Interest Rate Cut: Will A Half-Point Reduction By The Bank Of England Suffice?

Table of Contents

The Current Economic Climate and the Need for an Interest Rate Cut

The UK economy is currently navigating a complex landscape. High inflation, stubbornly persistent despite recent efforts, is squeezing household budgets and dampening consumer spending. The weakening pound, impacted by global economic uncertainty and Brexit-related factors, is increasing import costs, further fueling inflation. Growth has slowed considerably, raising concerns about a potential recession. This confluence of factors has prompted the Bank of England to consider a drastic measure: an interest rate cut. The hope is that a reduction in borrowing costs will stimulate investment, boost consumer confidence, and ultimately reignite economic activity.

- High inflation rates impacting consumer spending: Inflation significantly exceeding the Bank of England's target rate restricts disposable income, leading to reduced consumer spending and overall economic slowdown.

- Weakening pound affecting import costs: The pound's depreciation makes imported goods more expensive, exacerbating inflationary pressures and increasing the cost of living.

- Concerns about a potential recession: Slowing growth and declining consumer confidence raise the spectre of a recession, requiring proactive measures to avert a deeper economic downturn.

- Need to stimulate borrowing and investment: Lower interest rates aim to incentivize borrowing by businesses and consumers, fostering investment and economic expansion.

Analyzing the Potential Impact of a Half-Point Reduction

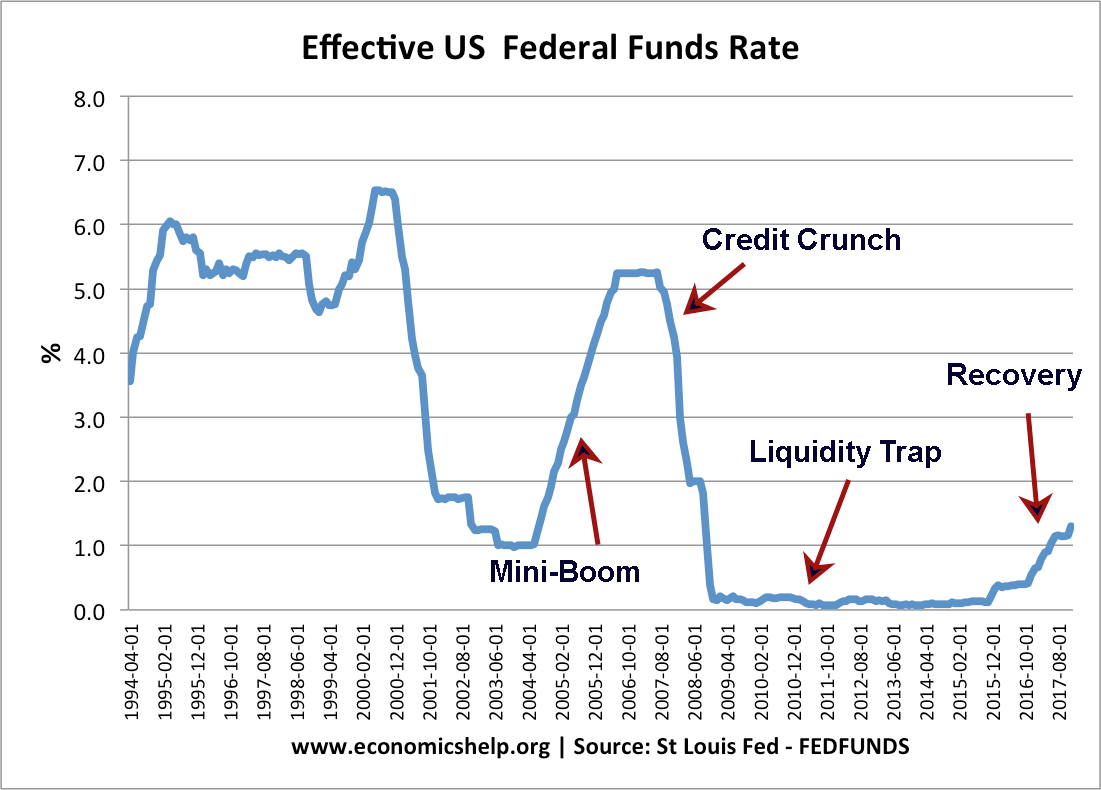

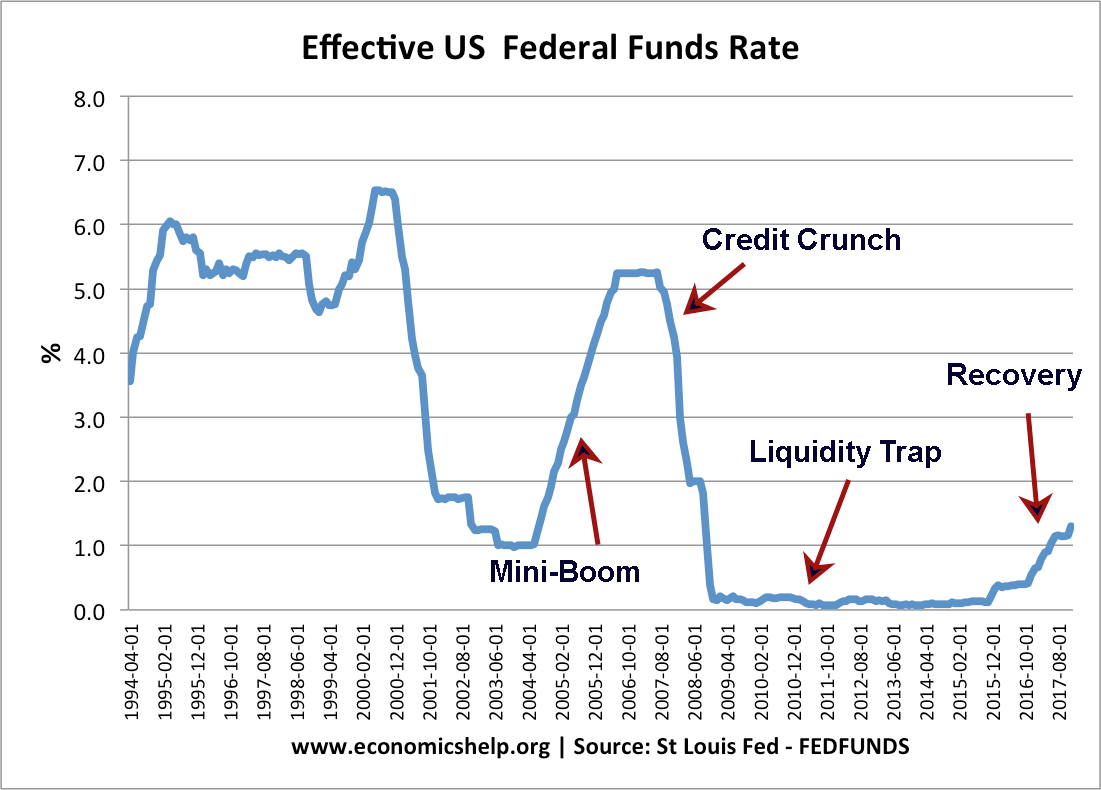

A 0.5% interest rate cut could bring about several positive outcomes. Lower borrowing costs for businesses would incentivize investment in expansion and job creation. Consumers might also see a boost in spending power, leading to increased demand and economic activity. However, this move isn't without potential drawbacks. A rate cut could further fuel inflation, particularly if it leads to increased consumer spending without a corresponding increase in supply. Furthermore, a significant rate cut could lead to a devaluation of the pound, potentially increasing import costs and further impacting inflation.

- Lower borrowing costs for businesses and consumers: Reduced interest rates make loans cheaper, encouraging investment and spending.

- Increased investment and business activity: Lower borrowing costs can spur business expansion, leading to increased job creation and economic growth.

- Potential boost to consumer spending: Lower interest rates on mortgages and loans could free up household disposable income, stimulating consumer spending.

- Risk of fueling inflation further: Increased consumer spending without commensurate increases in supply can lead to even higher inflation.

- Potential for currency depreciation: A rate cut could weaken the pound, making imports more expensive and potentially undermining the intended stimulative effect.

Alternative Monetary Policy Options and their Effectiveness

The Bank of England has other tools in its arsenal beyond interest rate cuts. Quantitative easing (QE), involving the creation of new money to purchase government bonds, can inject liquidity into the financial system. Forward guidance, providing clear communication about the Bank's future policy intentions, can influence market expectations. Negative interest rates, while unconventional, could further stimulate borrowing. However, each option has its limitations and potential downsides. QE can be inflationary, forward guidance can be unreliable, and negative interest rates might have unintended consequences on banks' profitability and lending behavior. The effectiveness of each option depends on the specific economic context and the prevailing market conditions.

- Quantitative easing (QE) and its potential impact: QE injects liquidity but can be inflationary if not carefully managed.

- Forward guidance and its limitations: While helpful in shaping expectations, forward guidance can lose credibility if economic conditions change unexpectedly.

- Negative interest rates and their feasibility: Negative interest rates can stimulate lending but may have unintended consequences for banks' profitability.

- Effectiveness of each option in the current economic climate: The optimal monetary policy mix depends on the specific challenges faced by the UK economy.

Market Reactions and Expert Opinions on the Interest Rate Cut

The prospect of a half-point interest rate cut has already elicited varied responses in the market. Stock markets might initially react positively to the prospect of increased economic activity. However, concerns about inflation could lead to increased volatility. Bond yields could fall reflecting lower borrowing costs, while the pound could experience depreciation, reflecting the potential impact on the UK's international competitiveness. Economists are divided on the efficacy of a half-point reduction. Some believe it's a necessary step to avert a recession, while others express concerns about its inflationary potential. The ultimate impact will depend on a complex interplay of factors, and the uncertainty surrounding the outcome is substantial.

- Stock market reactions to interest rate cut announcements: Stock markets typically react positively to interest rate cuts but the response can be volatile depending on other economic factors.

- Changes in bond yields and their implications: Lower interest rates usually lead to lower bond yields but the degree of change depends on market expectations.

- Pound sterling fluctuations in response to the news: The pound could depreciate following an interest rate cut, impacting import costs and inflation.

- Expert opinions on the efficacy of a half-point reduction: Economists offer diverse views on the effectiveness of the interest rate cut, reflecting the uncertainty surrounding its impact.

Conclusion

The Bank of England's consideration of a half-point interest rate cut represents a significant monetary policy decision aimed at tackling the challenges facing the UK economy. While a reduction in borrowing costs could stimulate investment and consumer spending, there are considerable risks, including increased inflation and currency depreciation. Alternative monetary policy options exist, each with its own set of potential benefits and drawbacks. Market reactions and expert opinions highlight the uncertainty surrounding the sufficiency of a half-point reduction, emphasizing the complexity of the economic situation. The ultimate impact will depend on a variety of interacting factors.

Call to Action: Stay informed about future announcements regarding the Bank of England's interest rate policy. Continue to monitor the impact of any interest rate cut on the UK economy and make informed financial decisions based on the evolving situation. Understand the implications of interest rate cuts and their effects on your personal finances and investment strategies. Learn more about the UK economy and the factors influencing interest rate decisions.

Featured Posts

-

Arsenal Ps Zh Istoriya Protivostoyaniy V Evrokubkakh

May 08, 2025

Arsenal Ps Zh Istoriya Protivostoyaniy V Evrokubkakh

May 08, 2025 -

Dwp Announces Universal Credit Refunds Impact Of 5 Billion Cuts On April And May Payments

May 08, 2025

Dwp Announces Universal Credit Refunds Impact Of 5 Billion Cuts On April And May Payments

May 08, 2025 -

Angels Triumph Over Dodgers Amid Shortstop Injuries

May 08, 2025

Angels Triumph Over Dodgers Amid Shortstop Injuries

May 08, 2025 -

Inters Sommer Out With Thumb Injury Impact On Upcoming Games

May 08, 2025

Inters Sommer Out With Thumb Injury Impact On Upcoming Games

May 08, 2025 -

Merkt Marakana Kyf Fqd Barbwza Asnanh

May 08, 2025

Merkt Marakana Kyf Fqd Barbwza Asnanh

May 08, 2025