Impact Of G-7 De Minimis Tariff Talks On Chinese Exports

Table of Contents

Understanding De Minimis Tariffs and Their Current Impact on Chinese Exports

De minimis tariffs refer to the value threshold below which imported goods are exempt from customs duties. The current de minimis values vary across G-7 nations, impacting the competitiveness of Chinese exporters shipping low-value goods. Lower thresholds mean more Chinese products are subject to tariffs, increasing import costs and potentially reducing their competitiveness compared to goods from countries with more favorable regulations. This disparity creates an uneven playing field, affecting the profitability and market share of Chinese businesses.

- Current de minimis thresholds in major G-7 countries: The thresholds vary considerably, ranging from a few dollars in some countries to over $800 in others. This lack of uniformity creates complexity and challenges for Chinese exporters.

- Examples of Chinese products affected by current regulations: Numerous products, including small electronics, clothing items, textiles, and various consumer goods, fall below the de minimis threshold in some countries but exceed it in others. This requires careful calculation and compliance procedures for each destination market.

- Analysis of the current competitive landscape: The current system favors exporters from countries with higher de minimis thresholds, giving them a price advantage in certain G-7 markets. Chinese exporters are often disadvantaged, particularly small and medium-sized enterprises (SMEs) that may lack the resources to navigate complex customs regulations.

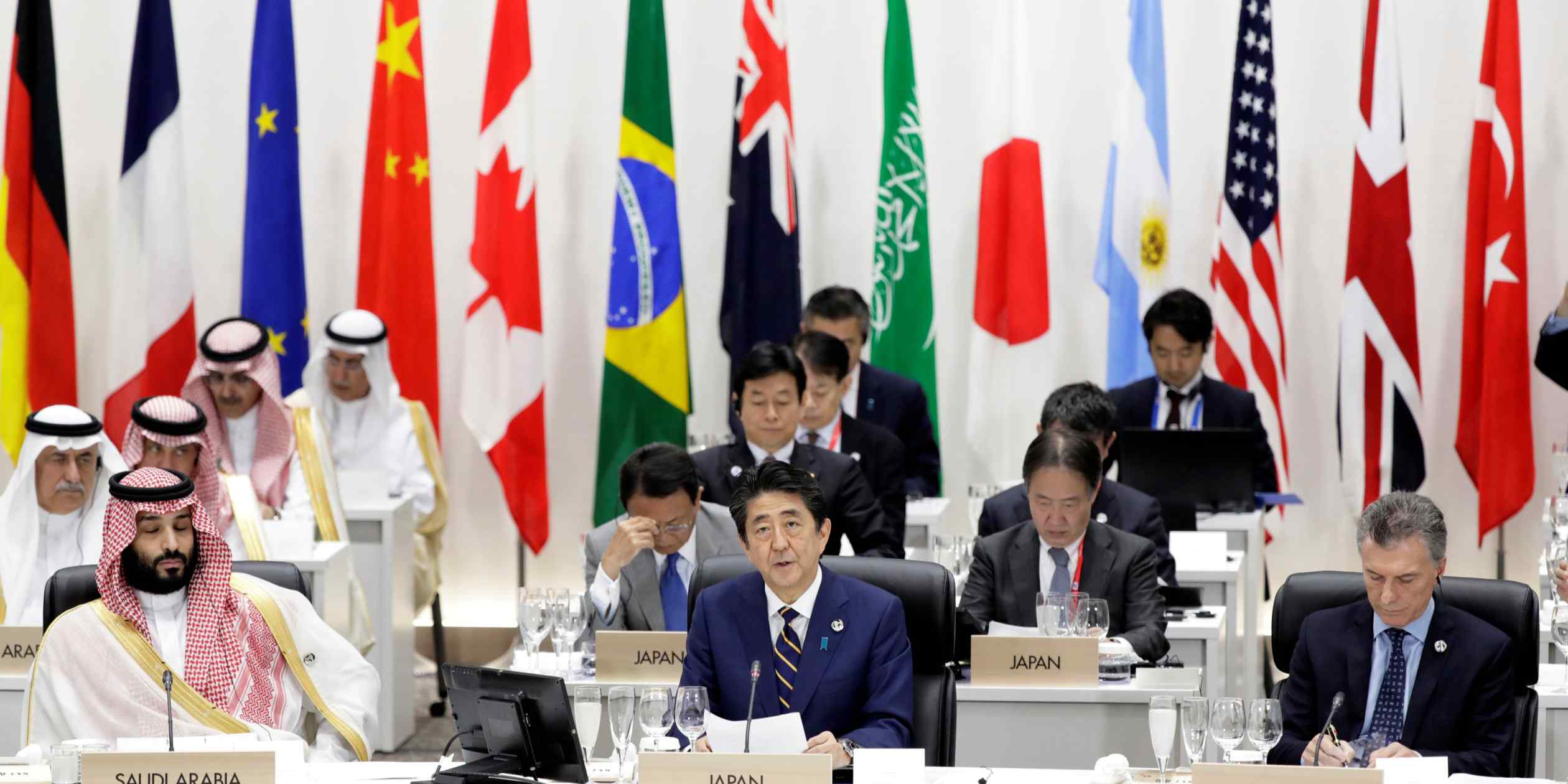

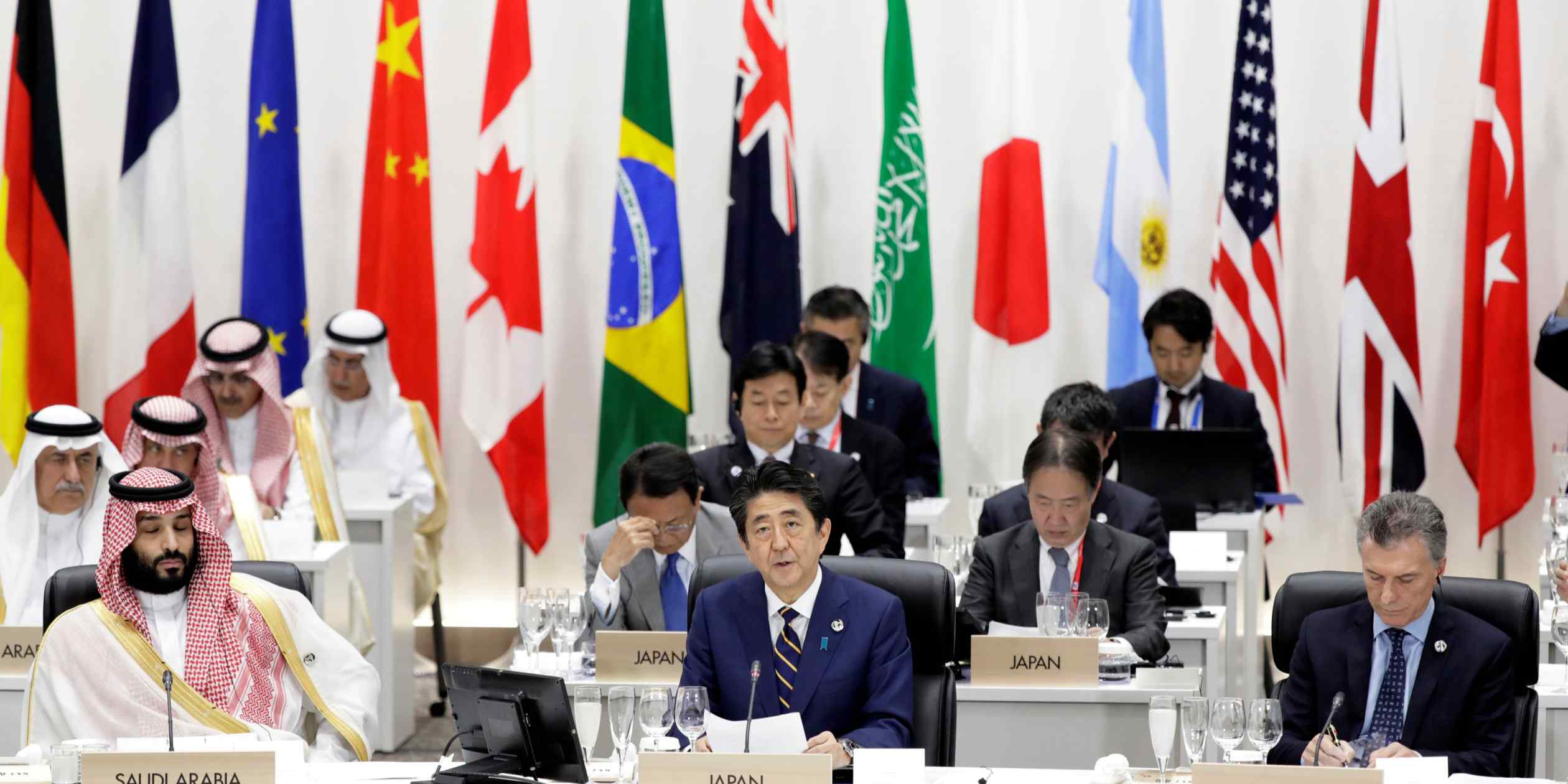

Potential Changes Proposed by the G-7 and Their Predicted Effects

The G-7 is currently considering changes to these de minimis thresholds. Proposals range from harmonizing thresholds across member nations to significantly lowering them globally. These changes could have a profound impact on Chinese exports. A reduction in thresholds would increase the number of Chinese goods subject to tariffs, potentially diminishing their price competitiveness and reducing export volumes. Conversely, harmonization could offer some predictability, but a lower universal threshold would still present challenges.

- Summary of the different proposals under discussion: The proposals vary widely, making it difficult to predict the exact outcome. However, the general trend seems to be towards either harmonization at a lower level or individual adjustments leading to lower thresholds in many countries.

- Predicted effects on various sectors of Chinese exports: Sectors heavily reliant on exporting low-value goods, such as textiles, consumer electronics, and certain manufactured goods, would be disproportionately affected. The impact would likely be felt most keenly by smaller exporters.

- Potential consequences for Chinese small and medium-sized enterprises (SMEs): SMEs often lack the resources to handle increased compliance costs associated with higher tariffs and more complex customs procedures. They may be forced to absorb increased costs, reduce profit margins, or exit certain G-7 markets.

Strategic Responses for Chinese Exporters to Adapt to Changing Regulations

To mitigate the potential negative impact of changes to de minimis thresholds, Chinese exporters need to proactively adapt their strategies. This involves a multifaceted approach focused on cost management, supply chain optimization, and improved trade compliance. Diversifying export markets to reduce reliance on G-7 nations is also crucial.

- Options for supply chain diversification: Exploring new markets beyond the G-7, such as those in Southeast Asia, Africa, or Latin America, can reduce dependence on potentially volatile trading partners.

- Strategies for cost reduction and enhanced efficiency: Streamlining operations, negotiating better prices with suppliers, and improving logistics can help offset increased tariff costs. Implementing technological solutions for efficient customs processes is also vital.

- Importance of proactive trade compliance and regulatory monitoring: Staying updated on the latest regulations and working with customs brokers to ensure compliance minimizes the risk of penalties and delays.

Wider Geopolitical Implications of the G-7's Actions on Global Trade

The G-7's de minimis tariff discussions are not isolated events; they exist within a broader geopolitical context. The decisions taken could significantly impact global trade relations, potentially triggering retaliatory measures from China or exacerbating existing trade tensions. This could lead to further protectionist measures and escalate trade disputes, with far-reaching consequences for the global economy.

- Potential impact on the broader global trade landscape: The changes could serve as a precedent for other nations to adjust their de minimis thresholds, creating a more complex and less predictable global trading environment.

- Analysis of the potential for retaliatory measures from China: China may respond with its own trade measures if it perceives the G-7's actions as unfair or discriminatory. This could involve tariffs on G-7 goods or other retaliatory actions.

- The long-term consequences for the global economy: Increased trade barriers and protectionist measures could slow down economic growth, disrupt supply chains, and impact consumer prices globally.

Conclusion

The G-7 de minimis tariff talks pose significant challenges and opportunities for Chinese exporters. Understanding the potential changes to these thresholds, and the varied impact on different sectors, is crucial for strategic planning. Proactive adaptation through supply chain diversification, cost optimization, and enhanced trade compliance are essential for maintaining competitiveness in the face of evolving regulations. Ignoring these discussions could result in decreased profitability and market share for many Chinese exporters. Stay informed about the evolving G-7 de minimis tariff discussions to effectively manage risks and navigate the shifting landscape of international trade. Proactive monitoring and strategic planning regarding G-7 de minimis tariffs are essential for success.

Featured Posts

-

Atletico Madrid In Geriden Gelisleri Analiz Ve Istatistikler

May 26, 2025

Atletico Madrid In Geriden Gelisleri Analiz Ve Istatistikler

May 26, 2025 -

Climate Change And The Rise Of Dangerous Fungi

May 26, 2025

Climate Change And The Rise Of Dangerous Fungi

May 26, 2025 -

Addressing Investor Anxiety Bof As View On Stretched Stock Market Valuations

May 26, 2025

Addressing Investor Anxiety Bof As View On Stretched Stock Market Valuations

May 26, 2025 -

Enquete Sur Le Nouveau Siege De La Rtbf La Ministre Galant Reclame La Transparence

May 26, 2025

Enquete Sur Le Nouveau Siege De La Rtbf La Ministre Galant Reclame La Transparence

May 26, 2025 -

The Hunger Games A Retrospective Of Ohnotheydidnt Posts

May 26, 2025

The Hunger Games A Retrospective Of Ohnotheydidnt Posts

May 26, 2025

Latest Posts

-

Stranger Things Star Films In Cardiff New Tv Project Details

May 29, 2025

Stranger Things Star Films In Cardiff New Tv Project Details

May 29, 2025 -

Everything We Know About Stranger Things Season 5 A Comprehensive Guide

May 29, 2025

Everything We Know About Stranger Things Season 5 A Comprehensive Guide

May 29, 2025 -

Sadie Sink Opens Up About The Production Of Stranger Things Season 5

May 29, 2025

Sadie Sink Opens Up About The Production Of Stranger Things Season 5

May 29, 2025 -

Stranger Things 5 Details And Speculation On The Final Season

May 29, 2025

Stranger Things 5 Details And Speculation On The Final Season

May 29, 2025 -

Stranger Things 5 Sadie Sink Teases Character Arcs And Production Challenges

May 29, 2025

Stranger Things 5 Sadie Sink Teases Character Arcs And Production Challenges

May 29, 2025