Important Information: HMRC Letters And High-Income Households In The UK

Table of Contents

Common Types of HMRC Letters Received by High-Income Households

High-income earners in the UK often receive specific types of HMRC correspondence. Understanding these different types of letters is the first step in effective management.

Tax Return Reminders and Enquiries

HMRC sends reminders for self-assessment tax returns. If information is missing or discrepancies arise, you'll receive an enquiry. Prompt responses are vital to avoid penalties.

- Examples of enquiry types: Missing bank statement information, unexplained discrepancies in declared income, inconsistencies between income sources and expenses.

- Penalties for late filing: Significant penalties can be levied for late submission, increasing with time.

- Methods of responding: Use the online HMRC portal for faster processing or respond via post, ensuring all necessary documentation is included.

Tax Assessments and Adjustments

HMRC issues tax assessments based on your submitted return. Adjustments might be needed due to capital gains tax (CGT) on property sales, inheritance tax (IHT) implications, or other complex tax situations.

- Understanding tax assessment timelines: Familiarize yourself with the timelines for assessments and appeals.

- Avenues for challenging an assessment: If you disagree with an assessment, you have the right to appeal through HMRC’s formal dispute resolution process.

- Engaging with HMRC's dispute resolution process: This may involve providing additional evidence and engaging with HMRC officers. Professional advice is highly recommended.

Payment Demands and Reminders

If your tax liability isn't paid on time, you'll receive payment demands and reminders. Ignoring these can lead to serious consequences.

- Payment plan options: HMRC offers payment plans to help manage tax debt, although interest and penalties may still apply.

- Methods of payment: Various payment methods are available, including online banking, debit/credit cards, and bank transfers. Choose the most convenient method for you.

- Understanding HMRC's debt collection procedures: Failure to comply with payment demands could lead to more aggressive debt collection actions, including legal proceedings.

Investigation Letters and Audits

In some cases, HMRC may initiate a full investigation or audit of your tax affairs. This requires careful attention and often professional assistance.

- Understanding the scope of an audit: HMRC audits can cover several tax years and various aspects of your income and expenses.

- Preparing for an HMRC investigation: Gather all relevant financial records and seek professional tax advice immediately.

- The role of tax advisors: A qualified tax advisor can provide vital support during an HMRC investigation, ensuring your rights are protected.

Understanding Your Responsibilities as a High-Income Earner

Managing your tax affairs effectively is crucial as a high-income earner in the UK. Proactive measures can significantly reduce the risk of HMRC scrutiny.

Accurate Record Keeping

Meticulous record-keeping is paramount. This minimizes the risk of errors and simplifies communication with HMRC.

- Types of records to keep: Bank statements, payslips, invoices from contractors, receipts for business expenses, and property purchase documents.

- Digital record-keeping best practices: Utilize secure cloud storage and robust accounting software.

- Recommended software: Explore accounting software like Xero, QuickBooks, or FreeAgent designed for efficient record keeping.

Seeking Professional Tax Advice

High-income individuals often have complex tax situations. Engaging a qualified tax advisor is highly recommended.

- Expertise in tax legislation: Tax advisors possess in-depth knowledge of complex UK tax laws and regulations, offering valuable insight.

- Assistance with tax planning: They can help optimize your tax strategy, minimizing your overall tax liability legally.

- Representation during HMRC investigations: They can act as your representative during HMRC investigations, ensuring your interests are protected.

Staying Compliant with Tax Laws

Staying updated on tax laws and regulations is crucial for high-income earners.

- Resources for staying informed: The official HMRC website, tax publications from professional bodies (like the Chartered Institute of Taxation), and regular newsletters from tax advisors.

- Potential penalties for non-compliance: Non-compliance can result in substantial financial penalties and legal consequences.

What to Do When You Receive an HMRC Letter

Responding appropriately to HMRC correspondence is vital. Here’s a step-by-step approach.

Read Carefully and Understand the Content

Take your time to thoroughly review the letter, noting all important details.

- Identifying key details: Reference numbers, deadlines for response, contact details of HMRC officers, and specific requests or queries.

Respond Promptly and Accurately

Respond to HMRC promptly and provide accurate information to avoid delays or penalties.

- Methods of response: Use the online HMRC portal wherever possible or respond via post, using recorded delivery for important documents. Always keep a copy of your response for your records.

- Seeking clarification if needed: Don't hesitate to contact HMRC if any aspect of the letter is unclear.

Seek Professional Help When Necessary

Don't hesitate to seek professional advice if you are unsure how to respond or if the matter is complex.

- When to consult a tax advisor or accountant: If you receive an investigation letter, are unsure about a tax assessment, or face any other complex tax issues.

Conclusion

Receiving HMRC letters can be stressful, particularly for high-income households in the UK. Understanding the different types of letters, your responsibilities as a high-income earner, and how to respond appropriately is crucial for avoiding penalties and maintaining tax compliance. By meticulously maintaining records, seeking professional advice when necessary, and responding promptly to HMRC communications, you can navigate the complexities of the UK tax system effectively. Don't hesitate to seek expert guidance if you're unsure about anything related to your HMRC letters high-income UK situation. Contact a qualified tax advisor today for peace of mind.

Featured Posts

-

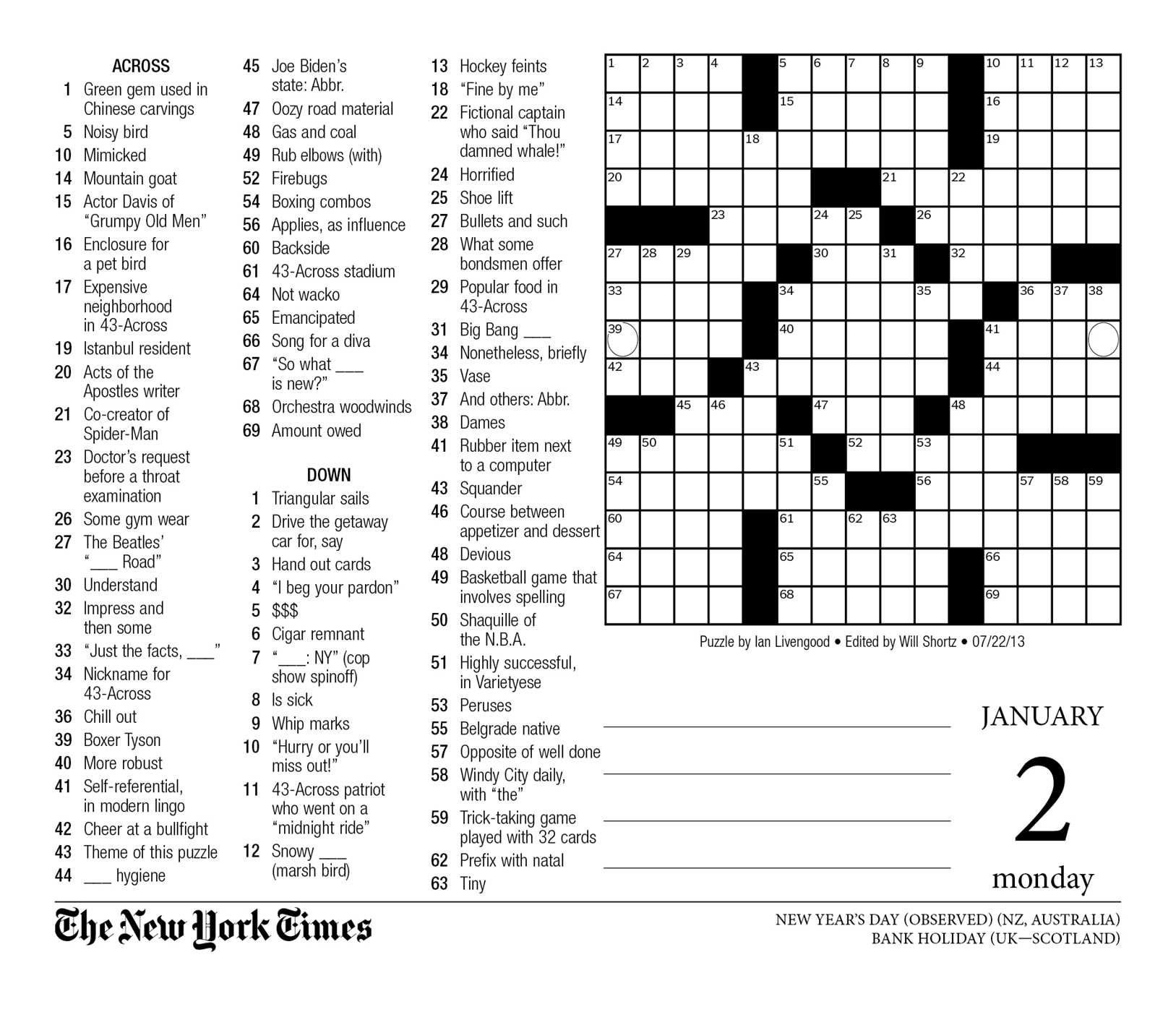

Nyt Mini Crossword Solutions March 13 Get The Answers Here

May 20, 2025

Nyt Mini Crossword Solutions March 13 Get The Answers Here

May 20, 2025 -

The Return Of Tyler Bate Wwe Raw Highlights

May 20, 2025

The Return Of Tyler Bate Wwe Raw Highlights

May 20, 2025 -

Sahrana Andelke Milivojevic Tadic Milica Milsa U Suzama Oprostaj Na Groblju

May 20, 2025

Sahrana Andelke Milivojevic Tadic Milica Milsa U Suzama Oprostaj Na Groblju

May 20, 2025 -

Hamilton Ve Leclerc In Diskalifiyesi Ferrari Icin Bueyuek Darbe

May 20, 2025

Hamilton Ve Leclerc In Diskalifiyesi Ferrari Icin Bueyuek Darbe

May 20, 2025 -

Qbts Stock Predicting The Earnings Report Impact

May 20, 2025

Qbts Stock Predicting The Earnings Report Impact

May 20, 2025