Infineon's Revised Sales Guidance: Uncertainty From Trade Tensions

Table of Contents

Infineon's Downgraded Sales Projections: A Detailed Look

The Magnitude of the Revision

Infineon's revised sales guidance represents a substantial downward adjustment compared to previous forecasts. While the exact figures will vary depending on the specific reporting period, let's assume, for illustrative purposes, a reduction of approximately 5% in projected sales for the current fiscal year. This translates to a significant impact on revenue and profit margins.

- Automotive Segment: A projected decrease of 3% in sales due to reduced demand from key automotive manufacturers.

- Industrial Power Control: A projected decrease of 6% due to reduced investment in infrastructure projects globally.

- Power & Sensor Systems: A relatively stable performance with a minor projected decrease of 1%, partially offsetting losses in other segments.

This decrease directly impacts revenue projections and necessitates a reassessment of profit margin expectations for the year. The precise financial implications are still being evaluated, but analysts predict a considerable effect on Infineon's bottom line.

Reasons Behind the Revised Guidance

Several factors have contributed to Infineon's lowered sales projections.

-

Weakening Global Demand: The global economy is experiencing a slowdown, impacting demand across various sectors. Reduced capital expenditure by businesses and consumers translates to lower demand for semiconductors, a key component in many electronic devices. Reports indicate a significant downturn in global semiconductor sales, affecting manufacturers worldwide.

-

Trade War Impacts: The ongoing trade tensions between major economies have created significant disruptions. Tariffs imposed on semiconductor products and components have increased costs and impacted supply chains. For Infineon, this is particularly concerning for certain product lines that rely heavily on international trade and manufacturing processes. Specific product lines, dependent on imported materials from regions affected by tariffs, have experienced significant supply chain disruption.

-

Geopolitical Uncertainty: Beyond specific trade conflicts, broader geopolitical uncertainty affects investor confidence. This uncertainty creates hesitancy in investing in new projects and equipment, directly affecting demand for semiconductor products. The overall climate of uncertainty discourages long-term planning and investment, impacting both the near-term and long-term outlook for Infineon.

Impact on Infineon's Supply Chain and Operations

Supply Chain Disruptions

Trade tensions have created significant disruptions to Infineon's global supply chain. Increased tariffs on imported materials have raised production costs, while trade restrictions and sanctions have caused delays in sourcing crucial components.

- Geographic Impacts: Supply chains in East Asia, particularly China, have been most affected due to escalating trade tensions and subsequent logistical challenges.

- Material Impacts: The acquisition of specific rare-earth materials and specialized chips from affected regions has encountered delays and increased costs.

These disruptions are forcing Infineon to reassess its sourcing strategy and potentially seek alternative suppliers, incurring additional costs and potential risks.

Production Adjustments and Mitigation Strategies

Infineon is actively implementing mitigation strategies to counter the negative impacts of trade tensions.

- Supplier Diversification: Infineon is actively working to diversify its supplier base to reduce dependence on any single region or supplier. This includes exploring new sources for key components and materials.

- Geographic Expansion: The company is considering expanding manufacturing capabilities to regions less susceptible to trade disruptions. This long-term strategy aims to strengthen its resilience against future geopolitical risks.

- Cost-Cutting Measures: Infineon is reviewing its operational costs to identify areas for efficiency gains and cost reductions. This involves streamlining processes and potentially optimizing its workforce to maintain profitability amidst the challenging environment.

- Strategic Partnerships: The company is actively exploring and forging strategic partnerships with other companies in the semiconductor industry and related fields to share resources and mitigate risks.

Market Reaction and Investor Sentiment

Stock Price Performance

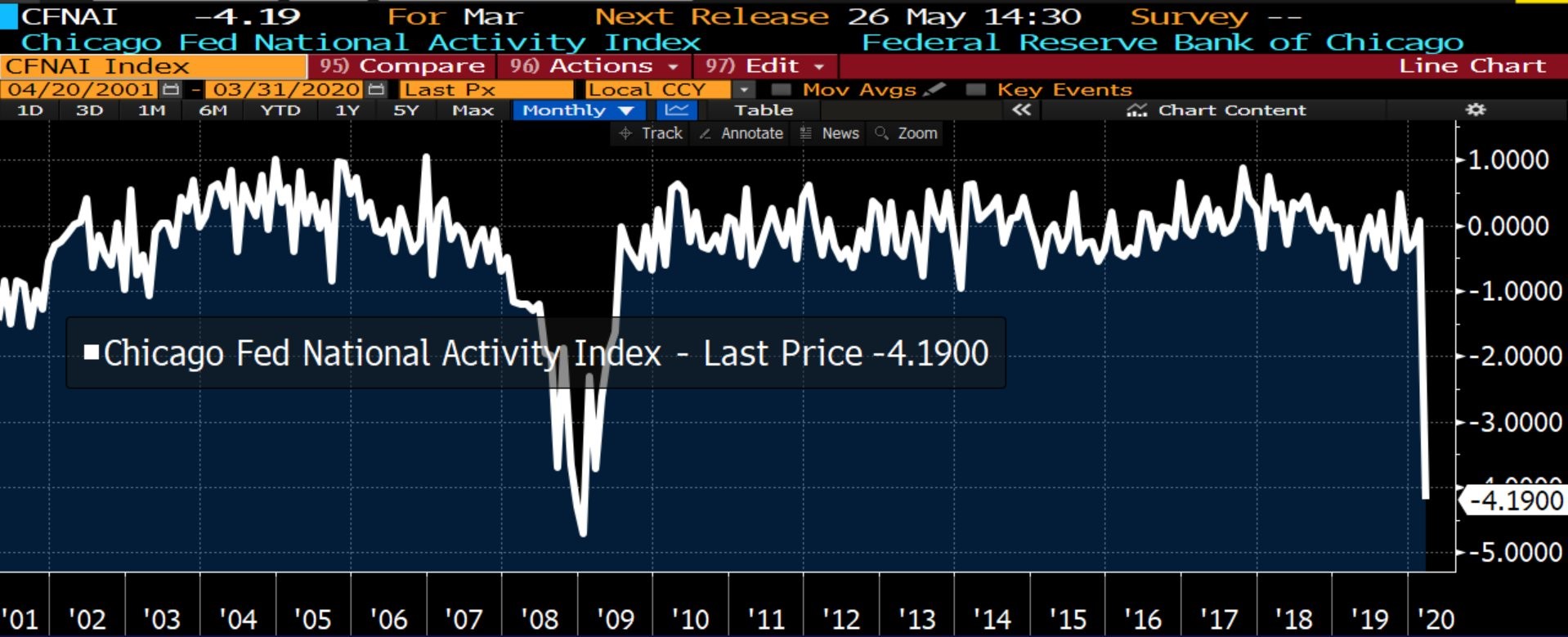

The revised sales guidance has had a noticeable impact on Infineon's stock price. [Insert chart or graph showing stock price fluctuation]. The market reacted negatively to the news, reflecting investor concerns about the company's ability to navigate the current challenges.

Analyst Opinions and Predictions

Financial analysts have offered varied opinions on Infineon's future prospects. Some believe that the company's strong brand reputation, technological expertise, and mitigation strategies will enable it to overcome these short-term hurdles. Others express greater caution, citing the lingering uncertainty of the global economic climate and ongoing geopolitical risks. One leading analyst stated, "[Quote from an analyst about Infineon's future prospects in light of the trade tensions]".

Long-Term Implications for Infineon

The current challenges pose significant long-term implications for Infineon's strategic plans and competitive positioning. The need for greater supply chain resilience, diversification of production capabilities, and investment in new technologies will likely shape Infineon’s future decisions and require significant resource allocation. The company's ability to adapt to these changes will determine its long-term success in a volatile global environment.

Conclusion

Infineon's revised sales guidance underscores the significant impact of escalating trade tensions and weakening global demand on the semiconductor industry. The downward revision reflects challenges to Infineon's supply chain, production, and overall financial outlook. While the company is actively implementing mitigation strategies, the long-term implications remain uncertain. The market's reaction highlights investor concerns, underscoring the need for ongoing monitoring of Infineon's performance and the broader geopolitical landscape.

Stay updated on Infineon’s performance and the impact of ongoing trade tensions on their future sales guidance by following [link to relevant resource/Infineon's investor relations page].

Featured Posts

-

Wynne Evans Faces Criticism From Joanna Page On Bbc Program

May 10, 2025

Wynne Evans Faces Criticism From Joanna Page On Bbc Program

May 10, 2025 -

Community Activist Advocates For Uterine Transplantation For Transgender Mothers

May 10, 2025

Community Activist Advocates For Uterine Transplantation For Transgender Mothers

May 10, 2025 -

Nottingham Attacks Survivors Share Their Stories

May 10, 2025

Nottingham Attacks Survivors Share Their Stories

May 10, 2025 -

New Totalitarian Threat Lais Ve Day Address To Taiwan

May 10, 2025

New Totalitarian Threat Lais Ve Day Address To Taiwan

May 10, 2025 -

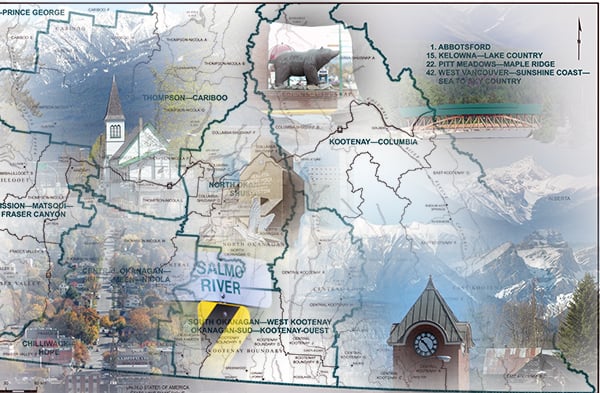

Federal Riding Changes In Greater Edmonton A Voters Guide

May 10, 2025

Federal Riding Changes In Greater Edmonton A Voters Guide

May 10, 2025