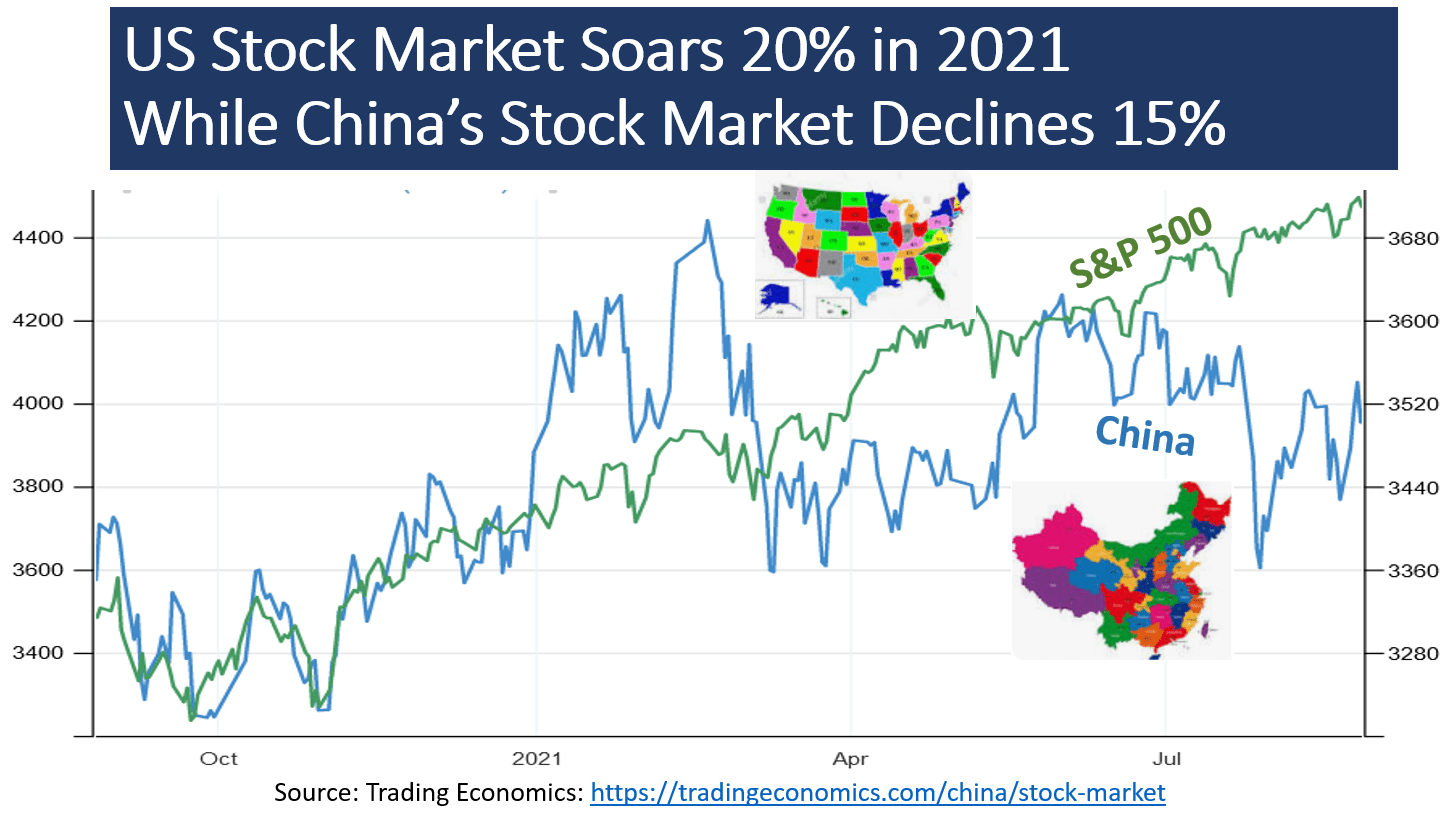

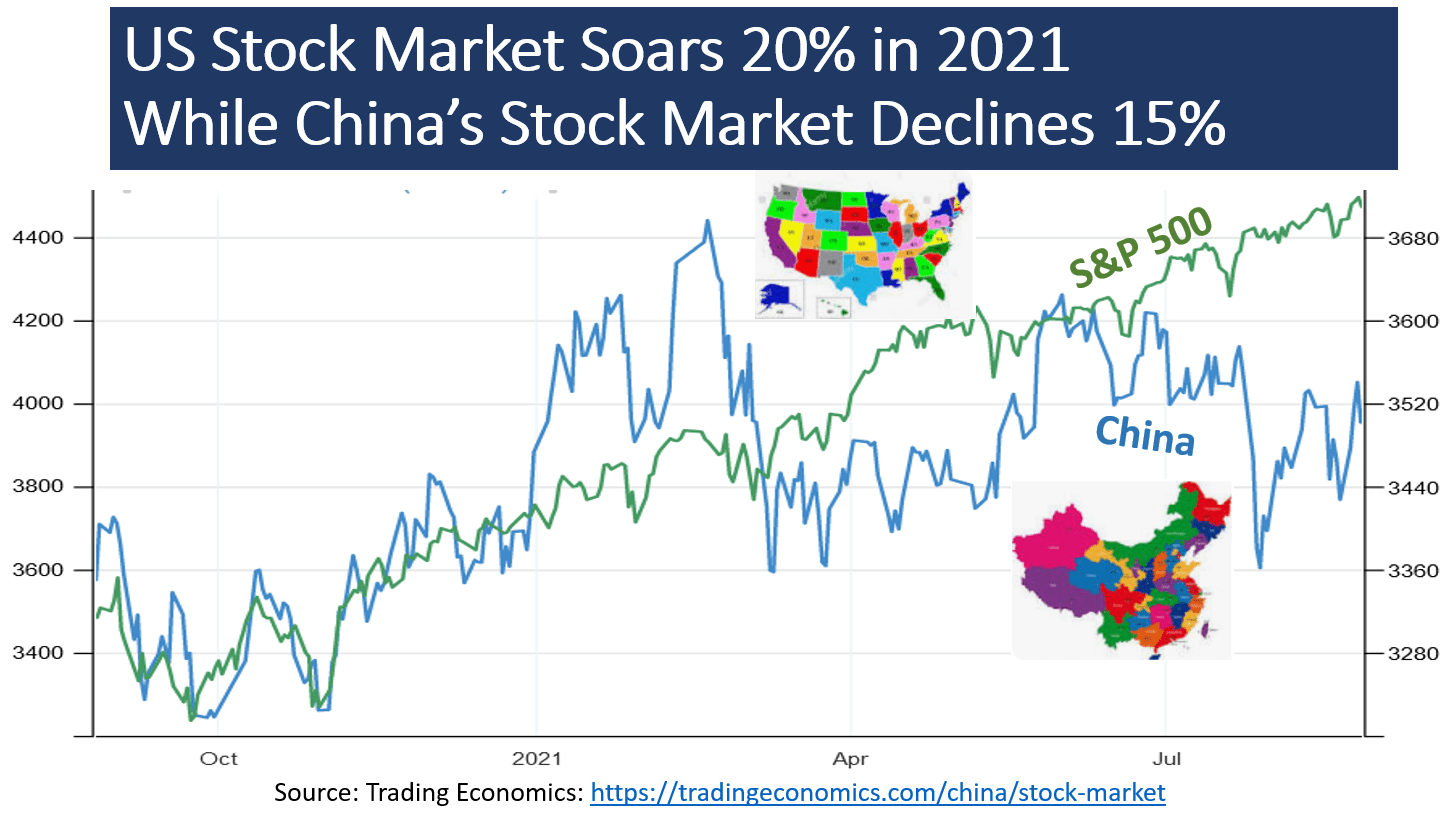

Impact Of US-China Relations And Economic Data On Chinese Stock Market Performance

Table of Contents

The Influence of US-China Relations on Chinese Stock Market Sentiment

Geopolitical risk stemming from US-China relations significantly influences investor confidence and consequently, the Chinese stock market's performance. Escalating tensions, whether through trade wars, technological sanctions, or diplomatic disputes, often trigger market downturns. Investor sentiment takes a hit as uncertainty increases, leading to capital flight and decreased investment activity. Conversely, periods of improved Sino-American relations, marked by positive diplomatic engagements and trade agreements, can significantly boost market sentiment, leading to increased investment and market rallies.

-

Examples of specific events and their impact: The initiation of the US-China trade war in 2018 led to a significant decline in the Shanghai Composite Index. Conversely, the signing of the Phase One trade deal in 2020 resulted in a temporary market upswing. Similarly, heightened tensions over Taiwan often cause market volatility.

-

Analysis of investor behavior: During periods of high tension, investors often adopt a risk-averse approach, opting to move their investments to perceived safer havens. This capital outflow puts downward pressure on Chinese stock prices. Conversely, improved relations often encourage a return of investment, driving market growth.

-

The role of media coverage: Media narratives significantly shape market perceptions. Negative news coverage of US-China relations can fuel investor anxieties and exacerbate market declines, while positive reporting can boost confidence and drive investment.

Key Economic Indicators and Their Impact on Chinese Stock Market Fluctuations

Key economic indicators provide vital insights into the health of the Chinese economy and significantly influence Chinese stock market fluctuations. GDP growth, inflation rates, interest rate adjustments, unemployment figures, consumer spending patterns, industrial production data, and the Purchasing Managers' Index (PMI) all play crucial roles in shaping market expectations and driving stock prices.

-

Positive economic data and market rallies: Strong GDP growth, low unemployment, rising consumer spending, and a healthy PMI generally signal a robust economy, leading to increased investor confidence and market rallies.

-

Impact of unexpected data releases: Unexpectedly strong or weak economic data releases can cause significant market volatility. Positive surprises often trigger sharp price increases, while negative surprises can lead to substantial market corrections.

-

Government policies and their influence: Government policies, such as fiscal stimulus packages or monetary policy adjustments, directly influence economic indicators and subsequently, the market's response. Announcements of significant policy changes can cause immediate and substantial market reactions.

The Role of the Renminbi (RMB) Exchange Rate

Fluctuations in the RMB (Yuan) exchange rate significantly impact the Chinese stock market, affecting both domestic and foreign investors. The RMB's value relative to other major currencies, such as the US dollar, plays a critical role in shaping investment decisions and market dynamics.

-

Weakening RMB and export-oriented companies: A weakening RMB can benefit export-oriented companies as their products become more competitive in international markets, potentially boosting their stock prices.

-

Strengthening RMB and import costs: A strengthening RMB, however, can increase the cost of imports, potentially impacting profitability for companies reliant on imported raw materials or goods, leading to negative market sentiment.

-

Central bank policies and the RMB's value: The Chinese central bank's monetary policies directly influence the RMB's value. Interventions aimed at managing the exchange rate can have significant implications for the stock market.

Analyzing Investment Strategies in Light of US-China Relations and Economic Data

Navigating the Chinese stock market successfully requires a sophisticated understanding of both US-China relations and key economic indicators. Investors need to develop robust investment strategies that account for the inherent complexities and volatilities.

-

Diversification to mitigate risk: Diversifying investments across different sectors and asset classes can help mitigate risk associated with fluctuations in US-China relations or economic data releases.

-

Thorough market research and due diligence: Before making any investment decisions, thorough research and due diligence are essential to understand the underlying risks and potential rewards associated with specific companies and sectors within the Chinese market.

-

Long-term perspective and patience: The Chinese stock market is subject to significant volatility. A long-term investment perspective and patience are crucial to weathering market fluctuations and capitalizing on long-term growth potential.

Conclusion

The Chinese stock market's performance is significantly shaped by the complex interplay between US-China relations and key economic data releases. Understanding these dynamics is paramount for investors and businesses seeking to navigate this challenging yet potentially rewarding market. By carefully analyzing geopolitical risks, economic indicators, and the RMB exchange rate, investors can develop more effective strategies to mitigate risks and identify lucrative investment opportunities. Staying informed about US-China relations and closely monitoring key economic indicators is crucial for making sound and informed decisions regarding investments in the Chinese stock market. Conduct thorough research and consider professional advice before investing in this dynamic market.

Featured Posts

-

Dominant Shooting Performance Propels Cavs Past Knicks

May 07, 2025

Dominant Shooting Performance Propels Cavs Past Knicks

May 07, 2025 -

Greg Abel From Canada To The Helm Of Berkshire Hathaway

May 07, 2025

Greg Abel From Canada To The Helm Of Berkshire Hathaway

May 07, 2025 -

Exploring The Phenomenon Of The Glossy Mirage

May 07, 2025

Exploring The Phenomenon Of The Glossy Mirage

May 07, 2025 -

Holland And Zendayas Shocking Family Plans

May 07, 2025

Holland And Zendayas Shocking Family Plans

May 07, 2025 -

Xrp Rally Examining The Influence Of A Presidential Article On Ripple

May 07, 2025

Xrp Rally Examining The Influence Of A Presidential Article On Ripple

May 07, 2025

Latest Posts

-

Tnt Announcers Roast Jayson Tatum In Hilarious Lakers Celtics Promo

May 08, 2025

Tnt Announcers Roast Jayson Tatum In Hilarious Lakers Celtics Promo

May 08, 2025 -

Cowherd On Tatums Performance Celtics Game 1 Post Game Analysis

May 08, 2025

Cowherd On Tatums Performance Celtics Game 1 Post Game Analysis

May 08, 2025 -

Celtics Game 1 Loss Prompts Sharp Criticism From Colin Cowherd On Tatum

May 08, 2025

Celtics Game 1 Loss Prompts Sharp Criticism From Colin Cowherd On Tatum

May 08, 2025 -

Jayson Tatum Reflects On Larry Birds Influence A Celtics Perspective

May 08, 2025

Jayson Tatum Reflects On Larry Birds Influence A Celtics Perspective

May 08, 2025 -

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1

May 08, 2025

Colin Cowherd Takes Aim At Jayson Tatum Post Celtics Game 1

May 08, 2025