Hudson's Bay Offloads Iconic Brands To Canadian Tire: A $30 Million Deal

Table of Contents

The Brands Involved: A Look at the Acquired Assets

The $30 million deal includes a portfolio of well-known brands with a substantial presence in the Canadian retail landscape. The acquired assets represent a significant piece of Canadian retail history and consumer familiarity. Let's take a closer look:

-

Mark's: This popular Canadian retailer specializing in workwear, outdoor apparel, and footwear holds a significant market share and strong brand recognition. Its acquisition represents a substantial addition to Canadian Tire's portfolio. Keywords: Mark's, brand acquisition, Canadian brands, retail brands.

-

Zellers: While significantly smaller than its former self, the Zellers brand still holds considerable nostalgic value for many Canadians. Its acquisition could allow Canadian Tire to leverage this brand recognition, potentially through strategic relaunching of select locations or an online presence. Keywords: Zellers, brand acquisition, Canadian brands, retail brands.

(Add other brands included in the deal here, following the same structure)

The combined market share and brand recognition of these acquired assets represent a significant coup for Canadian Tire and demonstrate its ambitious expansion strategy within the Canadian retail market.

Why Did Hudson's Bay Sell? Analyzing the Motivation

Hudson's Bay's decision to divest these brands likely stems from a combination of factors, primarily focused on strategic realignment and financial optimization. The company has faced challenges in recent years, struggling with profitability and competition in a rapidly evolving retail landscape.

-

Financial Performance: Declining profits and pressure from shareholders likely played a major role in the decision to sell off less profitable assets. Keywords: Hudson's Bay financial performance, strategic divestment, retail restructuring, debt reduction.

-

Strategic Realignment: By focusing on its core business operations, Hudson's Bay can streamline operations and potentially improve profitability. Selling non-core assets allows for a greater focus on its flagship department stores and other key initiatives.

-

Debt Reduction: The sale could also contribute to debt reduction, improving the company's overall financial health and providing greater financial flexibility for future investments.

The sale signals a significant strategic shift for Hudson's Bay, indicating a move towards a more streamlined and focused business model.

What This Means for Canadian Tire: Strategic Implications

For Canadian Tire, the acquisition presents a significant opportunity for strategic expansion and diversification. The addition of these brands expands its reach into new market segments and strengthens its overall retail dominance.

-

Expanded Market Reach: The acquired brands bring new customer bases and introduce Canadian Tire to segments it may not have previously targeted effectively. Keywords: Canadian Tire acquisition, strategic expansion, retail synergy, market share growth.

-

Synergies and Integration: Canadian Tire can leverage synergies between its existing brands and the newly acquired ones, potentially streamlining operations and improving efficiency. This could involve shared logistics, marketing, and other operational functions.

-

Future Plans: Canadian Tire will likely focus on integrating these brands seamlessly into its existing operations, potentially through rebranding efforts, strategic store placements, and updated product offerings.

The Impact on Consumers: Price Changes and Brand Experience

The acquisition's impact on consumers remains to be seen, but several potential scenarios exist. Changes to pricing, product offerings, and the overall brand experience are all likely.

-

Pricing Strategies: Canadian Tire might adjust pricing strategies for the acquired brands, potentially impacting consumer affordability. Keywords: consumer impact, price changes, retail experience, brand loyalty, product offerings.

-

Store Locations and Loyalty Programs: Changes to store locations and loyalty programs are possible, affecting consumers' access to these brands and their overall shopping experience.

-

Product Offerings: Canadian Tire might introduce new product lines or discontinue existing ones, altering the range of products available to consumers under these brands.

Consumers will need to monitor these changes closely to understand the full impact of this retail shakeup.

Conclusion: The Future of Hudson's Bay and Canadian Tire after the $30 Million Deal

The $30 million sale of Hudson's Bay's iconic brands to Canadian Tire represents a significant turning point for both companies and the Canadian retail landscape. Hudson's Bay has streamlined its operations, focusing on core businesses, while Canadian Tire has significantly expanded its market reach and portfolio. The long-term impact on consumers remains uncertain, with potential changes to pricing, brand experiences, and product offerings anticipated. The success of this acquisition will hinge on Canadian Tire's ability to integrate these brands effectively and capitalize on potential synergies. Share your thoughts on this significant deal and follow us for further updates on the integration of these Hudson's Bay brands under Canadian Tire's umbrella.

Featured Posts

-

Exclusive Air Traffic Controller Reveals Near Miss Details

May 17, 2025

Exclusive Air Traffic Controller Reveals Near Miss Details

May 17, 2025 -

Comey Deletes Instagram Post Amid Conservative Backlash

May 17, 2025

Comey Deletes Instagram Post Amid Conservative Backlash

May 17, 2025 -

Impact Of Injuries On Mariners Tigers Series March 31 April 2

May 17, 2025

Impact Of Injuries On Mariners Tigers Series March 31 April 2

May 17, 2025 -

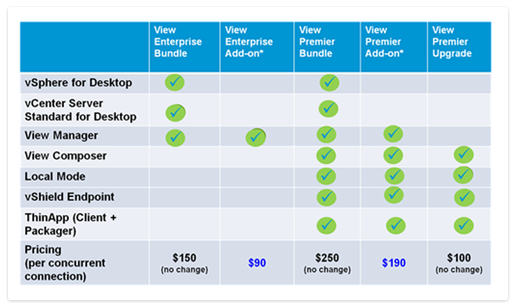

1 050 V Mware Price Increase At And T Sounds Alarm On Broadcoms Proposal

May 17, 2025

1 050 V Mware Price Increase At And T Sounds Alarm On Broadcoms Proposal

May 17, 2025 -

Tam Krwz Awr Mdah Jwtwn Ka Waqeh Swshl Mydya Pr Chrcha Ka Mwdwe

May 17, 2025

Tam Krwz Awr Mdah Jwtwn Ka Waqeh Swshl Mydya Pr Chrcha Ka Mwdwe

May 17, 2025

Latest Posts

-

Tony Bennett His Collaborations And The People He Inspired

May 17, 2025

Tony Bennett His Collaborations And The People He Inspired

May 17, 2025 -

Apple Tv 3 Month Discount 3 Offer Ending Soon

May 17, 2025

Apple Tv 3 Month Discount 3 Offer Ending Soon

May 17, 2025 -

Tony Bennett And The People Who Shaped His Career

May 17, 2025

Tony Bennett And The People Who Shaped His Career

May 17, 2025 -

Apple Tv Special Offer 3 Months Of Streaming For 3

May 17, 2025

Apple Tv Special Offer 3 Months Of Streaming For 3

May 17, 2025 -

Ralph Lauren Fall 2025 The Riser Collection Unveiled

May 17, 2025

Ralph Lauren Fall 2025 The Riser Collection Unveiled

May 17, 2025