Indian Stock Market Soars: Sensex And Nifty's Sharp Rise Explained

Table of Contents

Global Economic Factors Influencing the Indian Stock Market Surge

Several global economic trends have significantly contributed to the recent surge in the Indian stock market. Understanding these external factors is crucial for a comprehensive analysis of the Sensex and Nifty's performance.

Positive Global Sentiment

Positive global economic indicators have created a favorable environment for emerging markets, including India.

- Improved global growth forecasts: International organizations like the IMF have projected improved global growth, boosting investor confidence and encouraging capital flows into developing economies.

- Easing inflation concerns in major economies: A slowdown in inflation in countries like the US and Europe has reduced fears of aggressive interest rate hikes, thereby supporting global risk appetite and benefiting Indian stocks.

- Increased foreign investment flows into emerging markets like India: The search for higher returns has driven foreign institutional investors (FIIs) to allocate more capital to emerging markets perceived as having robust growth potential, such as India.

The correlation between global market trends and the performance of the Sensex and Nifty is undeniable. Positive global sentiment often translates into increased foreign investment, higher stock prices, and improved market liquidity.

Falling US Dollar

The weakening US dollar has played a significant role in attracting foreign investment into India.

- Increased attractiveness of Indian assets to foreign investors: A weaker dollar makes Indian assets relatively cheaper for investors holding other currencies, leading to increased demand and higher prices.

- Potential for higher returns in INR terms: Foreign investors benefit from higher returns when the rupee appreciates against the dollar.

- Increased purchasing power for Indian companies: A weaker dollar can lower the cost of imports for Indian companies, boosting their profitability and competitiveness.

Currency fluctuations significantly influence overall market sentiment. A falling dollar, therefore, generally fosters a positive outlook for the Indian stock market.

Domestic Factors Driving the Sensex and Nifty's Rise

While global factors have played a role, several domestic elements have been instrumental in driving the Sensex and Nifty's rise.

Strong Corporate Earnings

Robust financial results reported by Indian companies across various sectors have significantly boosted investor confidence.

- Increased profitability: Many companies have reported higher profits due to increased sales, improved operational efficiency, and cost-cutting measures.

- Positive revenue growth: Strong revenue growth across various sectors indicates a healthy and expanding Indian economy.

- Expansion into new markets: Indian companies are aggressively expanding both domestically and internationally, contributing to their overall growth trajectory.

- Successful implementation of new business strategies: Innovative business strategies and digital transformation initiatives have helped several companies enhance their profitability and market share.

Examples of leading companies demonstrating strong earnings include those in the IT, pharmaceuticals, and consumer goods sectors. These strong performances are directly reflected in the market's overall upward trend.

Government Policies and Initiatives

The Indian government's proactive policies and initiatives have also played a crucial role in bolstering investor confidence.

- Infrastructure development projects: Massive investments in infrastructure development have improved the country's logistics and connectivity, making it more attractive for businesses.

- Pro-business reforms: Initiatives aimed at simplifying regulations and improving the ease of doing business have made India a more attractive investment destination.

- Ease of doing business improvements: Streamlined procedures and reduced bureaucratic hurdles have made it easier for companies to operate in India.

- Initiatives aimed at attracting foreign direct investment (FDI): Policies designed to incentivize FDI have contributed to the significant inflow of foreign capital into the Indian market.

Increased Retail Investor Participation

The surge in participation from retail investors has added considerable momentum to the market's growth.

- Rising awareness of investment opportunities: Increased financial literacy and awareness of investment opportunities have encouraged more retail investors to enter the market.

- Increased access to online trading platforms: The proliferation of user-friendly online trading platforms has made investing more accessible to a wider segment of the population.

- Attractive returns compared to traditional investment options: The potential for higher returns compared to traditional investment options like fixed deposits has driven retail investor interest.

The demographic shift towards a younger, more digitally savvy population has significantly contributed to this increased retail investor participation, adding to market liquidity and driving up stock prices.

Potential Risks and Future Outlook for the Indian Stock Market

While the current outlook is positive, it's crucial to acknowledge potential risks that could impact the Indian stock market's performance.

Inflationary Pressures

Rising inflation poses a significant risk to the market's positive trajectory.

- Impact on interest rates: High inflation may lead to interest rate hikes by the Reserve Bank of India (RBI), potentially cooling down economic growth and impacting corporate profitability.

- Potential for reduced consumer spending: Increased inflation can reduce consumer spending, affecting demand and impacting the revenue of companies.

- Effect on corporate profitability: Higher input costs due to inflation can negatively impact corporate profitability and investor sentiment.

The current inflation rate and its projected trajectory will be key factors determining the market's future performance.

Geopolitical Uncertainties

Global geopolitical events can introduce volatility into the Indian stock market.

- Potential for market volatility: Geopolitical instability can lead to increased market uncertainty and price swings.

- Impact on foreign investment flows: Geopolitical tensions can deter foreign investors and reduce capital inflows into the Indian market.

- Effect on investor confidence: Uncertainty arising from geopolitical events can negatively impact investor confidence, leading to reduced investment and market corrections.

Close monitoring of global geopolitical events is essential for understanding potential risks and making informed investment decisions.

Sector-Specific Performance

The performance of various sectors within the Indian stock market varies significantly.

- Identify leading and lagging sectors: Some sectors, like IT and pharmaceuticals, have shown strong growth, while others may be lagging.

- Discuss the factors driving performance differences: Factors such as government policies, global demand, and technological disruptions contribute to sector-specific performance variations.

- Offer an outlook for key sectors: Analyzing industry trends and growth projections can help investors make informed decisions about sector-specific investments.

For example, the renewable energy sector is expected to experience significant growth due to government initiatives, while the traditional energy sector might face challenges due to climate change concerns.

Conclusion

The recent surge in the Indian stock market, reflected in the impressive performance of the Sensex and Nifty, is a result of a confluence of global and domestic factors. Strong corporate earnings, supportive government policies, and increased retail investor participation have propelled the market upward. However, potential risks such as inflationary pressures and geopolitical uncertainties need careful consideration. Understanding the intricate interplay of these factors is crucial for investors seeking to navigate this dynamic market successfully. The current "Indian Stock Market Soar" presents opportunities, but informed investment decisions require thorough research and potentially professional financial guidance. Conduct thorough due diligence and consult a financial advisor before investing in the Sensex and Nifty. Stay updated on market trends and economic indicators to effectively manage your investments in this exciting but volatile market.

Featured Posts

-

Us Immigration Policy In The Spotlight The Case Of Kilmar Abrego Garcia

May 09, 2025

Us Immigration Policy In The Spotlight The Case Of Kilmar Abrego Garcia

May 09, 2025 -

Tarykh Altdkhyn Byn Laeby Krt Alqdm

May 09, 2025

Tarykh Altdkhyn Byn Laeby Krt Alqdm

May 09, 2025 -

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 09, 2025

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 09, 2025 -

Analiza E Formacionit Si Psg Dominon Gjysmefinalet E Liges Se Kampioneve

May 09, 2025

Analiza E Formacionit Si Psg Dominon Gjysmefinalet E Liges Se Kampioneve

May 09, 2025 -

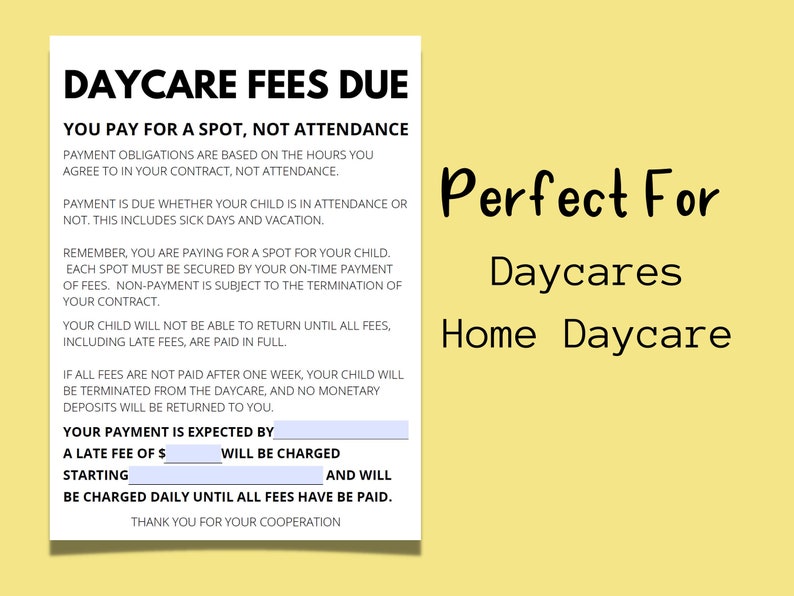

Expensive Babysitter Costs Lead To Even Higher Daycare Fees One Fathers Dilemma

May 09, 2025

Expensive Babysitter Costs Lead To Even Higher Daycare Fees One Fathers Dilemma

May 09, 2025