Internal Investigation Leads To PwC US Partners Cutting Brokerage Ties

Table of Contents

The Internal Investigation: Uncovering Conflicts of Interest

The nature of the PwC internal investigation remains partially undisclosed, protecting the confidentiality of the individuals involved and the ongoing process. However, reports suggest the investigation was triggered by a combination of factors, potentially including internal whistleblowing and a proactive review of compliance procedures. The investigation focused on identifying and addressing potential conflicts of interest among certain partners.

- Specific details about the alleged conflicts of interest: While specifics are limited to protect the integrity of the investigation, allegations reportedly involve the potential misuse of non-public information for personal financial gain, raising concerns about potential insider trading and violations of professional ethics.

- The scope of the investigation: The investigation encompassed a significant number of partners across several departments, highlighting the need for a thorough and comprehensive review of the firm's internal controls and compliance mechanisms. The exact number of partners implicated remains undisclosed.

- Timeline of the investigation: The investigation spanned several months, starting with initial reports and culminating in the decision by implicated partners to sever their brokerage links. The precise dates haven't been publicly released.

These actions demonstrate a clear effort to address potential ethical violations and maintain the highest standards of accounting ethics within the firm. The investigation highlights the critical importance of proactive measures to identify and mitigate potential conflicts of interest within large professional services organizations.

PwC's Response: Cutting Ties and Implementing Reforms

In response to the findings of the internal investigation, PwC US took decisive action. The firm required several partners to sever ties with their brokerage accounts, demonstrating a clear commitment to addressing potential conflicts of interest and upholding the highest standards of ethical conduct. This significant step underlines the seriousness with which PwC views such matters.

- Number of partners affected by the decision: The precise number of partners affected has not been publicly disclosed, emphasizing the firm’s commitment to confidentiality while addressing the issues raised.

- Specific brokerage firms involved: The names of the brokerage firms involved haven't been officially released, likely to protect the privacy of the partners involved.

- Details of the reforms implemented: PwC has pledged to implement a series of reforms to strengthen its PwC compliance framework and prevent similar incidents in the future. This includes enhanced training programs focused on ethics and conflict of interest management, as well as more rigorous internal review processes and strengthened conflict of interest prevention measures. Improved risk management and corporate governance practices are also expected.

- PwC's public statement on the matter: PwC has released a statement emphasizing its commitment to ethical conduct and its zero-tolerance policy towards violations. The statement reaffirms the firm's dedication to upholding the highest standards of professional responsibility.

These actions demonstrate a proactive approach to ethical reforms and underscore the firm's commitment to maintaining investor trust and confidence.

Implications for the Accounting Industry and Beyond

The internal investigation PwC brokerage ties and subsequent actions have significant implications for the accounting industry and the wider financial landscape. It raises concerns about the potential for conflicts of interest within large professional services firms and the effectiveness of existing regulatory frameworks.

- Potential impact on investor confidence in PwC: While PwC has taken swift action, the incident could potentially impact investor confidence in the firm. Transparency and effective communication will be crucial in mitigating any negative repercussions.

- Similar incidents in other accounting firms or financial institutions: This situation highlights the need for increased scrutiny of potential conflicts of interest across the accounting industry ethics sector and the financial industry as a whole. Similar incidents in other organizations underscore the systemic nature of these challenges.

- The role of regulatory bodies in overseeing ethical conduct: The incident emphasizes the importance of strong regulatory oversight in ensuring ethical conduct within the financial services sector. Regulatory bodies play a crucial role in setting standards and enforcing compliance.

- Discussion of best practices for conflict of interest management within large firms: This situation serves as a case study for developing and implementing best practices for conflict of interest management in large organizations, focusing on transparent policies, robust training programs, and effective internal controls. Strengthening regulatory compliance is paramount.

Conclusion

The internal investigation at PwC US, leading to partners severing brokerage ties, highlights the critical need for robust internal controls and proactive measures to prevent conflicts of interest. The reforms implemented demonstrate a commitment to ethical reforms within the firm. This case underscores the importance of ethical conduct and compliance, not only within PwC but also across the accounting industry ethics. Staying informed about developments in PwC internal investigation and accounting industry ethics is crucial for maintaining the integrity of the financial industry. Regularly check reputable news sources for updates on this case and other developments impacting the integrity of the financial services sector. Understanding internal investigation PwC brokerage ties is vital for navigating the complexities of ethical business practices.

Featured Posts

-

Severe Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 29, 2025

Severe Flooding Forces Cancellation Of Thunder Over Louisville Fireworks

Apr 29, 2025 -

Kentucky Storm Damage Assessments Delays And Reasons Why

Apr 29, 2025

Kentucky Storm Damage Assessments Delays And Reasons Why

Apr 29, 2025 -

Canadian Election Late Campaign Surge Questions Carneys Front Runner Status

Apr 29, 2025

Canadian Election Late Campaign Surge Questions Carneys Front Runner Status

Apr 29, 2025 -

Canadian Filipino Community In Mourning Following Car Attack

Apr 29, 2025

Canadian Filipino Community In Mourning Following Car Attack

Apr 29, 2025 -

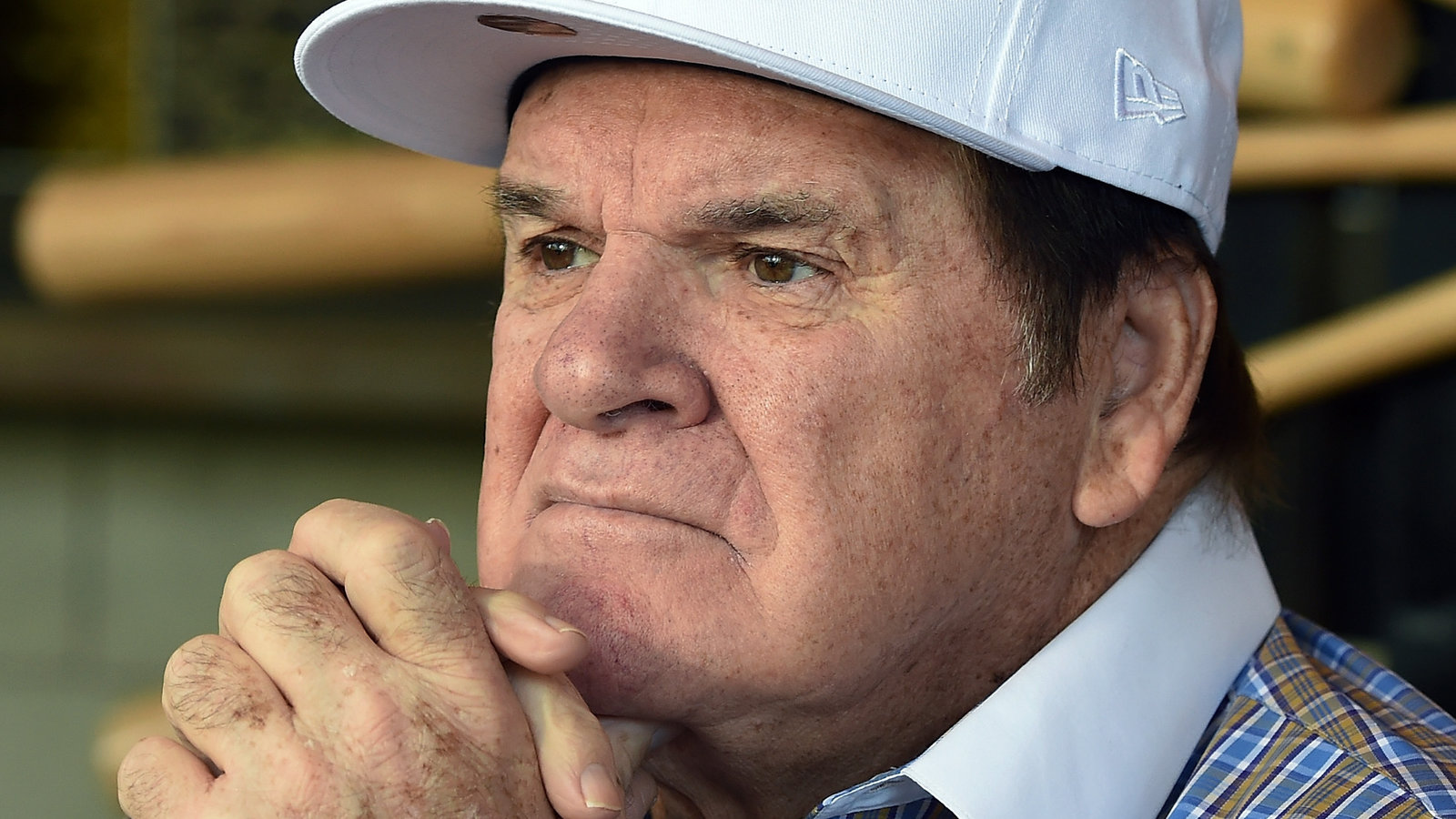

Pete Rose To Receive Posthumous Pardon Trumps Statement Analyzed

Apr 29, 2025

Pete Rose To Receive Posthumous Pardon Trumps Statement Analyzed

Apr 29, 2025

Adult Adhd From Suspicion To Support

Adult Adhd From Suspicion To Support