Impact Of The Amended Trump Tax Bill: House Votes For Passage

Table of Contents

Key Changes in the Amended Tax Bill and Their Impact

The amended Trump tax bill introduces several key changes compared to the original legislation. These alterations significantly impact individual taxpayers, corporations, and pass-through businesses.

Individual Tax Rate Adjustments

The amended bill brings modifications to individual income tax brackets, standard deductions, and other provisions.

- Tax Bracket Changes: [Insert specific examples of changes to tax brackets and their percentage rates. E.g., "The 22% bracket has been lowered to 20%, affecting individuals earning between $X and $Y."] This change will [Explain the impact – e.g., "result in a tax reduction for approximately Z million taxpayers."]

- Deduction Changes: [Insert specific examples of changes to deductions. E.g., "The standard deduction has been increased by $X, while the limit on state and local tax (SALT) deductions has been raised to $Y."] This will [Explain the impact – e.g., "provide greater tax relief for lower- and middle-income families, while still limiting deductions for high-income earners."]

- Impact on Income Groups: Data suggests that [Insert data or statistic illustrating the impact on different income groups. E.g., "lower-income households will see an average tax reduction of $500, while high-income households will see an average reduction of $2,000."]

Corporate Tax Rate Modifications

The corporate tax rate has also been altered in the amended bill.

- Rate Changes: [Insert specific details about the changes to the corporate tax rate. E.g., "The corporate tax rate has been reduced from 21% to 19%."] This change is intended to [Explain the intent – e.g., "boost business investment and stimulate job growth."]

- Economic Consequences: Economists predict that [Insert predictions about economic consequences. E.g., "this reduction could lead to increased corporate profits in the short term, but could also exacerbate income inequality and potentially increase the national debt over the long term."]

- Expert Opinions: [Include quotes or summaries of opinions from reputable economists or financial analysts on the potential impact of the corporate tax rate changes.]

Changes to Pass-Through Business Taxation

Amendments related to pass-through entities (LLCs, partnerships) are crucial for small business owners.

- Deduction and Rate Changes: [Insert specific changes to deductions or tax rates for pass-through businesses. E.g., "A new deduction for qualified business income (QBI) has been introduced, potentially benefitting small business owners."]

- Impact on Small Businesses: This change will [Explain the potential impact – e.g., "increase profitability for many small businesses, fostering economic growth and job creation at the local level."]

- Expert Commentary: [Include expert opinions on how these changes will affect small businesses and the overall economy. Reference specific studies or reports.]

Political Implications and Future Outlook

The amended Trump tax bill has sparked intense political debate.

Reactions from Different Political Parties

- Republican Response: [Include quotes or summaries of statements from Republican politicians supporting the bill, emphasizing their reasons.]

- Democratic Response: [Include quotes or summaries of statements from Democratic politicians opposing the bill, and their reasoning.]

- Legislative Challenges: The bill now faces [Describe the potential legislative challenges, such as Senate votes, potential filibusters, or presidential vetoes].

Potential Economic Consequences

- Short-Term Effects: Economists forecast [Insert short-term predictions regarding inflation, job growth, etc.]

- Long-Term Effects: The long-term implications include [Insert long-term predictions, considering impacts on government debt and national savings].

Impact on Specific Demographics

The amended bill's impact varies across different demographics.

Impact on High-Income Earners

- Tax Changes and Wealth Distribution: [Analyze how the changes affect high-income earners and their impact on wealth distribution.]

Impact on Low- and Middle-Income Households

- Tax Credits and Deductions: [Discuss any tax credits or deductions targeted toward these groups and their effectiveness.]

Impact on Specific Industries

- Industries Affected: [Analyze how specific industries, such as real estate or technology, are affected by changes in tax provisions.]

Conclusion: Understanding the Lasting Impact of the Amended Trump Tax Bill

The amended Trump tax bill introduces significant changes with potentially far-reaching consequences for individuals, businesses, and the overall economy. Understanding the Impact of the Amended Trump Tax Bill requires careful consideration of its various provisions and their predicted effects. The alterations to individual tax rates, corporate taxes, and pass-through business taxation will reshape the financial landscape for years to come. To navigate this complex change, consult with a qualified tax professional for personalized advice regarding the Trump Tax Bill Amendments and their implications for your specific situation. Stay informed about further legislative developments and the ongoing debate surrounding the Amended Tax Bill Impact to ensure you're prepared for the future.

Featured Posts

-

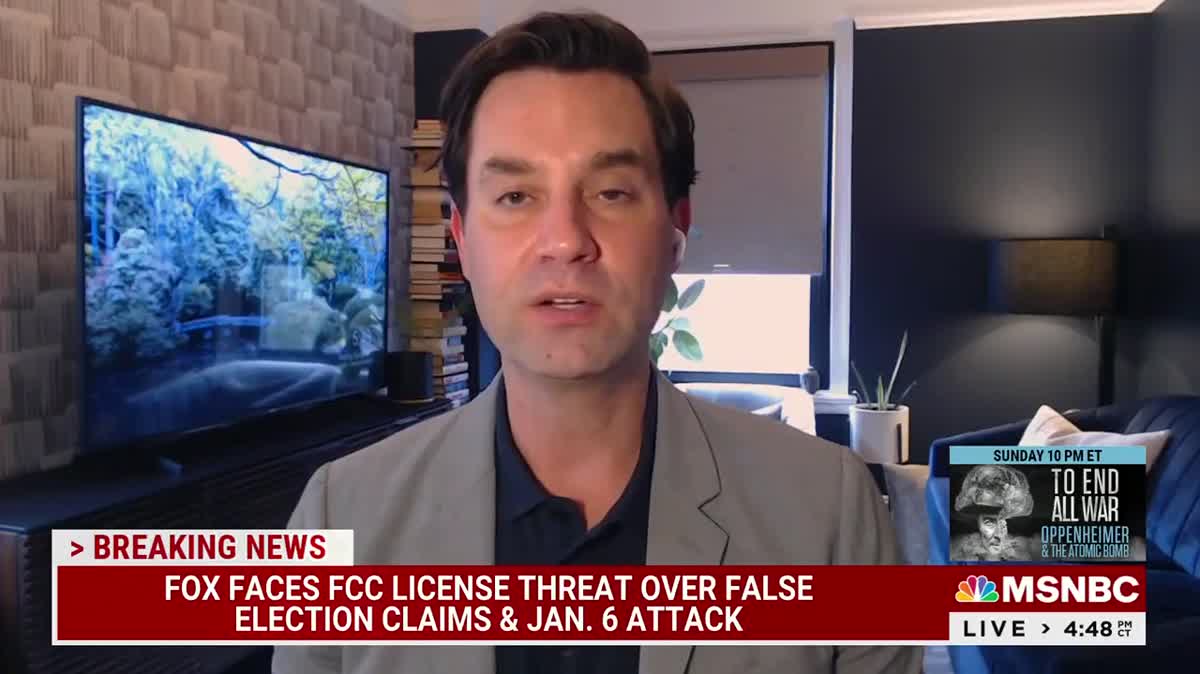

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Center Of The Lawsuit

May 23, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Center Of The Lawsuit

May 23, 2025 -

Msharkt Ebd Alqadr Fy Hzymt Qtr Amam Alkhwr

May 23, 2025

Msharkt Ebd Alqadr Fy Hzymt Qtr Amam Alkhwr

May 23, 2025 -

7 Eleven Canada Partners With Odd Burger For Nationwide Vegan Launch

May 23, 2025

7 Eleven Canada Partners With Odd Burger For Nationwide Vegan Launch

May 23, 2025 -

Man Utd Flop Blames Poor Form On Personal Life

May 23, 2025

Man Utd Flop Blames Poor Form On Personal Life

May 23, 2025 -

Kieran Culkins Unexpected Neverland Connection Investigating The Rumors

May 23, 2025

Kieran Culkins Unexpected Neverland Connection Investigating The Rumors

May 23, 2025

Latest Posts

-

Beruehrende Momente In Der Naehe Des Uniklinikums Essen

May 24, 2025

Beruehrende Momente In Der Naehe Des Uniklinikums Essen

May 24, 2025 -

Essen Aktuelles Und Beruehrendes Rund Um Das Uniklinikum

May 24, 2025

Essen Aktuelles Und Beruehrendes Rund Um Das Uniklinikum

May 24, 2025 -

Essen Naehe Uniklinikum Geschichten Die Bewegen

May 24, 2025

Essen Naehe Uniklinikum Geschichten Die Bewegen

May 24, 2025 -

Essen Uniklinikum Beruehrende Ereignisse In Der Naehe

May 24, 2025

Essen Uniklinikum Beruehrende Ereignisse In Der Naehe

May 24, 2025 -

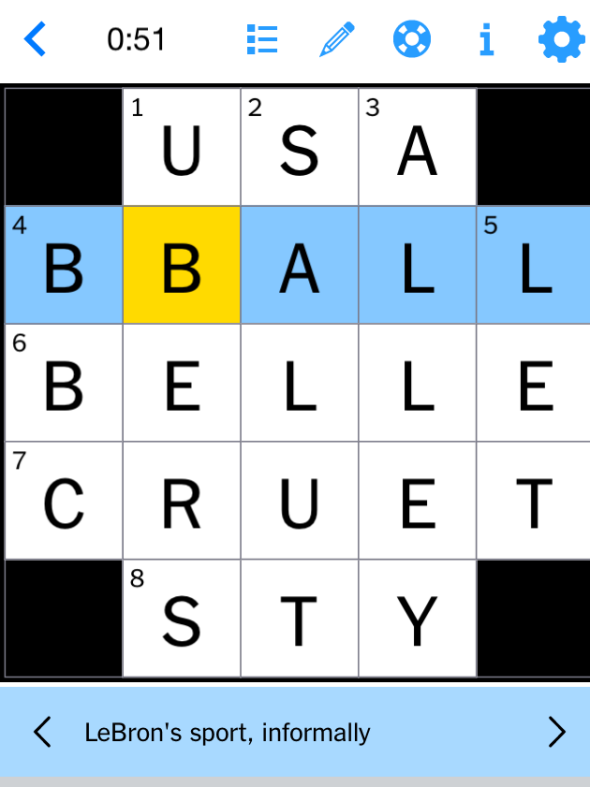

March 16th 2025 Nyt Mini Crossword Hints And Solutions

May 24, 2025

March 16th 2025 Nyt Mini Crossword Hints And Solutions

May 24, 2025