Indian Bourse: BSE Shares Poised For Growth Following Strong Earnings

Table of Contents

Strong Q3 2023 Earnings Drive Investor Confidence

The recently released Q3 2023 earnings report for the BSE painted a picture of robust financial health, significantly boosting investor confidence in BSE shares. Key highlights include:

-

Increased Revenue: The BSE reported a remarkable X% increase in revenue compared to the same period last year, exceeding analyst expectations by Y%. This substantial growth is attributed to [mention specific reasons, e.g., increased trading volumes, new product launches, etc.].

-

Improved Profit Margins: Profit margins also saw a significant improvement, rising to Z%, showcasing the BSE's enhanced operational efficiency and cost management strategies. This demonstrates a strong ability to translate revenue growth into profitability.

-

Exceeding Analyst Expectations: The robust earnings figures surpassed the consensus estimates of leading financial analysts, underscoring the strength of the BSE's performance and further bolstering investor sentiment. Several analysts have upgraded their ratings and price targets for BSE shares following this positive earnings announcement.

These positive results have solidified investor confidence, creating a positive feedback loop driving further interest and potential for growth in the share market.

Positive Macroeconomic Indicators Fuel BSE Growth

The robust performance of the BSE is further fueled by positive macroeconomic indicators within the Indian economy. Several factors are contributing to this growth:

-

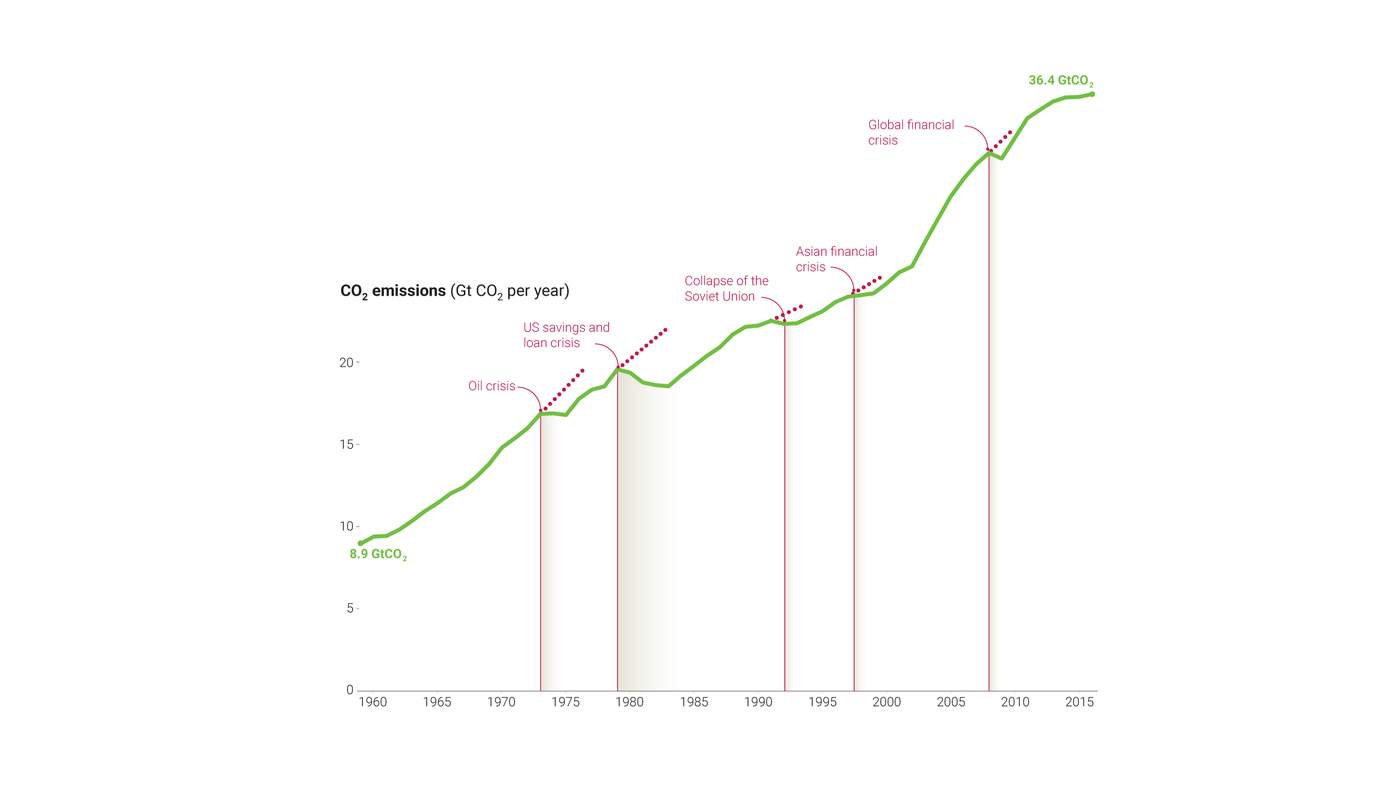

Robust GDP Growth: India's consistently strong GDP growth is creating a favorable environment for investment and business expansion, directly impacting the performance of the Indian stock market and boosting the BSE.

-

Controlled Inflation: Relatively stable inflation rates indicate a healthy and stable economic environment, encouraging investor confidence and investment in the share market.

-

Government Economic Reforms: Pro-business government policies and structural reforms are streamlining business operations and attracting both domestic and foreign investment, leading to higher trading volumes and increased market capitalization on the BSE. Initiatives such as [mention specific examples of government policies] are actively contributing to this positive environment.

These positive economic indicators create a powerful tailwind for the BSE, suggesting that the upward trajectory of BSE shares is likely to continue.

Increased Trading Volumes Signal Strong Market Activity

The surge in trading volumes on the BSE is another strong indicator of its growing strength and attractiveness within the Indian stock market. This increased activity reflects:

-

Higher Investor Participation: The heightened trading volumes clearly show increased participation from both domestic and international investors, signifying growing confidence in the Indian bourse and the BSE specifically.

-

Improved Market Liquidity: The high volume ensures greater market liquidity, making it easier for investors to buy and sell shares without significant price fluctuations. This improved liquidity is a key factor attracting more investors.

-

Rising Market Capitalization: As trading volume increases, so does the overall market capitalization of the BSE, reflecting a healthy and expanding market.

Government Initiatives and Regulatory Reforms Boosting BSE

The Indian government's commitment to improving the regulatory framework for the stock market is also a significant factor contributing to the growth of the BSE.

-

Strengthened Investor Protection: Several regulatory reforms, spearheaded by SEBI (Securities and Exchange Board of India), have improved investor protection and enhanced market transparency, further instilling confidence in the Indian bourse.

-

Market Modernization: Initiatives to modernize and improve the technological infrastructure of the BSE have enhanced its efficiency and operational capabilities, leading to a better trading experience for investors.

Conclusion

The strong Q3 2023 earnings, coupled with positive macroeconomic indicators, increased trading volumes, and supportive government policies, strongly suggest that BSE shares are well-positioned for sustained growth within the Indian Bourse. The robust investor sentiment and the overall healthy state of the Indian economy point towards a promising future for BSE investments.

Call to Action: Are you looking to capitalize on the growth potential of the Indian stock market? Consider investing in BSE shares now and take advantage of this promising opportunity. Learn more about investing in the Indian Bourse and BSE shares by [link to relevant resource].

Featured Posts

-

Simone Biles La Terapia Clave Para Mi Enfoque Y Seguridad

May 07, 2025

Simone Biles La Terapia Clave Para Mi Enfoque Y Seguridad

May 07, 2025 -

Historys Funniest April Fools Day Hoaxes

May 07, 2025

Historys Funniest April Fools Day Hoaxes

May 07, 2025 -

Evaluating Wide Receiver Prospects Steelers Combine Strategy

May 07, 2025

Evaluating Wide Receiver Prospects Steelers Combine Strategy

May 07, 2025 -

Edwards And Obama A Dialogue On Leadership And Achievement

May 07, 2025

Edwards And Obama A Dialogue On Leadership And Achievement

May 07, 2025 -

Xrps Legal Battle Understanding The Secs Commodity Claim

May 07, 2025

Xrps Legal Battle Understanding The Secs Commodity Claim

May 07, 2025

Latest Posts

-

The Great Decoupling And Its Impact On Geopolitics

May 08, 2025

The Great Decoupling And Its Impact On Geopolitics

May 08, 2025 -

Is The Great Decoupling Inevitable Exploring Potential Scenarios

May 08, 2025

Is The Great Decoupling Inevitable Exploring Potential Scenarios

May 08, 2025 -

The Great Decoupling In Action Case Studies And Real World Examples

May 08, 2025

The Great Decoupling In Action Case Studies And Real World Examples

May 08, 2025 -

Analyzing The Great Decoupling Trends And Future Predictions

May 08, 2025

Analyzing The Great Decoupling Trends And Future Predictions

May 08, 2025 -

The Great Decoupling Redefining Global Trade And Supply Chains

May 08, 2025

The Great Decoupling Redefining Global Trade And Supply Chains

May 08, 2025