Interest Rate Outlook: Why The Fed Is Different

Table of Contents

The Fed's Dual Mandate and its Impact on Interest Rate Decisions

The Federal Reserve operates under a dual mandate: achieving maximum employment and price stability. This differs significantly from many other central banks, which often focus solely on inflation control. This dual mandate profoundly impacts the Fed's interest rate decisions.

-

Employment Focus: The Fed considers the unemployment rate a key indicator. A persistently low unemployment rate, while positive for the economy, can contribute to inflationary pressures. The Fed must carefully balance boosting employment with controlling inflation, a complex task reflected in their interest rate strategies. For instance, during periods of low unemployment, the Fed might raise interest rates to cool down the economy and prevent runaway inflation.

-

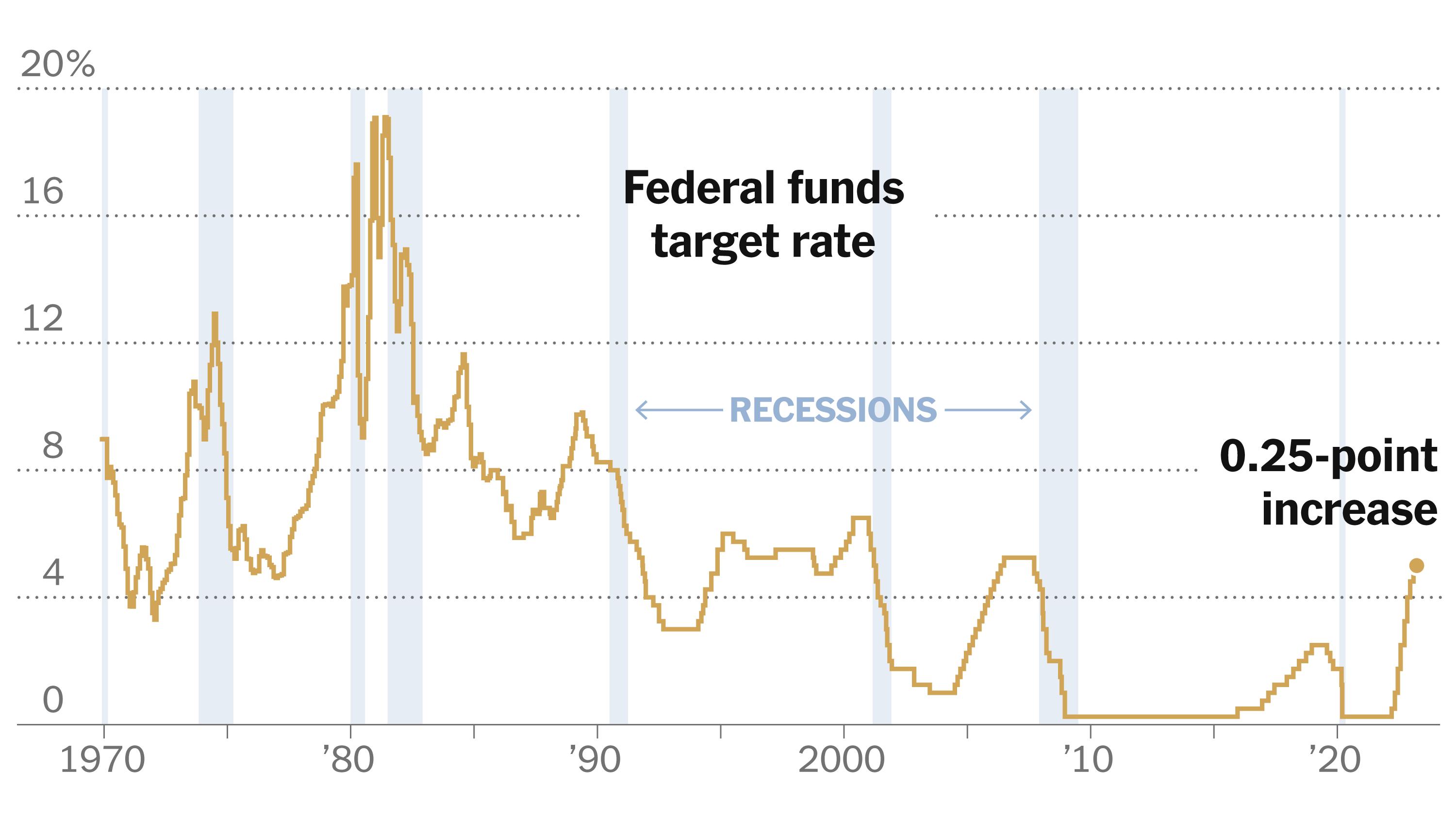

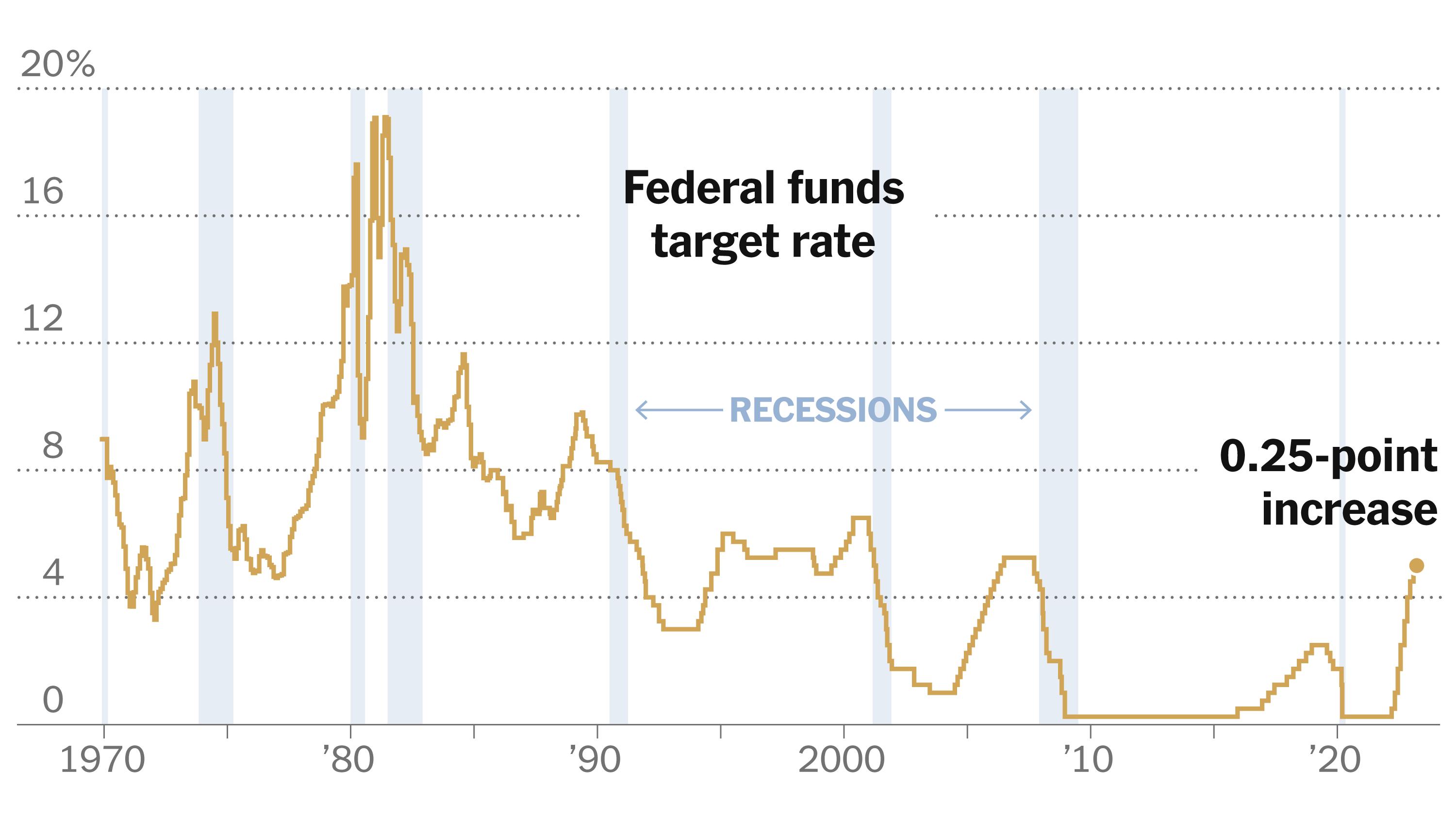

Inflation Target: The Fed sets an inflation target, typically around 2%, aiming to maintain price stability. Deviations from this target significantly influence interest rate decisions. High inflation rates generally prompt the Fed to raise interest rates to curb spending and reduce demand. Conversely, low inflation might lead to interest rate cuts to stimulate economic activity.

-

Comparison to Other Central Banks: Many central banks, like the European Central Bank (ECB), primarily focus on price stability. Their interest rate decisions are largely driven by inflation readings. The Fed's dual mandate necessitates a more nuanced approach, requiring consideration of both employment and inflation data, making its interest rate outlook more complex. For example, the ECB might prioritize inflation control even if it means accepting higher unemployment, unlike the Fed. The current inflation rate and unemployment rate are crucial factors in the Fed's decision-making process. GDP growth also plays a vital role, impacting both employment and inflation.

The Independence of the Federal Reserve

The Federal Reserve enjoys a significant degree of political independence, a crucial factor shaping its long-term interest rate strategies. This independence allows the Fed to make decisions based on economic data and analysis rather than short-term political considerations.

-

Data-Driven Decisions: The Fed's independence empowers its policymakers to act on economic realities, free from political pressure to manipulate interest rates for short-term electoral gains. This fosters confidence in the stability and predictability of the US monetary policy.

-

Contrast with Less Independent Banks: Many central banks around the world are subject to greater political influence. Government pressure to lower interest rates for economic stimulus, even in the face of inflationary pressures, can lead to unsustainable economic policies. The Fed's relative independence safeguards against this.

-

Implications of Political Interference: Even a perception of political interference can undermine the credibility of monetary policy. This could lead to increased uncertainty and volatility in financial markets, resulting in unpredictable interest rate fluctuations. The Fed’s independence acts as a bulwark against this potential instability.

Unique Economic Factors Influencing the US Interest Rate Outlook

Several unique aspects of the US economy heavily influence the Fed's interest rate decisions. These include:

-

The US Dollar as a Global Reserve Currency: The dollar's prominence in international trade and finance influences US interest rates. Changes in US interest rates ripple through the global financial system, affecting exchange rates and capital flows. The Fed must consider the global impact of its actions when setting interest rates.

-

Size and Complexity of the US Economy: The sheer size and complexity of the US economy necessitate a multifaceted approach to monetary policy. The Fed needs to consider a broader range of economic indicators and regional disparities when determining interest rate adjustments.

-

Influence of Global Economic Events: Global economic events, such as international crises or changes in commodity prices, significantly impact the US economy and, consequently, the Fed's interest rate decisions. The Fed needs to constantly monitor the global economic outlook.

-

Impact of Fiscal Policy: Fiscal policy decisions, like government spending and taxation, interact with monetary policy. The Fed needs to coordinate its interest rate strategies with the government's fiscal policies to ensure economic stability. The interplay between monetary and fiscal policy is crucial to the overall interest rate outlook.

Predicting Future Interest Rate Movements: Challenges and Considerations

Accurately forecasting future interest rate changes is notoriously challenging.

-

Unpredictability of Economic Variables: Economic variables are inherently unpredictable. Unexpected shocks, like pandemics or geopolitical events, can drastically alter economic conditions and necessitate adjustments to interest rate projections.

-

Limitations of Economic Models: Economic models, while helpful, cannot perfectly predict future economic behavior. These models rely on assumptions that may not hold true in dynamic real-world conditions.

-

Monitoring Key Economic Indicators: Close monitoring of key economic indicators, including inflation, unemployment, GDP growth, and consumer sentiment, is vital for refining interest rate forecasts. Regularly reviewing these indicators helps in creating more accurate predictions.

-

Role of Market Sentiment: Market sentiment plays a significant role in shaping interest rate expectations. Investor confidence and speculation can influence interest rates independently of underlying economic fundamentals. Understanding market psychology is crucial in interest rate forecasting.

Conclusion

The Interest Rate Outlook for the US is significantly shaped by the Fed's unique characteristics. Its dual mandate, political independence, and consideration of the unique aspects of the US economy, including the role of the US dollar and the interplay of monetary and fiscal policy, all contribute to a complex and dynamic interest rate environment. Accurately predicting future interest rate movements remains a challenge due to the inherent unpredictability of economic variables and the limitations of economic models. Understanding the nuances of the Fed's interest rate decisions is crucial for informed financial planning. Stay updated on the latest Interest Rate Outlook to make informed financial choices. Follow reputable economic news sources and subscribe to relevant newsletters to stay abreast of the ever-evolving interest rate landscape.

Featured Posts

-

Two Hat Tricks In One Month Hertls Dominance Against The Red Wings

May 10, 2025

Two Hat Tricks In One Month Hertls Dominance Against The Red Wings

May 10, 2025 -

Letartoztattak Egy Transznemu Not Floridaban A Noi Mosdo Hasznalataert

May 10, 2025

Letartoztattak Egy Transznemu Not Floridaban A Noi Mosdo Hasznalataert

May 10, 2025 -

Incendie A La Mediatheque Champollion De Dijon Premiers Elements

May 10, 2025

Incendie A La Mediatheque Champollion De Dijon Premiers Elements

May 10, 2025 -

Analyzing The Impact Tech Billionaires Losses After Donating To The Trump Inauguration

May 10, 2025

Analyzing The Impact Tech Billionaires Losses After Donating To The Trump Inauguration

May 10, 2025 -

The Cost Of Perus Mining Ban 200 Million In Lost Gold Revenue

May 10, 2025

The Cost Of Perus Mining Ban 200 Million In Lost Gold Revenue

May 10, 2025