Improved Investment Performance Drives China Life Profit Growth

Table of Contents

Strong Investment Returns: A Cornerstone of China Life's Success

Investment returns are crucial for the profitability of any insurance company, and China Life's success is a testament to its robust investment management capabilities. The company's improved performance stems from a multi-pronged approach focused on diversification, strategic asset allocation, and rigorous risk management. This proactive approach has yielded exceptional results.

China Life's improved investment strategies include:

- Diversification across asset classes: The company strategically distributes investments across equities, bonds, real estate, and other asset classes, mitigating risk and maximizing returns. This portfolio diversification strategy has proven highly effective.

- Strategic asset allocation: China Life employs sophisticated models to optimize asset allocation based on market conditions and long-term projections. This ensures that investments are aligned with the company's overall risk appetite and financial goals.

- Active management and research: A dedicated team of investment professionals continuously monitors market trends, conducting thorough research and making informed investment decisions.

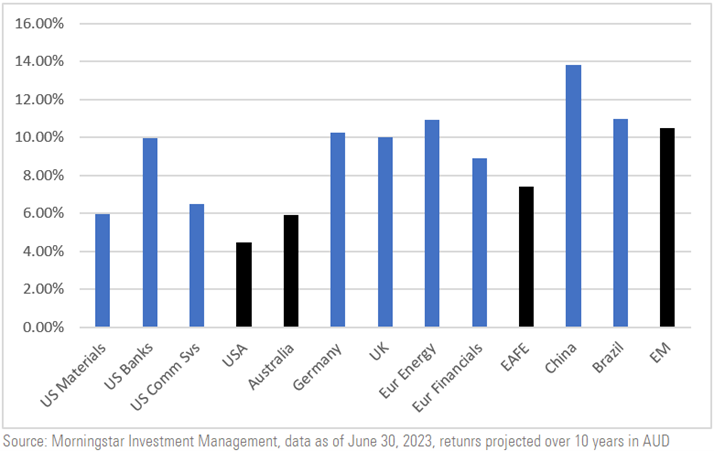

The impact of these refined China Life Investments is evident in the following key performance indicators (KPIs):

- Increased Return on Investment (ROI): China Life has witnessed a substantial increase in its ROI, exceeding industry benchmarks. (Specific percentage increase should be added here if available from official reports).

- Growth in specific investment portfolios: Significant growth has been observed in their equity and real estate portfolios. (Specific figures should be added if available).

- Improved performance compared to previous years: The year-over-year improvement in investment performance demonstrates the effectiveness of the new strategies. (Specific data comparison should be included here if available).

Growth in Insurance Premiums Contributes to Overall Profitability

Strong investment returns are only one piece of the puzzle. The significant increase in insurance premiums has played a crucial role in boosting China Life profit growth. This growth can be attributed to several factors:

- Increased demand for insurance products: Rising disposable incomes and growing awareness of the importance of insurance protection have driven higher demand for China Life's products.

- Expansion of product offerings: China Life has broadened its portfolio to include a wider range of life insurance sales and health insurance products catering to diverse customer needs and market segments.

- Effective marketing and distribution strategies: The company's effective marketing campaigns and comprehensive distribution network have enabled them to reach a wider customer base.

Here are some key figures illustrating the growth in insurance premiums:

- Year-over-year percentage increase in premium income: (Specific percentage increase should be added here if available).

- Market share growth: China Life has significantly increased its market share compared to its competitors. (Specific figures should be added if available).

- Expansion into new insurance segments: The company has successfully expanded its presence in emerging insurance segments. (Specific examples of segments should be added if available).

Effective Cost Management and Operational Efficiency

Efficient cost management is a critical factor contributing to higher profit margins. China Life has implemented several initiatives to enhance its operational efficiency, including:

- Digital transformation: The adoption of advanced technologies has streamlined operations, reducing manual processes and improving overall efficiency. This digital transformation has contributed significantly to cost savings.

- Process optimization: China Life has undertaken continuous improvement efforts to optimize its core business processes, leading to cost reductions and enhanced productivity.

- Strategic sourcing and procurement: The company has focused on optimizing its procurement strategies to secure better pricing and improved quality of goods and services.

These efforts have resulted in measurable cost savings:

- Reduction in operational expenses: (Specific percentage reduction should be added here if available).

- Improvements in claims processing efficiency: (Specific metrics should be added here if available, e.g., reduced processing time).

- Successful implementation of cost-cutting initiatives: (Specific examples of cost-cutting initiatives and their impact should be added if available).

Impact of Government Policies and Macroeconomic Factors

Favorable government policies supporting the insurance sector and a robust macroeconomic environment have also contributed to China Life's strong performance. The stable growth of the Chinese economy and supportive regulatory frameworks have created a favorable business environment. (Further elaboration on specific policies and their impact should be added here if sufficient data is available).

Sustained China Life Profit Growth: A Positive Outlook

In conclusion, the remarkable China Life profit growth is a result of a synergistic combination of factors: strong investment returns driven by effective investment strategy and asset management, impressive growth in insurance premiums, and a commitment to cost optimization and operational efficiency. These achievements underscore the company's strategic vision and operational excellence. This positive trajectory is poised for continuation, and it signals a bright future for China Life. Learn more about the strategies driving China Life profit growth and explore the potential of investing in this dynamic market.

Featured Posts

-

Communique De Presse Amf Valneva 24 Mars 2025 Points Importants Du Document Cp 2025 E1027271

Apr 30, 2025

Communique De Presse Amf Valneva 24 Mars 2025 Points Importants Du Document Cp 2025 E1027271

Apr 30, 2025 -

Beyonce Shkelqen Ne Fushaten E Levi S Nje Pamje Seksi Qe Ben Buje

Apr 30, 2025

Beyonce Shkelqen Ne Fushaten E Levi S Nje Pamje Seksi Qe Ben Buje

Apr 30, 2025 -

Vusion Group Document Amf Cp 2025 E1027277 Decryptage Du 24 Mars 2025

Apr 30, 2025

Vusion Group Document Amf Cp 2025 E1027277 Decryptage Du 24 Mars 2025

Apr 30, 2025 -

Tarykh Srf Rwatb Abryl 2025 Llmwzfyn Walmtqaedyn

Apr 30, 2025

Tarykh Srf Rwatb Abryl 2025 Llmwzfyn Walmtqaedyn

Apr 30, 2025 -

Top 5 Cruise Lines For A Family Vacation

Apr 30, 2025

Top 5 Cruise Lines For A Family Vacation

Apr 30, 2025

Latest Posts

-

Soski S Ovechkinym Ot Kinopoiska Podarok Novorozhdennym

Apr 30, 2025

Soski S Ovechkinym Ot Kinopoiska Podarok Novorozhdennym

Apr 30, 2025 -

Kinopoisk Darit Soski S Ovechkinym V Chest Rekorda N Kh L

Apr 30, 2025

Kinopoisk Darit Soski S Ovechkinym V Chest Rekorda N Kh L

Apr 30, 2025 -

Overtime Heartbreak Stars Defeat Ducks Despite Carlssons Double

Apr 30, 2025

Overtime Heartbreak Stars Defeat Ducks Despite Carlssons Double

Apr 30, 2025 -

Ducks Carlsson Scores Twice But Stars Win In Overtime Thriller

Apr 30, 2025

Ducks Carlsson Scores Twice But Stars Win In Overtime Thriller

Apr 30, 2025 -

Neal Pionk All The News And Highlights You Need To Know

Apr 30, 2025

Neal Pionk All The News And Highlights You Need To Know

Apr 30, 2025