Indian Stock Market Update: Sensex And Nifty Performance For Today

Table of Contents

Sensex Performance Analysis

Opening and Closing Values

The Sensex opened at 65,200 and closed at 65,500, representing a 0.46% increase compared to the previous day's closing. This positive movement suggests a relatively optimistic sentiment among investors. This small gain follows a period of uncertainty, showing some resilience in the market.

Top Gainers and Losers

-

Top Gainers:

- Reliance Industries (+1.2%): Strong performance driven by positive Q2 results.

- HDFC Bank (+0.9%): Increased investor confidence in the banking sector contributed to the gain.

- Infosys (+0.8%): Positive outlook for the IT sector boosted investor sentiment.

- Tata Consultancy Services (+0.7%): Continued growth in the IT sector contributed to the gains.

- Bajaj Finance (+0.6%): Strong financial performance supported the stock's increase.

-

Top Losers:

- ICICI Bank (-0.5%): Slight dip likely due to profit-booking after recent gains.

- State Bank of India (-0.4%): Market correction after a period of strong performance.

- Bharti Airtel (-0.3%): Minor correction observed following recent price increases.

- Hindustan Unilever (-0.2%): Slight dip due to overall market volatility.

- ITC (-0.1%): Relatively stable performance amidst market fluctuations.

Volume and Volatility

Trading volume was relatively high today, suggesting increased investor activity and engagement with the market. Volatility, however, remained moderate, indicating a degree of uncertainty but not excessive panic selling or buying. This balanced volume and volatility suggests a relatively healthy market environment.

Nifty Performance Analysis

Opening and Closing Values

The Nifty opened at 19,500 and closed at 19,580, showcasing a 0.41% increase. This positive movement mirrors the Sensex's performance, reinforcing a generally positive market trend for the day.

Top Gainers and Losers

-

Top Gainers:

- TCS (+1.1%): Strong performance driven by positive Q2 results and overall growth in the IT sector.

- ITC (+0.9%): Positive investor sentiment in the FMCG sector.

- Hindustan Unilever (+0.7%): Strong brand performance and positive consumer sentiment.

- Larsen & Toubro (+0.6%): Positive infrastructure sector outlook and company-specific growth.

- Asian Paints (+0.5%): Continued growth in the paints and coatings sector.

-

Top Losers:

- Mahindra & Mahindra (-0.6%): Slight dip possibly due to sector-specific factors.

- Maruti Suzuki (-0.4%): Minor correction observed in the automotive sector.

- Hero MotoCorp (-0.3%): Relatively stable performance amidst market fluctuations.

- Divis Laboratories (-0.2%): Slight dip in the pharmaceutical sector.

- Sun Pharma (-0.1%): Minor correction following recent price increases.

Sector-wise Performance

- IT Sector: The IT sector performed exceptionally well today, driven by strong quarterly results and a positive global outlook.

- FMCG Sector: The FMCG sector showed relatively stable performance, indicating resilience amidst market fluctuations.

- Banking Sector: The banking sector exhibited mixed results, with some banks posting gains while others experienced minor corrections.

- Pharmaceutical Sector: The pharmaceutical sector showed mostly stable performance, with some minor corrections.

- Automobiles Sector: The automotive sector experienced a slight dip, which can be attributed to sector-specific market conditions.

Factors Influencing Market Movement

Global Market Trends

The positive sentiment in the US markets had a spillover effect on the Indian stock market. Global economic data releases, including positive employment figures in the US, contributed to this positive sentiment.

Economic Indicators

While inflation remains a concern, recent data suggests a slight moderation, which may have contributed to the market's relatively positive performance. The Reserve Bank of India's recent monetary policy decisions also played a role in shaping investor sentiment.

Geopolitical Events

Geopolitical tensions remain a source of uncertainty, but their impact on today's market movement appeared minimal, suggesting a degree of resilience in the Indian stock market.

Conclusion

The Indian stock market, as reflected in the Sensex and Nifty performance today, showed a mix of gains and losses, demonstrating some resilience amidst market uncertainties. While global market trends and economic indicators played a part, the overall market performance suggests moderate optimism. Understanding the daily updates on the Indian stock market, specifically focusing on the Sensex and Nifty performance, is crucial for informed investment decisions. Stay updated with our regular Indian Stock Market Update: Sensex and Nifty Performance for Today to make well-informed decisions.

Featured Posts

-

Lidery Es Proignoriruyut Parad V Kieve 9 Maya Starmer Makron Merts I Tusk Ostanutsya Doma

May 10, 2025

Lidery Es Proignoriruyut Parad V Kieve 9 Maya Starmer Makron Merts I Tusk Ostanutsya Doma

May 10, 2025 -

Ihsaa Bans Transgender Athletes Following Trump Administration Order

May 10, 2025

Ihsaa Bans Transgender Athletes Following Trump Administration Order

May 10, 2025 -

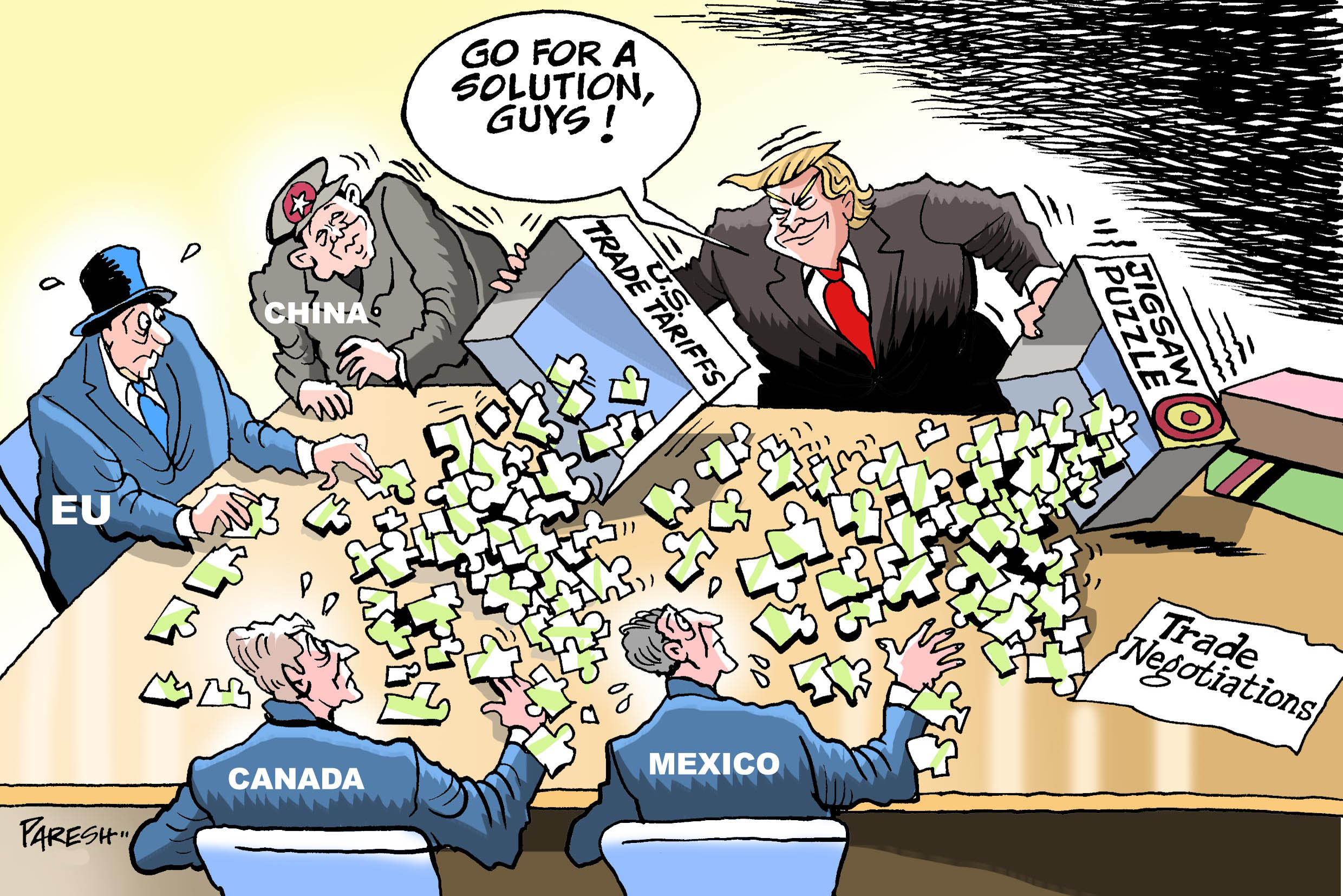

Trumps Tariffs A Weapon Not A Negotiation Tool Says Warner

May 10, 2025

Trumps Tariffs A Weapon Not A Negotiation Tool Says Warner

May 10, 2025 -

The Real Story Bert Kreischer His Wife And The Netflix Sex Joke Controversy

May 10, 2025

The Real Story Bert Kreischer His Wife And The Netflix Sex Joke Controversy

May 10, 2025 -

Mezhdunarodnaya Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 10, 2025

Mezhdunarodnaya Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 10, 2025