Investing In 2025: MicroStrategy Stock Compared To Bitcoin

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy, a business intelligence company, has become synonymous with a bold Bitcoin strategy. This section delves into its business model, the associated risks, and its long-term vision.

MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's core business involves providing enterprise analytics, mobility, and cloud-based solutions. However, its significant investment in Bitcoin has dramatically reshaped its profile. As of [Insert Date - find the most up-to-date information], MicroStrategy holds approximately [Insert Number] Bitcoin, representing a substantial portion of its overall assets. The company's rationale centers on Bitcoin's potential as a long-term store of value and a hedge against inflation.

- Market Capitalization: [Insert Current Market Cap]

- Total Bitcoin Holdings: [Insert Current Holdings]

- Average Purchase Price: [Insert Average Purchase Price]

- Impact on Balance Sheet: Significantly impacts the balance sheet, creating both opportunities and risks.

The correlation between MicroStrategy's stock price and Bitcoin's price is undeniable. When Bitcoin's price rises, MicroStrategy's stock price tends to follow suit, and vice versa. This direct relationship highlights the significant dependence of MicroStrategy's stock valuation on the cryptocurrency market's performance.

Risks Associated with MicroStrategy Stock

Investing in MicroStrategy stock carries inherent risks, primarily stemming from its heavy reliance on Bitcoin.

- Dependence on Bitcoin Price Fluctuations: The volatility of the cryptocurrency market directly impacts MicroStrategy's stock performance. A sharp drop in Bitcoin's price can severely impact the company's valuation.

- Potential Regulatory Risks: The regulatory landscape for cryptocurrencies remains in flux globally. Changes in regulations could negatively impact Bitcoin's price and, consequently, MicroStrategy's stock.

- Competition in the Business Intelligence Market: MicroStrategy faces competition from established players in the business intelligence sector. Its core business performance is crucial, independent of its Bitcoin holdings.

MicroStrategy's Long-Term Vision and Potential Returns

MicroStrategy's long-term vision is intertwined with Bitcoin's success. Their continued investment suggests a belief in Bitcoin's long-term value. Potential returns are directly linked to Bitcoin's price trajectory. If Bitcoin's price appreciates significantly, MicroStrategy's stock could see substantial gains. Conversely, a prolonged Bitcoin bear market could lead to significant losses.

Bitcoin as an Investment Asset

Bitcoin, the pioneering cryptocurrency, has captivated investors worldwide. This section analyzes its price volatility, its potential as an inflation hedge, and the associated risks.

Bitcoin's Price Volatility and Market Sentiment

Bitcoin's price is notoriously volatile. Its history is marked by significant price swings, influenced by various factors.

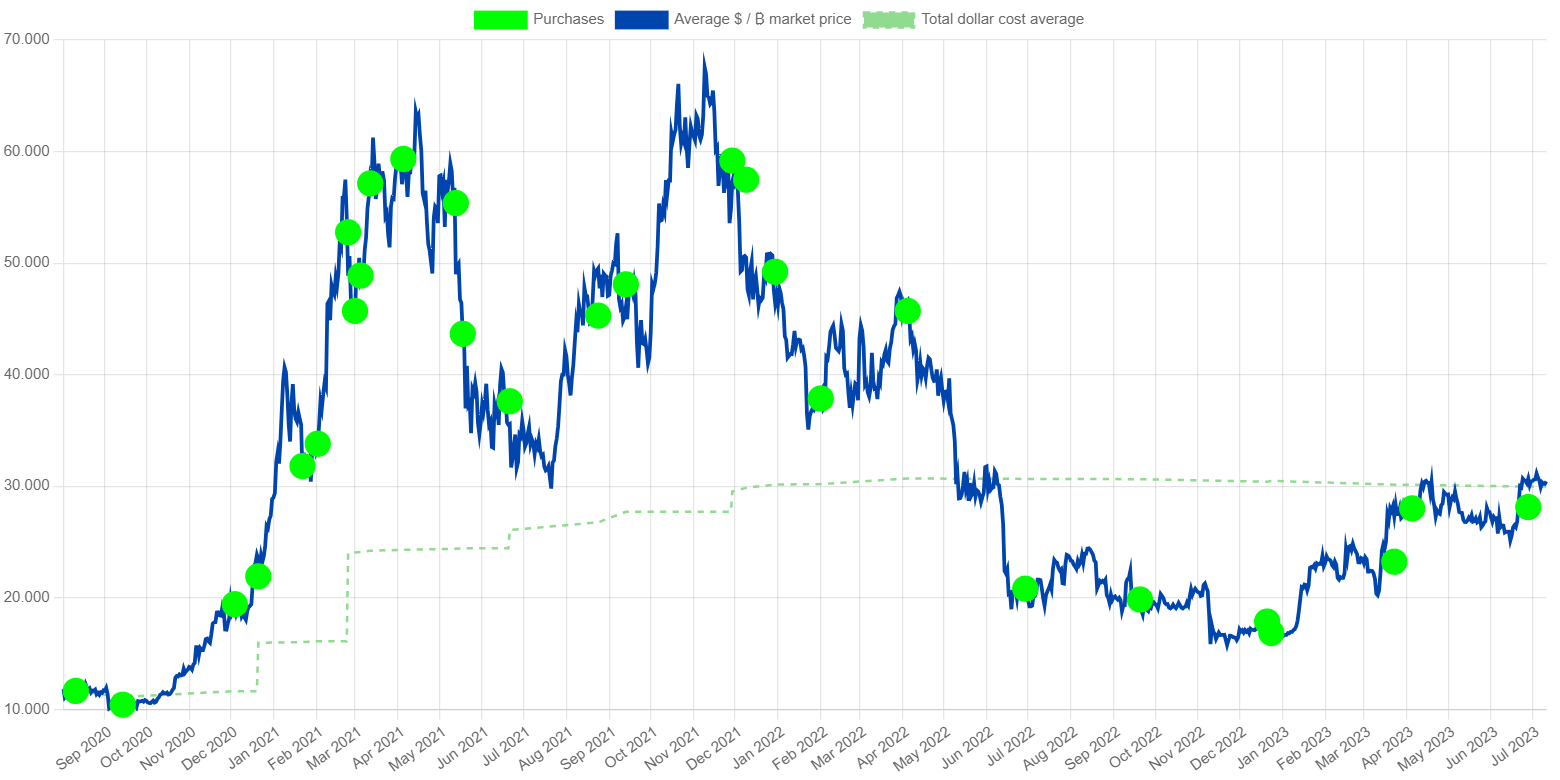

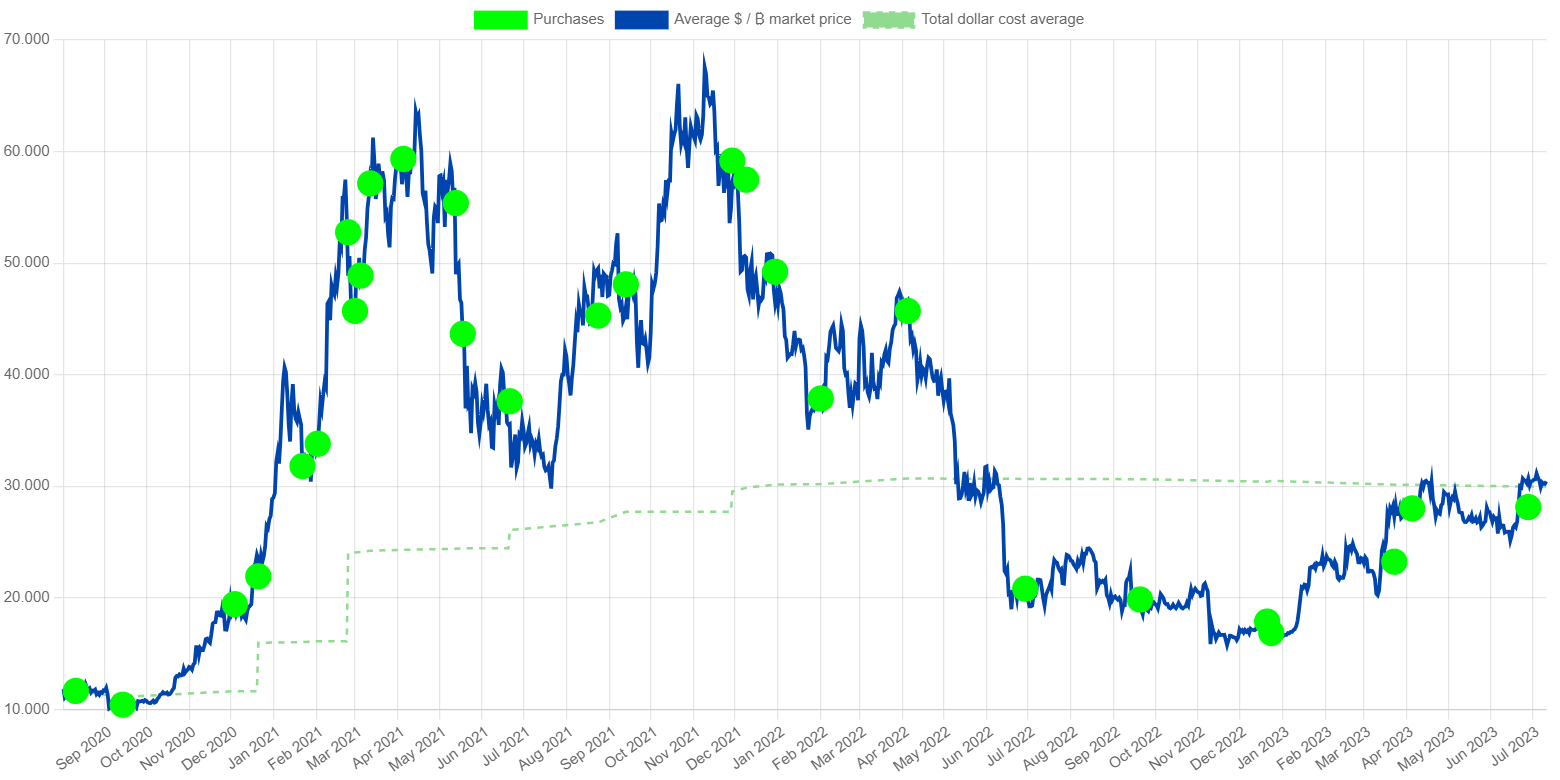

- Historical Price Charts: Show periods of explosive growth and sharp corrections.

- Major Price Swings: Illustrate the inherent risk of Bitcoin investment.

- Key Factors Influencing Price: Include market sentiment, regulatory news, adoption rates by businesses and institutions, and macroeconomic factors.

The Potential of Bitcoin as a Hedge Against Inflation

Many proponents view Bitcoin as a potential hedge against inflation due to its limited supply of 21 million coins. This scarcity, coupled with increasing adoption, could drive its value higher during inflationary periods.

- Supply and Demand Dynamics: The fixed supply creates potential scarcity value.

- Comparison with Traditional Assets like Gold: Bitcoin is often compared to gold as a store of value.

- Potential for Future Adoption: Widespread adoption by institutions and governments could significantly boost its value.

Risks Involved in Investing Directly in Bitcoin

Direct Bitcoin investment carries substantial risks.

- Wallet Security: Securing your Bitcoin requires careful attention to wallet security. Losses due to hacking or theft are possible.

- Exchange Hacks: Cryptocurrency exchanges have been targets of hacking, resulting in significant losses for investors.

- Potential for Government Regulation: Government regulations could significantly impact Bitcoin's price and accessibility.

Direct Comparison: MicroStrategy Stock vs. Bitcoin

This section directly compares MicroStrategy stock and Bitcoin, considering risk tolerance, diversification, and practical investment aspects.

Risk Tolerance and Investment Goals

The choice between MicroStrategy stock and Bitcoin hinges on individual risk tolerance and investment goals.

- Risk-Averse vs. Risk-Tolerant Investors: Risk-averse investors might find MicroStrategy stock less volatile than direct Bitcoin investment, although still subject to market fluctuations.

- Long-Term vs. Short-Term Investment Horizons: Bitcoin's volatility makes it potentially more suitable for long-term investors with a higher risk tolerance.

Diversification Considerations

Both MicroStrategy stock and Bitcoin should be considered within a diversified investment portfolio. The correlation between MicroStrategy's stock price and Bitcoin's price necessitates careful allocation to manage overall portfolio risk.

Practical Aspects of Investing

Investing in MicroStrategy stock involves using a brokerage account, while investing in Bitcoin requires a cryptocurrency exchange.

Conclusion

Investing in MicroStrategy stock or Bitcoin in 2025 presents both significant opportunities and substantial risks. MicroStrategy offers exposure to Bitcoin through a more established company, reducing some of the direct cryptocurrency risks, but its stock price remains highly correlated to Bitcoin's performance. Direct Bitcoin investment carries higher volatility but also offers potentially higher rewards. Before investing in either MicroStrategy stock or Bitcoin, conduct thorough research, understand your risk tolerance, and consider your long-term investment goals. Consult with a qualified financial advisor to develop a diversified investment strategy tailored to your individual circumstances. The potential rewards are substantial, but the risks associated with both MicroStrategy stock and Bitcoin investment strategies require careful consideration.

Featured Posts

-

Alex Carusos Playoff History Making Performance In Thunder Game 1 Victory

May 08, 2025

Alex Carusos Playoff History Making Performance In Thunder Game 1 Victory

May 08, 2025 -

Is Stephen Kings The Long Walk Adaptation Actually Happening A Trailer Review

May 08, 2025

Is Stephen Kings The Long Walk Adaptation Actually Happening A Trailer Review

May 08, 2025 -

Assassins Creed Shadows Of Mordor Ps 5 Pro Enhanced Visuals With Ray Tracing

May 08, 2025

Assassins Creed Shadows Of Mordor Ps 5 Pro Enhanced Visuals With Ray Tracing

May 08, 2025 -

Hong Kong Dollar Interest Rate Fall Significant Implications For Hkd Usd Exchange Rate

May 08, 2025

Hong Kong Dollar Interest Rate Fall Significant Implications For Hkd Usd Exchange Rate

May 08, 2025 -

Sonos Ikea Partnership Officially Over Impact On Symfonisk Speakers

May 08, 2025

Sonos Ikea Partnership Officially Over Impact On Symfonisk Speakers

May 08, 2025