Impact Of Proposed G-7 De Minimis Tariffs On Chinese Goods

Table of Contents

Understanding De Minimis Tariffs and their Current State

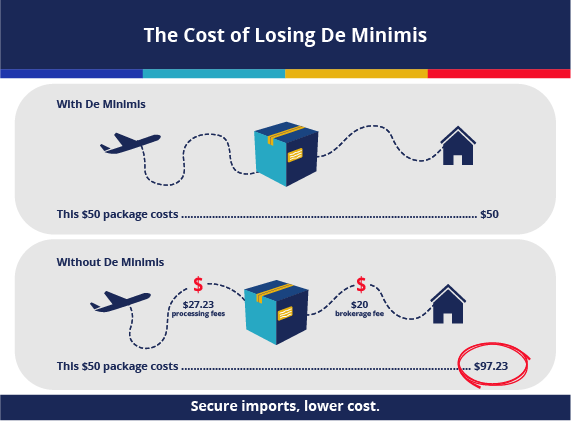

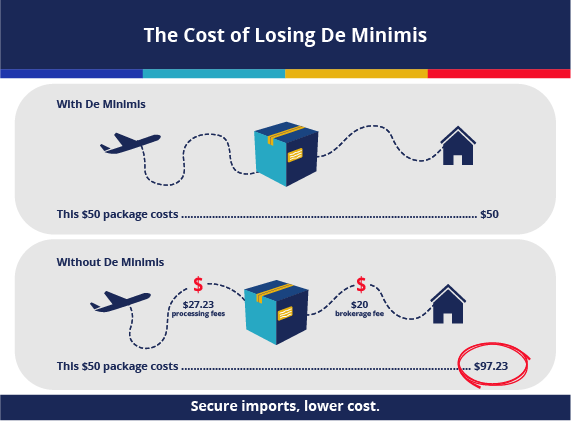

De minimis tariffs refer to the value threshold below which imported goods are exempt from customs duties. Their purpose is to simplify customs procedures and reduce the burden on smaller shipments, particularly those from e-commerce platforms. Currently, de minimis tariff thresholds vary significantly across G-7 nations, leading to inconsistencies in trade practices.

- Definition of de minimis value: This is the monetary value of goods imported below which tariffs are waived.

- Current tariff rates for various product categories: These rates differ depending on the type of good and the country of origin. Certain product categories might face higher duties even below the de minimis threshold.

- Comparison of current thresholds across G-7 nations: The US might have a higher threshold than Canada or the UK, leading to a competitive disadvantage for some businesses in those countries. This disparity creates an uneven playing field for importers and exporters.

- Impact on e-commerce and small businesses: Lower thresholds significantly impact small businesses and e-commerce operations relying on cross-border shipments of smaller, less valuable items. Higher thresholds can incentivize growth in these sectors.

Proposed Changes to G-7 De Minimis Tariffs and their Rationale

Proposed changes to G-7 de minimis thresholds aim for greater harmonization across member nations. The driving forces behind these changes are multifaceted:

- Specific proposed threshold changes for each G-7 nation: While specific proposals are still subject to negotiation and may vary, the overall trend is toward a harmonized, but likely higher, threshold.

- Arguments for and against the proposed changes: Proponents argue that harmonization simplifies trade procedures and fosters fair competition. Opponents express concern about potential negative impacts on domestic industries and increased consumer prices. Small businesses are particularly concerned about increased costs.

- Potential impact on global supply chains: Altered thresholds could significantly disrupt existing global supply chains, forcing businesses to readjust their logistics and sourcing strategies.

- Political motivations behind the proposed adjustments: The proposed changes reflect a broader trend towards protectionism and a reassessment of global trade relationships, particularly concerning the balance of trade with China.

Impact on Chinese Goods Imports

The proposed tariff adjustments will disproportionately impact imports of Chinese goods, given China's significant role in global manufacturing and exports.

- Sectors most affected by the tariff changes: Sectors such as electronics, textiles, and consumer goods are expected to be heavily affected due to the high volume of Chinese imports in these areas.

- Potential shift in sourcing for importers: Businesses might explore alternative sourcing options, possibly shifting production to countries with lower tariffs or more favorable trade agreements.

- Impact on consumer spending and purchasing habits: Higher prices on Chinese goods could lead to decreased consumer spending in those sectors, forcing consumers to seek alternatives or reducing overall purchasing power.

- Strategies Chinese businesses might employ to mitigate the impact: Chinese businesses might explore strategies such as regional production facilities in G-7 countries, increased investment in research and development to increase value, or adjustments in pricing to remain competitive.

Economic and Political Ramifications

The broader economic and political implications of the proposed G-7 de minimis tariffs are substantial.

- Potential for trade wars or retaliatory measures: The changes could trigger retaliatory measures from China, escalating trade tensions and potentially leading to trade wars.

- Impact on global economic growth: Disrupted trade flows and increased uncertainty could negatively impact global economic growth, particularly in countries heavily reliant on trade with China and G-7 nations.

- Effects on international relations and diplomatic ties: The proposed tariffs could strain relationships between G-7 nations and China, adding complexity to already delicate geopolitical dynamics.

- Potential for renegotiation or compromise on the proposed tariffs: The final outcome of the negotiations remains uncertain, with possibilities for adjustments, compromises, or even reversals of certain proposals.

Conclusion

The proposed G-7 de minimis tariffs on Chinese goods present a complex challenge with far-reaching consequences. The changes will likely impact Chinese exports significantly, causing price increases for consumers and potentially disrupting global supply chains. The economic and political ramifications could be substantial, ranging from increased trade tensions to impacts on global economic growth. Understanding the implications of these changes, particularly for businesses involved in importing and exporting goods to and from China and G-7 nations, is crucial. Stay informed about the ongoing developments regarding the G-7 de minimis tariffs on Chinese goods. Further research into specific sectors and their likely responses is crucial for navigating this evolving trade landscape. Careful analysis of the impact of these G-7 De Minimis Tariffs on Chinese Goods is vital for businesses to adapt and thrive in this new trade environment.

Featured Posts

-

Woody Allen Sexual Abuse Accusations Reignited Sean Penns Backing Sparks Debate

May 24, 2025

Woody Allen Sexual Abuse Accusations Reignited Sean Penns Backing Sparks Debate

May 24, 2025 -

Demna Gvasalia And Gucci A Partnership Redefining Luxury

May 24, 2025

Demna Gvasalia And Gucci A Partnership Redefining Luxury

May 24, 2025 -

Dallas Film Festival Free Movies Stars And Events

May 24, 2025

Dallas Film Festival Free Movies Stars And Events

May 24, 2025 -

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025 -

Escape To The Country Financing Your Rural Dream Home

May 24, 2025

Escape To The Country Financing Your Rural Dream Home

May 24, 2025

Latest Posts

-

A Relaxing Escape To The Country Tips For A Stress Free Transition

May 25, 2025

A Relaxing Escape To The Country Tips For A Stress Free Transition

May 25, 2025 -

Your Escape To The Country Choosing The Right Property

May 25, 2025

Your Escape To The Country Choosing The Right Property

May 25, 2025 -

Escape To The Country Weighing The Pros And Cons Of Rural Living

May 25, 2025

Escape To The Country Weighing The Pros And Cons Of Rural Living

May 25, 2025 -

Escape To The Country Finding Your Perfect Country Home

May 25, 2025

Escape To The Country Finding Your Perfect Country Home

May 25, 2025 -

Escape To The Country Top Destinations For A Countryside Getaway

May 25, 2025

Escape To The Country Top Destinations For A Countryside Getaway

May 25, 2025