Impact Of Mississippi's Potential Income Tax Cut On Hernando, MS

Table of Contents

Potential Economic Benefits for Hernando, MS

A successful Mississippi income tax cut could bring several economic advantages to Hernando.

Increased Disposable Income and Consumer Spending

Reduced income taxes would likely translate to higher disposable income for Hernando residents. This increased purchasing power could significantly boost local consumer spending. Restaurants, retail stores, and other local businesses could experience a surge in sales, leading to increased sales tax revenue for the city. This positive feedback loop could stimulate further economic growth.

- More dining out: Residents might opt for more frequent restaurant visits.

- Increased retail sales: More disposable income could lead to increased shopping at local stores.

- Higher property values: A thriving local economy could drive up property values.

Attracting New Businesses and Investment

A lower tax rate in Mississippi could make Hernando a more attractive location for businesses considering relocation or expansion. This influx of businesses could create numerous job creation opportunities, further stimulating the Hernando economy. New construction and development resulting from business growth would also increase property tax revenue for the city.

- New business startups: Lower taxes could encourage entrepreneurship and the creation of new businesses.

- Expansion of existing businesses: Existing businesses might expand their operations to take advantage of the lower tax burden.

- Increased employment opportunities: New and expanding businesses would create more jobs for Hernando residents.

Potential Economic Drawbacks for Hernando, MS

While the Mississippi income tax cut presents potential benefits, it's also essential to consider the potential drawbacks for Hernando.

Reduced State Revenue and Potential Cuts in Public Services

A significant reduction in state income tax revenue could necessitate cuts in funding for essential public services. Hernando could face reduced funding for schools, infrastructure projects, and public safety services. These cuts could negatively impact the quality of life for residents.

- Reduced funding for schools: Less state revenue could lead to larger class sizes, fewer resources, and potentially lower educational standards.

- Delayed infrastructure projects: Essential road repairs, improvements to water and sewer systems, and other infrastructure projects might be delayed or canceled.

- Potential impact on public safety services: Reduced funding could impact police and fire departments, potentially affecting response times and public safety.

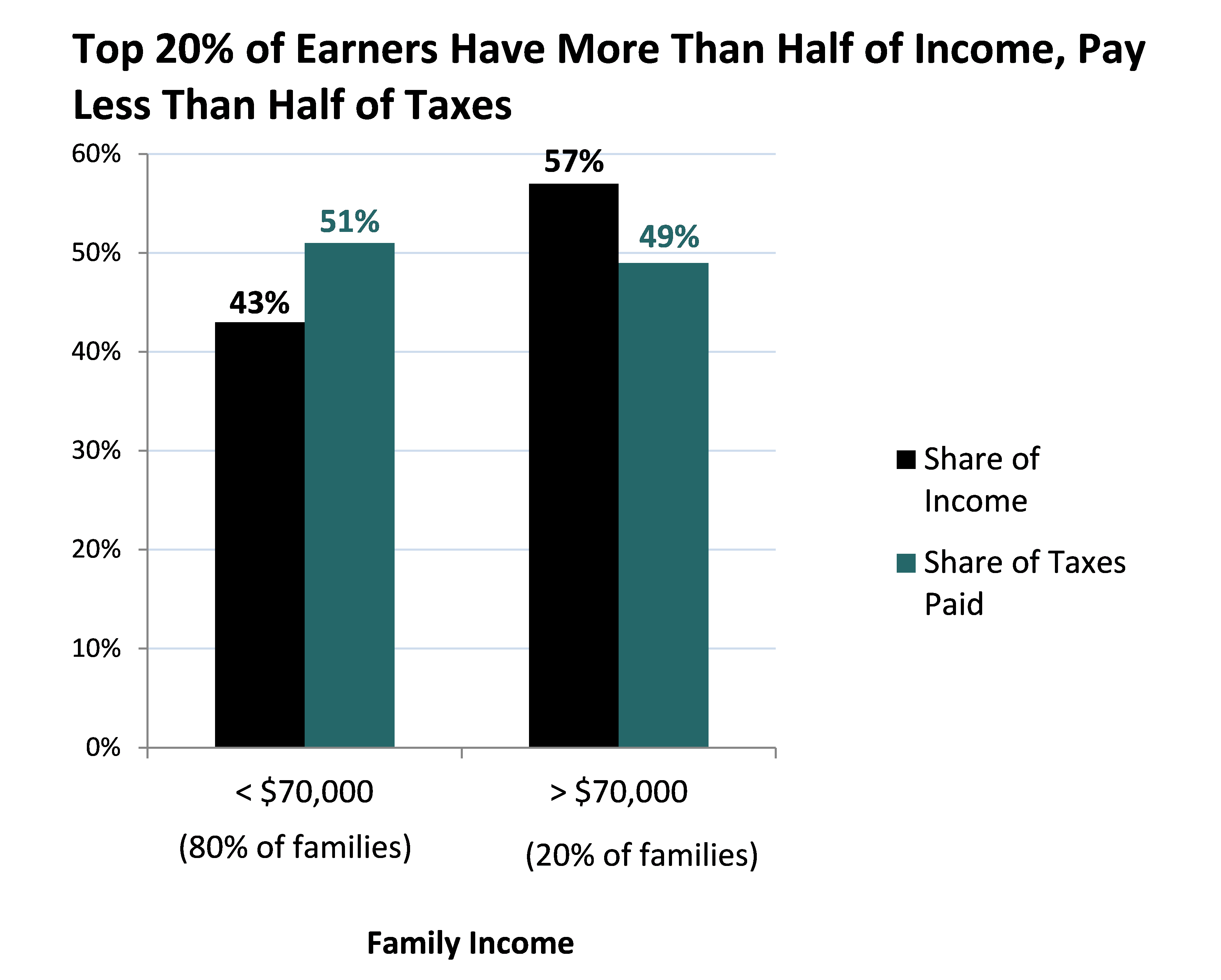

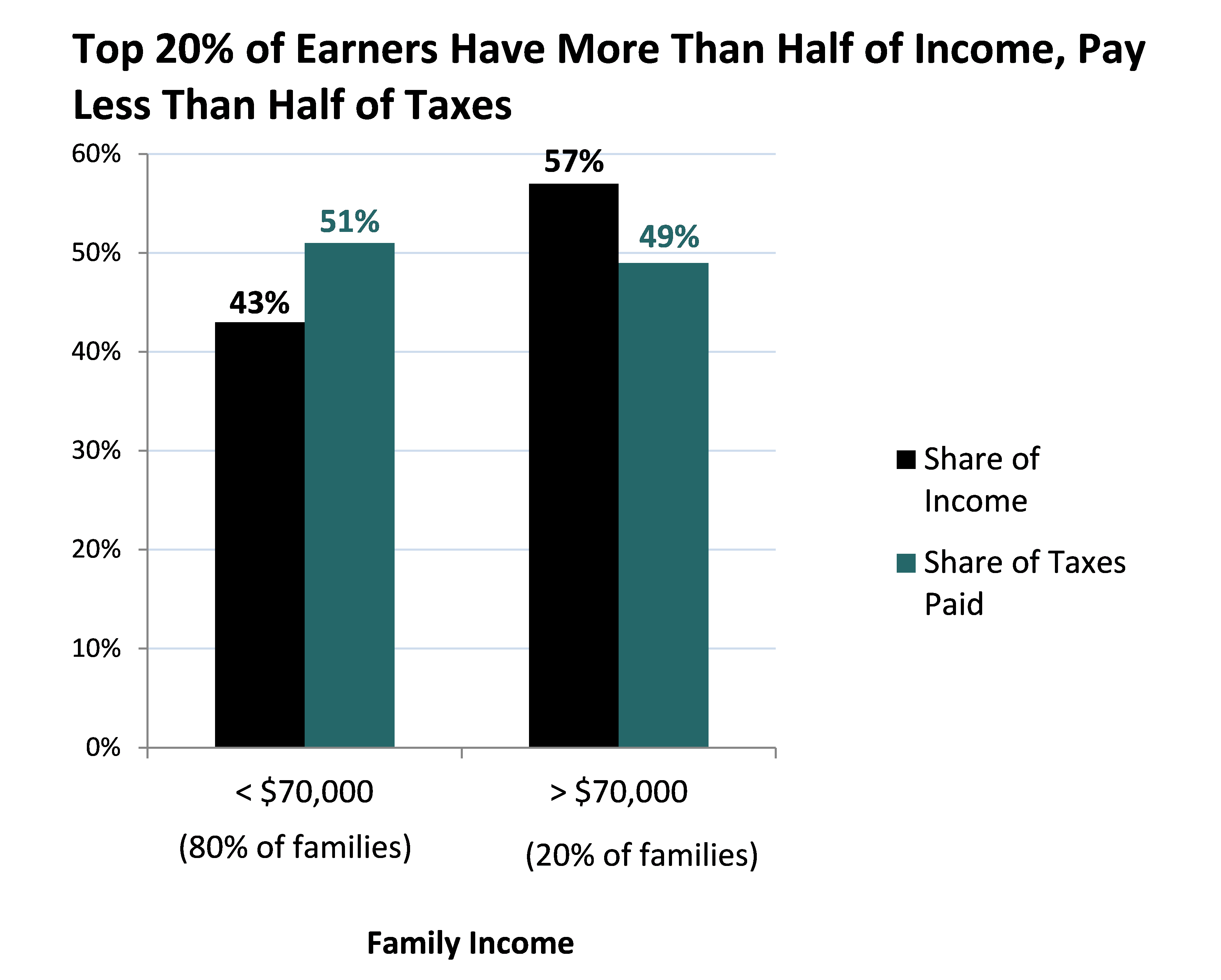

Potential for Income Inequality and its Impact on Hernando

The Mississippi income tax cut might disproportionately benefit higher-income earners, potentially exacerbating income inequality within Hernando. This widening income gap could lead to reduced social mobility and limit access to resources for low-income families.

- Increased wealth disparity: The tax cut could widen the gap between the wealthiest and poorest residents of Hernando.

- Limited access to resources for low-income families: Reduced funding for social programs could leave vulnerable populations with fewer resources.

- Potential for social unrest: Increased inequality could lead to social tensions and unrest within the community.

Analyzing the Net Impact on Hernando, MS

Determining the net impact of the Mississippi income tax cut on Hernando requires a careful assessment of the potential benefits and drawbacks. While increased disposable income and business attraction are promising, potential cuts to crucial public services and the exacerbation of income inequality pose significant challenges. Further research and analysis are crucial to fully understand the long-term consequences, including any unintended consequences.

- Arguments for the tax cut: Increased consumer spending, business attraction, job creation.

- Arguments against the tax cut: Reduced state revenue, potential cuts to public services, increased income inequality.

Conclusion: Understanding the Impact of Mississippi's Income Tax Cut on Hernando, MS

The potential Mississippi income tax cut presents a complex scenario for Hernando, MS. While it could stimulate economic growth through increased consumer spending and business attraction, it also risks undermining essential public services and exacerbating income inequality. Understanding the long-term implications for the Hernando MS economy and its residents is crucial. Stay informed about the Mississippi tax reform impact on your community and participate in local government discussions to advocate for policies that best serve Hernando's future. Stay informed about the Mississippi income tax cut and its potential impact on Hernando MS.

Featured Posts

-

Did Mairon Santos Win Ufc 313 A Review Of The Santos Vs Marshall Bout

May 19, 2025

Did Mairon Santos Win Ufc 313 A Review Of The Santos Vs Marshall Bout

May 19, 2025 -

Norways World Cup Qualification Opener A Haaland Masterclass Against Moldova

May 19, 2025

Norways World Cup Qualification Opener A Haaland Masterclass Against Moldova

May 19, 2025 -

Melodifestivalen 2025 Finalister Startordning Och Mer Information

May 19, 2025

Melodifestivalen 2025 Finalister Startordning Och Mer Information

May 19, 2025 -

Jennifer Lawrence And Husband Cooke Maroney A Public Appearance Amidst Baby No 2 Speculation

May 19, 2025

Jennifer Lawrence And Husband Cooke Maroney A Public Appearance Amidst Baby No 2 Speculation

May 19, 2025 -

Mlb Rumors Luis Robert Jr Trade Pirates Potential Profit And Arenados Contract Stalemate

May 19, 2025

Mlb Rumors Luis Robert Jr Trade Pirates Potential Profit And Arenados Contract Stalemate

May 19, 2025

Latest Posts

-

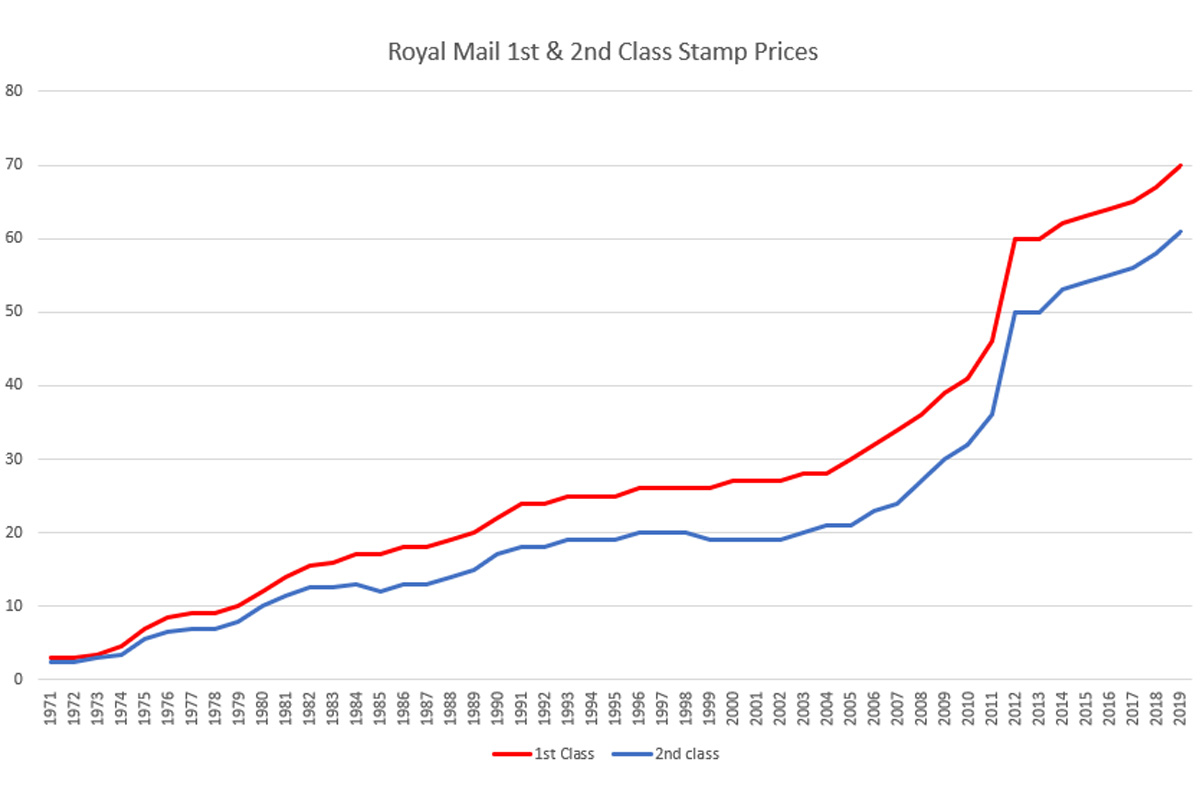

Royal Mails Next Generation Postboxes Combining Solar Power And Digital Technology

May 19, 2025

Royal Mails Next Generation Postboxes Combining Solar Power And Digital Technology

May 19, 2025 -

Full List Royal Mail Announces Exact Stamp Price Increases For April 7th

May 19, 2025

Full List Royal Mail Announces Exact Stamp Price Increases For April 7th

May 19, 2025 -

Understanding The Royal Mail Stamp Price Rises Starting April 7th

May 19, 2025

Understanding The Royal Mail Stamp Price Rises Starting April 7th

May 19, 2025 -

April 7th Royal Mail Stamp Price Increases A Complete Guide

May 19, 2025

April 7th Royal Mail Stamp Price Increases A Complete Guide

May 19, 2025 -

Royal Mail Price Hike Exact Stamp Costs Rising April 7th Full List

May 19, 2025

Royal Mail Price Hike Exact Stamp Costs Rising April 7th Full List

May 19, 2025