InterRent REIT Receives Takeover Offer: Details On Executive Chair And Sovereign Wealth Fund Involvement

Table of Contents

The Takeover Bid Details

A significant takeover bid has been launched for InterRent REIT by [Acquiring Entity Name], a [Type of Entity, e.g., private equity firm, another REIT]. The offer proposes to acquire all outstanding shares of InterRent REIT at a price of [Price per Share] per share, representing a total transaction value of approximately [Total Value]. This represents a [Percentage]% premium over InterRent REIT's closing share price on [Date].

- Offer price and premium offered: [Price per Share], representing a [Percentage]% premium over the closing price.

- Timeline for the completion of the transaction: The deal is expected to close by [Date], subject to regulatory approvals and other customary closing conditions.

- Conditions precedent to closing the deal: The successful completion of the transaction is contingent upon receiving the necessary approvals from regulatory bodies, including the [Relevant Regulatory Bodies], as well as the satisfaction of other standard closing conditions.

- Whether the offer is a cash offer, stock swap, or a combination of both: This is a [Type of Offer, e.g., all-cash offer, stock-for-stock exchange].

The Role of InterRent REIT's Executive Chair

[Executive Chair's Name], the executive chair of InterRent REIT, has played a pivotal role in the negotiations surrounding the takeover bid. Their involvement has been crucial in shaping the terms of the offer and advising the board on the best course of action for shareholders.

- The executive chair's statement regarding the offer: [Insert a quote from the executive chair's official statement regarding their position on the takeover offer].

- Potential conflicts of interest (if any): [Address any potential conflicts of interest, or state clearly that none are apparent].

- Their recommended course of action for shareholders (accept/reject): The executive chair has [Recommended Action, e.g., recommended that shareholders accept the offer, advised shareholders to carefully consider the offer and seek independent financial advice].

- Past performance and influence within the company: [Executive Chair's Name] has a long history with InterRent REIT, [Describe their contributions and influence].

Impact on Shareholder Value

The InterRent REIT takeover presents both potential benefits and risks for shareholders.

- Short-term and long-term effects on share price: The offer price represents a significant premium, suggesting a positive short-term impact on share price. The long-term effects will depend on [Acquiring Entity Name]'s post-acquisition strategy.

- Potential benefits and drawbacks for shareholders: Shareholders will receive a premium for their shares, but they will lose the opportunity to participate in any future appreciation of InterRent REIT's value.

- Analysis of the offered price compared to InterRent REIT's market value: The offered price of [Price per Share] is [Higher/Lower/Similar] to InterRent REIT's recent market valuation, suggesting a [Favorable/Unfavorable] deal for shareholders.

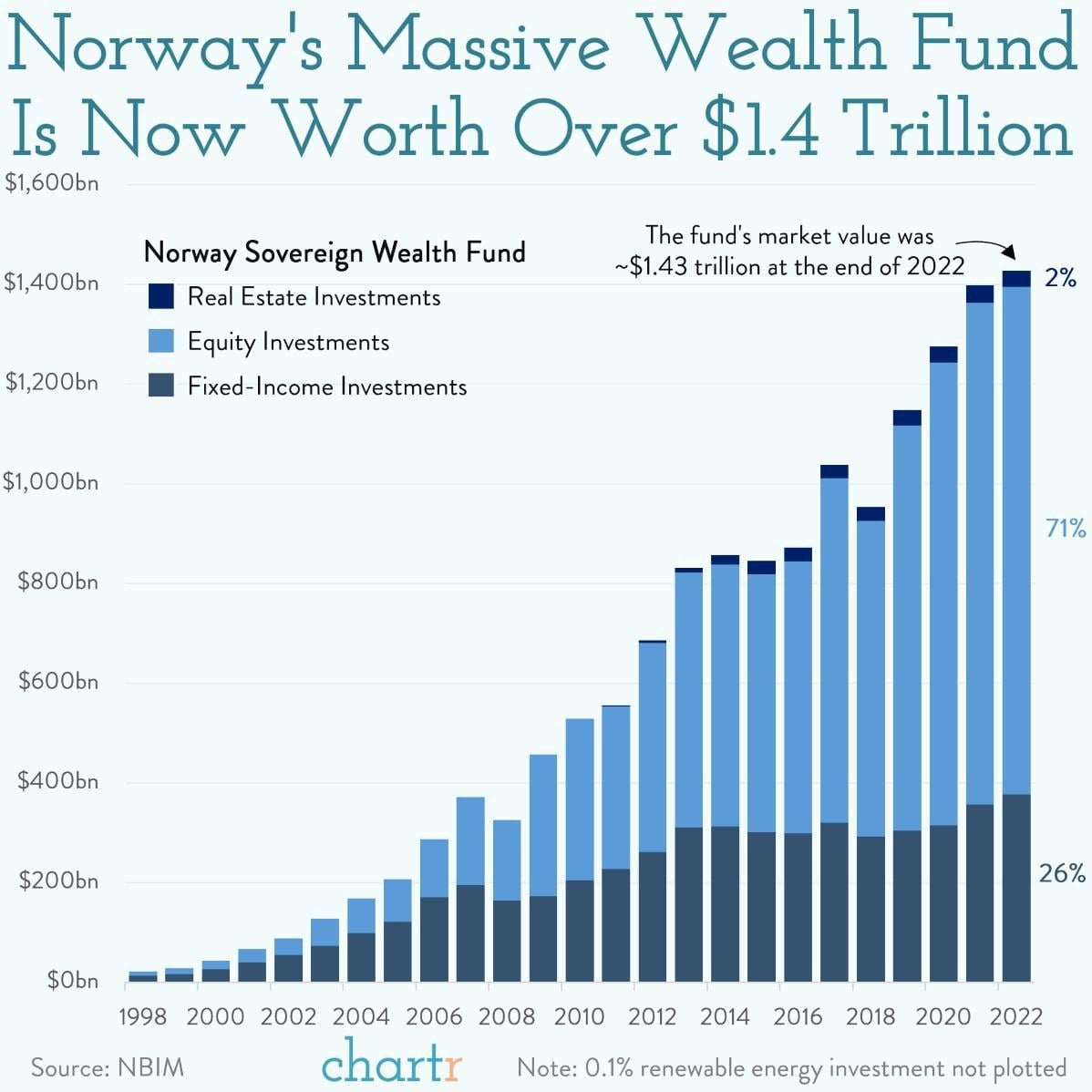

The Sovereign Wealth Fund's Participation

[Sovereign Wealth Fund Name], a prominent sovereign wealth fund, is a significant player in this InterRent REIT takeover. Their participation adds a new dimension to the transaction.

- Identify the sovereign wealth fund: [Sovereign Wealth Fund Name], based in [Country].

- Their investment strategy and reasons for participating in the deal: [Sovereign Wealth Fund Name] typically invests in [Investment Strategy], and their participation in this deal likely reflects their interest in [Reasons for Participation, e.g., the Canadian real estate market, diversification of their portfolio].

- Potential implications of their involvement for InterRent REIT's future strategy: The involvement of [Sovereign Wealth Fund Name] could lead to significant changes in InterRent REIT's strategic direction and investment priorities.

- The fund's track record in real estate investments: [Sovereign Wealth Fund Name] has a [Strong/Mixed] track record in real estate investments, with notable successes in [Mention specific examples].

Future Outlook for InterRent REIT

The successful completion of this InterRent REIT takeover will likely result in significant changes for the company.

- Potential changes to management and operations: [Acquiring Entity Name] may implement changes to InterRent REIT's management team and operational strategies.

- Expected impact on InterRent REIT's portfolio and strategy: The takeover could lead to changes in InterRent REIT's portfolio of properties and its overall investment strategy.

- Analysis of the long-term effects on the Canadian real estate market: The deal could have broader implications for the Canadian real estate market, potentially impacting competition and investment flows.

- Speculation on future acquisitions or divestitures: [Acquiring Entity Name] may pursue further acquisitions or divestitures within InterRent REIT's portfolio following the completion of the takeover.

Conclusion

The InterRent REIT takeover bid represents a significant development in the Canadian REIT sector. The active roles played by the executive chair and a substantial sovereign wealth fund highlight the complexities and potential implications of this transaction. The offer presents a clear opportunity for shareholders, but it's crucial to carefully weigh the potential benefits and drawbacks. The long-term future of InterRent REIT will depend significantly on [Acquiring Entity Name]'s post-acquisition strategy and integration process. This InterRent REIT takeover is a dynamic situation, demanding close monitoring.

Call to Action: Stay informed about the latest developments concerning the InterRent REIT takeover. Follow our website for continued coverage and analysis of this evolving situation. Learn more about InterRent REIT takeover implications by subscribing to our newsletter. Keep up-to-date with the latest news on InterRent REIT’s future.

Featured Posts

-

Two Stranger Things Stars Back To Back Dystopian Sci Fi Releases

May 29, 2025

Two Stranger Things Stars Back To Back Dystopian Sci Fi Releases

May 29, 2025 -

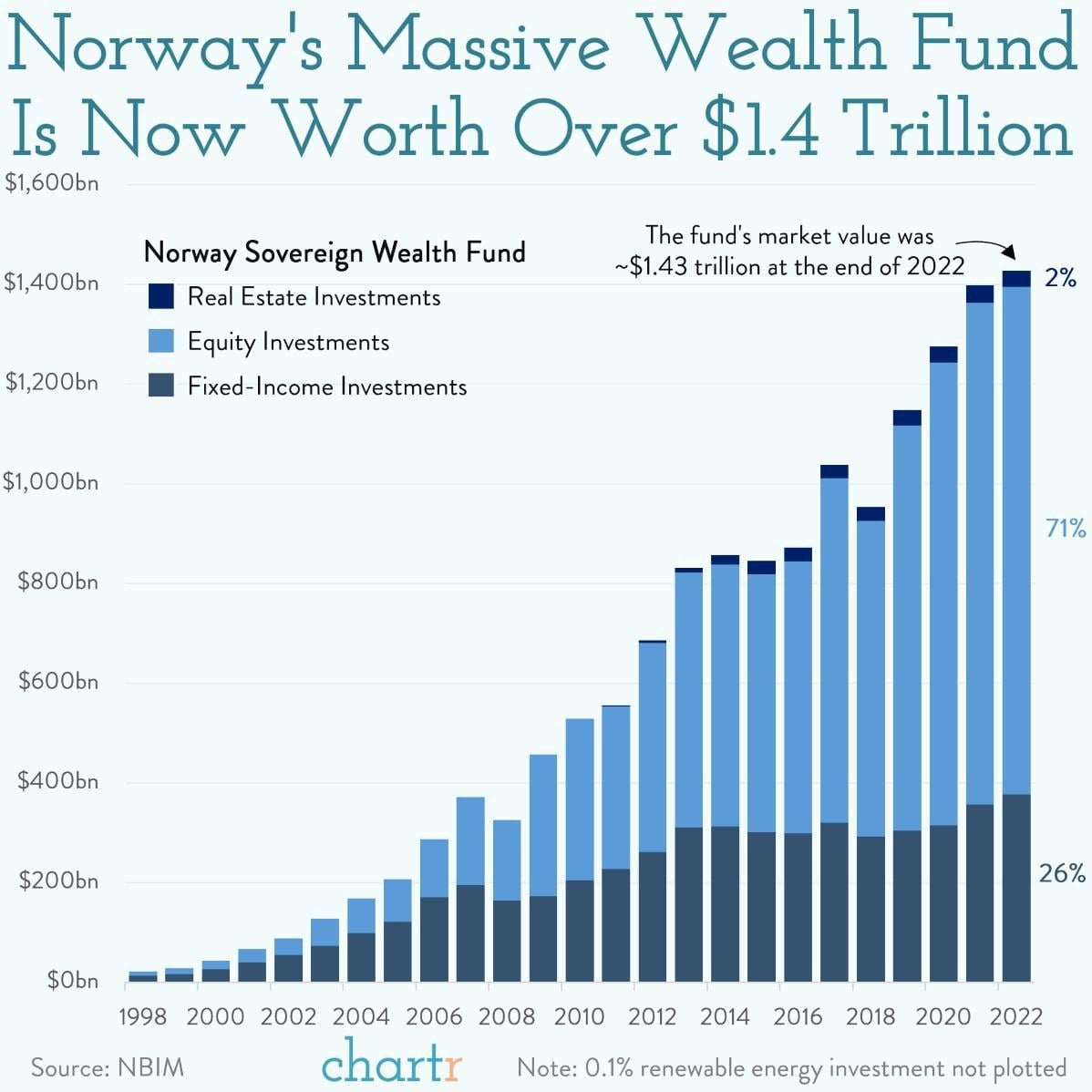

Beyond The Witcher The Fantasy Show That Captivated Henry Cavill

May 29, 2025

Beyond The Witcher The Fantasy Show That Captivated Henry Cavill

May 29, 2025 -

Adult Only Cruise Tuis Latest Offering For Discerning Travelers

May 29, 2025

Adult Only Cruise Tuis Latest Offering For Discerning Travelers

May 29, 2025 -

Descifrando Los Arcanos Menores Palos Numeros E Interpretacion

May 29, 2025

Descifrando Los Arcanos Menores Palos Numeros E Interpretacion

May 29, 2025 -

Nome Do Filme Como Uma Frase Mudou O Cinema Para Sempre 20 Anos Depois

May 29, 2025

Nome Do Filme Como Uma Frase Mudou O Cinema Para Sempre 20 Anos Depois

May 29, 2025

Latest Posts

-

Bruno Marsin Kappaleiden Kopioiminen Miley Cyrusia Vastaan Nostetut Syytteet Pysyvaet

May 31, 2025

Bruno Marsin Kappaleiden Kopioiminen Miley Cyrusia Vastaan Nostetut Syytteet Pysyvaet

May 31, 2025 -

Auction Alert Banksys Broken Heart Wall On Sale

May 31, 2025

Auction Alert Banksys Broken Heart Wall On Sale

May 31, 2025 -

Banksy Male Or Female Examining The Evidence

May 31, 2025

Banksy Male Or Female Examining The Evidence

May 31, 2025 -

Banksy Print Market Explodes 22 777 000 In Annual Sales

May 31, 2025

Banksy Print Market Explodes 22 777 000 In Annual Sales

May 31, 2025 -

Auction Alert Banksys Broken Heart Wall Art

May 31, 2025

Auction Alert Banksys Broken Heart Wall Art

May 31, 2025