India's Ultra-High-Net-Worth Individuals: Expanding Global Investment Portfolios

Table of Contents

Factors Driving Global Investment Diversification

Several key factors are propelling India's UHNWIs to expand their investment horizons beyond national borders.

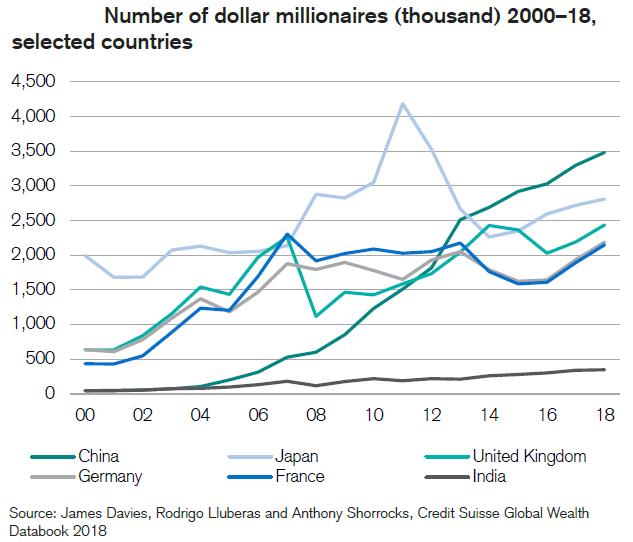

Increased Wealth Creation

India's booming economy has fueled unprecedented wealth creation. Key sectors like technology, pharmaceuticals, and renewable energy are contributing significantly to this growth. Reports indicate a substantial increase in the number of UHNWIs in India year-on-year, demonstrating the expanding pool of capital seeking global opportunities. This wealth, generated through entrepreneurial ventures and successful businesses, is now actively seeking international diversification.

- Technology: The explosive growth of Indian tech companies has created a new generation of wealthy individuals.

- Pharmaceuticals: The Indian pharmaceutical industry's global reach contributes significantly to UHNWIs' wealth.

- Renewable Energy: The increasing focus on sustainable energy is creating new avenues for wealth generation.

Seeking Higher Returns

Domestic Indian market returns, while positive, are often perceived as less competitive compared to international markets offering potentially higher yields. UHNWIs are actively seeking opportunities for superior returns on their investments. This pursuit drives them to explore global markets with greater potential for capital appreciation.

- Higher potential yields: International markets often offer investment opportunities with higher returns than those found domestically.

- Currency diversification: Investing in multiple currencies mitigates risks associated with fluctuations in the Indian Rupee.

- Access to global markets: Diversification opens doors to a wider range of investment options not available in India.

Risk Mitigation

Diversification is paramount for risk mitigation. By spreading investments across different geographies and asset classes, UHNWIs can reduce their dependence on the performance of the Indian economy. This strategy buffers against potential geopolitical risks, economic downturns, and sector-specific volatility within India.

- Geopolitical risks: Diversification protects against political instability or policy changes within India.

- Economic downturns: A global portfolio is less susceptible to domestic economic shocks.

- Sectoral risks: Over-reliance on a specific sector within India can be mitigated through global diversification.

Preferred Global Investment Destinations

India's UHNWIs are showing a strong preference for specific regions and markets for their global investments.

North America (US, Canada)

The United States and Canada remain highly attractive destinations, particularly for investments in technology, real estate, and established businesses. The stability of these markets, access to advanced technologies, and a well-developed regulatory framework contribute to their popularity.

- Technology investments: Silicon Valley and other tech hubs continue to attract significant Indian investment.

- Real estate: High-value properties in major North American cities are a preferred asset class.

- Established businesses: Acquisition of successful businesses provides stable, long-term growth potential.

Europe

European investment opportunities, particularly in the UK and Germany, are also gaining traction. The UK's real estate market and Germany's automotive industry are key areas of interest. Established regulatory frameworks and access to the broader European market are major draws.

- UK Real Estate: Prime properties in London and other major UK cities are popular investment choices.

- German Automotive: Investments in the German automotive industry offer exposure to a global leader.

- European Union access: Investing in the EU provides access to a large and integrated market.

Asia-Pacific (excluding India)

Within Asia-Pacific, Singapore, Hong Kong, and Australia stand out. These markets offer opportunities across technology, infrastructure, and real estate, appealing to India's UHNWIs seeking diversification within the region.

- Singapore: Its robust financial infrastructure and strategic location make it a favored investment hub.

- Hong Kong: Despite recent geopolitical events, Hong Kong still retains its allure as a global financial center.

- Australia: Its stable economy and real estate market attract considerable foreign investment.

Emerging Markets

While carrying higher risk, emerging markets also present the potential for significant returns. Indian UHNWIs are strategically allocating portions of their portfolios to these markets, balancing risk and reward.

- Southeast Asia: Countries like Vietnam and Indonesia show strong growth potential.

- Latin America: Certain Latin American economies offer unique investment opportunities.

- Africa: Select African countries with rapidly growing economies are attracting attention.

Investment Strategies and Asset Classes

India's UHNWIs employ a diversified approach across several key asset classes.

Real Estate

Global real estate continues to be a significant component of their investment strategies. High-value properties in prime locations worldwide offer both capital appreciation and rental income potential.

- Luxury residential properties: High-end residential real estate in major global cities remains a favorite.

- Commercial real estate: Investments in office buildings, shopping centers, and other commercial properties are also common.

- Development projects: Participation in large-scale development projects offers significant potential returns.

Private Equity and Venture Capital

There is a growing interest in private equity and venture capital investments. While higher-risk, these asset classes offer the potential for substantial returns. Indian UHNWIs are increasingly seeking access to these opportunities through specialized funds and direct investments.

- Technology startups: Investments in promising technology startups worldwide provide high-growth potential.

- Infrastructure projects: Private equity investments in infrastructure projects in emerging markets are gaining popularity.

- Fund investments: Accessing global private equity and venture capital through established funds is a common strategy.

Public Equities

Public equities play a crucial role in globally diversified portfolios. Global index funds provide broad market exposure, while individual stock selection offers opportunities for targeted growth. Understanding international market dynamics is crucial for success in this area.

- Global index funds: A simple way to gain broad exposure to diverse international markets.

- International blue-chip stocks: Investing in established companies worldwide provides stability and potential growth.

- Emerging market equities: Higher risk, higher reward opportunities exist in emerging markets.

Conclusion: Future Outlook for India's Ultra-High-Net-Worth Individuals and Global Investments

The expansion of India's ultra-high-net-worth individuals' global investment portfolios is driven by a confluence of factors: increased wealth creation, the pursuit of higher returns, and the imperative for risk mitigation. North America, Europe, Asia-Pacific, and selected emerging markets are key destinations, with real estate, private equity, venture capital, and public equities representing the primary asset classes. Looking ahead, this trend of global diversification is likely to continue, with Indian UHNWIs actively seeking sophisticated investment strategies to optimize their returns and manage risk effectively in an increasingly interconnected world. Learn more about how to effectively manage and expand your global investment portfolio as an Indian UHNW individual. Contact us today to discuss your options for bespoke global investment solutions.

Featured Posts

-

A Refugee Familys Escape From War And The Helping Hand Of Pope Francis

Apr 25, 2025

A Refugee Familys Escape From War And The Helping Hand Of Pope Francis

Apr 25, 2025 -

Millions Stolen Hacker Targets Executive Office365 Accounts Fbi Says

Apr 25, 2025

Millions Stolen Hacker Targets Executive Office365 Accounts Fbi Says

Apr 25, 2025 -

The Harrogate Spring Flower Show Is Back April 24th

Apr 25, 2025

The Harrogate Spring Flower Show Is Back April 24th

Apr 25, 2025 -

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 25, 2025

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 25, 2025 -

1 050 Price Hike At And T Details The Impact Of Broadcoms V Mware Deal

Apr 25, 2025

1 050 Price Hike At And T Details The Impact Of Broadcoms V Mware Deal

Apr 25, 2025

Latest Posts

-

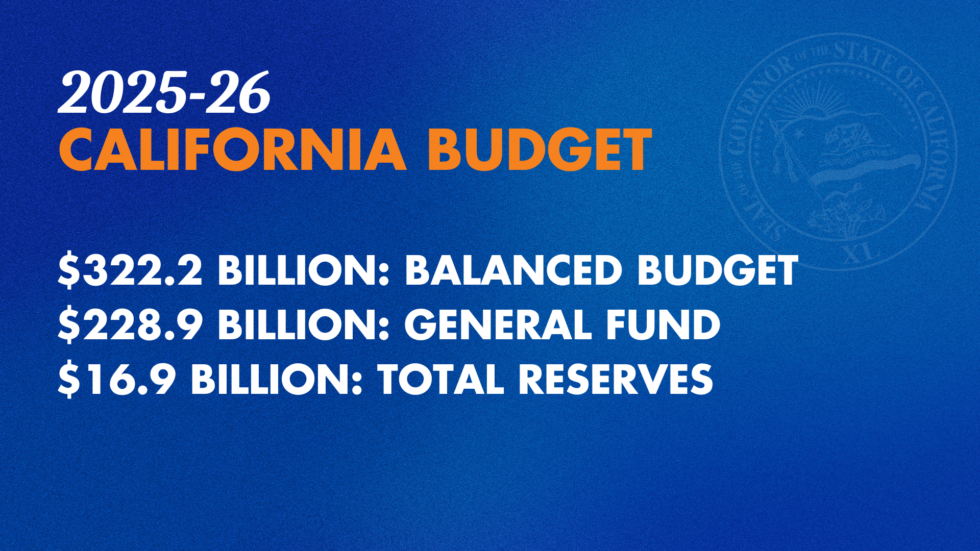

The Portnoy Newsom Feud What You Need To Know

Apr 26, 2025

The Portnoy Newsom Feud What You Need To Know

Apr 26, 2025 -

Dave Portnoy Unloads On Gavin Newsom The Full Story

Apr 26, 2025

Dave Portnoy Unloads On Gavin Newsom The Full Story

Apr 26, 2025 -

Portnoy Slams Newsom A Detailed Look At The Controversy

Apr 26, 2025

Portnoy Slams Newsom A Detailed Look At The Controversy

Apr 26, 2025 -

Understanding The Controversy Surrounding Gavin Newsom

Apr 26, 2025

Understanding The Controversy Surrounding Gavin Newsom

Apr 26, 2025 -

Newsoms Policies A Balanced Perspective

Apr 26, 2025

Newsoms Policies A Balanced Perspective

Apr 26, 2025