Indian Insurers Push For Streamlined Bond Forward Regulations

Table of Contents

Current Challenges Faced by Insurers in the Bond Forward Market

The current regulatory framework governing bond forward transactions in India presents several complexities for insurers. This often leads to operational inefficiencies, hindering their ability to effectively manage risk and participate fully in the market.

Lack of Clarity and Consistency

Inconsistencies across different regulatory bodies overseeing aspects of bond forward transactions create significant ambiguity. This lack of clarity impacts insurers' investment strategies and operational efficiency.

- Examples of Ambiguities: Differing interpretations of regulations related to risk management, reporting requirements, and permissible investment strategies across bodies like IRDAI, SEBI, and RBI.

- Impact: Insurers face difficulties in complying with regulations, leading to increased legal and operational risks. This uncertainty also limits their ability to optimize investment portfolios and hampers strategic planning.

Operational Inefficiencies

The current processes involved in bond forward transactions are often cumbersome and time-consuming. This results in significant operational inefficiencies and increased costs for insurers.

- Examples of Inefficient Processes: Lengthy approval processes for transactions, complex documentation requirements, and a lack of standardized electronic platforms for trading.

- Impact: High transaction costs, delays in executing trades, and reduced competitiveness compared to international markets where processes are often more streamlined. These inefficiencies directly impact profitability.

Limited Transparency and Market Depth

The current regulatory environment also hinders transparency and market depth. This lack of transparency impacts price discovery and ultimately limits investor participation.

- Examples of Lack of Transparency: Lack of standardized reporting formats, limited access to real-time market data, and difficulties in comparing prices across different trading venues.

- Impact: Increased uncertainty, making it difficult for insurers to accurately assess risk and make informed investment decisions. The resulting reduced market liquidity increases transaction costs and limits the overall size of the market.

Proposed Solutions for Streamlined Bond Forward Regulations

To overcome these challenges, insurers are proposing several solutions to streamline bond forward regulations. These proposals focus on simplifying the regulatory framework, enhancing transparency, and leveraging technological advancements.

Simplified Regulatory Framework

A unified and simplified regulatory structure is crucial. This would involve consolidating regulatory oversight and clarifying ambiguous rules.

- Suggestions for Improvement: Consolidating regulatory responsibilities under a single authority, establishing clear guidelines for permissible investment strategies, and streamlining approval processes.

- Expected Outcome: Reduced regulatory burden, increased efficiency, and lower compliance costs for insurers.

Enhanced Transparency and Disclosure Requirements

Improved transparency mechanisms are vital for fostering market depth and attracting greater investor participation.

- Suggestions for Improvement: Implementing standardized reporting formats for bond forward transactions, enhancing data dissemination through electronic platforms, and strengthening market surveillance mechanisms.

- Expected Outcome: Improved price discovery, increased market liquidity, and reduced information asymmetry.

Technological Advancements

Leveraging technology can significantly improve efficiency and reduce costs.

- Suggestions for Improvement: Implementing blockchain technology for secure and transparent record-keeping, developing digital platforms for electronic trading, and utilizing automated systems for trade processing and reporting.

- Expected Outcome: Reduced operational costs, faster transaction processing, and enhanced security.

Potential Benefits of Streamlined Regulations

Streamlining bond forward regulations offers numerous benefits for insurers, the Indian financial market, and the overall economy.

Increased Investment in Indian Bonds

Simplified regulations will encourage greater participation from both domestic and international investors.

- Benefits: Increased market liquidity, reduced transaction costs, and improved risk management.

- Impact: This will attract greater capital inflows, lowering borrowing costs for Indian corporates and facilitating economic growth.

Improved Risk Management for Insurers

A clearer regulatory environment will enable insurers to manage risks more effectively.

- Benefits: Better risk assessment tools, reduced operational risks, and enhanced compliance capabilities.

- Impact: This leads to more sound investment strategies and increased stability within the insurance sector.

Boost to the Indian Economy

A more efficient bond market will contribute significantly to the Indian economy's overall growth.

- Benefits: Increased capital flows, lower borrowing costs for corporates, and sustainable economic growth.

- Impact: This will lead to increased investment in infrastructure projects, create jobs, and boost overall economic development.

Conclusion

The Indian insurance sector's push for streamlined bond forward regulations is a crucial step towards a more robust and efficient financial market. The current complexities hinder growth and increase operational costs for insurers. The proposed solutions, including a simplified regulatory framework, improved transparency, and technological advancements, promise significant benefits. Further dialogue and collaboration between insurers, regulators, and policymakers are essential to achieving a regulatory environment that fosters sustainable growth and attracts greater investment. The implementation of effective and streamlined bond forward regulations will be key to unlocking the full potential of the Indian bond market.

Featured Posts

-

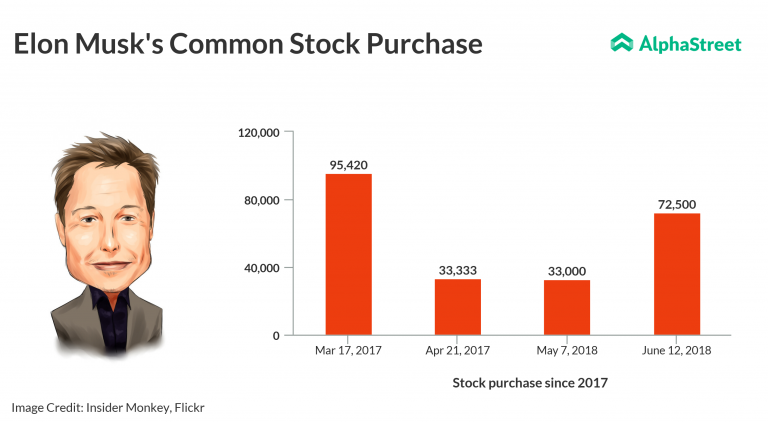

Elon Musk Space X Stake Surpasses Tesla Holding By 43 Billion

May 09, 2025

Elon Musk Space X Stake Surpasses Tesla Holding By 43 Billion

May 09, 2025 -

Open Ais Chat Gpt Under Ftc Scrutiny Implications For Ai Regulation

May 09, 2025

Open Ais Chat Gpt Under Ftc Scrutiny Implications For Ai Regulation

May 09, 2025 -

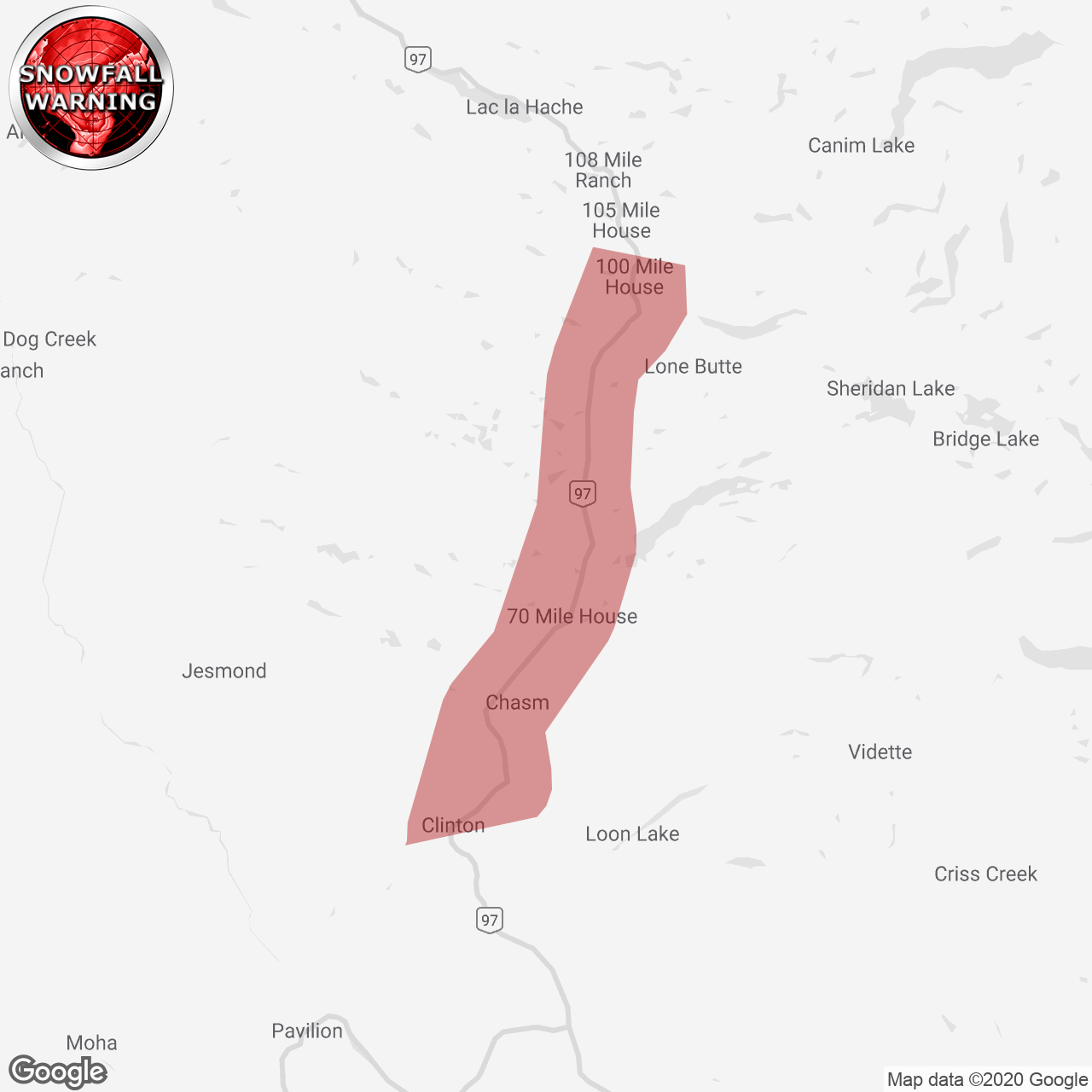

Snowfall Warning Issued For Parts Of Western Manitoba

May 09, 2025

Snowfall Warning Issued For Parts Of Western Manitoba

May 09, 2025 -

Bondis Announcement Unprecedented Fentanyl Seizure Shakes The Us

May 09, 2025

Bondis Announcement Unprecedented Fentanyl Seizure Shakes The Us

May 09, 2025 -

Barcelona Vs Inter Arsenal Vs Psg Champions League Semi Final Dates

May 09, 2025

Barcelona Vs Inter Arsenal Vs Psg Champions League Semi Final Dates

May 09, 2025