Investing In CoreWeave Stock: Risks And Rewards

Table of Contents

Potential Rewards of Investing in CoreWeave Stock

Strong Growth Potential in the Cloud Computing Market

The cloud computing market is experiencing explosive growth. Industry analysts predict a continued expansion in the coming years, creating significant opportunities for companies like CoreWeave.

- Market Size Projections: Gartner and IDC consistently project multi-billion dollar growth in the cloud computing market annually. This expansion provides a favorable environment for CoreWeave's expansion.

- CoreWeave's Market Share Growth: CoreWeave is strategically positioned to capture a significant portion of this market growth due to its focus on high-performance computing and sustainability. Their innovative approach is attracting a growing number of clients.

- Competitive Advantages: CoreWeave differentiates itself through its dedication to sustainable practices and its specialized infrastructure optimized for GPU-accelerated workloads. This gives them a unique selling proposition in a crowded market. Their commitment to renewable energy sources for powering their data centers is a major advantage.

First-Mover Advantage and Technological Innovation

CoreWeave's innovative technology and early adoption of cutting-edge GPU infrastructure provide a significant first-mover advantage.

- Unique Technologies: CoreWeave utilizes proprietary technology for optimizing GPU utilization and resource management. This translates into better performance and cost efficiency for its clients.

- Strategic Partnerships: Collaborations with leading technology providers strengthen CoreWeave's market position and ensure access to cutting-edge technology.

- Scalability and Adaptability: The company's infrastructure is designed for scalability, allowing them to quickly adapt to growing client demands and market trends.

Strong Management Team and Financial Backing

CoreWeave boasts a highly experienced management team with a proven track record in the technology industry.

- Experienced Leadership: The team's expertise in cloud computing, data centers, and financial management provides stability and direction for the company.

- Significant Funding Rounds: Successful funding rounds demonstrate investor confidence in CoreWeave's business model and future prospects, indicating a strong financial foundation.

- Industry Recognition: Awards and recognition from industry experts further solidify the company's reputation and credibility.

Risks Associated with Investing in CoreWeave Stock

Market Volatility and Competition

Investing in any stock, especially in a rapidly growing sector like cloud computing, carries inherent risks.

- Market Downturns: Economic downturns can significantly impact the stock market, potentially leading to decreased CoreWeave stock price even if the company performs well.

- Intense Competition: The cloud computing market is highly competitive, with established giants and emerging players vying for market share. CoreWeave faces competition from established players like AWS, Azure, and Google Cloud.

- Technological Disruption: Rapid technological advancements could render CoreWeave's current technology obsolete, impacting future profitability.

Financial Performance and Profitability

While CoreWeave shows promise, its current financial performance and path to profitability warrant careful examination.

- Revenue Growth: Monitoring revenue growth is essential to assess the company's ability to generate income and expand its operations.

- Profit Margins: Analyzing profit margins helps evaluate the company's efficiency in converting revenue into profit.

- Debt Levels: High levels of debt could pose a significant risk, particularly during economic downturns. Assessing the company's debt-to-equity ratio is crucial.

Regulatory and Legal Risks

CoreWeave, like any company, is subject to regulatory and legal risks that could affect its operations.

- Data Privacy Regulations: Compliance with evolving data privacy regulations (like GDPR and CCPA) is paramount and requires significant investment.

- Environmental Regulations: The company's commitment to sustainability must align with evolving environmental regulations.

- Intellectual Property Protection: Protecting its proprietary technology and intellectual property is critical for CoreWeave's long-term success.

Conclusion

Investing in CoreWeave Stock presents both exciting opportunities and inherent risks. The potential rewards include high growth potential within the rapidly expanding cloud computing market, a first-mover advantage with innovative technology, and a strong management team. However, risks include market volatility, intense competition, and the need for consistent financial performance and profitability. Remember that the CoreWeave IPO, while potentially lucrative, is not without its challenges.

While Investing in CoreWeave Stock offers a potentially lucrative investment opportunity, it is crucial to conduct thorough due diligence before committing any capital. Analyzing the company's financials, understanding the competitive landscape, and assessing the overall market conditions are essential steps in making an informed investment decision regarding CoreWeave investment. Remember, all investments carry risk, and this article is not financial advice. Conduct your own due diligence before making any investment decisions related to CoreWeave stock.

Featured Posts

-

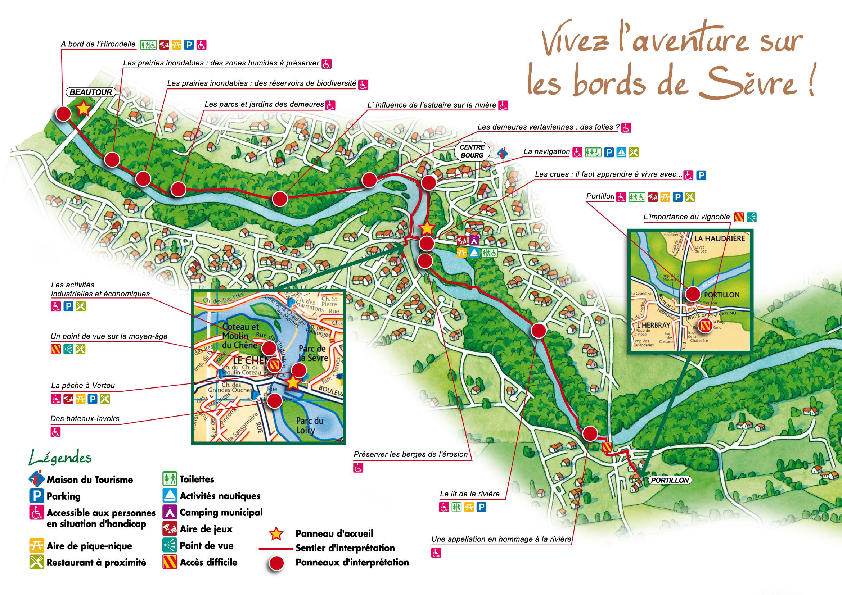

Clisson Et Moncoutant Sur Sevre Diversification Agricole Et Economique

May 22, 2025

Clisson Et Moncoutant Sur Sevre Diversification Agricole Et Economique

May 22, 2025 -

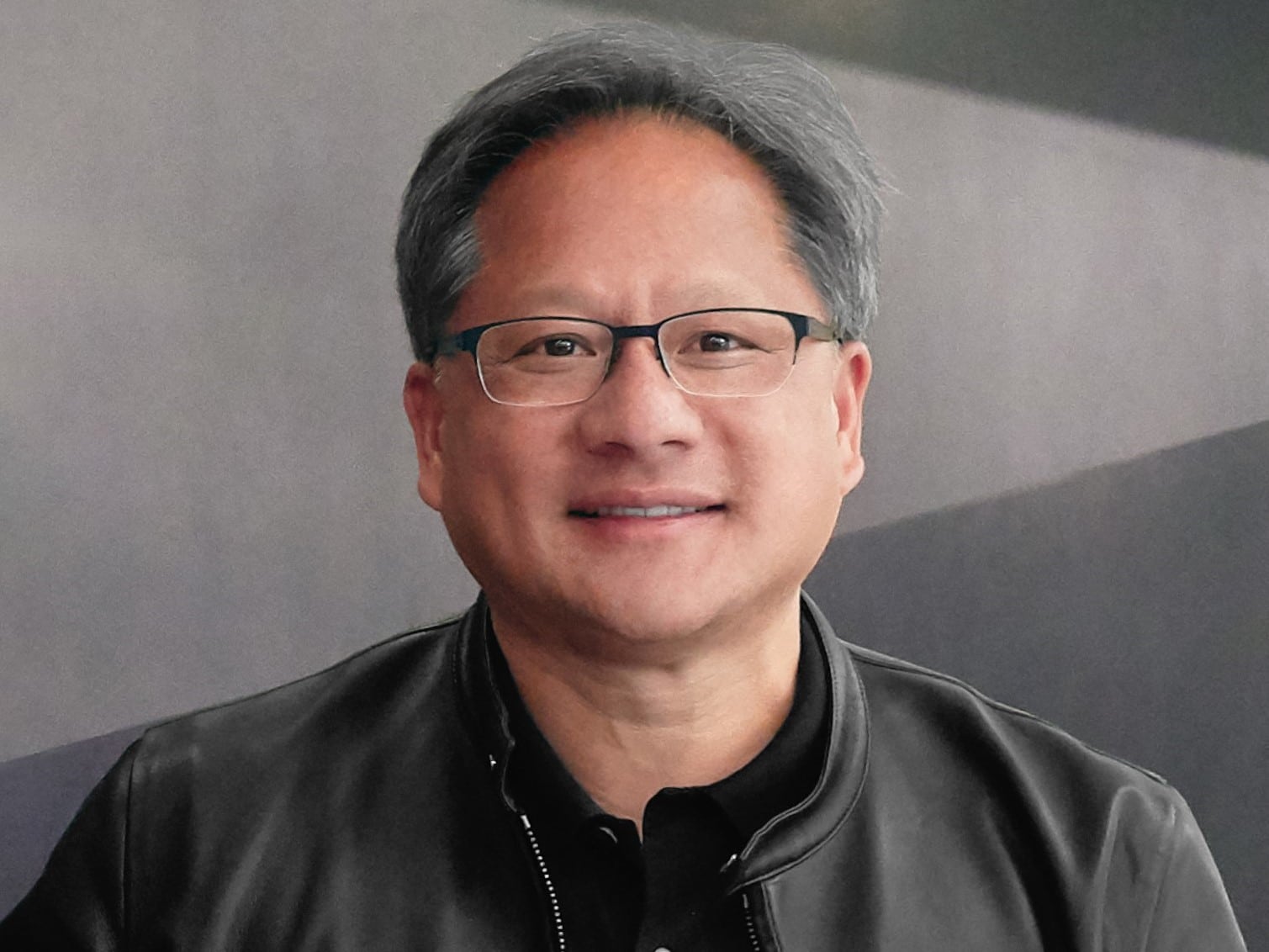

Analysis Nvidia Ceos View On Us Export Controls And Trumps Role

May 22, 2025

Analysis Nvidia Ceos View On Us Export Controls And Trumps Role

May 22, 2025 -

5 Circuits Velo Pour Explorer La Loire Le Vignoble Et L Estuaire De Nantes

May 22, 2025

5 Circuits Velo Pour Explorer La Loire Le Vignoble Et L Estuaire De Nantes

May 22, 2025 -

Showbiz Fallout David Walliams And Simon Cowell No Longer Speaking

May 22, 2025

Showbiz Fallout David Walliams And Simon Cowell No Longer Speaking

May 22, 2025 -

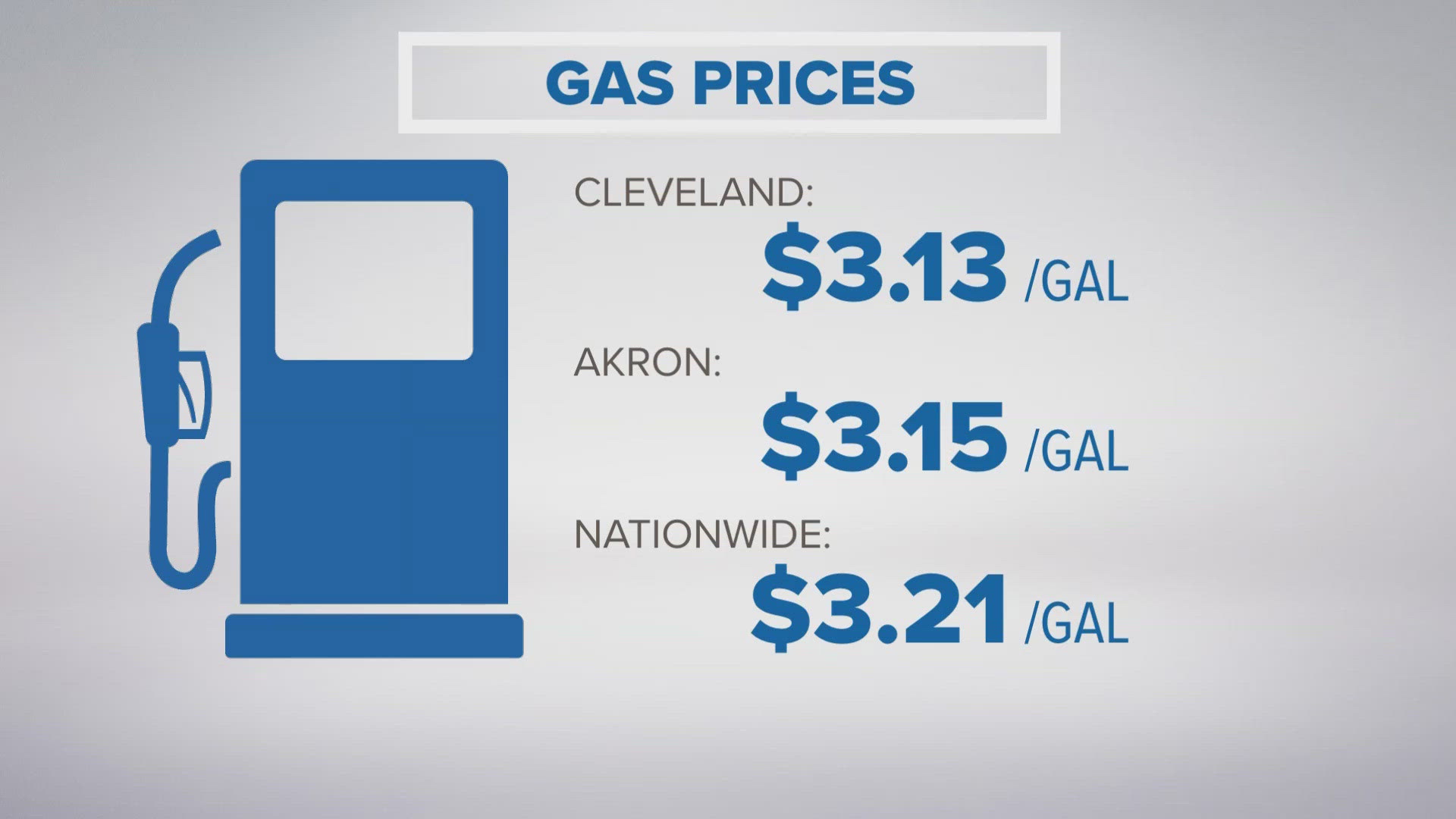

Akron And Cleveland Gas Prices Why The Recent Spike Ohio Gas Buddy Updates

May 22, 2025

Akron And Cleveland Gas Prices Why The Recent Spike Ohio Gas Buddy Updates

May 22, 2025

Latest Posts

-

Siren On Netflix Julianne Moore Meghann Fahy And Milly Alcock Lead The Cast

May 22, 2025

Siren On Netflix Julianne Moore Meghann Fahy And Milly Alcock Lead The Cast

May 22, 2025 -

Lindsey Graham Calls For Crushing Sanctions Against Russia If Ceasefire Fails

May 22, 2025

Lindsey Graham Calls For Crushing Sanctions Against Russia If Ceasefire Fails

May 22, 2025 -

A Look At Netflixs Dark Comedy Starring Kevin Bacon And Julianne Moore

May 22, 2025

A Look At Netflixs Dark Comedy Starring Kevin Bacon And Julianne Moore

May 22, 2025 -

Is This Netflix Dark Comedy With Kevin Bacon And Julianne Moore A Hit

May 22, 2025

Is This Netflix Dark Comedy With Kevin Bacon And Julianne Moore A Hit

May 22, 2025 -

Your Netflix Watchlist 7 Shows To Catch May 18 24

May 22, 2025

Your Netflix Watchlist 7 Shows To Catch May 18 24

May 22, 2025