Impact Of Potential Trump Tariffs On The Aircraft Industry

Table of Contents

Increased Costs of Imported Components

The aircraft manufacturing industry relies heavily on a global supply chain for parts and materials. The Tariff Impact Aircraft Parts was immediate and substantial. Many components, from raw materials to sophisticated avionics, are sourced internationally. Tariffs imposed during the Trump administration significantly increased the cost of these imports, directly impacting the profitability of aircraft manufacturers. This ripple effect inevitably led to higher prices for consumers and significant adjustments within the industry.

- Increased costs of aluminum, titanium, and other metals: These essential materials for aircraft construction experienced price hikes due to tariffs, adding directly to manufacturing costs.

- Higher prices for engines and avionics systems: Many aircraft engines and sophisticated onboard systems are sourced from international suppliers, increasing the final cost of the aircraft.

- Supply chain disruptions due to tariff-related delays: Tariffs created bureaucratic hurdles and delays, disrupting established supply chains and creating production bottlenecks.

- Potential for manufacturers to relocate production to avoid tariffs: To mitigate the impact of tariffs, some manufacturers considered, and in some cases implemented, relocation of production facilities to countries outside the tariff's reach.

Reduced Global Trade and Competition

The imposition of tariffs frequently triggers retaliatory measures from affected countries, leading to a decrease in overall global trade. This was clearly felt in the aircraft industry, where Trump Tariffs Global Aircraft Trade significantly impacted the dynamics of international commerce. The reduction in trade negatively affected competition and innovation.

- Reduced exports of aircraft and related services: Tariffs created barriers to entry for US aircraft manufacturers in international markets, hindering export opportunities.

- Decreased foreign investment in the US aircraft industry: Uncertainty created by trade wars discouraged foreign investment, limiting growth opportunities within the US sector.

- Potential for trade wars to escalate, further harming the sector: Retaliatory tariffs from other countries created a cycle of escalating trade tensions, ultimately harming the entire global aircraft industry.

- Loss of market share to competitors in countries with less restrictive trade policies: Companies in countries with more favorable trade policies gained a competitive edge, capturing market share from US manufacturers.

Impact on Employment and Investment in the Aircraft Industry

The economic consequences of tariffs on the aircraft industry extended beyond simple price increases. The Trump Tariffs Aircraft Jobs Investment had a measurable negative impact on employment and investment. The resulting uncertainty created a ripple effect throughout the sector and related industries.

- Potential job losses due to factory closures or reduced production: Increased costs and reduced market share led to factory closures and reduced production in some sectors, resulting in job losses.

- Reduced investment in research and development of new aircraft technologies: The economic uncertainty resulting from tariffs discouraged investment in crucial research and development, hindering innovation.

- Negative impact on related industries, such as aerospace engineering and maintenance: The challenges faced by aircraft manufacturers affected related industries, such as aerospace engineering and maintenance, leading to further job losses.

- Uncertainty and hesitancy for potential investors: The overall instability created by tariffs made potential investors hesitant to commit capital to the industry, slowing its growth.

Case Study: Boeing and Airbus

The impact of tariffs was acutely felt by industry giants like Boeing and Airbus. Both companies rely on extensive global supply chains, making them particularly vulnerable to trade disruptions. Boeing, for example, faced increased costs for imported parts, while Airbus navigated challenges related to retaliatory tariffs imposed by the EU. Both companies had to adapt their strategies and operations to navigate the complex tariff environment, highlighting the widespread impact of these trade policies. The case of Boeing and Airbus exemplifies the challenges faced by major players in the industry.

Conclusion

The potential Trump tariffs posed a significant threat to the aircraft industry, impacting costs, global trade, and employment. The ramifications extended beyond immediate financial losses, influencing long-term investment and technological innovation. Understanding the lasting impact of these Trump tariffs on the aircraft industry is crucial for navigating future trade policies and mitigating similar risks. Further research and analysis into the long-term effects of these tariffs are needed to inform effective strategies for the future of this vital sector. Learn more about the impact of Trump tariffs on the aircraft industry and how to navigate these complex trade issues.

Featured Posts

-

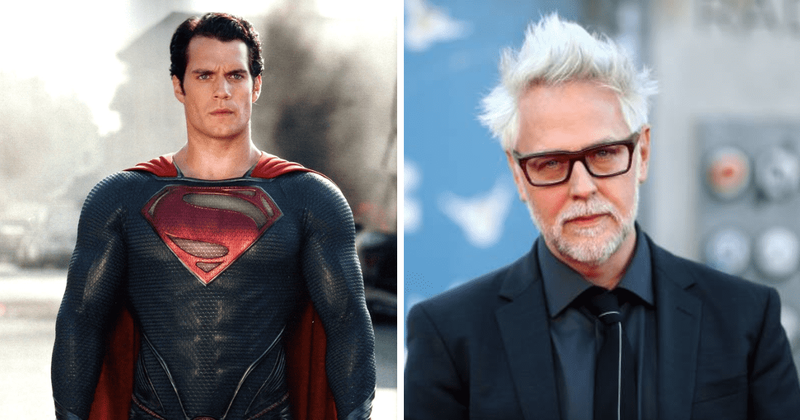

James Gunn Confirms Henry Cavills Difficult Dc Experience

May 11, 2025

James Gunn Confirms Henry Cavills Difficult Dc Experience

May 11, 2025 -

The Truth Behind Henry Cavills Mid Scene Beard Growth In Mission Impossible Fallout

May 11, 2025

The Truth Behind Henry Cavills Mid Scene Beard Growth In Mission Impossible Fallout

May 11, 2025 -

Nba Award Boston Celtics Guard Opting Out

May 11, 2025

Nba Award Boston Celtics Guard Opting Out

May 11, 2025 -

Calvin Klein Unveils New Campaign With Lily Collins Picture Gallery

May 11, 2025

Calvin Klein Unveils New Campaign With Lily Collins Picture Gallery

May 11, 2025 -

Mlb Injury News Yankees Vs Diamondbacks April 1 3 Series

May 11, 2025

Mlb Injury News Yankees Vs Diamondbacks April 1 3 Series

May 11, 2025