Ignoring Student Loan Payments: The Impact On Your Credit Score

Table of Contents

H2: The Immediate Impact on Your Credit Score

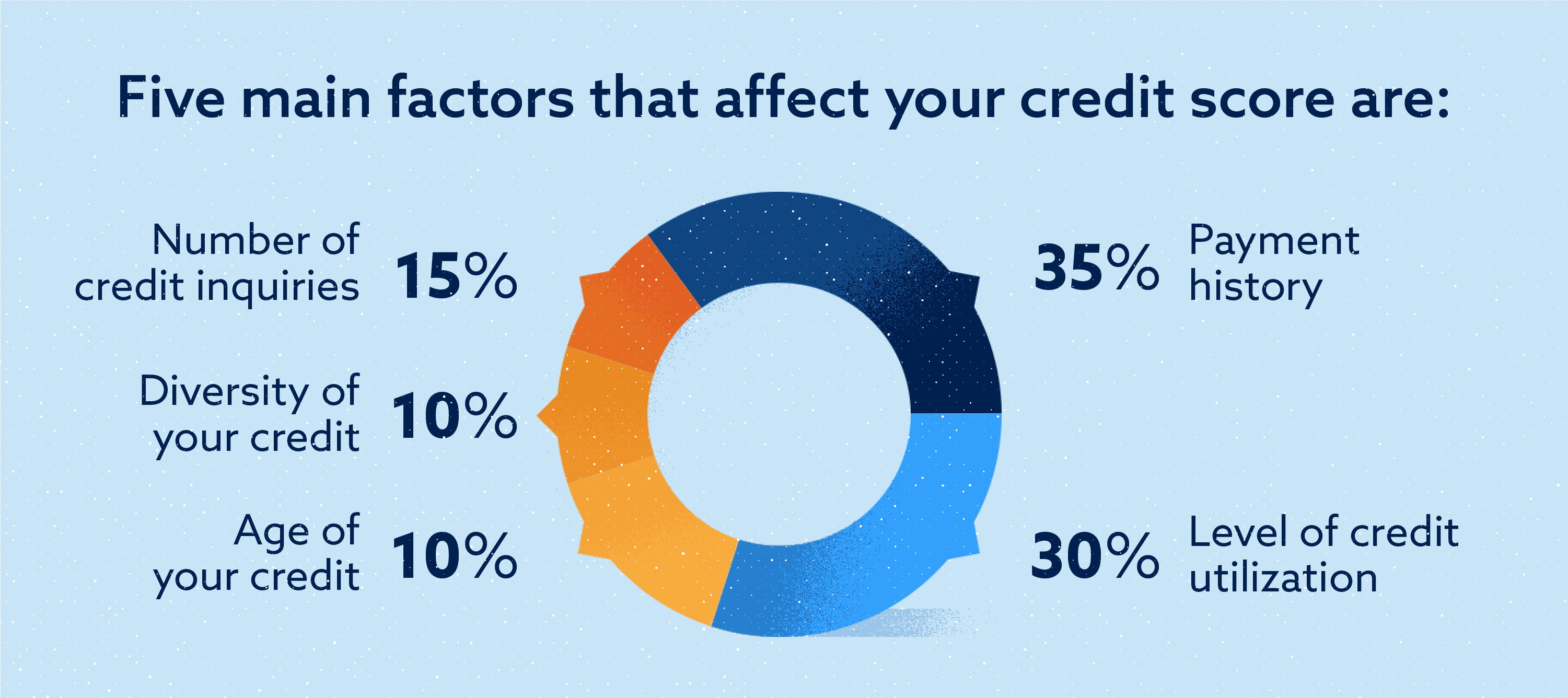

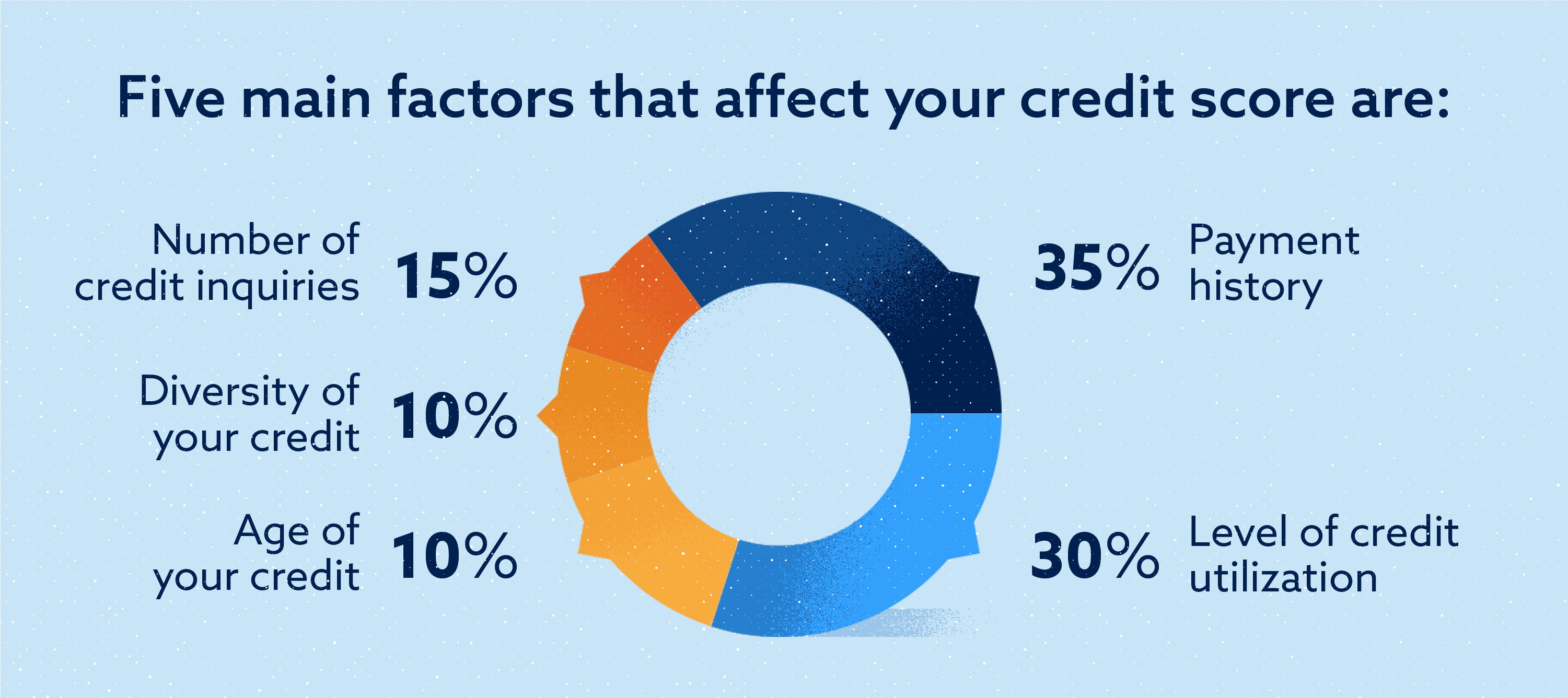

Ignoring even a single student loan payment sets off a chain reaction with immediate and significant consequences for your credit score.

H3: Delinquency and Reporting to Credit Bureaus

Missed student loan payments are typically reported to the major credit bureaus (Equifax, Experian, and TransUnion) after just 30 days of delinquency. This triggers a series of negative events:

- Impact on FICO Score: Your FICO score, a crucial number used by lenders to assess your creditworthiness, will plummet. The severity of the drop depends on the length of the delinquency and your overall credit history. A single missed payment can cause a significant drop, and repeated delinquencies can cause a catastrophic fall.

- Negative Marks on Credit Report: A "late payment" or "delinquent account" notation will appear on your credit report. These negative marks remain for seven years, severely impacting your ability to obtain credit in the future.

- Potential for Collection Agency Involvement: If you continue to ignore your payments, your loan will likely be sent to a collections agency. This further damages your credit score and can lead to aggressive debt collection tactics.

Detail: A FICO score typically ranges from 300 to 850. Missing a payment can easily deduct 50-100 points or more, depending on the severity of your credit history. Consistent delinquencies can severely impair your chances of securing loans with favorable interest rates.

H3: Increased Interest Rates and Fees

Ignoring your student loan payments doesn't stop the interest from accruing. In fact, it accelerates the problem:

- Interest Capitalization: Unpaid interest is often added to your principal balance, increasing the total amount you owe. This is known as capitalization and significantly increases your overall debt.

- Compounding Interest: The longer you delay payments, the more interest you accrue, leading to a snowball effect of ever-growing debt.

- Additional Penalties: Late payment fees are typically added to your balance, further increasing the amount you owe.

Detail: Let's say you have a $30,000 loan with a 6% interest rate. Ignoring payments for six months could result in an additional $900 in interest alone, plus late fees, significantly increasing your total debt burden.

H2: Long-Term Consequences of Ignoring Student Loan Payments

The consequences of ignoring student loan payments extend far beyond your credit score. The long-term effects can be devastating.

H3: Difficulty Obtaining Credit in the Future

A damaged credit score makes obtaining any future credit incredibly difficult:

- Higher Interest Rates on Future Loans: Lenders view borrowers with poor credit as high-risk, leading to significantly higher interest rates on mortgages, auto loans, personal loans, and even credit cards.

- Loan Application Denials: Many loan applications will be denied outright if your credit score is too low. This can severely limit your financial opportunities.

- Difficulty Renting an Apartment: Landlords often check credit reports, and a low score can make it difficult to secure housing.

Detail: A low credit score can mean paying thousands of extra dollars in interest over the life of a loan, significantly impacting your financial stability.

H3: Wage Garnishment and Tax Refund Offset

For persistent non-payment, lenders can take drastic measures:

- Legal Ramifications: The lender can sue you to recover the debt, leading to court proceedings and potential judgments against you.

- Wage Garnishment: A portion of your wages can be legally seized to pay off your debt. This can significantly impact your ability to meet your financial obligations.

- Tax Refund Offset: The government can intercept your tax refund to pay off your student loan debt.

Detail: Wage garnishment can be a highly stressful and disruptive process, leaving you with significantly less income to cover essential expenses.

H3: Damage to Your Financial Reputation

A poor credit history can have far-reaching consequences:

- Difficulty Securing Employment: Some employers, particularly in finance and other sensitive sectors, conduct credit checks during the hiring process. A low credit score can negatively affect your employment prospects.

- Higher Insurance Premiums: Insurance companies often consider credit scores when setting premiums. A poor credit history can lead to higher rates for car insurance, homeowners insurance, and other types of insurance.

Detail: The impact of a negative credit record can extend for years, potentially hindering your ability to buy a home, secure a better job, or even rent an apartment.

H2: Alternatives to Ignoring Student Loan Payments

There are many options available to manage student loan debt without resorting to the disastrous consequences of ignoring payments.

H3: Deferment and Forbearance Options

These programs offer temporary relief from student loan payments:

- Eligibility Requirements: Eligibility criteria vary depending on the type of loan and your circumstances (e.g., unemployment, economic hardship).

- Application Process: You typically need to apply through your loan servicer and provide documentation to support your request.

- Potential Drawbacks: Interest may continue to accrue during deferment or forbearance, potentially increasing your total loan amount.

Detail: Deferment postpones payments, while forbearance reduces or suspends them temporarily. It's essential to understand the specific terms and conditions of each option.

H3: Income-Driven Repayment Plans

These plans adjust your monthly payments based on your income and family size:

- Types of Income-Driven Repayment Plans: Several plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

- Eligibility Criteria: Eligibility depends on your income and loan type.

- Long-Term Implications: These plans often extend the repayment period, resulting in paying more interest over the life of the loan.

Detail: Income-driven repayment plans can make student loan payments more manageable in the short term, but you should carefully consider the potential for increased long-term costs.

H3: Student Loan Consolidation and Refinancing

Consolidating or refinancing can simplify repayment and potentially lower interest rates:

- Benefits and Drawbacks: Consolidation combines multiple loans into one, simplifying payments. Refinancing replaces existing loans with a new one, potentially at a lower interest rate. However, refinancing might not be available to everyone.

- Eligibility Criteria: Eligibility requirements vary among lenders.

Detail: Carefully compare offers from different lenders to ensure you are getting the best possible terms.

H3: Seeking Professional Help

Don't hesitate to seek assistance from professionals:

- Resources Available to Borrowers: Numerous organizations provide free or low-cost student loan counseling and financial advice.

- Benefits of Professional Guidance: A financial advisor can help you create a budget, explore repayment options, and develop a long-term financial plan.

Detail: The National Foundation for Credit Counseling (NFCC) and the Student Loan Borrower Assistance website are valuable resources.

3. Conclusion

Ignoring student loan payments has severe and long-lasting consequences for your credit score and overall financial well-being. While the immediate temptation to avoid payments might seem appealing, the long-term repercussions—including damaged credit, wage garnishment, and financial instability—far outweigh any short-term benefits. Instead of ignoring your student loan payments, explore the available options for repayment assistance, such as deferment, forbearance, income-driven repayment plans, or refinancing. Don't let ignoring student loan payments ruin your future. Take control of your finances and find a solution that works for you. Contact a financial advisor or explore the resources mentioned above to manage your student loan debt effectively. Proactive management of your student loans is crucial to protecting your credit and financial future. Don't ignore the problem; address it head-on.

Featured Posts

-

Analysis The Problem Of Misattributed Angel Reese Quotes

May 17, 2025

Analysis The Problem Of Misattributed Angel Reese Quotes

May 17, 2025 -

Mc Collums Transition From Drake To Iowa A New Chapter

May 17, 2025

Mc Collums Transition From Drake To Iowa A New Chapter

May 17, 2025 -

New York Knicks The Landry Shamet Conundrum

May 17, 2025

New York Knicks The Landry Shamet Conundrum

May 17, 2025 -

Tom Hanks And Tom Cruise The 1 Debt That Wont Go Away

May 17, 2025

Tom Hanks And Tom Cruise The 1 Debt That Wont Go Away

May 17, 2025 -

0 1 Portugal Gana A Belgica Resumen Y Goles Del Encuentro

May 17, 2025

0 1 Portugal Gana A Belgica Resumen Y Goles Del Encuentro

May 17, 2025

Latest Posts

-

2025s Leading Bitcoin And Crypto Casinos Your Complete Guide

May 17, 2025

2025s Leading Bitcoin And Crypto Casinos Your Complete Guide

May 17, 2025 -

Best Australian Crypto Casino Sites 2025 A Comprehensive Guide

May 17, 2025

Best Australian Crypto Casino Sites 2025 A Comprehensive Guide

May 17, 2025 -

Pet Friendly Uber Rides Now Available In Delhi And Mumbai A Partnership With Heads Up For Tails

May 17, 2025

Pet Friendly Uber Rides Now Available In Delhi And Mumbai A Partnership With Heads Up For Tails

May 17, 2025 -

Uber Expands Pet Transportation Services To Delhi And Mumbai

May 17, 2025

Uber Expands Pet Transportation Services To Delhi And Mumbai

May 17, 2025 -

Top Bitcoin And Crypto Casinos For 2025 A Comprehensive Review

May 17, 2025

Top Bitcoin And Crypto Casinos For 2025 A Comprehensive Review

May 17, 2025