Investing In Global Stocks And Bonds: A Guide For India's Ultra-Rich

Table of Contents

Understanding the Benefits of Global Diversification

For India's ultra-rich, global diversification isn't just a strategy; it's a necessity in today's interconnected world. By strategically allocating assets across international markets, UHNWIs can significantly enhance their portfolios.

Reduced Portfolio Volatility

Investing solely in the Indian stock market exposes your portfolio to the specific risks and volatility of the Indian economy. Global diversification reduces this dependence.

- Exposure to different economic cycles: When one market experiences a downturn, others may be performing well, smoothing out overall portfolio performance.

- Reduced correlation with domestic assets: Global investments often have a low correlation with Indian assets, minimizing the impact of domestic market fluctuations.

- Enhanced risk-adjusted returns: Diversification can lead to higher returns relative to the level of risk taken.

Access to Higher Growth Opportunities

The Indian market, while vibrant, may not offer the same breadth of opportunities as global markets.

- Investment in established global blue-chip companies: Access to globally recognized companies with long track records of success and stability.

- Access to emerging markets with high growth potential: Opportunities in rapidly developing economies can offer substantial growth potential.

- Exposure to innovative technologies and sectors: Gain exposure to cutting-edge technologies and sectors that may not yet be prominent in India.

Hedging Against Currency Fluctuations

The rupee's value fluctuates against other currencies. Global investments can act as a hedge against this risk.

- Strategic allocation across different currencies: Diversifying currency exposure minimizes the impact of rupee depreciation.

- Utilizing currency hedging strategies: Employing financial instruments to mitigate currency risk.

- Minimizing exposure to rupee volatility: Reducing reliance on the rupee's performance protects wealth against currency fluctuations.

Navigating the Regulatory Landscape for Indian UHNWIs

Investing globally requires careful consideration of Indian regulations and tax implications.

FEMA Compliance

The Foreign Exchange Management Act (FEMA) governs all foreign exchange transactions in India. Strict adherence is crucial.

- Authorized dealers and their roles: Utilizing authorized dealers for all foreign exchange transactions ensures compliance.

- Limits on outward remittances: Understanding and adhering to the limits on the amount of money that can be sent abroad.

- Documentation requirements: Maintaining meticulous records of all international transactions is essential for compliance audits.

Tax Implications of International Investments

Global investments have tax implications both in India and the country of investment. Proper planning is essential.

- Double taxation treaties: Understanding and leveraging double taxation avoidance agreements to minimize tax liabilities.

- Tax havens and their implications: Avoiding jurisdictions known for aggressive tax avoidance schemes.

- Seeking professional tax advice: Consulting with experienced tax professionals specializing in international taxation is vital.

Choosing the Right Investment Vehicles

Several investment vehicles offer access to global markets, each with its own risk-return profile.

- Offshore investment options: Exploring options like investing in offshore mutual funds or setting up offshore accounts.

- International mutual funds specializing in specific geographies or sectors: Diversifying investments through specialized funds.

- Direct investment through global brokerage accounts: Gaining direct access to international stock exchanges.

Strategic Approaches for Global Stock and Bond Investments

A well-defined investment strategy is key to maximizing returns and minimizing risk.

Asset Allocation Strategies

The optimal mix of stocks and bonds depends on individual risk tolerance and investment goals.

- Conservative vs. aggressive investment strategies: Choosing an investment approach aligned with your risk profile.

- Diversification across developed and emerging markets: Spreading investments across various markets to minimize risk.

- Regular portfolio rebalancing: Periodically adjusting the portfolio to maintain the desired asset allocation.

Utilizing Global Investment Advisors

Experienced international wealth managers provide invaluable expertise and guidance.

- Expertise in international markets: Benefitting from deep knowledge of global markets and investment opportunities.

- Personalized investment strategies: Receiving tailored investment advice based on specific needs and goals.

- Compliance and regulatory guidance: Ensuring compliance with all relevant regulations.

Due Diligence and Risk Management

Thorough research and risk assessment are crucial before any investment decision.

- Understanding geopolitical risks: Assessing potential risks stemming from global political events.

- Currency risk management: Implementing strategies to mitigate currency fluctuations.

- Analyzing company financials and fundamentals: Conducting thorough due diligence before investing in any company.

Conclusion

Investing in global stocks and bonds presents significant advantages for India's ultra-rich, offering diversification, access to higher growth, and currency risk mitigation. However, success hinges on understanding and complying with FEMA regulations, employing effective tax planning strategies, and working with experienced international wealth managers. By implementing a well-defined strategy and conducting thorough due diligence, Indian UHNWIs can effectively build a robust and diversified international portfolio. Start exploring the world of investing in global stocks and bonds for India's ultra-rich today and unlock new avenues for wealth creation and preservation.

Featured Posts

-

Evolyutsiya Poglyadiv Trampa Na Viynu V Ukrayini

Apr 25, 2025

Evolyutsiya Poglyadiv Trampa Na Viynu V Ukrayini

Apr 25, 2025 -

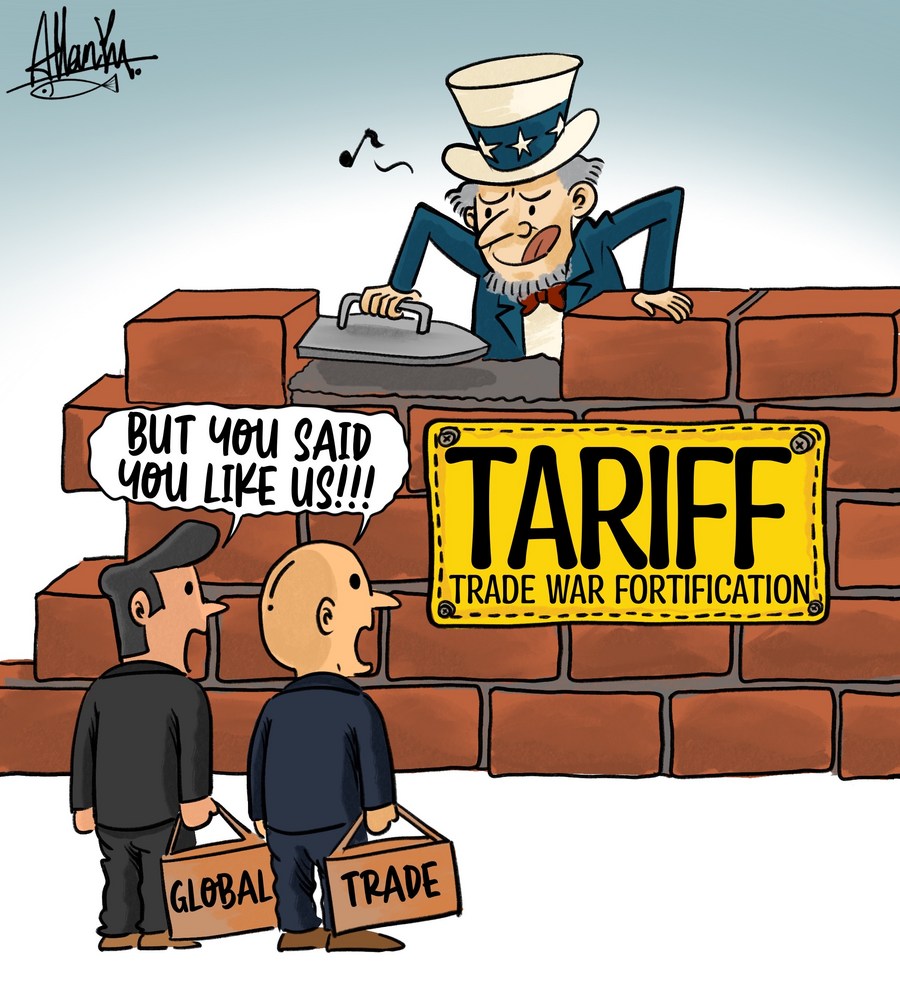

Chinas Resilience Xis Strategy For A Lengthy Trade War With The Us

Apr 25, 2025

Chinas Resilience Xis Strategy For A Lengthy Trade War With The Us

Apr 25, 2025 -

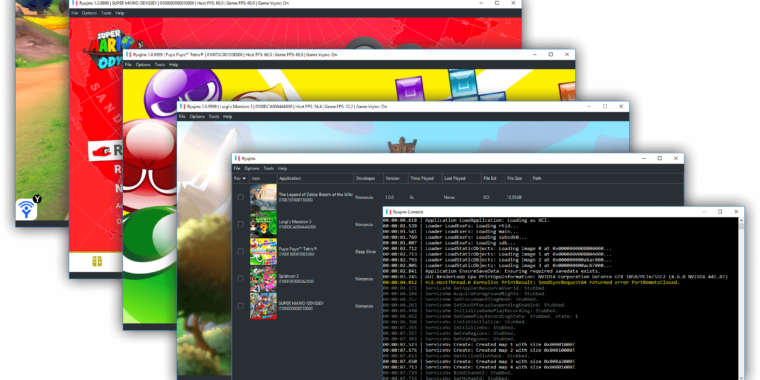

The End Of Ryujinx Nintendo Contact Forces Development Halt

Apr 25, 2025

The End Of Ryujinx Nintendo Contact Forces Development Halt

Apr 25, 2025 -

Dope Thief Episode 4 Ending Explained Rays Plan After Michelles Warning

Apr 25, 2025

Dope Thief Episode 4 Ending Explained Rays Plan After Michelles Warning

Apr 25, 2025 -

Bayern Munich Cruise Past Werder Bremen Thanks To Harry Kanes Double

Apr 25, 2025

Bayern Munich Cruise Past Werder Bremen Thanks To Harry Kanes Double

Apr 25, 2025

Latest Posts

-

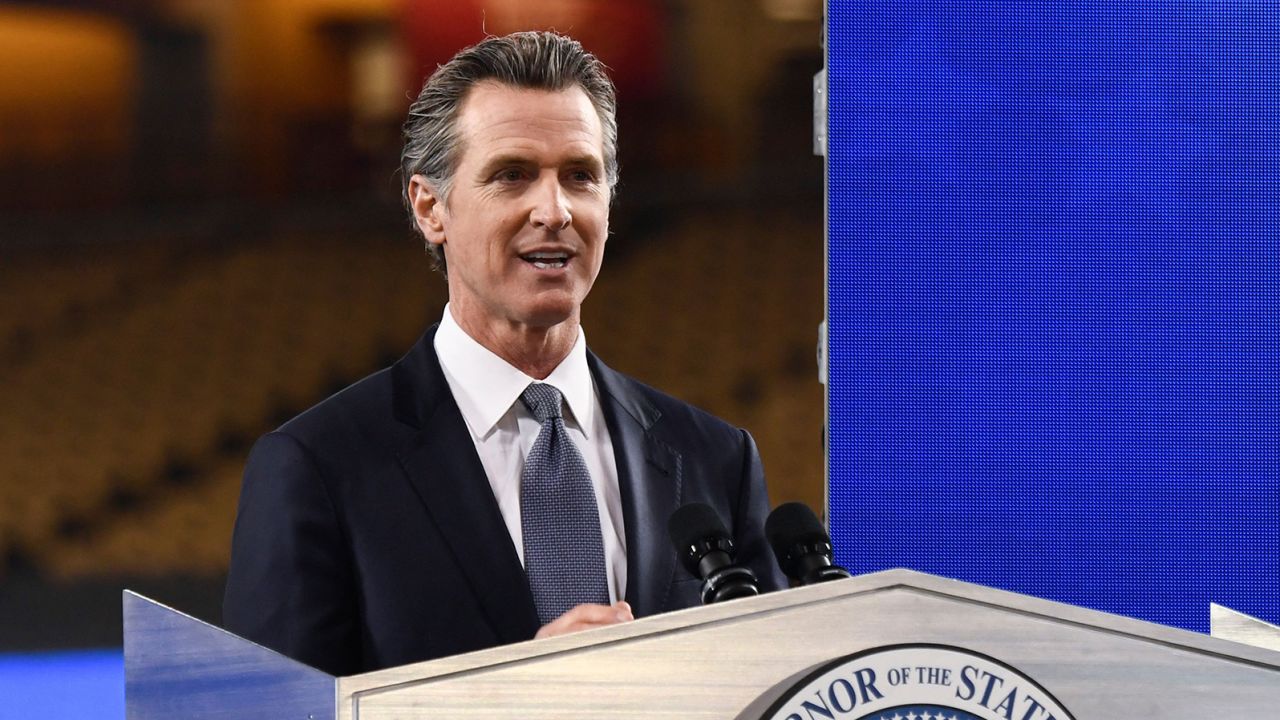

Is Gavin Newsoms New Trans Athlete Rule Deeply Unfair A Critical Analysis

Apr 26, 2025

Is Gavin Newsoms New Trans Athlete Rule Deeply Unfair A Critical Analysis

Apr 26, 2025 -

A Critical Look At Governor Gavin Newsoms Recent Decisions

Apr 26, 2025

A Critical Look At Governor Gavin Newsoms Recent Decisions

Apr 26, 2025 -

Deeply Unfair Examining The Controversy Around Newsoms Transgender Sports Policy

Apr 26, 2025

Deeply Unfair Examining The Controversy Around Newsoms Transgender Sports Policy

Apr 26, 2025 -

Evaluating The Accuracy Of Statements Made About Gavin Newsom

Apr 26, 2025

Evaluating The Accuracy Of Statements Made About Gavin Newsom

Apr 26, 2025 -

Fck Yeah Thunderbolt Stars Candid Take On Nepo Baby Status

Apr 26, 2025

Fck Yeah Thunderbolt Stars Candid Take On Nepo Baby Status

Apr 26, 2025