings report. By examining key performance indicators (KPIs), we can identify trends and potential areas of strength or weakness.

Key Performance Indicators (KPIs) to Watch:

-

Revenue growth/decline: Consistent year-over-year revenue growth signals a healthy business model. Declining revenue, however, raises concerns about market share and future profitability.

-

Earnings per share (EPS): EPS reflects the company's profitability on a per-share basis. Beating or missing EPS expectations significantly impacts investor sentiment and the QBTS stock price.

-

Profit margins: Profit margins indicate the efficiency of QBTS's operations. Improving profit margins suggest effective cost management and pricing strategies.

-

Debt levels: High levels of debt can burden a company, increasing its financial risk and potentially impacting its stock valuation.

-

Customer acquisition costs: High customer acquisition costs can hinder profitability, especially for subscription-based models.

-

Example: In Q2 2024, QBTS exceeded EPS expectations by 15%, indicating strong performance and potentially driving up the QBTS stock price after the report's release. However, a subsequent decline in revenue growth in Q3 could offset this positive impact.

Analyzing the relationship between these KPIs in past QBTS earnings reports and the subsequent stock price movements reveals patterns that can inform future predictions. A history of positive surprises often leads to a positive market reaction, while consistent misses can result in a sell-off.

Factors Beyond QBTS's Financial Results that Could Influence Stock Price

The QBTS stock price isn't solely determined by the numbers in the QBTS earnings report. External factors can significantly impact investor decisions.

Macroeconomic Conditions:

- Inflation: High inflation can erode consumer spending, potentially affecting QBTS's revenue.

- Interest rates: Rising interest rates increase borrowing costs, potentially impacting QBTS's investment decisions and profitability.

- Recessionary fears: Economic uncertainty can lead investors to favor safer assets, causing a sell-off even if the QBTS earnings report is positive.

Industry Trends and Competition:

- Competitive landscape: The presence of aggressive competitors can impact QBTS's market share and profitability.

- Emerging threats: New technologies or business models could disrupt QBTS's market, affecting investor confidence.

- Regulatory changes: New regulations in QBTS's industry could impose costs or limit growth opportunities.

Investor Sentiment and Market Psychology:

- Overall market sentiment: A positive market environment generally boosts stock prices, even for companies with less-than-stellar results.

- News coverage: Positive or negative news coverage can sway investor opinions and influence the stock price reaction to the QBTS earnings report.

- Analyst predictions: Analyst ratings and forecasts can significantly influence investor behavior and the QBTS stock price.

Interpreting the QBTS Earnings Report: What to Look For

The QBTS earnings report itself provides crucial information, but careful analysis is essential.

Guidance for Future Performance:

- Management's outlook for future quarters is a key indicator of investor confidence. Positive guidance usually leads to a positive stock price reaction.

- Realistic and achievable targets are preferred over overly optimistic projections.

Conference Call and Q&A Session:

- The management team's responses during the conference call offer valuable insights into the company's strategic direction and address investor concerns.

- Unexpected answers or shifts in strategy can significantly impact investor sentiment.

Unexpected Developments or Surprises:

- Unexpected positive news (e.g., a new strategic partnership) can boost the stock price significantly.

- Negative surprises (e.g., a product recall) can trigger a sharp drop in the QBTS stock price, regardless of the core earnings figures.

Conclusion: Preparing for the Impact of the QBTS Earnings Report on Stock Price

The QBTS stock price's reaction to the upcoming QBTS earnings report will depend on a complex interplay of factors: past performance, macroeconomic conditions, industry dynamics, investor sentiment, and the report's contents themselves. Staying informed about the QBTS earnings report release date is vital. Learn how to analyze the QBTS earnings report and make informed investment decisions based on your risk tolerance. Understand the factors that will affect the QBTS stock price and develop a robust investment strategy.

Disclaimer: Investing in the stock market involves inherent risks, including the potential loss of capital. This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions. Stay tuned for the upcoming QBTS earnings report!

Featured Posts

-

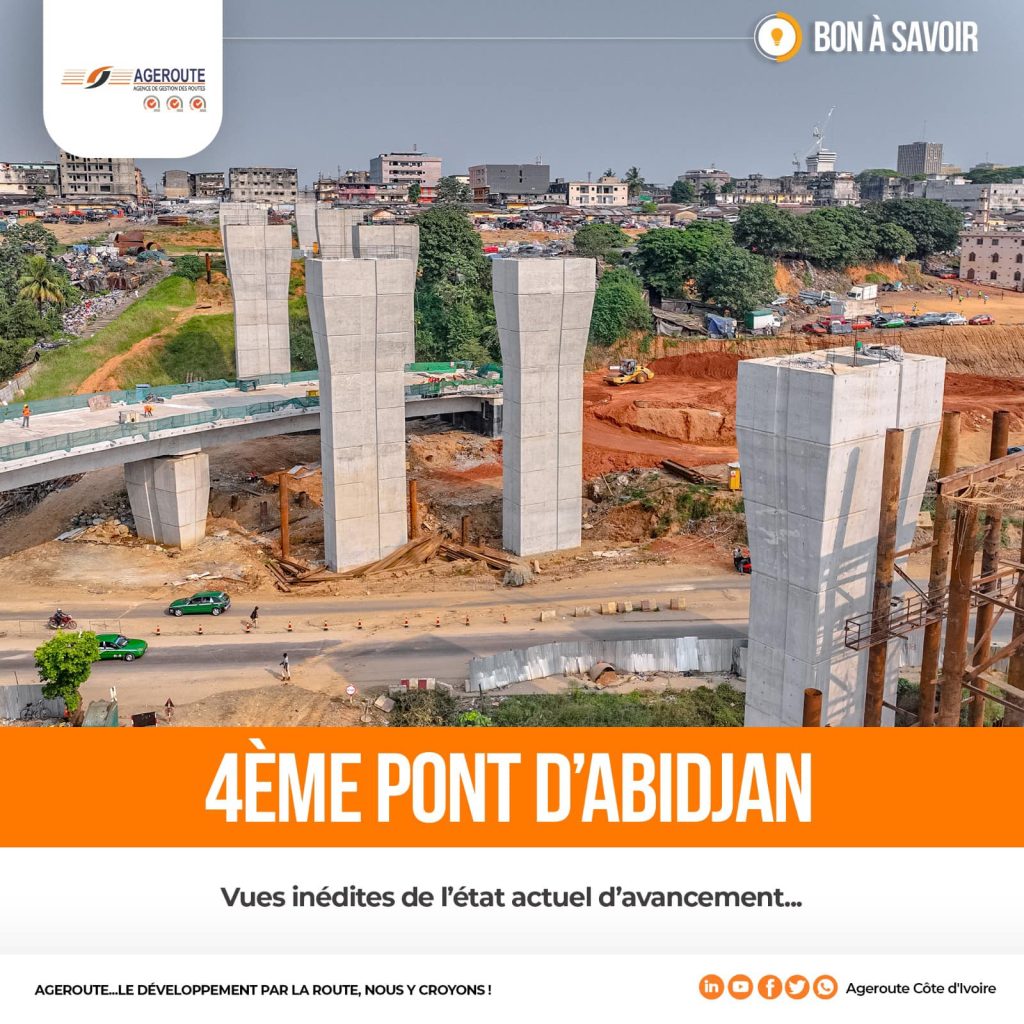

4eme Pont D Abidjan Delai Cout Et Depenses Les Clarifications

May 20, 2025

4eme Pont D Abidjan Delai Cout Et Depenses Les Clarifications

May 20, 2025 -

Solo Travel The Rise Of The Independent Explorer

May 20, 2025

Solo Travel The Rise Of The Independent Explorer

May 20, 2025 -

Todays Nyt Mini Crossword Answers March 13 2025

May 20, 2025

Todays Nyt Mini Crossword Answers March 13 2025

May 20, 2025 -

High Winds And Fast Moving Storms A Guide To Safety

May 20, 2025

High Winds And Fast Moving Storms A Guide To Safety

May 20, 2025 -

Leclerc Speaks Out Team Orders Controversy And Hamiltons Impact

May 20, 2025

Leclerc Speaks Out Team Orders Controversy And Hamiltons Impact

May 20, 2025