Investing For Beginners: A Practical Podcast On Money

Table of Contents

Understanding Basic Investing Concepts

Before diving into specific investment vehicles, it's crucial to grasp fundamental investing concepts.

What is Investing?

Investing involves allocating your money in assets with the expectation of generating a return over time. This differs from saving, which focuses on preserving capital, and trading, which aims for short-term profits. Investing is a long-term strategy, typically spanning years or even decades, allowing your investments to grow through the power of compounding. Successful long-term investment strategies require patience and discipline. Building a diverse investment portfolio is key to mitigating risk and maximizing returns. Your return on investment (ROI) will depend on various factors, including market performance and your investment choices.

Risk Tolerance and Investment Goals

Before investing, assess your risk tolerance – your comfort level with potential losses. Are you a conservative investor who prioritizes capital preservation, or are you more aggressive and willing to accept higher risk for potentially higher returns? Your investment goals—whether it's retirement planning, buying a house, or funding your children's education—will also influence your investment strategy. Financial planning helps align your investments with your long-term objectives. A clear understanding of your risk assessment and investment goals is crucial for making informed investment decisions.

Diversification

Diversification is a cornerstone of successful investing. It involves spreading your investments across different asset classes, such as stocks, bonds, and real estate. This reduces your reliance on any single investment's performance and helps mitigate risk. Effective asset allocation—the process of distributing your investments among these asset classes—is essential for building a resilient portfolio. Portfolio diversification is crucial for minimizing the impact of market fluctuations on your overall returns.

Compounding

Compounding, also known as the "snowball effect," is the magic of earning returns on your initial investment and on the accumulated returns. Over time, this creates exponential growth, significantly boosting your wealth. Compound interest is a powerful tool for long-term wealth building. The longer your money is invested, the more potent the effect of compounding becomes.

Choosing the Right Investment Vehicles for Beginners

Several investment options cater to beginners, each offering different levels of risk and potential return.

Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) are excellent choices for beginners. They offer low-cost, diversified exposure to a broad market index, making passive investing readily accessible. These funds track a specific market index, such as the S&P 500, making them a simple and effective way to participate in market growth. Low-cost investing is crucial for maximizing your returns over the long term.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Actively managed funds employ professional fund managers to select and manage investments, potentially offering higher returns but with potentially higher fees.

High-Yield Savings Accounts and Bonds

For risk-averse investors seeking capital preservation, high-yield savings accounts and bonds provide relatively safe options. These instruments offer lower returns than stocks but minimize the risk of principal loss. Fixed income investments like bonds provide stability to your overall portfolio.

Robo-Advisors

Robo-advisors leverage technology to automate investment decisions based on your risk tolerance and financial goals. Automated investing through robo-advisors simplifies the process, making it particularly convenient for beginners. Algorithmic investing used by robo-advisors can often provide diversified portfolios at low cost.

Getting Started with Investing: Practical Steps

Now let's explore the practical steps involved in starting your investment journey.

Opening a Brokerage Account

The first step is opening a brokerage account with a reputable online brokerage or investment platform. This account will serve as your gateway to buying and selling investments. Choosing the right online brokerage involves considering factors like fees, investment options, and user-friendliness.

Researching and Selecting Investments

Before investing, conduct thorough research on potential investments. Understanding fundamental analysis, which involves evaluating a company's financial statements and business model, is crucial for making informed decisions.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a strategy of investing a fixed amount of money at regular intervals, regardless of market fluctuations. This reduces the impact of market volatility and helps mitigate risk. DCA is particularly useful for beginners who may be hesitant to invest lump sums in volatile markets.

Monitoring Your Portfolio

Regularly monitor your investment portfolio and rebalance it as needed to maintain your desired asset allocation. Investment review is essential to ensure your portfolio continues to align with your goals and risk tolerance.

Conclusion

Investing for beginners can seem daunting, but by understanding basic concepts, choosing appropriate investment vehicles, and taking practical steps, you can build a solid foundation for your financial future. Our practical podcast on money and this article have provided a starting point. Remember to conduct thorough research, consider your risk tolerance, and diversify your portfolio. Don't delay – start your investing journey today! Listen to our podcast and learn more about investing for beginners and building your financial future through practical money management. Start your investment journey now!

Featured Posts

-

Constance Lloyd Wilde Paying The Price For Oscars Genius

May 31, 2025

Constance Lloyd Wilde Paying The Price For Oscars Genius

May 31, 2025 -

Detroit Tigers Suffer First Home Series Loss To Texas Rangers

May 31, 2025

Detroit Tigers Suffer First Home Series Loss To Texas Rangers

May 31, 2025 -

Achieving The Good Life Steps To Happiness And Fulfillment

May 31, 2025

Achieving The Good Life Steps To Happiness And Fulfillment

May 31, 2025 -

Cycling Team Victorious Aims High At The Tour Of The Alps

May 31, 2025

Cycling Team Victorious Aims High At The Tour Of The Alps

May 31, 2025 -

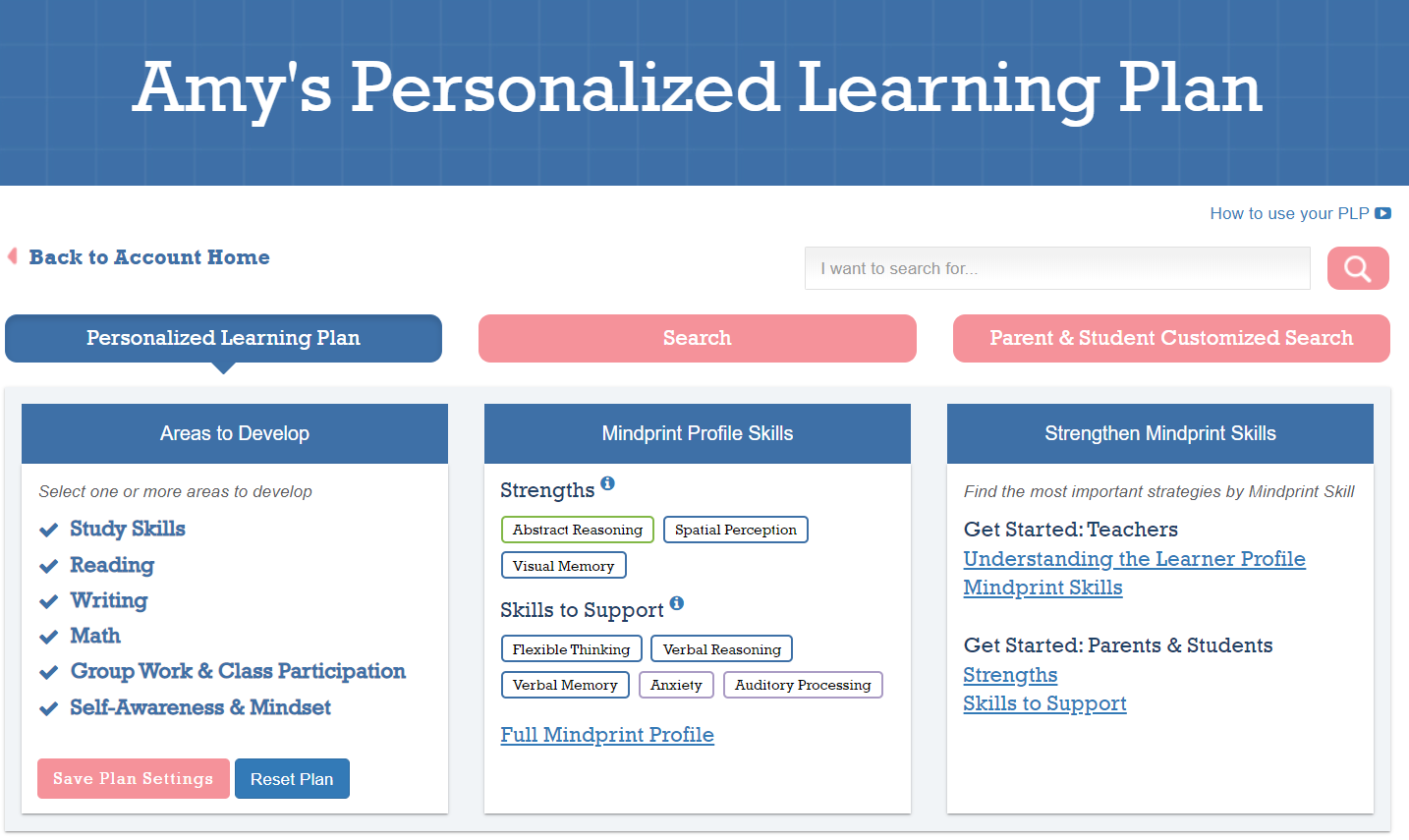

Your Good Life A Personalized Plan For Success

May 31, 2025

Your Good Life A Personalized Plan For Success

May 31, 2025