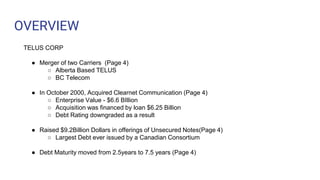

Increased Q1 Profit And Dividend Announcement From Telus

Table of Contents

Strong Q1 Financial Performance: A Detailed Look at Telus's Earnings Report

Telus's Q1 2024 earnings report painted a picture of remarkable growth and efficiency. The company exceeded expectations across several key financial metrics, solidifying its position as a leading player in the Canadian telecom market. Let's examine the numbers:

-

Revenue Growth: Telus reported a substantial increase in revenue, exceeding analyst projections by [Insert Percentage]%. This growth is primarily attributable to strong performance across its various service offerings.

-

Earnings Per Share (EPS): The company's EPS also saw a significant boost, reaching [Insert Number] compared to [Insert Number] in the same period last year, representing a [Insert Percentage]% increase. This signifies increased profitability and value for shareholders.

-

EBITDA Margin: Telus maintained a healthy EBITDA margin of [Insert Percentage]%, showcasing efficient cost management and operational excellence. This strong margin reflects the company's ability to generate substantial profits from its operations.

-

Operating Income: Operating income also witnessed impressive growth, climbing to [Insert Number], exceeding analyst forecasts.

Key performance drivers contributing to this exceptional Q1 performance include:

- Growth in wireless subscribers: A significant increase in the number of wireless subscribers reflects the strong demand for Telus's wireless services and its competitive offerings.

- Increased demand for high-speed internet services: The rising demand for high-bandwidth internet services, driven by increased work-from-home trends and streaming content consumption, fueled substantial growth in this segment.

- Successful expansion into new markets (if applicable): [Insert details about any successful market expansion initiatives, if applicable]

- Cost-cutting measures and operational efficiencies: Strategic cost-cutting measures and operational efficiencies played a crucial role in boosting profitability.

Telus Dividend Increase: Implications for Investors

In conjunction with its strong Q1 earnings, Telus announced a [Insert Percentage]% increase in its quarterly dividend, signifying a commitment to rewarding its shareholders. This translates to a new quarterly dividend of [Insert Amount] per share, representing a [Insert Percentage]% dividend yield based on the current stock price.

The reasons behind this generous dividend hike are clear:

- Strong financial performance: The exceptional Q1 results demonstrate Telus's ability to generate substantial cash flow, providing ample resources to support dividend growth.

- Confidence in future growth: The dividend increase signals Telus’s confidence in its future growth prospects and its ability to sustain high levels of profitability.

This dividend increase has several important implications for investors:

- Increased passive income: Shareholders will receive a higher quarterly dividend payment, boosting their passive income stream.

- Attractive yield compared to competitors: The increased dividend yield makes Telus's stock more attractive compared to competitors in the telecom sector.

- Potential for long-term capital appreciation: The strong Q1 performance and the dividend increase suggest a potential for long-term capital appreciation, further enhancing the attractiveness of Telus as an investment.

Analysis of Market Reactions and Future Outlook for Telus

The market reacted positively to Telus's Q1 earnings announcement and dividend increase. The stock price saw a [Insert Percentage]% increase following the news, reflecting investor confidence in the company's future. Analyst ratings have also been generally positive, with many upgrading their forecasts for Telus's future performance. The increased market capitalization reflects this positive sentiment.

Looking ahead, Telus’s future outlook remains promising, driven by:

- Continued growth in key market segments: The company is expected to maintain its strong growth trajectory in wireless and high-speed internet services.

- Potential for further investments in 5G infrastructure: Further investments in 5G infrastructure will drive future growth and enhance Telus’s competitive edge.

- Competitive landscape and regulatory environment: While the competitive landscape remains challenging, Telus is well-positioned to navigate these dynamics given its strong financial position and strategic initiatives. Regulatory developments will also play a role in shaping the company's future.

Conclusion: Investing in Telus's Continued Success

Telus's Q1 2024 results showcase remarkable financial strength and a clear commitment to shareholder value. The significant increase in Q1 profit, combined with the generous dividend increase, paints a positive picture for the company's future. The positive market reaction further reinforces this outlook. This strong performance and the positive future outlook make Telus a compelling investment opportunity for those seeking both income and capital appreciation in the telecom sector. Learn more about investing in Telus and benefiting from its strong financial performance and growing dividend. Explore Telus's investment opportunities and capitalize on this exciting growth story.

Featured Posts

-

Projected Lineups And Injury News Yankees Vs Diamondbacks April 1 3

May 12, 2025

Projected Lineups And Injury News Yankees Vs Diamondbacks April 1 3

May 12, 2025 -

Payton Pritchards Impact A Case For Celtics Sixth Man Of The Year

May 12, 2025

Payton Pritchards Impact A Case For Celtics Sixth Man Of The Year

May 12, 2025 -

Boris Dzhonson Zarabatyvaet Na Fotografiyakh S Poklonnikami

May 12, 2025

Boris Dzhonson Zarabatyvaet Na Fotografiyakh S Poklonnikami

May 12, 2025 -

District Final Archbishop Bergans Victory Over Norfolk Catholic

May 12, 2025

District Final Archbishop Bergans Victory Over Norfolk Catholic

May 12, 2025 -

Celtics Game 1 Win Payton Pritchards Crucial Contribution In The Playoffs

May 12, 2025

Celtics Game 1 Win Payton Pritchards Crucial Contribution In The Playoffs

May 12, 2025

Latest Posts

-

Ufc 313 Mauricio Ruffys Ko Clinching Spinning Kick Training

May 12, 2025

Ufc 313 Mauricio Ruffys Ko Clinching Spinning Kick Training

May 12, 2025 -

De La Defaite A La Victoire L Histoire D Adaptation De Jose Aldo

May 12, 2025

De La Defaite A La Victoire L Histoire D Adaptation De Jose Aldo

May 12, 2025 -

Analyzing 3 Key Mma Fights 5 10 And 25 Minute Rounds Mma Torch

May 12, 2025

Analyzing 3 Key Mma Fights 5 10 And 25 Minute Rounds Mma Torch

May 12, 2025 -

Jose Aldo Une Inspiration Pour La Surmonter Les Epreuves

May 12, 2025

Jose Aldo Une Inspiration Pour La Surmonter Les Epreuves

May 12, 2025 -

Mma Torch Presents 3 Unmissable Mma Fights 5 10 25 Minutes

May 12, 2025

Mma Torch Presents 3 Unmissable Mma Fights 5 10 25 Minutes

May 12, 2025