Impact Of Saudi Arabia's ABS Market Deregulation: A Spain-Sized Opportunity

Table of Contents

The Saudi Vision 2030 and its Impact on the ABS Market

Saudi Vision 2030, the Kingdom's ambitious blueprint for economic diversification and transformation, is fundamentally reshaping its financial landscape. A key element of this transformation is the development of a more sophisticated and robust financial market, including a thriving ABS sector. The plan aims to reduce reliance on oil revenue and foster private sector growth, creating a surge in demand for innovative financing solutions. The Public Investment Fund (PIF), a crucial player in Vision 2030's infrastructure projects, is a significant driver of this increased demand for funding. These large-scale initiatives require substantial financing, creating a fertile ground for the growth of the Saudi Arabia ABS market.

- Increased private sector participation in infrastructure projects: Vision 2030 encourages private sector involvement in major infrastructure projects, fueling the need for diversified financing mechanisms like ABS.

- Growing demand for financing solutions: The ambitious construction and development plans necessitate innovative financing options beyond traditional bank lending, creating opportunities for ABS issuances.

- Government initiatives to attract foreign investment: The Saudi government is actively attracting foreign investment, further stimulating the growth of the ABS market through increased liquidity and international expertise.

- Development of a robust regulatory framework: The Kingdom's commitment to strengthening its regulatory framework enhances transparency and investor confidence, paving the way for substantial growth within the Saudi Arabia ABS market.

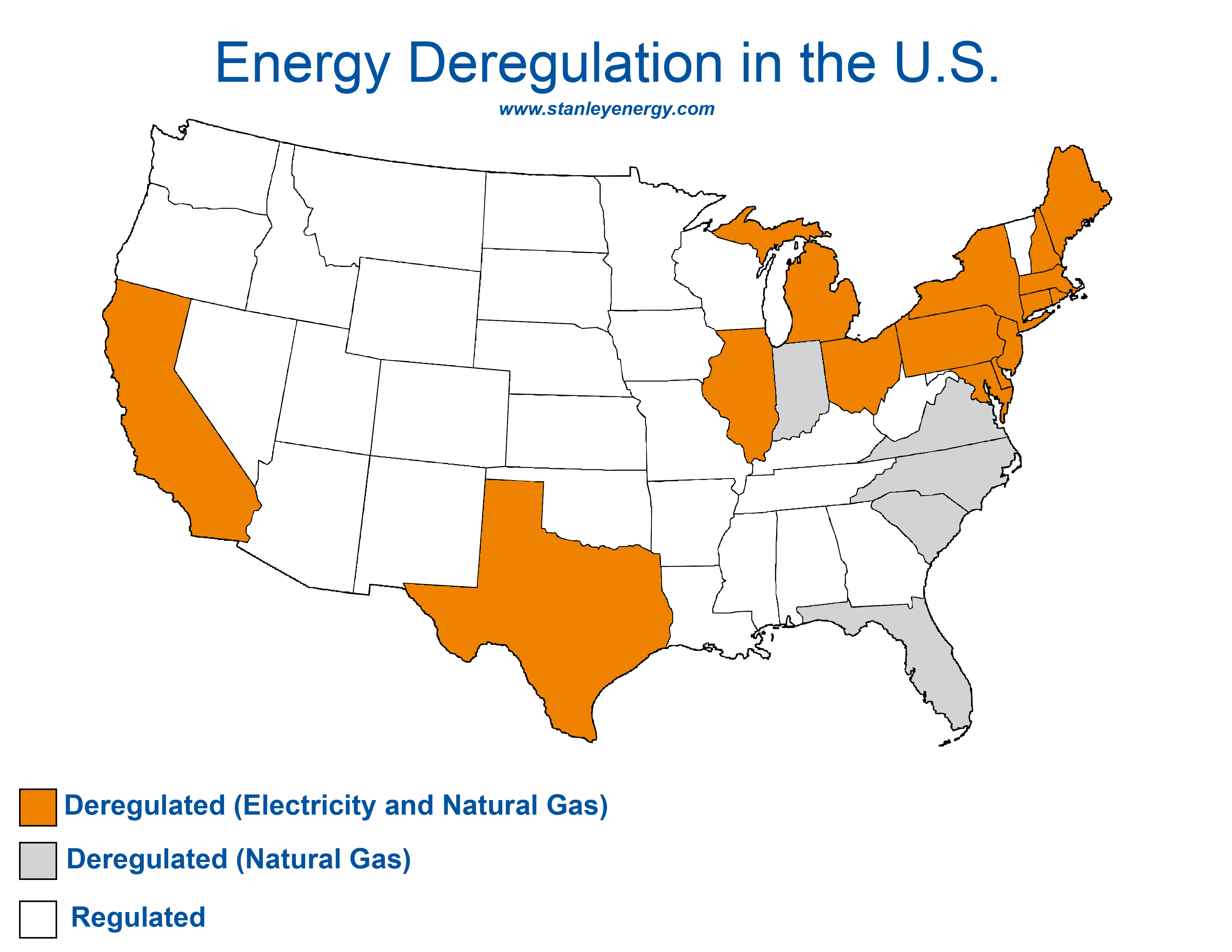

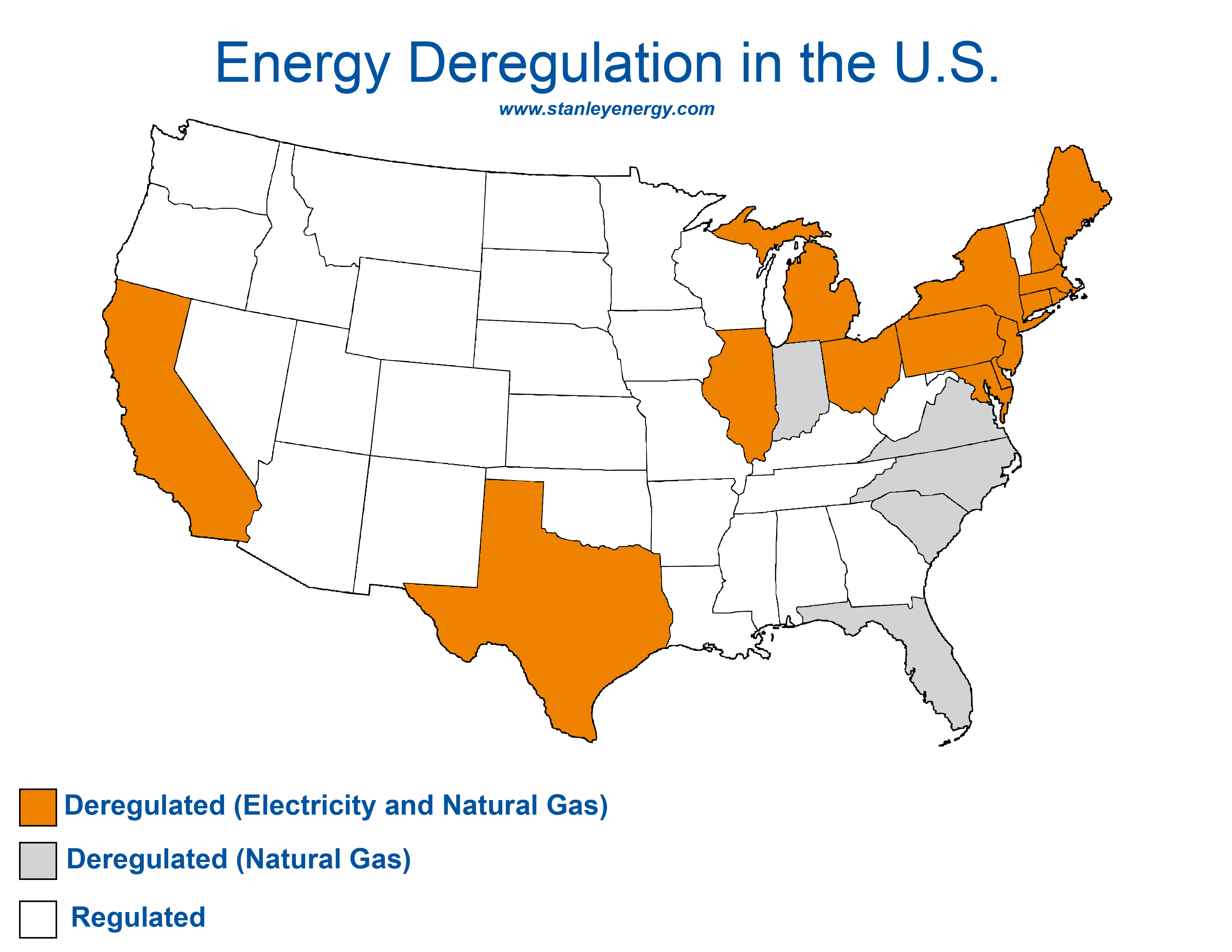

Deregulation and its Implications for Investors

Recent deregulation measures in Saudi Arabia have significantly impacted the ABS market, creating a more attractive environment for investors. These reforms aim to boost liquidity, transparency, and overall market efficiency. By reducing barriers to entry, the Kingdom is encouraging both domestic and international participation, leading to greater competition and potentially improved yields for investors. While offering substantial potential, it is crucial to understand that investing in any emerging market carries inherent risks requiring a comprehensive risk assessment.

- Reduced barriers to entry: The deregulation has lowered hurdles for both domestic and international players to access the Saudi ABS market, boosting competition and liquidity.

- Increased competition leading to potentially better pricing and yields: The influx of investors and issuers fosters a more competitive market, potentially resulting in better pricing and higher yields for investors.

- Opportunities for diversification: Investment in Saudi Arabia ABS provides diversification benefits for fixed-income portfolios, reducing overall risk.

- Enhanced transparency and regulatory oversight: Improved regulatory oversight fosters greater transparency, mitigating risks and improving investor confidence in the Saudi Arabia ABS market.

- Need for careful due diligence and risk management: Despite the opportunities, thorough due diligence and robust risk management strategies are crucial for successful investments.

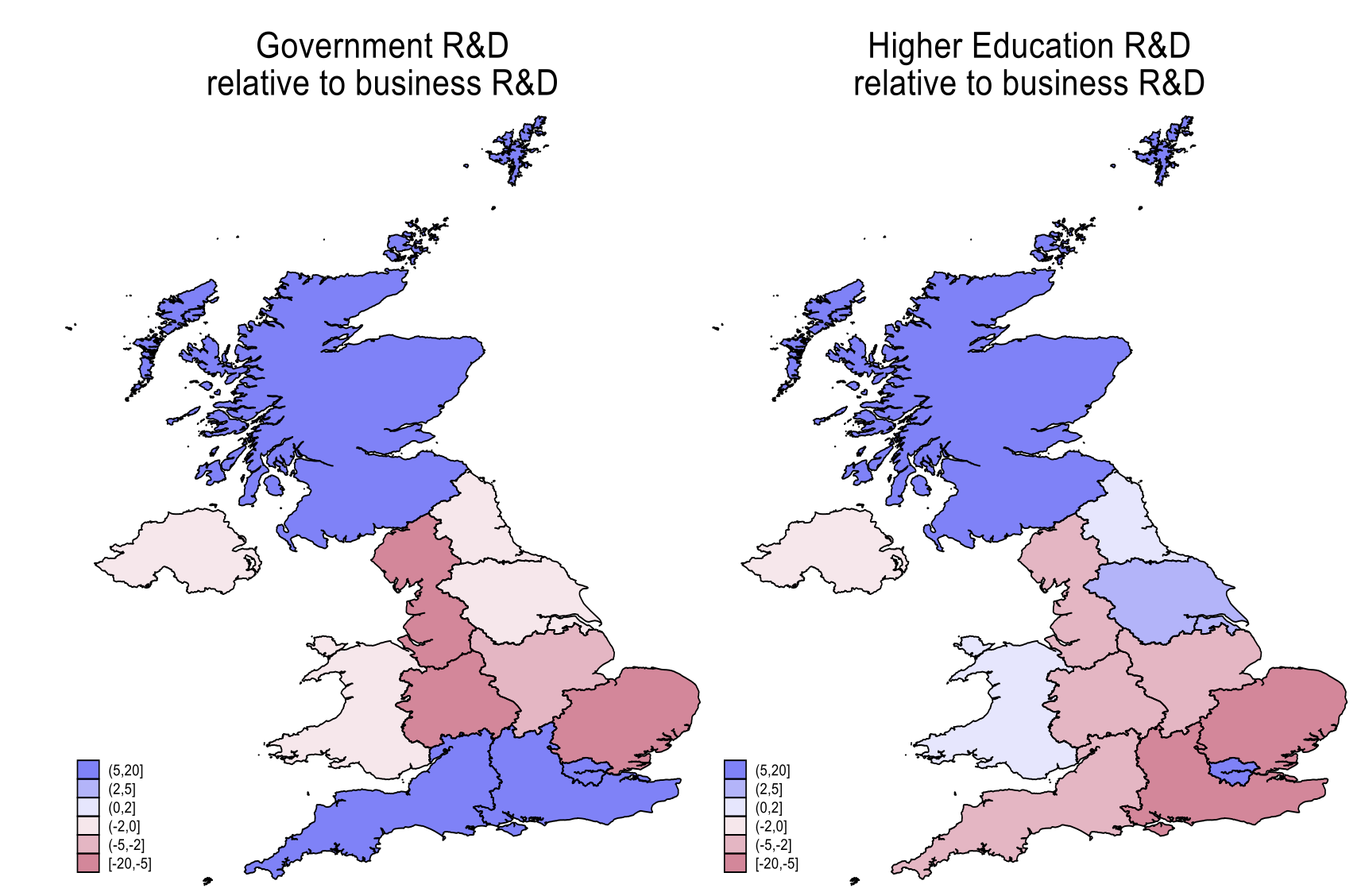

Comparing the Saudi and Spanish ABS Markets: A Case for Growth

The evolution of Spain's ABS market offers a compelling parallel for understanding the potential trajectory of Saudi Arabia's burgeoning sector. Spain's success in this area was fueled by factors such as a well-developed financial infrastructure, robust legal framework, and significant demand for mortgages and other asset-backed products. Saudi Arabia, with its own unique economic drivers and the growing prominence of Islamic finance (including Sukuk bonds), shows potential for similar, if not exceeding, growth. The integration of Islamic finance principles into the ABS market represents a distinct advantage, potentially unlocking a vast pool of capital for infrastructure projects and other investments.

- Analysis of historical growth patterns: Studying Spain's ABS market growth can provide valuable insights into potential growth paths for the Saudi market.

- Key factors contributing to Spain's success: Identifying the key elements of Spain's ABS market success helps understand what could fuel growth in Saudi Arabia.

- Potential for Saudi Arabia to replicate or surpass this growth: The unique context of Saudi Arabia, fueled by Vision 2030, presents opportunities for surpassing Spain's growth.

- Exploring the role of Sukuk: The incorporation of Sukuk bonds within the Saudi ABS market offers a unique opportunity for growth, attracting a wider investor base.

Opportunities and Challenges in the Saudi ABS Market

The Saudi ABS market presents diverse investment opportunities, appealing to various investor profiles, from institutional investors managing large portfolios to high-net-worth individuals seeking alternative investment vehicles. The high-yield potential, driven by the country's rapid development, is a significant draw. However, investors must be aware of the challenges, including market volatility stemming from geopolitical factors and the necessity for robust due diligence. Engaging with experienced local partners and advisors is critical to navigating the market effectively and mitigating risks.

- High-yield opportunities for fixed-income investors: The Saudi ABS market offers potential for higher returns compared to more mature markets.

- Potential for significant capital appreciation: The rapid growth of the Saudi economy and the increasing demand for financing creates opportunities for significant capital appreciation.

- Challenges related to market volatility and geopolitical risks: Investors need to be aware of potential volatility due to global and regional geopolitical factors.

- Importance of thorough due diligence and risk assessment: Thorough due diligence is paramount to minimizing risk and maximizing returns in this emerging market.

- Need for experienced local partners and advisors: Local expertise is crucial for navigating the regulatory landscape and understanding market dynamics.

Conclusion

The deregulation of Saudi Arabia's ABS market presents a significant opportunity for investors, potentially mirroring the impressive growth experienced by established markets like Spain's. While challenges exist, including inherent market risks and the need for comprehensive due diligence, the rewards are substantial, driven by Vision 2030's ambitious economic plans and the significant demand for financing within a rapidly expanding economy. The strategic integration of Islamic finance principles further enhances the appeal and potential of this burgeoning market. Don't miss out on this Spain-sized opportunity. Explore the potential of the burgeoning Saudi Arabia ABS market and capitalize on this exciting investment landscape by conducting thorough research and engaging with experts in the field. Invest wisely in the future of the Saudi Arabia ABS market.

Featured Posts

-

Fortnite Leak Lara Crofts Imminent Return Confirmed

May 02, 2025

Fortnite Leak Lara Crofts Imminent Return Confirmed

May 02, 2025 -

Latest Fortnite Leak Lara Crofts Return Confirmed

May 02, 2025

Latest Fortnite Leak Lara Crofts Return Confirmed

May 02, 2025 -

Will Momo Watanabe Return Mercedes Mones Tbs Championship

May 02, 2025

Will Momo Watanabe Return Mercedes Mones Tbs Championship

May 02, 2025 -

Geweldsmisdrijf In Van Mesdagkliniek Groningen Malek F In Hechtenis

May 02, 2025

Geweldsmisdrijf In Van Mesdagkliniek Groningen Malek F In Hechtenis

May 02, 2025 -

England Women Vs Spain Tv Coverage Kick Off Time And How To Watch

May 02, 2025

England Women Vs Spain Tv Coverage Kick Off Time And How To Watch

May 02, 2025

Latest Posts

-

This Country Regional Differences And Highlights

May 02, 2025

This Country Regional Differences And Highlights

May 02, 2025 -

A Doctor Who Pause Russell T Davies Hints On The Shows Future

May 02, 2025

A Doctor Who Pause Russell T Davies Hints On The Shows Future

May 02, 2025 -

Doctor Who Future Uncertain Showrunner Hints At Potential Hiatus

May 02, 2025

Doctor Who Future Uncertain Showrunner Hints At Potential Hiatus

May 02, 2025 -

Planning Your Trip To This Country Essential Information

May 02, 2025

Planning Your Trip To This Country Essential Information

May 02, 2025 -

The Geography And People Of This Country

May 02, 2025

The Geography And People Of This Country

May 02, 2025