India's Ultra-Wealthy: New Avenues For Global Stock And Bond Investments

Table of Contents

Growing Appetite for Global Diversification Among India's Ultra-High-Net-Worth Individuals

India's ultra-wealthy are increasingly recognizing the limitations of relying solely on domestic markets. The desire for wealth diversification is driven by several key factors:

- Increased volatility in the Indian stock market: Fluctuations in the domestic market can significantly impact returns. Global diversification helps mitigate this risk.

- Desire for higher returns than domestic markets offer: International markets often present opportunities for higher returns compared to India's relatively mature markets.

- Need for portfolio diversification to mitigate risks: Spreading investments across different geographies and asset classes reduces overall portfolio volatility.

- Exposure to global growth opportunities: Investing globally allows access to burgeoning markets and sectors not readily available domestically.

Recent data suggests a substantial increase in Indian UHNWIs' investments in international markets. For example, [Insert statistic or example of successful global investment by Indian investors here – e.g., "A recent report by [Source] indicates a X% increase in Indian UHNWIs investing in US equities in the past year"]. This trend reflects a sophisticated understanding of the benefits of global portfolio diversification for long-term wealth preservation and growth.

Strategic Approaches to Global Stock Investments for Indian Ultra-Wealthy

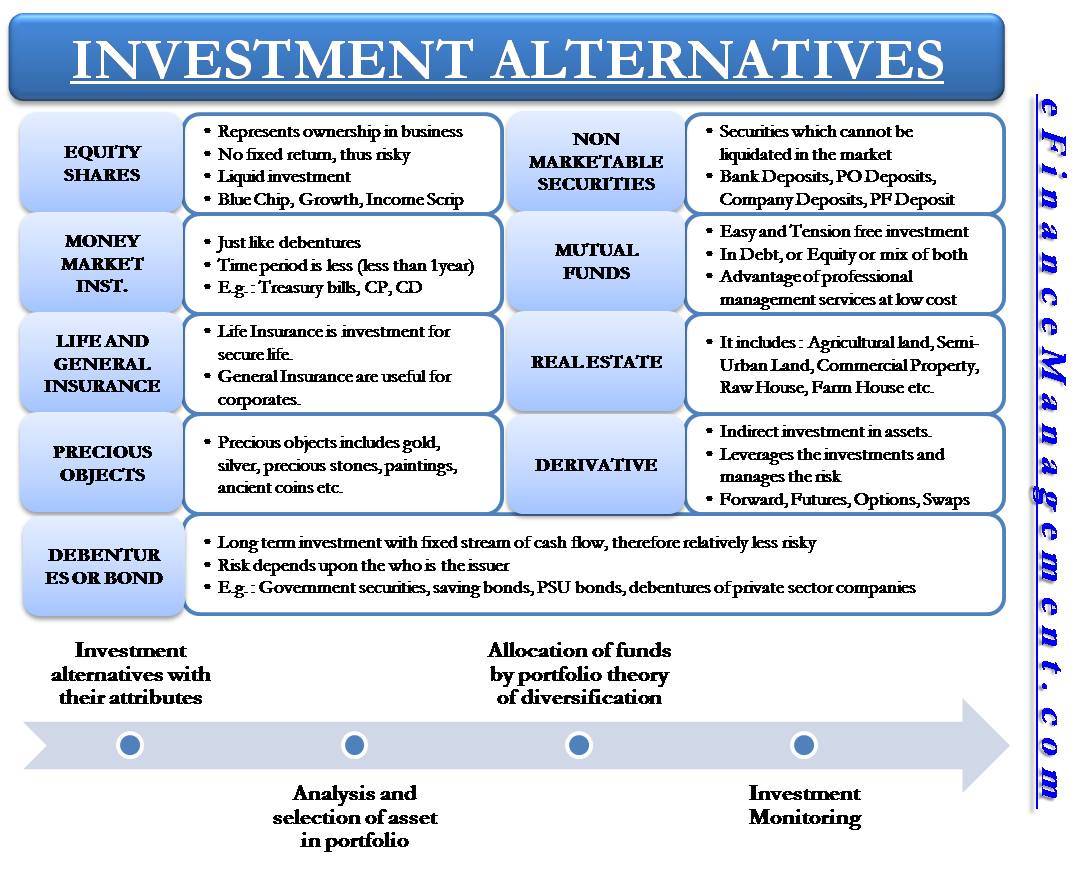

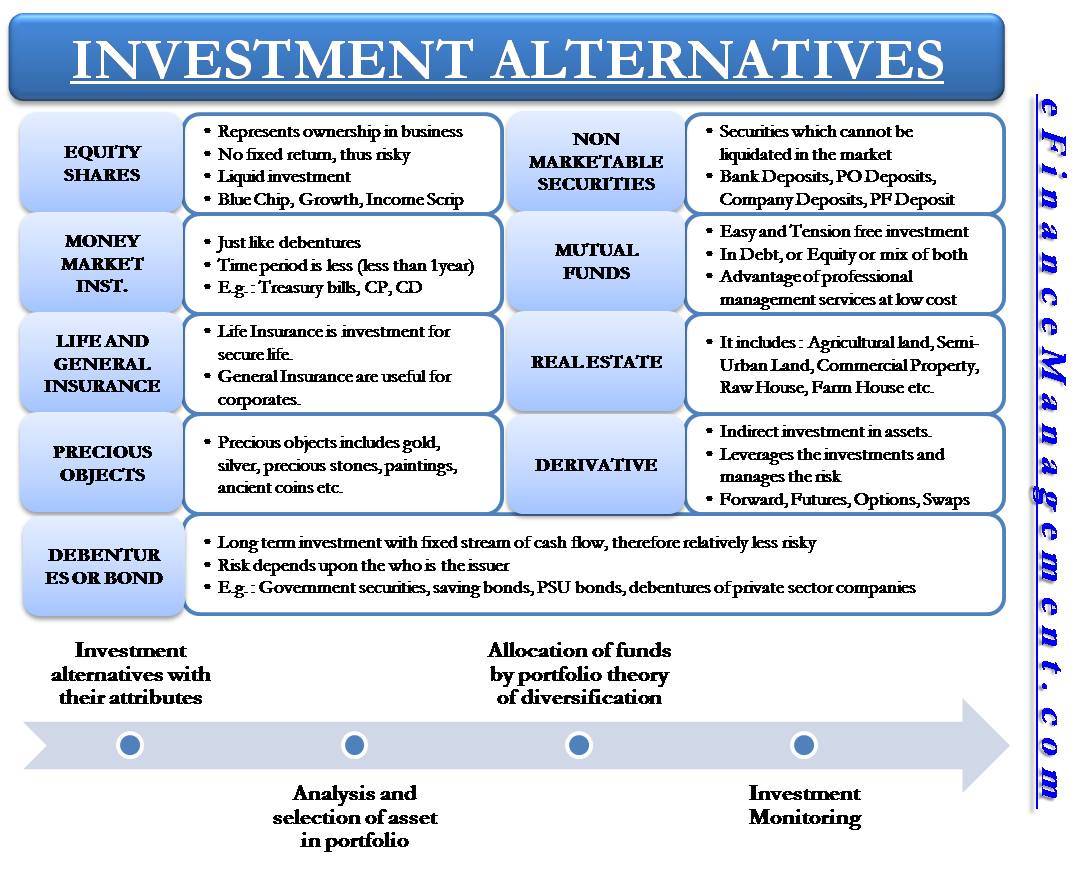

Indian ultra-wealthy individuals have several avenues for accessing global stock markets:

- Direct investments in international equities: This offers maximum control but requires in-depth market knowledge and potentially higher risk.

- Investing through mutual funds or ETFs focused on global markets: This provides diversification and professional management at a lower cost than direct investing. ETFs tracking global indices offer broad market exposure.

- Utilizing international brokerage accounts: This option provides direct access to international exchanges but necessitates navigating complexities of foreign regulations and tax implications.

Advantages and Disadvantages: Direct investment offers higher potential returns but involves greater risk and requires extensive research. Mutual funds and ETFs offer diversification and professional management, but returns may be less than direct investments. International brokerage accounts offer flexibility but necessitate a deep understanding of international markets and regulations.

- Currency risk and hedging strategies: Fluctuations in exchange rates can significantly impact returns. Hedging strategies can mitigate this risk.

- Due diligence and selecting reputable investment vehicles: Thorough research is crucial to identify suitable and reliable investment vehicles.

- Tax implications of foreign investments for Indian residents: Understanding tax treaties and regulations is vital to minimize tax liabilities.

Navigating Global Bond Markets: Opportunities and Challenges

Global bond markets present compelling opportunities for diversification and stable returns for India's ultra-wealthy. Different types of international bonds offer varying levels of risk and return:

- Government bonds: Generally considered low-risk, offering stable returns.

- Corporate bonds: Offer potentially higher returns but carry greater credit risk.

Key considerations:

- Interest rate risk and currency fluctuations: Changes in interest rates and exchange rates can impact bond prices.

- Credit rating analysis and understanding bond yields: Thorough analysis of credit ratings and yields is essential for informed investment decisions.

- Accessing global bond markets through international brokers or specialized funds: These provide access to a wider range of bond options.

The Role of Wealth Management Firms in Facilitating Global Investments

Navigating the complexities of global stock and bond markets requires expertise. Wealth management firms play a crucial role in guiding UHNWIs:

- Personalized investment advice tailored to individual risk tolerance and financial goals: Firms develop customized strategies aligned with individual investor needs.

- Access to exclusive investment opportunities: Firms often have access to exclusive investment opportunities unavailable to individual investors.

- Assistance with regulatory compliance and tax optimization: They help investors navigate international regulations and minimize tax liabilities.

Regulatory Landscape and Tax Implications of Global Investments for Indian Investors

Investing globally requires understanding India's regulatory framework and tax implications:

- Compliance with FEMA (Foreign Exchange Management Act) regulations: Adherence to FEMA regulations is crucial for legal and compliant foreign investments.

- Understanding tax treaties between India and other countries: Tax treaties can significantly affect the tax liability on foreign income.

- Seeking professional tax advice: Professional tax advice is essential to minimize tax liabilities and ensure compliance.

Conclusion: Unlocking Global Opportunities for India's Ultra-Wealthy

India's ultra-wealthy are increasingly recognizing the potential of global stock and bond investments for wealth diversification and growth. Strategic approaches, thorough due diligence, and expert guidance from reputable wealth management firms are crucial for success. Understanding the regulatory landscape and tax implications is equally vital. Begin exploring the vast opportunities in global stock and bond investments to secure your financial future. Consult with a reputable wealth management firm specializing in international markets to create a customized investment strategy tailored to your specific needs. Successfully navigating the global investment landscape requires careful planning and a long-term perspective, allowing India's ultra-wealthy to leverage global markets for optimal returns and secure their financial future.

Featured Posts

-

Indias Ai Boom Databricks To Add Hundreds Of New Roles

Apr 25, 2025

Indias Ai Boom Databricks To Add Hundreds Of New Roles

Apr 25, 2025 -

Sydney Anzac Bridge Accident Significant Traffic Disruption Due To Collision

Apr 25, 2025

Sydney Anzac Bridge Accident Significant Traffic Disruption Due To Collision

Apr 25, 2025 -

Jack O Connell As The Ultimate I Am Legend Antagonist

Apr 25, 2025

Jack O Connell As The Ultimate I Am Legend Antagonist

Apr 25, 2025 -

Why Middle Managers Are Essential For Company Success

Apr 25, 2025

Why Middle Managers Are Essential For Company Success

Apr 25, 2025 -

Before It Disappears Catch Jack O Connells Powerful Drama On Amazon Prime

Apr 25, 2025

Before It Disappears Catch Jack O Connells Powerful Drama On Amazon Prime

Apr 25, 2025

Latest Posts

-

King Announces Advance Birthday Party Plans

Apr 26, 2025

King Announces Advance Birthday Party Plans

Apr 26, 2025 -

Early Birthday Celebrations Announced By The King

Apr 26, 2025

Early Birthday Celebrations Announced By The King

Apr 26, 2025 -

A Kings Birthday Party Plans Unveiled Ahead Of Schedule

Apr 26, 2025

A Kings Birthday Party Plans Unveiled Ahead Of Schedule

Apr 26, 2025 -

Royal Birthday Bash King Starts Festivities Early

Apr 26, 2025

Royal Birthday Bash King Starts Festivities Early

Apr 26, 2025 -

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025