Infineon's (IFX) Disappointing Sales Forecast: Impact Of Trump Tariffs

Table of Contents

Infineon's Revised Sales Outlook and its Implications

Infineon's downwardly revised sales forecast paints a concerning picture. While specific numbers vary depending on the reporting period and analysts' interpretations, the general consensus points to a significant shortfall compared to previous predictions. This revenue decline represents a substantial percentage decrease, indicating a considerable slowdown in growth. Infineon cited several factors contributing to this disappointing forecast, including weakening global demand across various market segments and, crucially, the lingering impact of trade uncertainties stemming from past tariffs.

The impact varies across Infineon's product segments.

- Automotive: Reduced demand for automotive chips due to the global economic slowdown, exacerbated by tariff-related uncertainties, has significantly affected this key segment.

- Industrial: The industrial sector, also sensitive to economic fluctuations and supply chain disruptions caused by tariffs, experienced a slowdown in demand for Infineon's power semiconductors and other related products.

- Power & Sensor Systems: This segment, while showing some resilience, also faced challenges related to increased material costs and supply chain complexities linked to tariffs.

The overall picture reveals a significant strain on Infineon's revenue streams, highlighting the substantial impact of macroeconomic factors and lingering trade-related issues.

The Role of Trump Tariffs in Dampening Infineon's Growth

The Trump-era tariffs played a substantial role in hindering Infineon's growth trajectory. These tariffs directly increased the cost of imported materials and components crucial for Infineon's manufacturing processes. This cost inflation impacted pricing strategies, reducing Infineon's competitiveness in the global market. Furthermore, the tariffs contributed to supply chain disruptions, leading to production delays and increased uncertainty.

- Increased Import Costs: Increased tariffs on imported raw materials led to a noticeable rise in production costs, impacting profitability across various divisions.

- Pricing Pressures: To maintain market share, Infineon faced challenges in passing increased costs onto customers, squeezing profit margins.

- Supply Chain Disruptions: Tariffs complicated supply chains, creating delays and uncertainties in securing essential components, impacting production schedules.

- Reduced Investment: The uncertainty created by the trade war discouraged investment in new production capacity and research and development.

The cumulative effect of these factors significantly dampened Infineon's growth potential and profitability.

Infineon's Response Strategies to Mitigate Tariff Impacts

In response to the negative effects of the tariffs, Infineon implemented various strategic measures to mitigate the risks and bolster its resilience. These efforts focused on diversifying its supply chains, optimizing costs, and adjusting its pricing strategies.

- Supply Chain Diversification: Infineon invested in regional production facilities to reduce its dependence on tariff-affected import sources, thereby strengthening its supply chain resilience.

- Cost Optimization: The company implemented rigorous cost-cutting measures throughout its operations to offset the increased input costs associated with tariffs.

- Strategic Partnerships: Infineon strengthened its partnerships with suppliers to secure more stable and cost-effective sourcing of critical components.

- Price Adjustments: While mindful of market competitiveness, Infineon implemented selective price adjustments to account for increased production costs, though this strategy carries the risk of reduced sales volume.

The effectiveness of these strategies is still being assessed, but they represent a crucial effort to navigate the challenges posed by the tariff environment.

Long-Term Implications for Infineon and the Semiconductor Sector

The long-term consequences of the Trump tariffs extend beyond Infineon's immediate financial performance. The increased uncertainty and trade friction created by these policies may discourage long-term investments in research and development within the semiconductor industry as a whole, potentially hindering technological innovation and future competitiveness. The global landscape of semiconductor manufacturing has been profoundly affected, and the industry is still grappling with the ramifications.

- Geopolitical Risks: Increased geopolitical risks associated with trade disputes create uncertainty for long-term planning and investment decisions.

- Regionalization of Production: The tariffs have accelerated the trend towards regionalization of semiconductor production, leading to changes in global supply chains.

- Innovation Slowdown: Reduced investment in research and development due to uncertainty may stifle innovation in the sector.

Conclusion: Understanding the Infineon (IFX) Sales Forecast in the Context of Trump Tariffs

The disappointing sales forecast issued by Infineon (IFX) underscores the significant negative impact of Trump-era tariffs on its performance and the broader semiconductor industry. While Infineon has implemented several mitigation strategies, including supply chain diversification and cost optimization, the long-term effects of these trade policies remain a concern. The semiconductor sector faces ongoing challenges from geopolitical uncertainty and the need to adapt to a changing global landscape. Stay updated on future developments affecting Infineon's sales forecast and the ongoing impact of trade policies on the global semiconductor market to better understand this dynamic sector.

Featured Posts

-

The Back Outside Album Updates On Young Thugs Highly Anticipated Project

May 09, 2025

The Back Outside Album Updates On Young Thugs Highly Anticipated Project

May 09, 2025 -

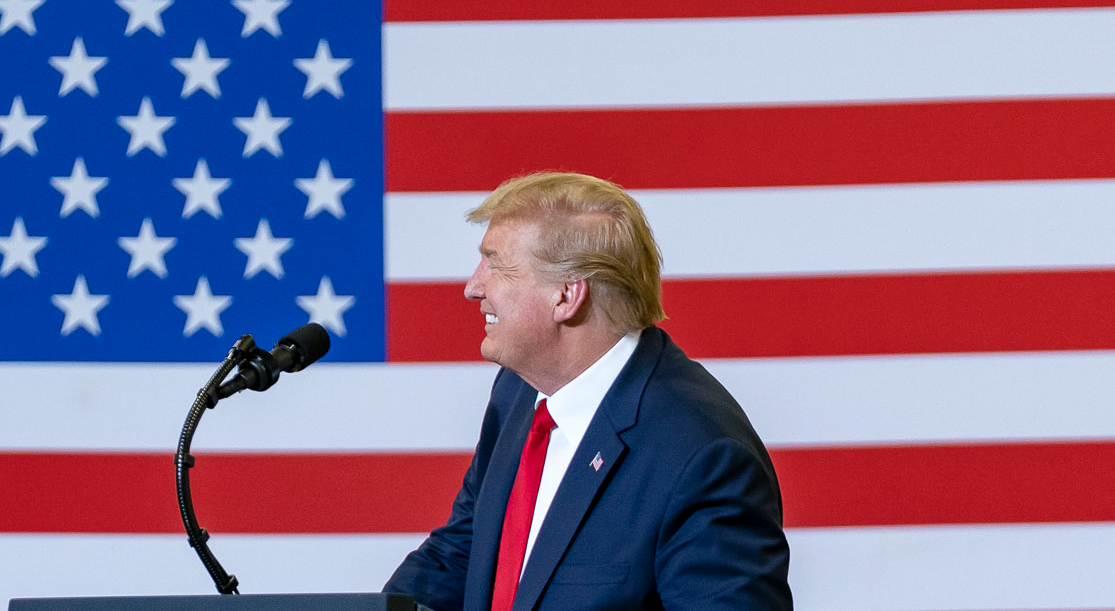

Future Of Wireless Mesh Networks Market Size And 9 8 Cagr Growth

May 09, 2025

Future Of Wireless Mesh Networks Market Size And 9 8 Cagr Growth

May 09, 2025 -

Williams Release Of Franco Colapinto To Alpine Explained

May 09, 2025

Williams Release Of Franco Colapinto To Alpine Explained

May 09, 2025 -

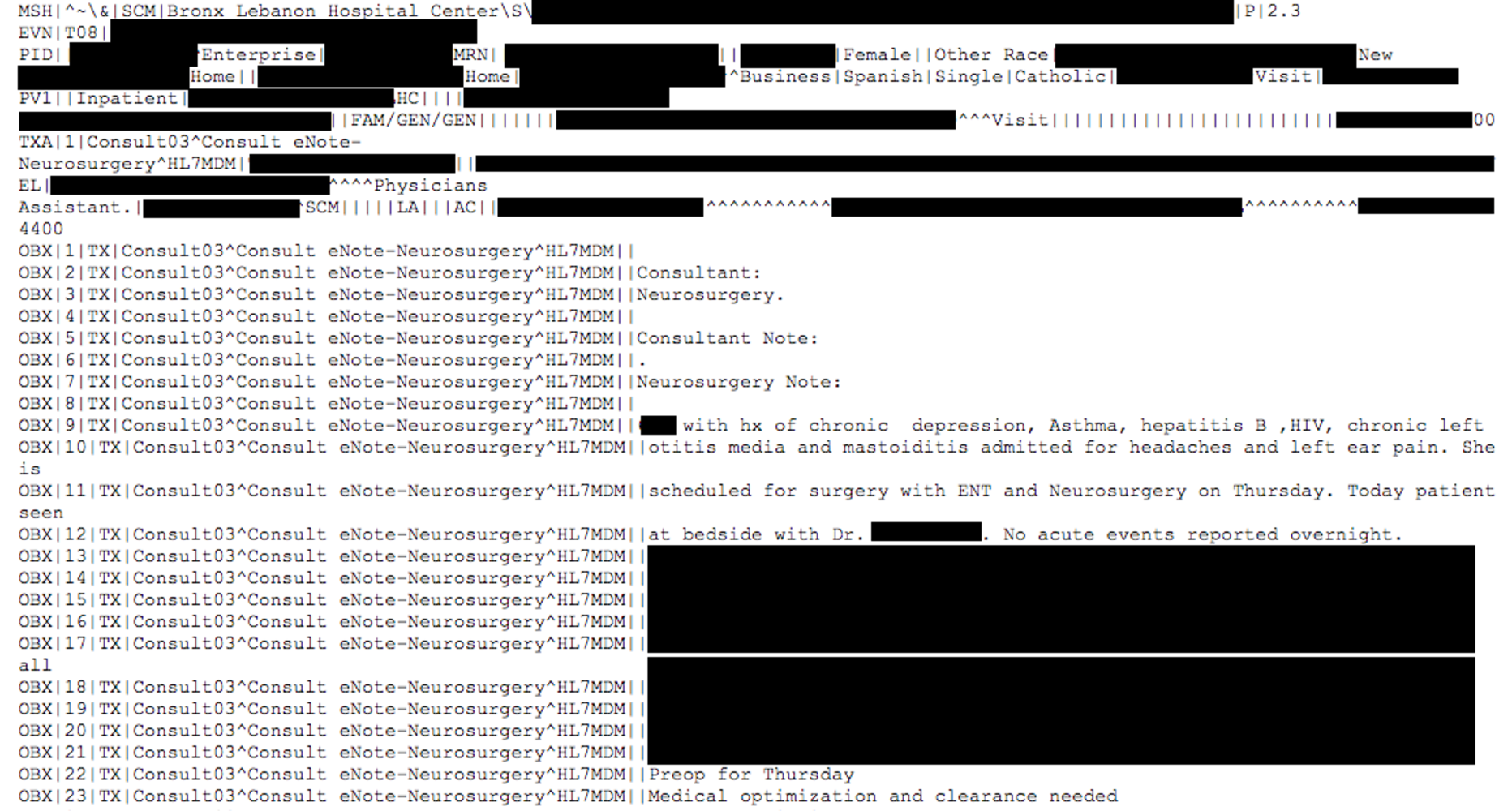

Nottingham Hospital Data Breach Families Anger Over Access To A And E Records

May 09, 2025

Nottingham Hospital Data Breach Families Anger Over Access To A And E Records

May 09, 2025 -

North Carolina Daycare Suspension Investigation By Wfmy News 2

May 09, 2025

North Carolina Daycare Suspension Investigation By Wfmy News 2

May 09, 2025