Ignoring High Stock Market Valuations: BofA's Rationale

Table of Contents

BofA's Justification for a Bullish Outlook Despite High Valuations

BofA's bullish outlook, despite acknowledging high valuations, rests on several key pillars extending beyond traditional valuation metrics. Their core argument centers on the belief that robust underlying economic fundamentals and strong corporate performance outweigh the concerns raised by elevated price-to-earnings (P/E) ratios and other valuation indicators.

-

Strong Corporate Earnings Growth Projections: BofA analysts consistently predict strong earnings growth for many sectors, suggesting that current valuations may be justified by future profitability. This projection is underpinned by factors such as sustained consumer spending and ongoing business investment.

-

Positive Economic Forecasts: Despite persistent inflation concerns, BofA maintains a relatively positive outlook for the overall economy. They highlight factors like a resilient labor market and ongoing government stimulus as supporting arguments. This economic strength, they believe, is a catalyst for further corporate growth and higher stock prices.

-

Technological Innovation Driving Long-Term Growth: BofA emphasizes the transformative impact of technological advancements across various sectors. They argue that innovation fosters productivity gains and opens up new avenues for growth, potentially justifying higher valuations in the long run. This includes sectors like artificial intelligence, renewable energy, and biotechnology.

-

The Supportive Role of Low Interest Rates: While interest rates are rising, they remain historically low in many regions. This low interest rate environment continues to support asset prices, including stocks, by making borrowing cheaper and encouraging investment. This factor, BofA suggests, partially offsets the impact of elevated valuations.

-

Supporting Evidence from BofA Reports: Numerous BofA research reports and analyst comments support these claims. Specific reports should be referenced here, linking directly to them to bolster credibility and provide further insights into their detailed analysis. (Note: In a real article, you'd insert actual links to these reports.)

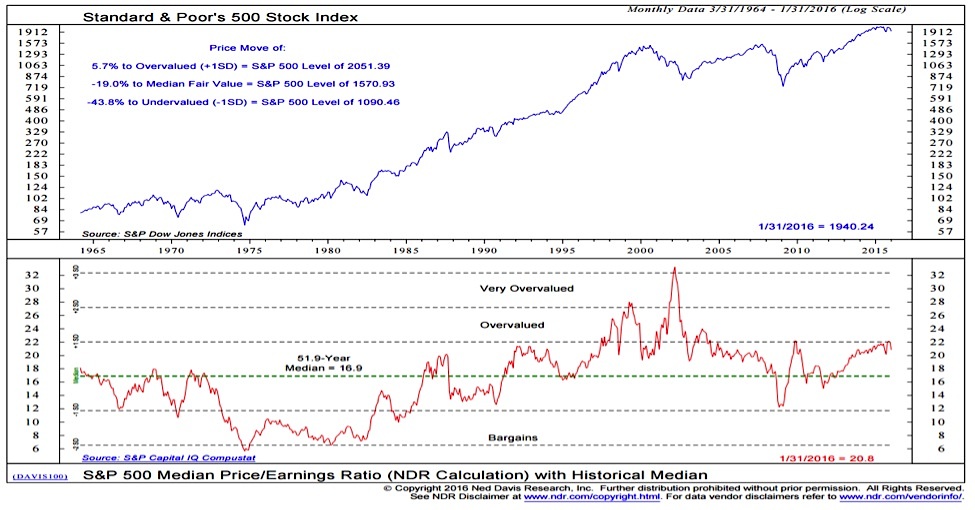

Analyzing Traditional Valuation Metrics and Their Limitations

Traditional valuation metrics like P/E ratios, Price-to-Sales ratios, and Price-to-Book ratios are commonly used to assess whether a stock or the overall market is overvalued or undervalued. However, BofA suggests these metrics have limitations in the current environment.

-

Limitations of Historical Comparisons: Using historical data to benchmark current valuations might be misleading given the rapid technological advancements and unprecedented economic events of recent years. Past performance is not necessarily indicative of future results.

-

Impact of Low (but Rising) Interest Rates on Discount Rates: Lower discount rates used in discounted cash flow (DCF) models – a cornerstone of valuation – can significantly inflate valuations. Although rates are rising, the impact is still debated and may not fully counteract the effect of high valuations.

-

Potential for Future Earnings Surprises: BofA argues that the market may be underestimating the potential for future earnings growth in certain sectors. Positive earnings surprises could justify current high valuations, making traditional metrics less relevant in predicting future performance.

-

Alternative Valuation Frameworks: BofA may be employing alternative valuation frameworks that take into account factors not fully captured by traditional metrics, such as intangible assets, network effects, or the potential for disruptive innovation.

Risks Associated with Ignoring High Valuations

While BofA presents a compelling case for a bullish outlook, it's crucial to acknowledge the inherent risks associated with ignoring high valuations. A purely bullish strategy in this environment exposes investors to significant potential downsides.

-

Market Corrections and Price Declines: Highly valued markets are inherently more vulnerable to corrections. A sudden shift in investor sentiment or an unexpected economic downturn could trigger significant price declines.

-

Vulnerability to Interest Rate Hikes and Inflation: Rising interest rates and persistent inflation erode the purchasing power of future earnings, making high valuations less sustainable. Higher interest rates also increase borrowing costs for companies, potentially impacting future earnings.

-

Geopolitical Uncertainties: Global political instability and geopolitical events can dramatically impact market sentiment, leading to sharp price swings and potentially eroding the value of investments.

-

Overestimating Future Earnings Growth: The risk of overestimating future earnings growth is significant. Should growth fail to meet expectations, valuations could become significantly stretched, leading to substantial losses.

Alternative Investment Strategies in a High-Valuation Market

Acknowledging the high valuations doesn't necessitate a completely bearish stance. Investors can employ several strategies to participate in the market while mitigating risks.

-

Value Investing: Focusing on undervalued sectors or companies offers the potential for higher returns while limiting exposure to the most inflated segments of the market.

-

Diversification Across Asset Classes: Diversifying investments across asset classes like bonds, real estate, commodities, and alternative investments can help reduce overall portfolio volatility and cushion against market downturns.

-

Strategic Asset Allocation: Tailoring an investment portfolio based on risk tolerance and individual financial goals is essential. This involves carefully balancing growth-oriented assets with more conservative holdings.

-

Defensive Investment Strategies: Employing defensive investment strategies, such as increasing cash holdings or investing in low-volatility stocks, can help protect against potential market downturns.

Conclusion: Evaluating BofA's Rationale on Ignoring High Stock Market Valuations

BofA's bullish outlook, despite high stock market valuations, rests on strong corporate earnings growth projections, positive economic forecasts, technological innovation, and the supporting role of (relatively) low interest rates. However, it's crucial to acknowledge the inherent risks associated with ignoring these high valuations, including the potential for market corrections, increased vulnerability to interest rate hikes and inflation, geopolitical uncertainties, and the risk of overestimating future earnings growth. A balanced approach is necessary, weighing the potential rewards against these potential risks. Carefully evaluate your approach to high stock market valuations, understanding the risks and rewards of ignoring high stock market valuations. Develop a robust strategy for navigating high stock market valuations that aligns with your risk tolerance and financial objectives.

Featured Posts

-

Nba Draft Lottery 2025 Odds Live Stream And Top Contenders

May 13, 2025

Nba Draft Lottery 2025 Odds Live Stream And Top Contenders

May 13, 2025 -

Indore Sizzles At 40 C Loo Warning Issued

May 13, 2025

Indore Sizzles At 40 C Loo Warning Issued

May 13, 2025 -

Dodgers Cubs Game Prediction Analyzing Las Unbeaten Home Streak

May 13, 2025

Dodgers Cubs Game Prediction Analyzing Las Unbeaten Home Streak

May 13, 2025 -

The Da Vinci Code A Deep Dive Into Dan Browns Bestseller

May 13, 2025

The Da Vinci Code A Deep Dive Into Dan Browns Bestseller

May 13, 2025 -

Zaderzhanie Stalkera Ugrozhavshego Teraktom Seme Skarlett Yokhansson

May 13, 2025

Zaderzhanie Stalkera Ugrozhavshego Teraktom Seme Skarlett Yokhansson

May 13, 2025