Individual Investors And Market Corrections: Opportunities And Risks

Table of Contents

Understanding Market Corrections

Defining a Market Correction

A market correction is generally defined as a drop of 10% or more in a major market index, such as the S&P 500, from its recent high. It's a significant downturn, but importantly, it's different from a bear market. A bear market is typically a more prolonged and deeper decline, often exceeding 20%. Corrections are usually shorter-term events, lasting anywhere from a few weeks to several months.

- Percentage Drops: Corrections typically range from 10% to 20%, while bear markets see drops exceeding 20%.

- Timeframe Considerations: Corrections are relatively short-lived compared to the extended duration of bear markets.

- Distinguishing Factors: The key difference lies in the severity and duration of the decline. A correction is a temporary setback, while a bear market signals a more significant and sustained downturn.

Understanding the nuances between a market downturn, market volatility, and a stock market correction is vital for appropriate risk management.

Causes of Market Corrections

Market corrections can be triggered by a variety of factors, often intertwined and difficult to pinpoint with certainty. Common causes include:

- Economic Downturns: Recessions or significant slowdowns in economic growth can lead to decreased investor confidence and market corrections. Weakening economic indicators, such as declining GDP growth or rising unemployment rates, often precede corrections.

- Geopolitical Events: Major global events, like wars, political instability, or terrorist attacks, can create uncertainty and trigger market volatility, potentially leading to corrections.

- Interest Rate Hikes: Central banks raising interest rates to combat inflation can impact borrowing costs for businesses and consumers, slowing economic activity and potentially causing a market correction.

- Investor Sentiment Shifts: Sudden shifts in investor psychology, driven by fear, uncertainty, or speculative bubbles bursting, can lead to rapid sell-offs and corrections.

Analyzing past events provides valuable insight. For instance, the correction of 2020 was partly fueled by the initial impact of the COVID-19 pandemic, while the dot-com bubble burst in the early 2000s showcased the dangers of overinflated investor expectations. Understanding these contributing factors – economic indicators, inflation, interest rates, and geopolitical risk – is crucial for navigating market corrections effectively. Investor psychology also plays a significant role.

Risks of Market Corrections for Individual Investors

Potential for Significant Losses

Market corrections pose a substantial risk of significant portfolio losses, particularly for investors with shorter-term investment horizons. Those heavily invested in stocks or other volatile assets are especially vulnerable.

- Examples of Historical Losses: Reviewing historical market corrections reveals the potential magnitude of losses. During the 2020 correction, many stocks experienced double-digit declines.

- Impact on Different Asset Classes: Different asset classes react differently during corrections. Stocks are generally more volatile than bonds, which can offer some protection during downturns. However, portfolio diversification, a crucial element of risk management, can help mitigate these losses.

A well-defined investment strategy, taking into account your risk tolerance and time horizon, is essential to weathering market corrections.

Emotional Decision-Making

One of the biggest risks during market corrections is emotional decision-making. Fear and panic can lead investors to make rash choices, such as panic selling, which can lock in losses and prevent them from benefiting from any subsequent recovery.

- Cognitive Biases: Understanding cognitive biases, such as confirmation bias and loss aversion, is important to avoid impulsive reactions.

- Emotional Responses to Market Volatility: Market volatility triggers a strong emotional response in many investors. Maintaining a long-term perspective helps reduce the impact of these emotions.

- Importance of a Long-Term Perspective: A long-term buy and hold strategy can help mitigate the impact of short-term market fluctuations.

Investor behavior during market corrections often involves impulsive reactions driven by fear and uncertainty. Adopting a disciplined approach and focusing on your long-term financial goals is paramount.

Opportunities Presented by Market Corrections

Discounted Asset Prices

Market corrections create opportunities for savvy investors to acquire quality assets at significantly discounted prices. This is a cornerstone of value investing.

- Value Investing Strategies: Identifying undervalued companies with strong fundamentals can yield substantial long-term returns.

- Identifying Undervalued Stocks: Careful research and analysis are crucial to identify companies whose stock prices have fallen disproportionately to their intrinsic value.

- Long-Term Growth Potential: Buying quality assets during corrections offers the potential for significant long-term capital appreciation.

Capitalizing on discounted assets requires thorough research and a long-term perspective.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a valuable strategy during market corrections. It involves investing a fixed amount of money at regular intervals, regardless of market fluctuations.

- How Dollar-Cost Averaging Works: DCA reduces the risk of investing a large sum at a market bottom, a difficult task even for experienced investors.

- Advantages During Market Volatility: DCA smooths out the impact of market volatility, reducing the average cost per share.

- Reducing Risk Exposure: This strategy mitigates the risk of buying high and selling low.

Dollar-cost averaging (DCA) and risk mitigation go hand in hand, offering a relatively safe approach to investing during times of market uncertainty.

Conclusion

Market corrections are inevitable but manageable. By understanding the inherent risks and capitalizing on the opportunities, individual investors can navigate these periods effectively. While the potential for losses during a market correction is real, the discounted asset prices and the ability to employ strategies like dollar-cost averaging can significantly enhance long-term returns. Remember to develop a sound investment strategy, diversify your portfolio, and avoid emotional decision-making during periods of market volatility. Learn more about navigating future market corrections and building a resilient investment plan.

Featured Posts

-

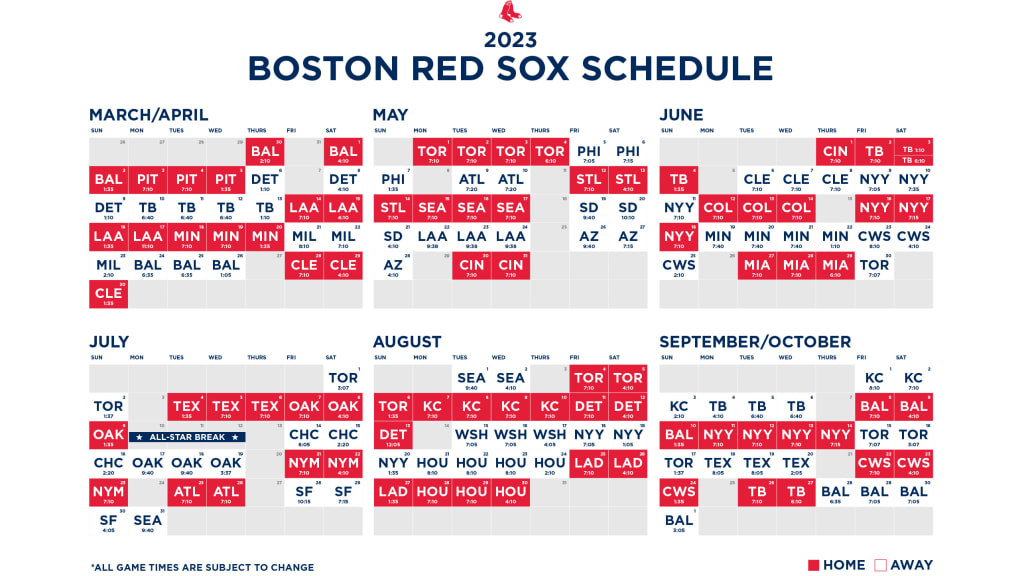

Espn Predicts A Surprising Red Sox Outfield For 2025

Apr 28, 2025

Espn Predicts A Surprising Red Sox Outfield For 2025

Apr 28, 2025 -

The Overseas Highway History And Drive Through The Florida Keys

Apr 28, 2025

The Overseas Highway History And Drive Through The Florida Keys

Apr 28, 2025 -

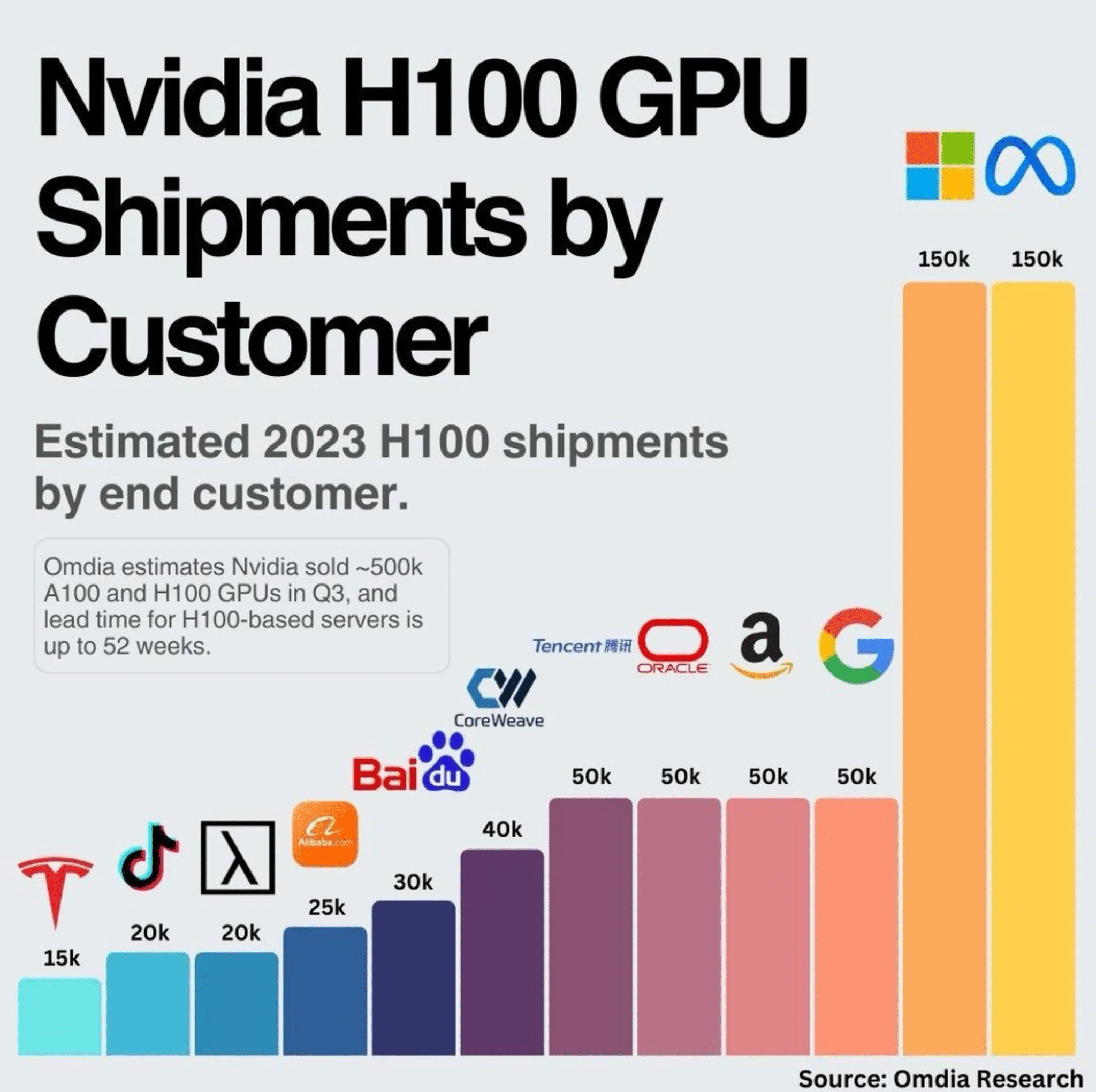

Navigating The High Cost Of Gpus A Buyers Guide

Apr 28, 2025

Navigating The High Cost Of Gpus A Buyers Guide

Apr 28, 2025 -

Espn Forecasts Red Sox 2025 Performance A Risky Prediction

Apr 28, 2025

Espn Forecasts Red Sox 2025 Performance A Risky Prediction

Apr 28, 2025 -

Ohio Derailments Aftermath Persistent Toxic Chemicals In Buildings

Apr 28, 2025

Ohio Derailments Aftermath Persistent Toxic Chemicals In Buildings

Apr 28, 2025

Latest Posts

-

Is Marv Albert The Greatest Basketball Announcer Mike Breens Opinion

Apr 28, 2025

Is Marv Albert The Greatest Basketball Announcer Mike Breens Opinion

Apr 28, 2025 -

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025 -

Dwyane Wade Highlights Doris Burkes Expert Thunder Vs Timberwolves Breakdown

Apr 28, 2025

Dwyane Wade Highlights Doris Burkes Expert Thunder Vs Timberwolves Breakdown

Apr 28, 2025 -

Nba Analyst Doris Burke Receives Kudos From Dwyane Wade For Thunder Timberwolves Coverage

Apr 28, 2025

Nba Analyst Doris Burke Receives Kudos From Dwyane Wade For Thunder Timberwolves Coverage

Apr 28, 2025 -

Doris Burkes Thunder Timberwolves Game Analysis Earns Dwyane Wades Approval

Apr 28, 2025

Doris Burkes Thunder Timberwolves Game Analysis Earns Dwyane Wades Approval

Apr 28, 2025