Ignoring High Stock Market Valuations: The BofA Rationale

Table of Contents

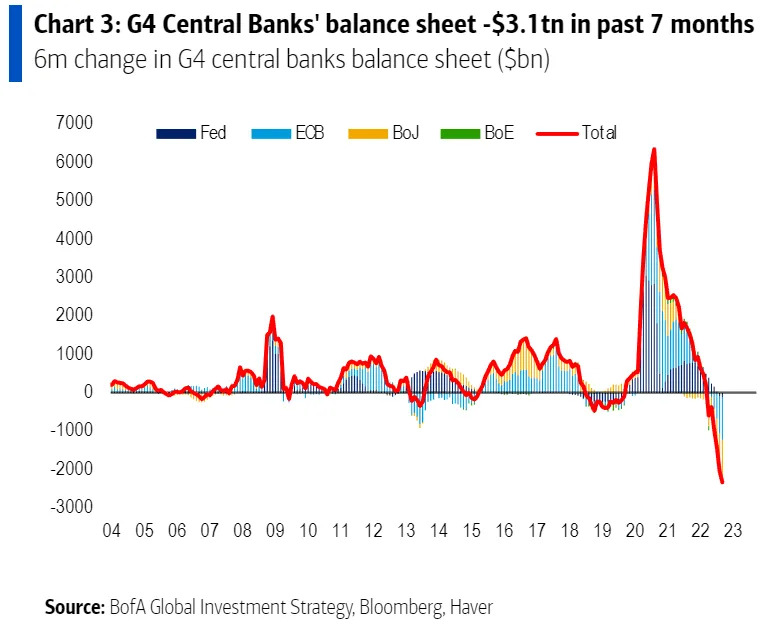

BofA's Macroeconomic Outlook and its Impact on Valuation Metrics

BofA's investment strategy is heavily influenced by its macroeconomic outlook. Their analysts continuously monitor key economic indicators to inform their valuation assessments. Currently, BofA might be factoring in expectations of continued, albeit moderated, economic growth, despite persistent inflationary pressures and rising interest rates. This outlook affects how they interpret traditional valuation metrics like Price-to-Earnings (P/E) ratios and Price-to-Sales (P/S) ratios.

- Specific macroeconomic indicators BofA is tracking: Inflation rates (CPI, PPI), interest rate hikes by the Federal Reserve, GDP growth, unemployment rates, consumer confidence indices.

- How these indicators influence their valuation assessments: Stronger-than-expected GDP growth or moderating inflation might justify higher valuations, as companies are expected to generate greater profits in a healthy economic environment. Conversely, rising interest rates could put downward pressure on valuations, increasing the discount rate used in discounted cash flow models.

- Examples of how BofA might justify higher valuations: If BofA anticipates sustained earnings growth exceeding the increase in interest rates, they might justify higher P/E multiples, arguing that future earnings will outweigh the increased cost of capital.

The Role of Corporate Earnings Growth in BofA's Strategy

BofA's strategy likely hinges on the expectation of robust corporate earnings growth. Strong earnings growth can offset concerns about high valuations, justifying premium prices. Their analysts are likely focusing on sectors poised for significant expansion.

- Sectors BofA expects strong earnings growth from: Technology (AI-related companies), renewable energy, healthcare (particularly pharmaceuticals), and select consumer staples.

- Reasons behind BofA's earnings growth predictions: Technological advancements driving efficiency gains, increased government spending on infrastructure and green initiatives, aging populations fueling healthcare demand, and resilient consumer spending in essential goods.

- How strong earnings growth can justify seemingly high valuations: If a company's earnings grow at a faster rate than the market anticipates, its P/E ratio might appear high in the short term, but will decrease relative to earnings over time.

Alternative Valuation Methods Employed by BofA

While traditional metrics are important, BofA likely employs more sophisticated valuation methods. These alternative approaches might provide a different perspective on market valuations.

- Specific alternative valuation methods used by BofA (if known): Discounted Cash Flow (DCF) analysis, relative valuation based on comparable companies, and potentially more complex models incorporating macroeconomic forecasts.

- Advantages and limitations of these methods: DCF analysis offers a more intrinsic valuation, but relies heavily on future projections, while relative valuation offers a market-based perspective but is sensitive to market biases.

- How these methods can lead to different conclusions about market valuations: Different valuation models can lead to varying conclusions about whether the market is overvalued. BofA’s use of multiple methods allows for a more nuanced assessment.

Risks and Considerations of Ignoring High Valuations

Ignoring high valuations inherently carries significant risk. While BofA might have a positive outlook, market corrections or downturns are always possible.

- Potential market corrections or downturns: Unexpected economic slowdown, geopolitical instability, or a sudden shift in investor sentiment could trigger a market correction, eroding portfolio value.

- Impact on investor portfolios: High valuations increase the potential for losses if the market corrects. Investors with significant exposure to overvalued assets could experience substantial portfolio declines.

- BofA's risk management approach: While the specifics are not publicly known, BofA likely utilizes diversified investment strategies, hedging techniques, and stress testing to manage risk.

Comparison to Other Investment Banks' Perspectives

Other major investment banks may hold differing views on stock market valuations. Some might advocate for a more cautious approach, emphasizing the risks of elevated valuations. Comparing BofA's strategy with these other perspectives provides a valuable context for assessing the overall market sentiment.

Conclusion: Understanding BofA's Rationale for Ignoring High Stock Market Valuations

BofA's apparent willingness to ignore high stock market valuations stems from their optimistic macroeconomic outlook, expectations of strong corporate earnings growth, and the utilization of sophisticated valuation methods beyond traditional metrics. While this strategy might offer potential rewards, it's crucial to recognize the inherent risks. Understanding the nuances of ignoring high stock market valuations requires careful evaluation of BofA's investment rationale, along with independent research and risk assessment. Before making any investment decisions based on this information, consider consulting with a qualified financial advisor to develop your own informed investment strategy considering high stock market valuations.

Featured Posts

-

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Suomeen

May 20, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Suomeen

May 20, 2025 -

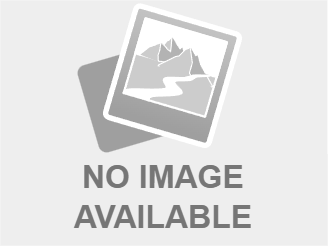

Understanding The Market Reaction D Wave Quantum Qbts Stocks Thursday Drop

May 20, 2025

Understanding The Market Reaction D Wave Quantum Qbts Stocks Thursday Drop

May 20, 2025 -

Allegations Of Censorship How Abc Cbs And Nbc Handled The New Mexico Gop Arson Attack

May 20, 2025

Allegations Of Censorship How Abc Cbs And Nbc Handled The New Mexico Gop Arson Attack

May 20, 2025 -

Nova Bebica U Obitelji Lawrence Maroney

May 20, 2025

Nova Bebica U Obitelji Lawrence Maroney

May 20, 2025 -

Michael Schumachers Comeback A Pointless Pursuit Red Bulls Ignored Advice

May 20, 2025

Michael Schumachers Comeback A Pointless Pursuit Red Bulls Ignored Advice

May 20, 2025