ING Group 2024 Annual Report (Form 20-F) Released

Table of Contents

Key Financial Highlights of ING Group's 2024 Performance

The 2024 Annual Report reveals a strong financial performance for ING Group, showcasing robust revenue growth and healthy net income. Let's delve into the specific numbers:

Net Profit and Revenue

ING Group's 2024 financial results demonstrate continued success, exceeding expectations in several key areas.

- Net Income: Reported net income reached €[Insert Actual Figure] billion, representing a [Insert Percentage]% increase compared to 2023. This strong performance is attributed to [Insert Key Reasons for Increase, e.g., improved lending margins, strong growth in specific segments].

- Revenue Growth: Total revenue experienced a significant boost, reaching €[Insert Actual Figure] billion, reflecting a [Insert Percentage]% growth year-on-year. This growth demonstrates ING's resilience in a challenging economic environment.

- Earnings Per Share (EPS): EPS increased to €[Insert Actual Figure], signifying enhanced shareholder value.

This performance surpasses industry benchmarks and sets a positive trajectory for future growth.

Segment Performance Analysis

ING Group's diverse business segments contributed to the overall financial success.

- Retail Banking: This segment showed solid performance with [Insert Key Metrics, e.g., growth in customer deposits, increase in loan originations]. This success can be attributed to [Insert Reasons, e.g., successful digital transformation initiatives, expansion into new markets].

- Wholesale Banking: The Wholesale Banking segment achieved [Insert Key Metrics, e.g., increased trading revenue, strong performance in investment banking]. [Insert Reasons, e.g., strategic partnerships, successful risk management strategies] contributed to these positive results.

- Insurance: The Insurance arm delivered [Insert Key Metrics, e.g., growth in premium income, improved underwriting profitability]. [Insert Reasons, e.g., new product offerings, strong customer retention].

Capital Position and Solvency

ING Group maintains a robust capital position, demonstrating its financial stability and resilience.

- Capital Adequacy Ratio (CAR): The CAR significantly exceeded regulatory requirements, indicating a strong buffer against potential risks. [Insert Actual Figure]% CAR ensures financial stability.

- Risk Management: The company's proactive risk management strategies and rigorous compliance procedures contributed to its strong capital position.

- Financial Stability: ING's solid capital base and effective risk management underscore its capacity to weather economic uncertainties and continue delivering value to its stakeholders.

Significant Events and Strategic Developments in 2024

2024 was a year of significant strategic developments for ING Group.

Major Acquisitions or Divestments

[Mention any significant mergers, acquisitions, or divestitures. If none, state this clearly]. For example: "ING Group did not engage in any major M&A activity during 2024, instead focusing on organic growth and operational efficiency."

Strategic Initiatives and Future Outlook

ING Group’s strategic initiatives focus on several key areas:

- Digital Transformation: Significant investments in digital technologies aim to enhance customer experience and operational efficiency.

- Sustainable Finance: ING Group continues to expand its commitment to sustainable finance, aligning its operations with ESG principles.

- Growth in Key Markets: The company plans to expand its presence in key markets through organic growth and strategic partnerships.

Sustainability and ESG Reporting

ING Group's 2024 sustainability report highlights significant progress in its ESG performance:

- Reduced Carbon Footprint: [Insert Specific Data, e.g., X% reduction in carbon emissions].

- Social Initiatives: [Mention specific social responsibility initiatives].

- Governance Improvements: [Highlight improvements in corporate governance].

Where to Find the Complete ING Group 2024 Annual Report (Form 20-F)

The complete ING Group 2024 Annual Report (Form 20-F) is available for download on the official ING Group investor relations website: [Insert Direct Link to the Report]. You can also find supplementary materials and investor presentations there.

Conclusion: Understanding the ING Group 2024 Annual Report (Form 20-F)

The ING Group 2024 Annual Report (Form 20-F) showcases strong financial performance, underpinned by a robust capital position and strategic initiatives focused on long-term growth and sustainability. The report provides vital insights into the company's performance across various segments and highlights its commitment to ESG principles. Understanding this report is crucial for investors, analysts, and stakeholders to make informed decisions about ING Group. Download the full ING Group 2024 Annual Report (Form 20-F) today to gain a comprehensive understanding of the company's performance and future outlook. Reviewing this important document will ensure you have the complete picture of ING Group’s financial results and strategic direction for 2024.

Featured Posts

-

Sejarah Dan Statistik Juara Premier League Siapa Yang Akan Berjaya Di 2024 2025

May 21, 2025

Sejarah Dan Statistik Juara Premier League Siapa Yang Akan Berjaya Di 2024 2025

May 21, 2025 -

Abn Amro Stijgt Na Positieve Kwartaalresultaten

May 21, 2025

Abn Amro Stijgt Na Positieve Kwartaalresultaten

May 21, 2025 -

De Afhankelijkheid Van Goedkope Arbeidsmigranten Een Analyse Van Abn Amro Voor De Voedingsindustrie

May 21, 2025

De Afhankelijkheid Van Goedkope Arbeidsmigranten Een Analyse Van Abn Amro Voor De Voedingsindustrie

May 21, 2025 -

Half Dome Secures Abn Group Victoria Account Details Of The Successful Pitch

May 21, 2025

Half Dome Secures Abn Group Victoria Account Details Of The Successful Pitch

May 21, 2025 -

Sandylands U Tv Listings And Showtimes

May 21, 2025

Sandylands U Tv Listings And Showtimes

May 21, 2025

Latest Posts

-

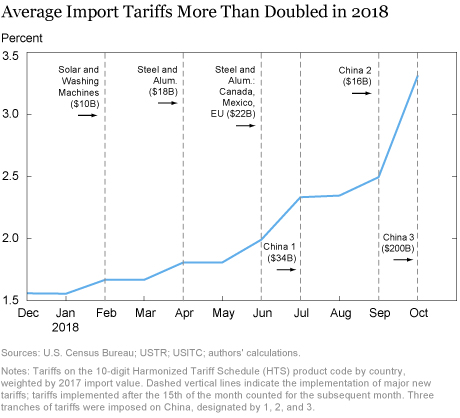

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025 -

Ftc Vs Meta The Defense Begins

May 21, 2025

Ftc Vs Meta The Defense Begins

May 21, 2025 -

Home And Abroad Fp Videos Analysis Of Current Tariff Challenges

May 21, 2025

Home And Abroad Fp Videos Analysis Of Current Tariff Challenges

May 21, 2025 -

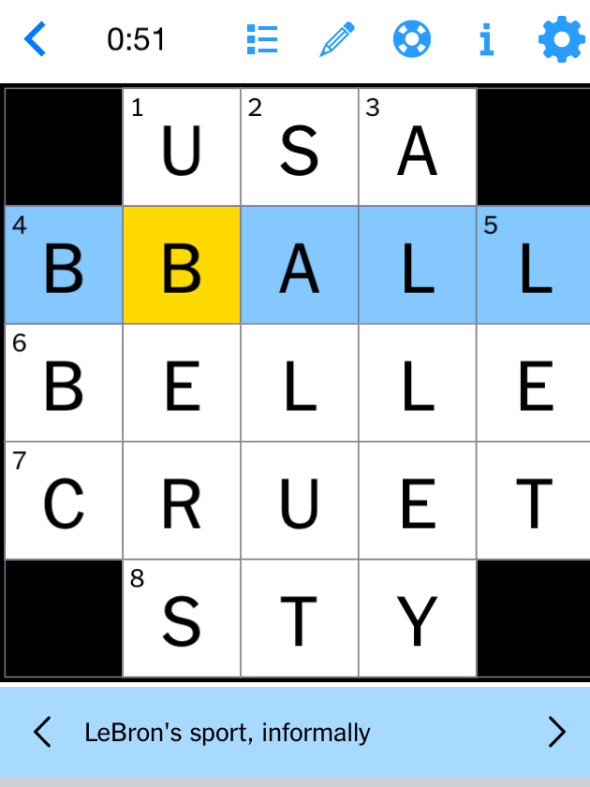

Nyt Mini Crossword Solutions March 13 Hints And Full Answers

May 21, 2025

Nyt Mini Crossword Solutions March 13 Hints And Full Answers

May 21, 2025 -

Ftcs Meta Monopoly Trial A Shift In Strategy

May 21, 2025

Ftcs Meta Monopoly Trial A Shift In Strategy

May 21, 2025