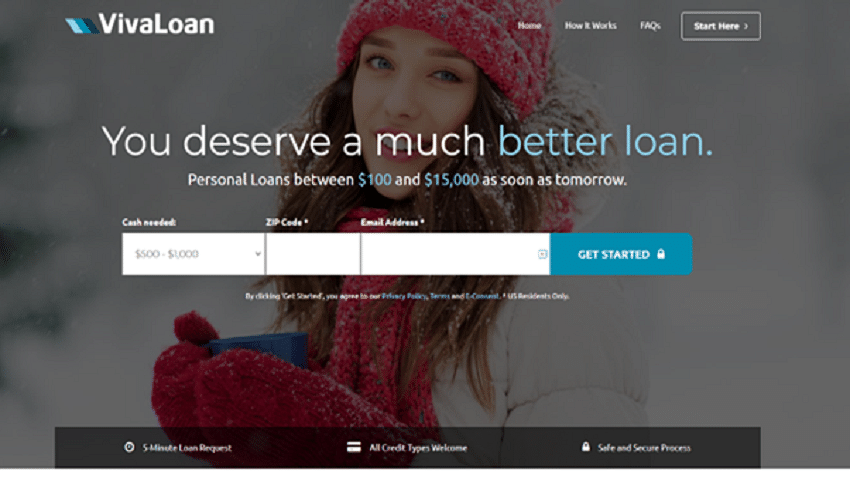

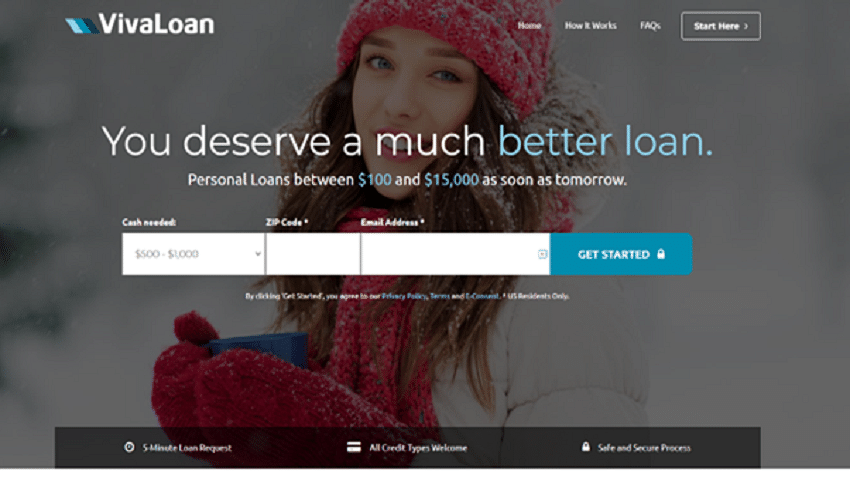

IOnline Payday Loans: Best Tribal Loans For Bad Credit With Guaranteed Approval

Table of Contents

Understanding Online Payday Loans

What are Online Payday Loans?

Online payday loans are short-term, small-dollar loans designed to bridge the gap until your next payday. They're typically repaid in a single lump sum, usually within two to four weeks. These loans are accessed and managed entirely online, offering convenience and speed. Loan amounts generally range from a few hundred to a thousand dollars, depending on the lender and your financial situation. Interest rates on payday loans are significantly higher than traditional loans, a key factor to consider.

Advantages of Online Payday Loan Applications

- Convenience and Accessibility: Apply anytime, anywhere, 24/7, from the comfort of your home or mobile device.

- Faster Processing Times: Online applications often result in quicker approval and funding compared to traditional bank loans.

- Privacy and Discretion: The entire process is conducted online, maintaining your privacy.

Disadvantages of Online Payday Loans

- High Interest Rates and Fees: Payday loans come with significantly higher interest rates and fees than other loan types, potentially leading to a substantial increase in your debt.

- Risk of Debt Traps: The short repayment period and high interest can create a cycle of debt if not managed carefully. Missed payments can lead to further fees and penalties.

- Potential for Predatory Lenders: The online lending landscape includes some predatory lenders who exploit vulnerable borrowers. It's crucial to exercise caution and choose reputable lenders.

Tribal Loans for Bad Credit

What are Tribal Loans?

Tribal loans are offered by lenders affiliated with Native American tribes. These loans operate under tribal sovereignty, meaning they are subject to tribal laws and regulations, which may differ from state laws. While some see this as an advantage, the regulatory landscape surrounding tribal lending can be complex and less transparent than traditional loans. It's essential to thoroughly research any tribal lender before applying.

Finding Reputable Tribal Lenders

Finding a reputable tribal lender requires diligent research. Look for lenders:

- With clear licensing and registration information.

- Positive customer reviews and testimonials from verified sources.

- Transparent terms and conditions, clearly outlining interest rates, fees, and repayment schedules.

Avoid lenders who pressure you into accepting a loan or make unrealistic promises of guaranteed approval.

Eligibility Requirements for Tribal Loans with Bad Credit

While tribal lenders often advertise their willingness to work with borrowers who have bad credit, eligibility still requires meeting certain criteria:

- You'll typically need to be of legal age (usually 18 or 21).

- Proof of income is essential to demonstrate your ability to repay the loan.

- You'll need a valid bank account for direct deposit of funds and loan repayments.

Even with bad credit, you might be approved, but expect higher interest rates compared to borrowers with good credit scores.

"Guaranteed Approval" – A Realistic Perspective

The Truth Behind Guaranteed Approval Claims

Many lenders advertise "guaranteed approval" for online payday loans and tribal loans. This is often a marketing tactic. While lenders may have more lenient approval criteria, it doesn't guarantee approval. Meeting specific financial requirements, such as a minimum income level and a verifiable bank account, remains essential.

Improving Your Chances of Loan Approval

To maximize your chances of approval:

- Improve your credit score: While not always required, a better credit score improves your chances and might lead to lower interest rates.

- Provide thorough documentation: Accurate and complete documentation of your income and expenses strengthens your application.

- Compare loan offers: Shop around and compare offers from multiple lenders to find the best terms and interest rates.

Alternatives to Online Payday and Tribal Loans

Exploring Other Borrowing Options

Before considering high-interest payday loans or tribal loans, explore these alternatives:

- Personal Loans: These loans typically have lower interest rates than payday loans, but often require better credit.

- Credit Union Loans: Credit unions sometimes offer more favorable terms than banks, especially for members with less-than-perfect credit.

- Borrowing from Family and Friends: While not always possible, borrowing from trusted sources can be a low-cost solution.

Conclusion

Online payday loans and tribal loans can offer quick access to funds, but they come with high interest rates and potential risks. The promise of "guaranteed approval" should be viewed with skepticism. Thoroughly research lenders, understand the terms and conditions, and explore alternative borrowing options before applying. Find the best online payday loan for your needs by comparing offers and understanding the implications. Responsible borrowing is key to avoiding a cycle of debt.

Featured Posts

-

Persistent Rain In Seattle Weekend Weather Outlook

May 28, 2025

Persistent Rain In Seattle Weekend Weather Outlook

May 28, 2025 -

South Korea Presidential Election A Comprehensive Overview Of Candidates And The Race

May 28, 2025

South Korea Presidential Election A Comprehensive Overview Of Candidates And The Race

May 28, 2025 -

San Diego Padres Looking For A Series Win Against Colorado

May 28, 2025

San Diego Padres Looking For A Series Win Against Colorado

May 28, 2025 -

Arsenals Interest In Luis Diaz Fact Or Fiction

May 28, 2025

Arsenals Interest In Luis Diaz Fact Or Fiction

May 28, 2025 -

Gambling On Disaster The Rise Of Wildfire Betting In Los Angeles

May 28, 2025

Gambling On Disaster The Rise Of Wildfire Betting In Los Angeles

May 28, 2025

Latest Posts

-

Marine Le Pen Et La Justice L Analyse De Laurent Jacobelli

May 30, 2025

Marine Le Pen Et La Justice L Analyse De Laurent Jacobelli

May 30, 2025 -

Hbo Announces Adaptation Of French Rape Victims Memoir

May 30, 2025

Hbo Announces Adaptation Of French Rape Victims Memoir

May 30, 2025 -

Europe 1 Soir Du 19 03 2025 L Integrale De L Emission

May 30, 2025

Europe 1 Soir Du 19 03 2025 L Integrale De L Emission

May 30, 2025 -

Le Ministre Tabarot Confirme L Ouverture Du Tunnel De Tende Pour Juin

May 30, 2025

Le Ministre Tabarot Confirme L Ouverture Du Tunnel De Tende Pour Juin

May 30, 2025 -

Emission Integrale Europe 1 Soir Du 19 Mars 2025

May 30, 2025

Emission Integrale Europe 1 Soir Du 19 Mars 2025

May 30, 2025