Impact Of China's Lithium Export Controls On Eramet: CEO's Perspective

Table of Contents

China's Lithium Dominance and its Strategic Implications for Eramet

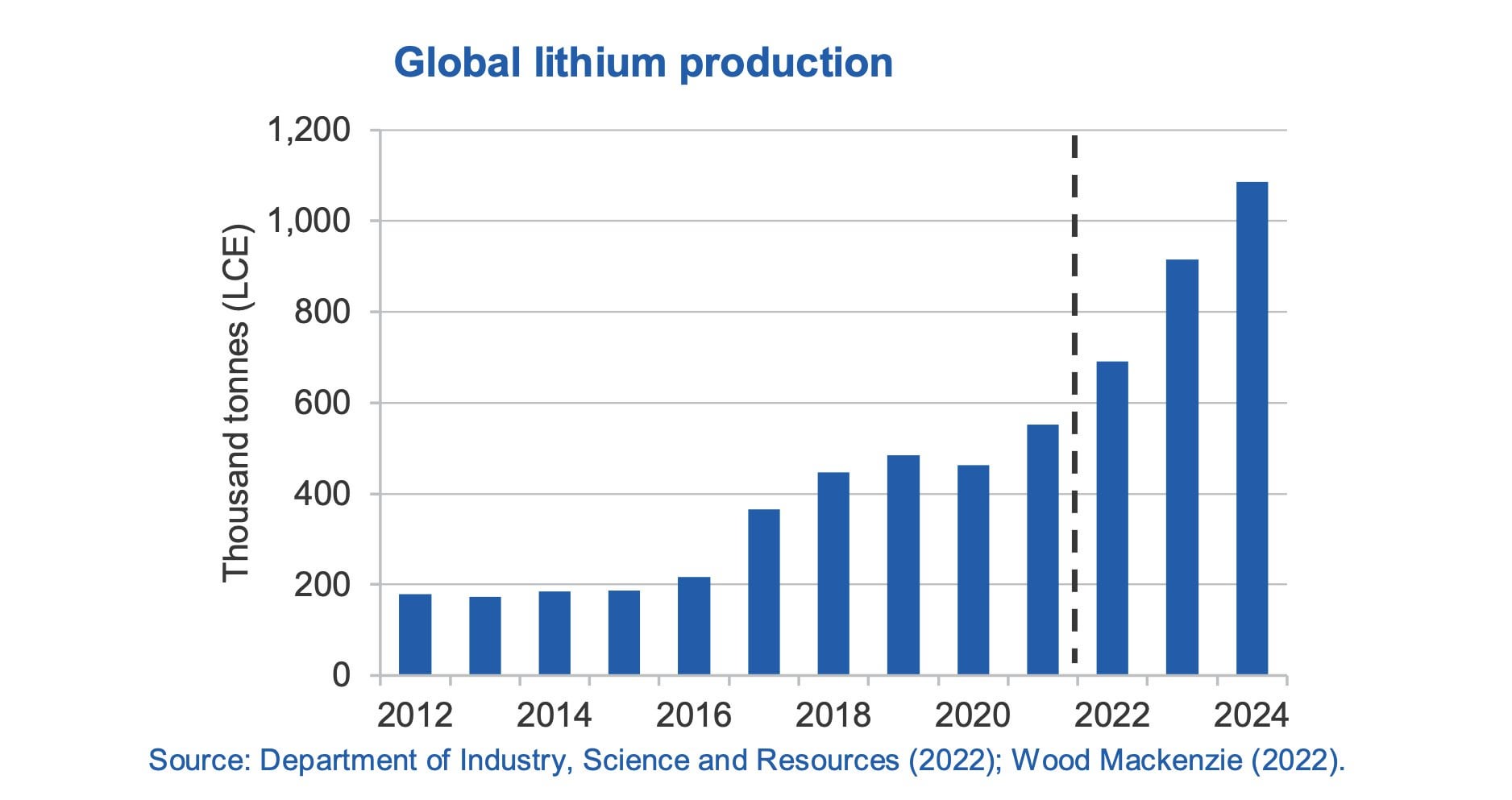

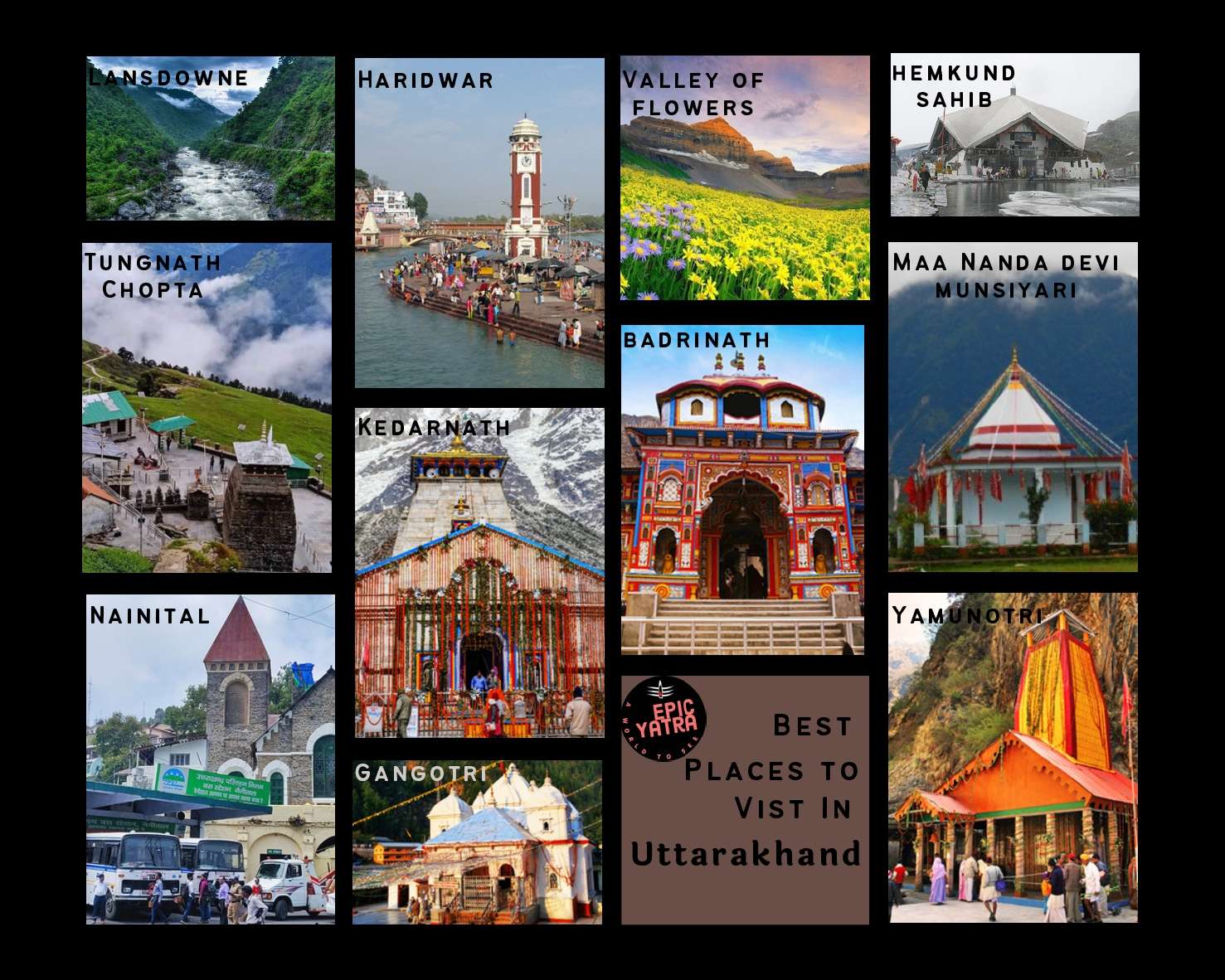

China holds a commanding position in the lithium processing and refining sector. This dominance allows it to exert considerable influence over the global lithium market. The potential for China to leverage this power through export controls presents significant strategic implications for companies like Eramet.

- China's Lithium Processing Prowess: China's refining capacity far surpasses that of other nations, controlling a significant portion of the global supply chain. This gives them leverage in setting prices and potentially restricting supply.

- Historical Precedents: China has demonstrated a willingness to use export controls as a strategic tool in other sectors, affecting various global industries. This history raises concerns about similar actions concerning lithium.

- Strategic Goals: China’s strategic goals likely include securing domestic supply chains, supporting its domestic EV industry, and potentially gaining leverage in international negotiations.

Eramet's Current Lithium Operations and Exposure to Chinese Supply Chains

Eramet's lithium operations are spread across several locations, and the company's reliance on China's lithium resources and processing capabilities varies depending on specific projects. Understanding this exposure is crucial to assessing the potential impact of China's export controls.

- Global Footprint: Eramet's lithium mining and processing activities are geographically diverse, reducing but not eliminating reliance on any single nation. The precise details are commercially sensitive.

- Chinese Dependence: While Eramet actively diversifies its supply chain, a precise percentage of lithium sourced from China (if any) is not publicly available due to business confidentiality concerns.

- Existing Partnerships: Eramet may have partnerships with Chinese companies, potentially increasing exposure to China's policy changes concerning lithium export controls. The nature of these relationships, and their vulnerability, would depend on the specifics of each agreement.

Potential Economic and Strategic Responses by Eramet to Chinese Export Controls

Facing the threat of Chinese lithium export controls, Eramet could employ several strategies to mitigate risk and ensure business continuity.

- Supply Chain Diversification: This involves sourcing lithium from alternative locations such as Australia, Chile, Argentina, and potentially other emerging lithium-producing countries.

- Upstream Investments: Increasing investments in upstream mining and processing operations will reduce dependence on external suppliers and offer greater control over the supply chain.

- Technological Innovation: Exploring and investing in alternative battery technologies that reduce or eliminate the need for lithium could offer long-term resilience.

- Political Engagement: Engaging in international lobbying efforts to influence trade policies related to lithium and advocate for fair and open markets is another crucial strategic avenue.

The Broader Impact on the Global Lithium Market and Electric Vehicle Industry

The potential ripple effects of China's lithium export controls extend far beyond Eramet, impacting the entire global lithium market and the electric vehicle industry.

- Price Volatility: Restrictions on lithium supply would likely lead to significant price increases, impacting EV manufacturers and consumers.

- Supply Chain Disruptions: The EV industry's already fragile supply chain would face further stress, potentially slowing down production and delaying the widespread adoption of EVs.

- Geopolitical Implications: Increased dependence on specific lithium-producing nations could heighten geopolitical tensions and create new vulnerabilities for nations reliant on these resources.

Conclusion: Navigating the Challenges of China's Lithium Export Controls on Eramet's Future

China's potential lithium export controls pose significant challenges to Eramet and the broader lithium industry. Diversifying supply chains, investing in upstream operations, exploring alternative technologies, and engaging in proactive political strategies are critical for mitigating these risks. The potential impacts are wide-ranging, affecting not only Eramet but also the global lithium market and the electric vehicle sector. To learn more about Eramet's response to these challenges and its commitment to navigating the complexities of the global lithium market in the face of China's lithium export controls, please visit their website and follow their news releases. Monitoring the impact of China's lithium export controls on Eramet and the broader industry remains crucial for all stakeholders.

Featured Posts

-

Your Guide To Charizard Ex A2b 010 In Pokemon Tcg Pocket Deck Building And Counterplay

May 14, 2025

Your Guide To Charizard Ex A2b 010 In Pokemon Tcg Pocket Deck Building And Counterplay

May 14, 2025 -

Refus D Alexis Kohler Atteinte Aux Institutions Democratiques Selon Transparency International

May 14, 2025

Refus D Alexis Kohler Atteinte Aux Institutions Democratiques Selon Transparency International

May 14, 2025 -

La Fondation Seydoux Pathe Celebre La Nuit Des Musees 2025 Avec Le Cinema

May 14, 2025

La Fondation Seydoux Pathe Celebre La Nuit Des Musees 2025 Avec Le Cinema

May 14, 2025 -

Best Places To Visit In May A Month Of Global Adventures

May 14, 2025

Best Places To Visit In May A Month Of Global Adventures

May 14, 2025 -

Tentative D Intrusion A Toulon Individu Sous Oqtf Interpelle Par Un Policier

May 14, 2025

Tentative D Intrusion A Toulon Individu Sous Oqtf Interpelle Par Un Policier

May 14, 2025