Indian Stock Market: Sensex, Nifty Performance & Top Gainers/Losers

Table of Contents

Sensex and Nifty Performance Analysis

The Sensex (BSE SENSEX), representing the Bombay Stock Exchange, and the Nifty 50 (NSE Nifty), representing the National Stock Exchange, are the two primary indices reflecting the overall health of the Indian stock market. Their performance is a crucial indicator for investors. Analyzing their trends – daily, weekly, and monthly – helps to gauge market sentiment and potential investment opportunities. Factors influencing their performance are multifaceted, ranging from global economic conditions and government policies to sector-specific news and investor confidence.

- Yesterday's Closing Values: (Insert Yesterday's Closing Values for Sensex and Nifty here. Ensure this is updated regularly for optimal SEO) For example: Sensex closed at 65,000, a 1% increase, while Nifty closed at 19,300, a 0.8% increase.

- Significant Percentage Changes and Implications: (Analyze the implications of the percentage change. Was it driven by specific sectors? What are the broader market implications?) For instance, a significant drop might indicate investor concern about rising interest rates.

- Key Events Affecting the Indices: (Mention any significant news or events (e.g., policy announcements, global market trends, earnings reports from major companies) that influenced the indices' movement.) Example: The recent announcement of a new infrastructure project positively impacted the infrastructure sector, driving up the Sensex.

- Relevant Charts and Graphs: (Include visually appealing charts showing the performance of Sensex and Nifty over different timeframes (daily, weekly, monthly).)

Top Gainers in the Indian Stock Market

Identifying the top gainers offers insights into sectors exhibiting strong growth and potential investment opportunities. High growth stocks frequently reflect positive factors such as strong earnings reports, successful product launches, and positive industry trends. Analyzing the reasons behind their success can help investors make informed decisions.

- Top 5 Gainers (Last Week): (List the top 5-10 gainers, their percentage change, their sector, and a brief reason for their performance). For example:

- Reliance Industries (+5%): Strong Q2 earnings report.

- Infosys (+4%): Positive outlook for the IT sector.

- HDFC Bank (+3%): Increased loan disbursement.

- TCS (+3%): Major contract win.

- HCL Technologies (+2%): Strong client acquisition.

- Sector Analysis: (Mention the prevalent sectors among the top gainers to highlight industry trends.) For instance, a predominance of IT companies might suggest a bullish outlook for that sector.

- News Links: (Include links to relevant news articles or company announcements explaining their performance.)

Top Losers in the Indian Stock Market

Analyzing the top losers provides crucial insights into sectors facing headwinds and potential risks. Understanding the reasons for underperformance—ranging from negative earnings reports to regulatory issues or negative market sentiment—is essential for risk assessment and investment strategy adjustments.

- Top 5 Losers (Last Week): (List the top 5-10 losers, their percentage change, their sector, and a brief reason for their poor performance.) For example:

- Company A (-6%): Disappointing Q2 results.

- Company B (-5%): Regulatory concerns.

- Company C (-4%): Negative market sentiment in the sector.

- Sector Impact: (Highlight the sectors where most of the losers belong to identify potential risks in those areas.) A concentration of losers in a specific sector might signal broader sector-specific challenges.

- News Links: (Include links to news articles or company statements explaining the decline.)

Understanding the Indian Stock Market Volatility

The Indian stock market, like any other, experiences periods of volatility. Understanding the factors contributing to these fluctuations is key to effective risk management. Global events, domestic economic data releases, and shifts in investor sentiment can all significantly impact market movements.

- Impact of Global Factors: (Discuss the influence of global factors such as inflation, interest rate changes in major economies, and geopolitical events.) For example, a global recession could negatively impact Indian stocks.

- Effects of Domestic Policies and Economic News: (Analyze the impact of domestic policies, such as monetary policy changes, and important economic data releases like GDP growth or inflation figures.) Example: A surprise increase in interest rates could dampen market optimism.

- Risk Mitigation Strategies: (Suggest strategies for investors to manage risk during volatile periods, including diversification, hedging, and setting stop-loss orders.)

Conclusion

Analyzing the Sensex and Nifty performance, identifying top gainers and losers, and understanding market volatility are critical aspects of navigating the Indian stock market. By regularly tracking these indicators and understanding the underlying factors, investors can make more informed decisions and manage risk effectively. Stay updated on the Indian Stock Market: Sensex, Nifty, and top performers regularly! Regular monitoring of the Indian stock market, paying close attention to the Sensex, Nifty, and the daily performance of top gainers and losers, is crucial for successful investment strategies.

Featured Posts

-

Leon Draisaitls 100 Point Milestone Oilers Defeat Islanders In Overtime

May 10, 2025

Leon Draisaitls 100 Point Milestone Oilers Defeat Islanders In Overtime

May 10, 2025 -

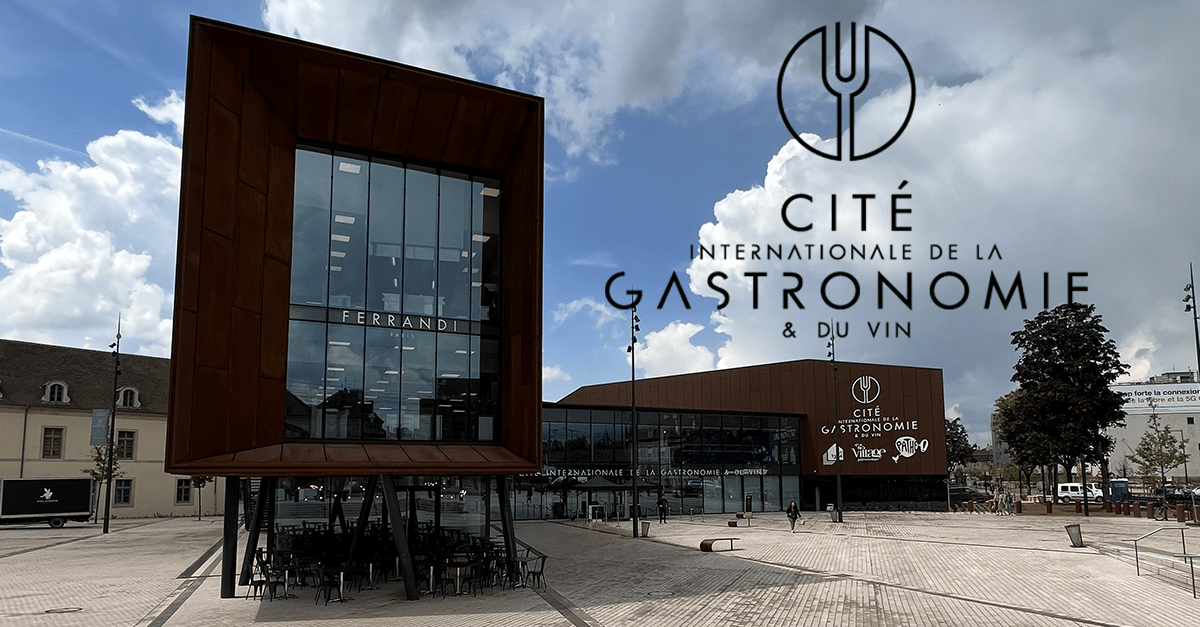

La Cite De La Gastronomie A Dijon Gestion Des Difficultes Et Le Cas Epicure

May 10, 2025

La Cite De La Gastronomie A Dijon Gestion Des Difficultes Et Le Cas Epicure

May 10, 2025 -

Unveiling Jeanine Pirros Fox News Persona A Closer Look

May 10, 2025

Unveiling Jeanine Pirros Fox News Persona A Closer Look

May 10, 2025 -

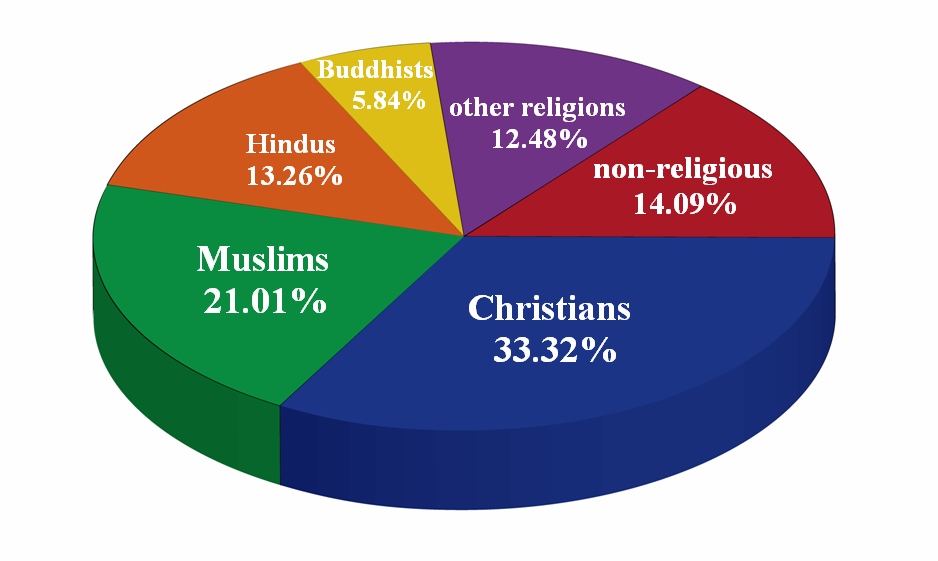

Gods Mercy Across Faiths Religious Beliefs In 1889

May 10, 2025

Gods Mercy Across Faiths Religious Beliefs In 1889

May 10, 2025 -

Rethinking Stephen King 4 Unexpected Randall Flagg Theories

May 10, 2025

Rethinking Stephen King 4 Unexpected Randall Flagg Theories

May 10, 2025