Investigation Reveals Fraud: PFC Revokes Gensol Promoters' EoW Transfer

Table of Contents

Keywords: Gensol, PFC, Pakistan Forex Company, Encashment of Warrants, EoW, Fraud, Investigation, Financial Fraud, Promoter Fraud, Stock Market Fraud, Securities Fraud.

The Pakistan Forex Company (PFC) has taken decisive action against Gensol promoters, revoking their Encashment of Warrants (EoW) transfer following a thorough investigation that uncovered significant evidence of fraudulent activities. This case highlights the critical importance of transparency and accountability within the Pakistani financial markets and serves as a stark warning against the devastating consequences of financial fraud. This article delves into the details of the investigation, the PFC's response, and the broader impact on Gensol, its investors, and the market as a whole.

The Gensol EoW Transfer and the Subsequent Investigation

The initial EoW transfer involved a substantial sum, the exact amount of which is currently undisclosed pending further investigation. The transfer originated from Gensol promoters to undisclosed parties and involved a complex series of transactions. The PFC initiated an investigation following several complaints from concerned stakeholders and the detection of several suspicious activities flagged by the PFC's internal monitoring systems. These irregularities triggered a detailed forensic audit of the transactions.

-

Timeline of Events:

- March 15th: Initial EoW transfer initiated by Gensol promoters.

- March 22nd: Suspicious activity detected by PFC's monitoring systems.

- April 5th: Formal investigation launched by the PFC.

- May 10th: Preliminary findings indicate potential fraud.

- June 1st: PFC revokes the EoW transfer.

-

Key Individuals Involved: The investigation focuses on several key individuals within Gensol's management and their associates involved in facilitating the transaction. Names are being withheld pending the completion of the legal process.

-

Preliminary Findings: The initial findings suggested potential breaches of securities regulations and a deliberate attempt to mislead regulatory authorities.

Evidence of Fraudulent Activities Unveiled

The PFC investigation uncovered compelling evidence of fraudulent activities, including instances of misrepresentation, forgery, and potential insider trading. The evidence suggests a coordinated effort to deceive the PFC and defraud investors.

-

Type of Fraudulent Activities: Misrepresentation of assets, forgery of documents, and suspicious trading patterns suggestive of insider trading.

-

Specific Evidence: Forged documents relating to the asset valuation, manipulated financial records, and evidence of communication suggesting an attempt to conceal the true nature of the transactions.

-

Impact on Investors and the Market: The fraudulent activities have eroded investor confidence in Gensol and potentially impacted the broader market's stability, highlighting the systemic risk associated with such scams.

PFC's Response and Revocation of the EoW Transfer

Based on the overwhelming evidence of fraud, the PFC took the decisive step of revoking the EoW transfer. This action signifies the PFC's commitment to upholding the integrity of the financial markets and protecting investors. The Gensol promoters now face serious legal implications, including potential fines, imprisonment, and a ban from future participation in the Pakistani financial markets.

-

Details of the Revocation Order: The PFC issued a formal order detailing the reasons for the revocation and outlining the legal consequences for the involved parties.

-

Potential Penalties and Sanctions: The promoters face significant penalties, including substantial fines and potential criminal charges related to securities fraud and financial misconduct.

-

Future Steps by PFC: The PFC is committed to strengthening its regulatory oversight and implementing enhanced monitoring systems to prevent similar incidents in the future. Further investigations and potential legal actions are ongoing.

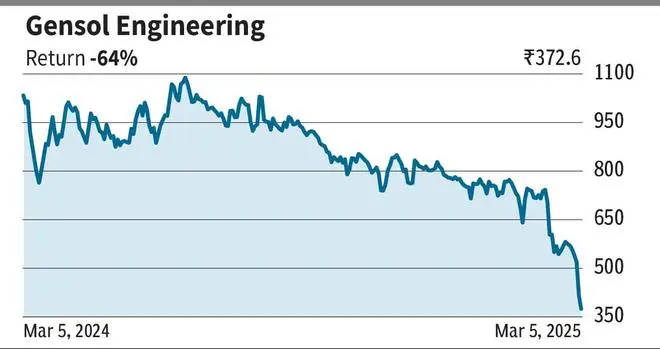

Impact on Gensol Stock and Investor Confidence

The revelation of the fraudulent EoW transfer has had an immediate and significant negative impact on Gensol's stock price. Investor sentiment has plummeted, leading to significant losses for shareholders. Market analysts predict potential long-term consequences for Gensol's reputation and business operations.

-

Changes in Gensol's Stock Price: A sharp and sustained decline in Gensol's stock price has been observed since the news broke.

-

Investor Reaction and Market Sentiment: Investor confidence in Gensol has been severely shaken, leading to widespread sell-offs and a negative market reaction.

-

Possible Long-Term Impact: The long-term impact could include significant financial losses, reputational damage, and difficulty attracting future investments.

Conclusion

The PFC's investigation into the Gensol EoW transfer has revealed a serious case of financial fraud, highlighting the need for constant vigilance and robust regulatory oversight within the Pakistani financial markets. The PFC's decisive action in revoking the fraudulent transfer underscores its commitment to protecting investors and maintaining market integrity. The consequences for the Gensol promoters serve as a stark reminder of the severe penalties associated with financial misconduct. Stay vigilant against financial fraud. Report suspicious activity and learn more about protecting yourself from EoW scams and understanding the complexities of Encashment of Warrants to safeguard your investments.

Featured Posts

-

Dows Canadian Project Construction Delays And Market Volatility

Apr 27, 2025

Dows Canadian Project Construction Delays And Market Volatility

Apr 27, 2025 -

A Night Of Fear Robert Pattinsons Horror Movie Experience

Apr 27, 2025

A Night Of Fear Robert Pattinsons Horror Movie Experience

Apr 27, 2025 -

Simkus Signals Further Ecb Rate Cuts Due To Trade Tensions

Apr 27, 2025

Simkus Signals Further Ecb Rate Cuts Due To Trade Tensions

Apr 27, 2025 -

2025 Nfl Season Justin Herbert And The Chargers Play In Brazil

Apr 27, 2025

2025 Nfl Season Justin Herbert And The Chargers Play In Brazil

Apr 27, 2025 -

Increased Tourist Arrivals Canadas Growing Appeal To International Travelers

Apr 27, 2025

Increased Tourist Arrivals Canadas Growing Appeal To International Travelers

Apr 27, 2025

Latest Posts

-

Two Year Old Us Citizens Deportation Case Federal Judge Sets Hearing

Apr 28, 2025

Two Year Old Us Citizens Deportation Case Federal Judge Sets Hearing

Apr 28, 2025 -

Federal Court Hearing Scheduled For Deportation Of 2 Year Old Us Citizen

Apr 28, 2025

Federal Court Hearing Scheduled For Deportation Of 2 Year Old Us Citizen

Apr 28, 2025 -

Us Citizen Age 2 Fights Deportation In Federal Court Hearing

Apr 28, 2025

Us Citizen Age 2 Fights Deportation In Federal Court Hearing

Apr 28, 2025 -

The Closure Of Anchor Brewing Company Impact On The Craft Beer Industry

Apr 28, 2025

The Closure Of Anchor Brewing Company Impact On The Craft Beer Industry

Apr 28, 2025 -

Anchor Brewing Companys Closure Whats Next For The Iconic Brewery

Apr 28, 2025

Anchor Brewing Companys Closure Whats Next For The Iconic Brewery

Apr 28, 2025