Investing In Baazar Style Retail Through JM Financial: A Rs 400 Consideration

Table of Contents

Understanding the Baazar Style Retail Market in India

India's retail sector is a dynamic mix of organized and unorganized players. The "baazar style" retail market, encompassing traditional kirana stores, mom-and-pop shops, and small independent retailers, forms a significant portion of this landscape. This segment, often overlooked in favor of large retail chains, presents a unique investment opportunity. Understanding its characteristics is crucial for assessing its potential.

- Dominance of small, independent retailers across India: These businesses form the backbone of Indian retail, serving local communities effectively.

- High customer loyalty and strong community ties: These established relationships foster sustained business and resilience against competition.

- Resilience to economic downturns: Their localized operations and direct customer relationships help them weather economic storms more effectively than larger, centralized chains.

- Untapped potential for modernization and technological integration: The adoption of technology, even on a small scale, offers significant growth potential for these businesses, increasing efficiency and reach. This presents a compelling area for investment and potential high returns. The integration of digital payment systems and inventory management tools is a key area for future growth in this sector.

JM Financial's Role in Baazar Style Retail Investment

JM Financial, a prominent player in the Indian financial services industry, offers various avenues for investing in different market segments, including the burgeoning baazar style retail sector. While they may not directly invest in individual kirana stores, they provide investment vehicles that indirectly allow participation in this market’s growth.

- Types of investment options offered by JM Financial: JM Financial likely offers mutual funds and other investment products that include exposure to companies supporting or servicing the baazar style retail sector – such as FMCG companies distributing goods to these smaller retailers, or technology companies providing solutions to them.

- Risk assessment and diversification strategies: JM Financial provides resources and expertise to help investors understand the associated risks and build diversified portfolios.

- Potential returns on investment: While specific returns aren't guaranteed, investment in this high-growth sector holds the potential for significant returns, especially considering long-term growth prospects.

- Transparency and regulatory compliance: JM Financial operates under strict regulatory guidelines, ensuring transparency and investor protection.

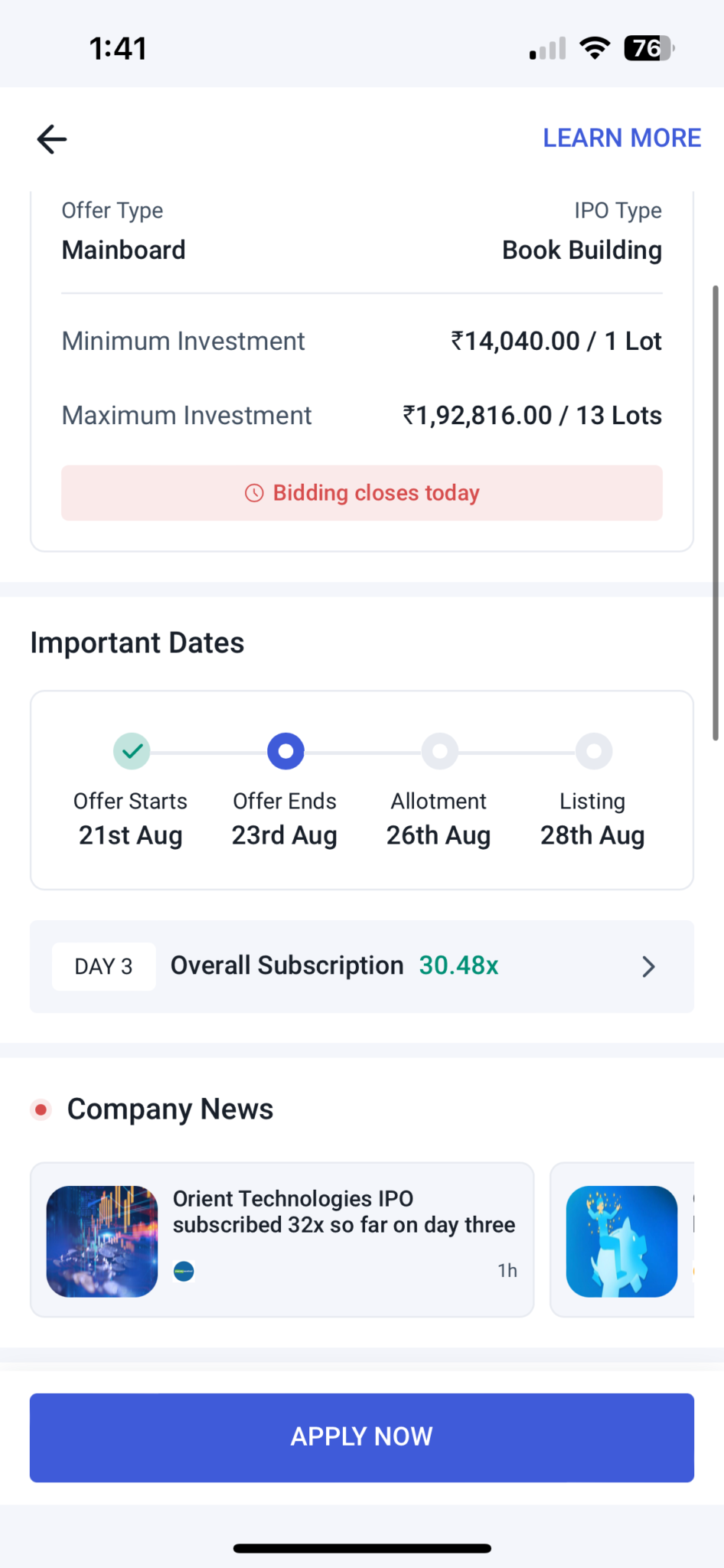

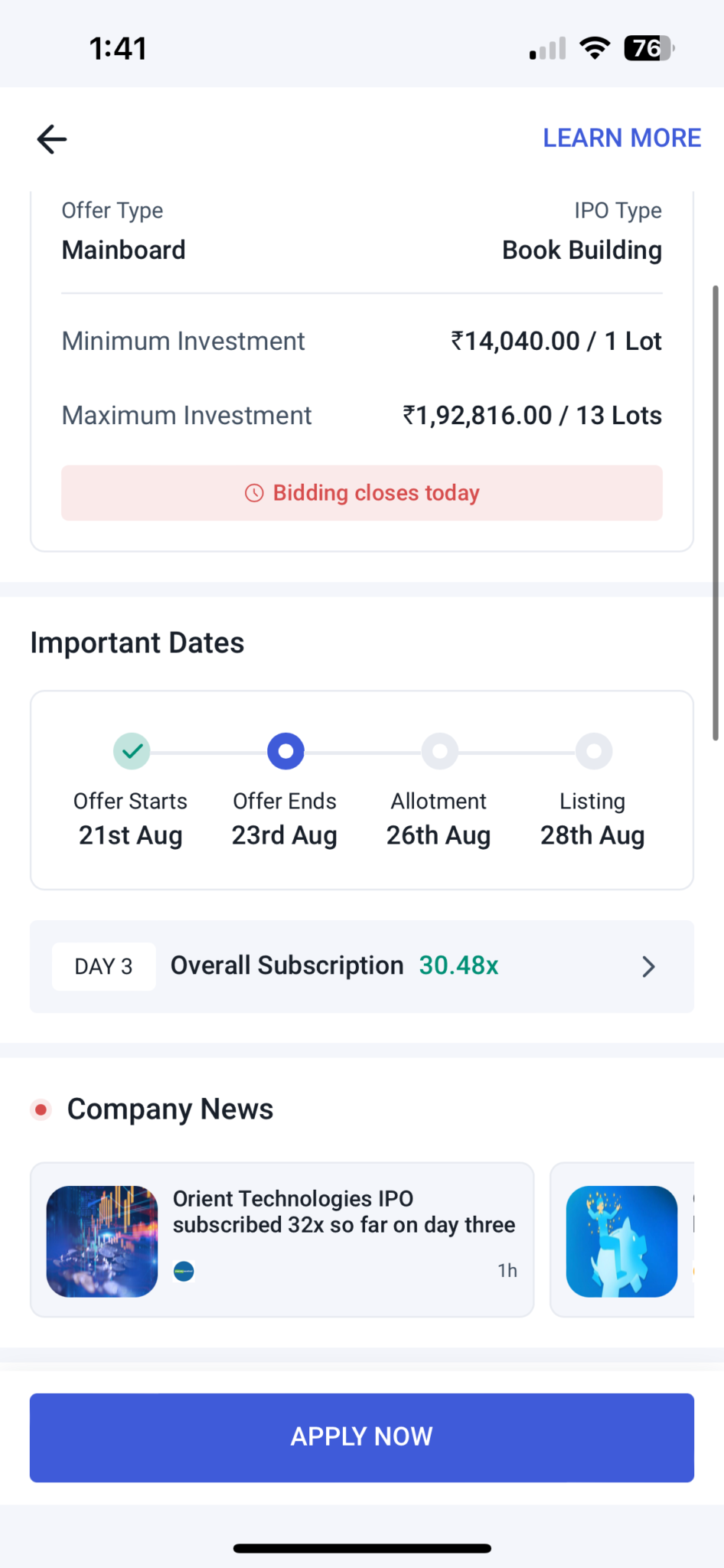

Analyzing the Rs 400 Investment Consideration

Investing Rs 400 might seem insignificant, but in the context of mutual funds or other pooled investment vehicles offered by JM Financial, it can represent a meaningful first step. While direct investment in individual kirana stores with such a small amount is unlikely, participating in funds with exposure to this sector is entirely feasible.

- Break down the investment options available at this price point: Many mutual funds allow for even small initial investments, making participation accessible.

- Evaluate the potential for capital appreciation and income generation: While returns aren't guaranteed, long-term growth in the Indian retail sector presents considerable potential.

- Discuss the associated risks and how to mitigate them: Market volatility and the inherent risks associated with any investment must be considered. Diversification across different investment vehicles is key to mitigating risk.

- Compare the potential return with other investment options: Rs 400 is a small amount, so comparing potential returns to other low-investment options is essential for making informed decisions.

Potential Benefits and Risks of Investing in Baazar Style Retail

Investing in the baazar style retail sector through JM Financial offers a unique blend of potential benefits and risks. A thorough understanding of both is crucial for making sound investment decisions.

- High growth potential due to increasing consumer spending: India's rising middle class fuels increased consumer spending, benefiting the retail sector.

- Risks associated with market volatility and competition: Economic downturns and increased competition from organized retail pose inherent risks.

- Importance of thorough due diligence before investing: Carefully research any investment vehicle before committing funds. Understanding the fund's investment strategy and associated risks is crucial.

- The potential for long-term, sustainable returns: Despite the risks, the long-term growth potential of India's retail market makes this sector an attractive investment option.

Conclusion

Investing in baazar style retail through JM Financial presents a potentially lucrative opportunity, even with a modest Rs 400 investment. The significant growth potential of this largely untapped market segment, coupled with the access provided by JM Financial's investment vehicles, makes it a compelling option for investors. However, thorough research and understanding of the inherent risks are crucial. Consider exploring JM Financial's investment options related to the Indian retail sector today to capitalize on this emerging market. Learn more about investing in baazar style retail and discover the potential of your Rs 400!

Featured Posts

-

2 0 Olimpia Se Impone Ante Penarol Goles Y Resumen Del Partido

May 15, 2025

2 0 Olimpia Se Impone Ante Penarol Goles Y Resumen Del Partido

May 15, 2025 -

Leo Carlsson Two Goal Game Not Enough For Ducks Against Stars

May 15, 2025

Leo Carlsson Two Goal Game Not Enough For Ducks Against Stars

May 15, 2025 -

Un Marche Famelique Pour Les Gardiens Penurie Et Opportunites

May 15, 2025

Un Marche Famelique Pour Les Gardiens Penurie Et Opportunites

May 15, 2025 -

The Unexpected Truth Behind Trumps Egg Price Remarks

May 15, 2025

The Unexpected Truth Behind Trumps Egg Price Remarks

May 15, 2025 -

Post Match Analysis Earthquakes Loss And Steffens Performance Against Rapids

May 15, 2025

Post Match Analysis Earthquakes Loss And Steffens Performance Against Rapids

May 15, 2025