Impact Of US Tariffs On Shein's London Initial Public Offering

Table of Contents

Shein's Reliance on US Markets and the Tariff Impact

Shein's substantial US market share makes it highly vulnerable to tariff increases. Understanding this reliance is crucial to assessing the Shein IPO's success.

US Market Share and Revenue

Shein's US sales figures are not publicly released with complete transparency, but industry estimates suggest a significant portion of its overall revenue comes from the American market. This makes the company particularly sensitive to fluctuations in US trade policy.

- Quantify Shein's US market penetration: While precise figures are elusive, analysts suggest Shein holds a considerable share of the US online fast fashion market, competing fiercely with established players. This large market share makes the US a key component of its revenue stream.

- Detail the specific tariffs impacting Shein's product categories: The tariffs imposed on clothing and textiles directly impact Shein's profit margins. These tariffs vary depending on the specific product and its origin, adding complexity to the analysis. Understanding these specific tariff rates is crucial for accurate financial projections.

- Explain the potential impact of increased tariffs on Shein's profit margins in the US: Increased tariffs translate directly to higher production costs, potentially squeezing Shein's already thin profit margins. This could force the company to either absorb the costs, reduce profit, or pass the increased expenses onto the consumer, potentially impacting demand.

Impact on Supply Chain and Manufacturing

Shein's famously nimble supply chain is a core component of its business model. However, US tariffs could force a significant restructuring.

- Analyze the current location of Shein's manufacturing facilities: Shein primarily relies on a network of manufacturers in Asia, particularly China. Relocating production to avoid US tariffs presents significant logistical and financial hurdles.

- Evaluate the costs associated with relocating production: Shifting manufacturing to other countries, such as Mexico or Vietnam, involves substantial investment in new facilities and transportation infrastructure, impacting the company's already lean operational model.

- Discuss the implications for Shein's speed-to-market strategy: A slower, more complex supply chain, potentially resulting from tariff-driven relocation, could directly conflict with Shein's core strategy of rapid product turnover and trendy designs.

Investor Sentiment and the Shein IPO Valuation

The uncertainty surrounding US tariffs significantly influences potential investors' risk assessment and consequently, the Shein IPO valuation.

Risk Assessment by Investors

The imposition or increase of tariffs adds a layer of unpredictable risk for investors considering participation in the Shein IPO.

- Discuss the impact on investor confidence: The unpredictability of US trade policy creates uncertainty and potentially reduces investor confidence in Shein's long-term financial outlook. This uncertainty can discourage investment.

- Analyze how the risk profile affects the IPO valuation: Increased perceived risk usually results in a lower IPO valuation, reducing the potential funds Shein can raise.

- Highlight potential investor concerns regarding long-term profitability: Investors will scrutinize Shein's ability to maintain profitability in the face of potential tariff increases, potentially demanding higher returns to compensate for the added risk.

Attracting Investors Despite Tariff Uncertainty

Despite these challenges, Shein can employ several strategies to attract investors.

- Discuss transparent communication regarding tariff mitigation strategies: Openly communicating Shein's plans to address the tariff challenges, including diversification efforts and lobbying activities, can increase investor confidence.

- Highlight Shein's diversification efforts beyond the US market: Demonstrating a growing presence in markets less affected by US tariffs can showcase resilience and reduce reliance on a single, high-risk region.

- Analyze the potential for Shein to showcase strong overall growth despite US tariff impacts: Highlighting strong overall revenue growth and market share gains in other regions can offset concerns about US tariff impacts.

Strategic Responses to US Tariffs and their Influence on the IPO

Shein's strategic responses to US tariffs are crucial for the success of its London IPO.

Price Adjustments and Consumer Demand

Passing increased costs to consumers might be a necessary strategy, but it carries significant risks.

- Discuss the elasticity of demand for Shein's products: Shein needs to assess how price-sensitive its customer base is. Significant price increases could lead to a decline in sales volume.

- Analyze the potential for losing market share due to price increases: Competitors not facing similar tariff pressures may gain market share if Shein raises prices substantially.

- Evaluate alternative strategies to maintain profit margins, such as cost-cutting measures: Shein could explore strategies like streamlining operations, negotiating better deals with suppliers, or improving efficiency to offset tariff-related cost increases.

Lobbying and Political Engagement

Shein might consider actively engaging in lobbying efforts to influence US trade policy.

- Analyze the effectiveness of lobbying efforts on the outcome of tariffs: The effectiveness of lobbying depends on various factors, including political climate and the strength of Shein's lobbying campaign.

- Discuss potential alliances with other businesses facing similar challenges: Forming alliances with other businesses affected by tariffs could amplify their collective influence on policymakers.

- Examine the reputational implications of lobbying activities: Engaging in lobbying activities carries reputational risks. Transparency and ethical conduct are crucial.

Conclusion

Shein's planned London IPO faces significant headwinds due to the uncertainty surrounding US tariffs. The impact on Shein's US market share, investor sentiment, and strategic responses will heavily influence the IPO's success. While challenges exist, Shein can mitigate risks through transparent communication, strategic supply chain diversification, and proactive engagement with US trade policy. Understanding the full impact of US tariffs on the Shein IPO requires continued monitoring of the evolving political and economic landscape. Stay informed on the latest developments regarding the Shein IPO and the complexities of fast fashion tariffs to fully grasp the potential outcomes. Understanding the interplay between Shein IPO and US Tariffs is crucial for investors and industry analysts alike.

Featured Posts

-

Nhl Standings The Fight For The Western Conference Wild Card Spot

May 05, 2025

Nhl Standings The Fight For The Western Conference Wild Card Spot

May 05, 2025 -

Singapores Ruling Party Faces A Crucial Vote

May 05, 2025

Singapores Ruling Party Faces A Crucial Vote

May 05, 2025 -

Severe Heatwave Warning Issued For 5 Districts In South Bengal

May 05, 2025

Severe Heatwave Warning Issued For 5 Districts In South Bengal

May 05, 2025 -

Third Emmy Nomination For Greg Olsen A Triumph Over Tom Brady On Fox

May 05, 2025

Third Emmy Nomination For Greg Olsen A Triumph Over Tom Brady On Fox

May 05, 2025 -

Lizzos Weight Loss Journey Diet Exercise And Body Positivity

May 05, 2025

Lizzos Weight Loss Journey Diet Exercise And Body Positivity

May 05, 2025

Latest Posts

-

Brian Tees Highly Anticipated Return In Chicago Med Season 10 Episode 14

May 05, 2025

Brian Tees Highly Anticipated Return In Chicago Med Season 10 Episode 14

May 05, 2025 -

Brian Tee Returns To Chicago Med Season 10 Episode 14

May 05, 2025

Brian Tee Returns To Chicago Med Season 10 Episode 14

May 05, 2025 -

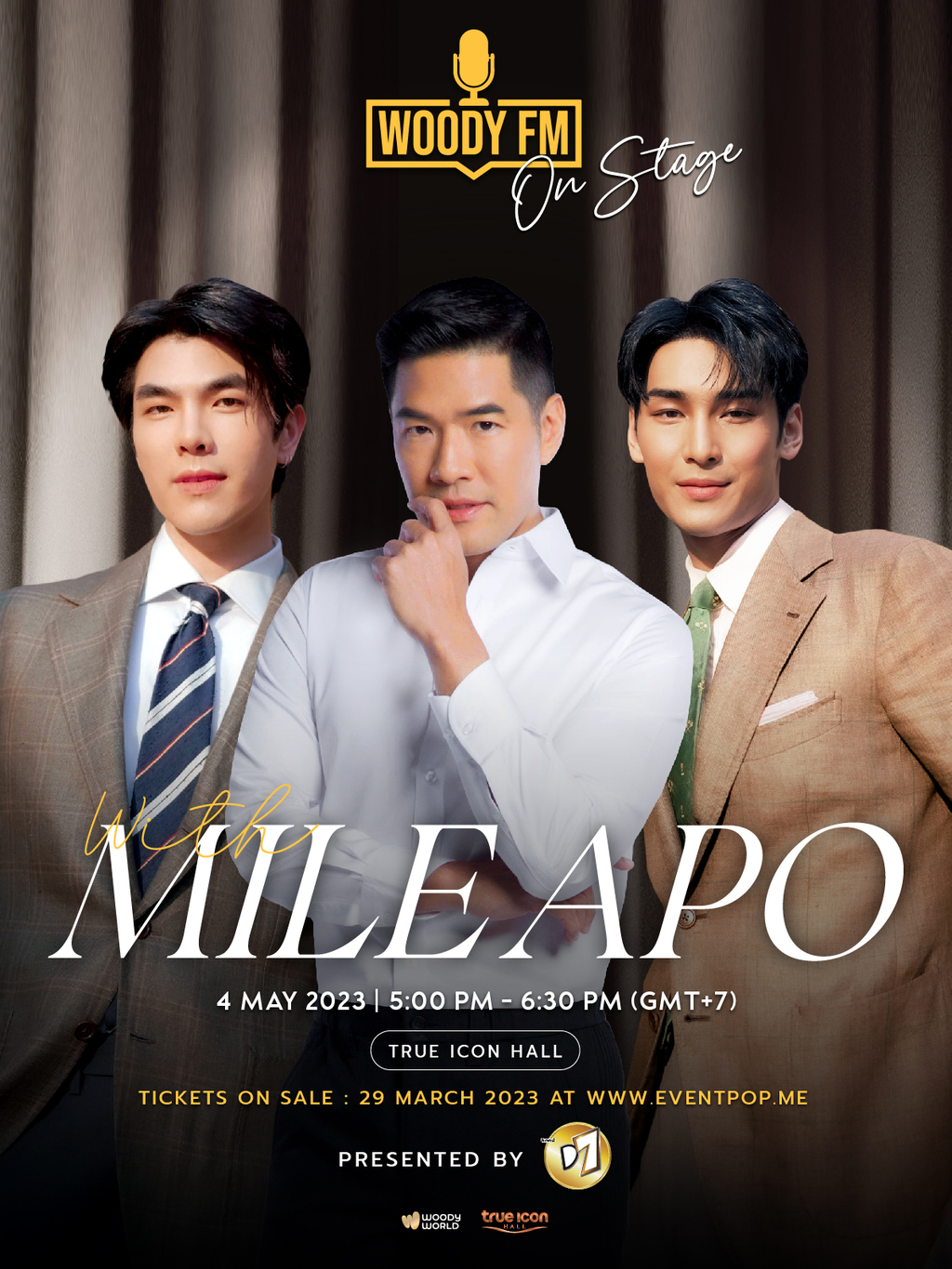

A 390 000 Win For Nelson Dong In Apo Main Event

May 05, 2025

A 390 000 Win For Nelson Dong In Apo Main Event

May 05, 2025 -

Convicted Paedophile Receives Significant Prison Term

May 05, 2025

Convicted Paedophile Receives Significant Prison Term

May 05, 2025 -

Apo Main Event Champion Nelson Dong Secures A 390 000

May 05, 2025

Apo Main Event Champion Nelson Dong Secures A 390 000

May 05, 2025